Laser Welding System Market Research: 2032

The Global Laser Welding system market size was valued at $2.9 billion in 2020, and is projected to reach $6.3 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032. Laser welding is an advanced fabrication process that is used in various industries such as automotive, medical, aerospace, electronics, jewelry, and tool and die manufacturing. In addition, the laser welding process uses an intense laser to apply heat to the seam which fuses the two materials. The main advantage over traditional techniques is that it is cooler, resulting in fewer stresses in the joint. It achieves a strong bond in application in which the weld only penetrates less than 1mm deep.

Market Dynamics

The increase in the trend of automation in industries for high efficiency, improved productivity, and accuracy has resulted in laser welding systems market growth. The rise in the adoption of laser systems is expected to register high market revenue, owing to an increase in the need for high-precision laser systems for various applications on different materials. Furthermore, the rise in demand for material processing in various sectors such as automotive, aerospace, industrial machinery, electronics, and medical is driving the laser welding systems market share growth. Furthermore, the shift of the automotive sector toward electric vehicles is generating demand opportunities for laser welding systems.

The automotive industry is one of the highest-contributing sectors in the world GDP. However, owing to COVID-19 induced supply chain blockade, the global sales of automotives declined. This significantly reduced the revenue of the automotive manufacturers. However, after the COVID-19 subsided to a significant level, the automotive market is recovering at a greater pace. For instance, according to news reports the sales of cars crossed the 3 million marks in 2021. It is significantly higher than the sales made in 2019, which were around 2.9 million, if the negative effects of COVID-19 are considered.

Furthermore, the number of vehicles in developing economies is witnessing exponential growth. For instance, India and China have emerged as major automotive markets in the last decade. According to the International Energy Agency, India has approximately 25 vehicles per thousand people as of 2020, and the number is expected to across 150 by the year 2040. Moreover, laser welding system is extensively used for automotive components such as solenoids, engine parts, air conditioning units, alternators, fuel injectors, and filters. Furthermore, there are various types of laser welding that are currently used for automotive applications such as blue direct diode, fiber, pulsed, and disk lasers. Thus, a rise in automobile sale is anticipated to drive the demand for laser welding systems. However, the high initial cost is expected to restrain the growth of the market. On the contrary, the technological advancements in fiber laser are anticipated to provide lucrative opportunities for the growth of the market.

Segmental Overview

The laser welding system market is segmented into Laser Type, Power, Application, and Region. By laser type, the market is categorized into gas laser (CO2), solid-state laser, fiber laser, and others. On the basis of power, it is bifurcated into less than 1kW and more than 1.1kW. and on the basis of application, the market is categorized into automotive, electronics, aerospace, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

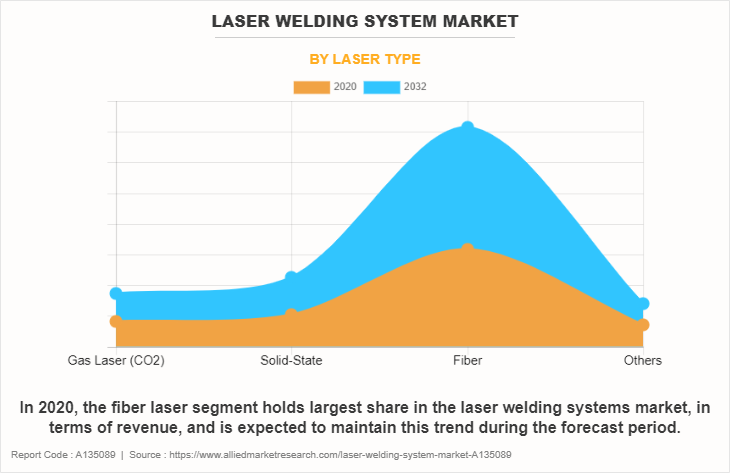

By laser type:

The laser welding systems market is divided into gas laser (CO2), solid-state laser, fiber laser, and others. In 2020, the fiber laser segment dominated the laser welding systems market, in terms of revenue, and is expected to maintain this trend during the forecast period. A fiber laser is a solid-state laser that generates a high-intensity laser beam through the process of stimulated emission. The laser utilizes optical fiber as the gain medium or the source of laser light amplification. The core of a fiber laser consists of a specially designed optical fiber, often doped with rare-earth elements such as erbium, ytterbium, or neodymium. These dopants provide the necessary energy levels for the laser to operate. The fiber is surrounded by a cladding layer that helps confine and guide the light within the core.

The unique properties of fiber lasers offer several advantages over other types of lasers. For instance, it can achieve high power output while maintaining good beam quality and waveguide structure. In addition, fiber lasers are known for their high efficiency, reliability, and compact size. They can be easily integrated into various systems, making them popular in industrial applications such as material processing, laser cutting, welding, marking, and telecommunications. Fiber lasers have found applications in the healthcare sector for surgical procedures, medical diagnostics, and cosmetic treatments. Additionally, the growing demand for high-speed and high-capacity communication networks has led to the increased adoption of fiber lasers in the telecommunications industry for optical fiber amplification and signal transmission.

In addition, major players are adopting various strategies such as product launches, acquisitions, and others. For instance, IPG Photonics Corporation introduced the new YLR-U series near-infrared 1 μm fiber lasers. The YLR-U series is the world’s highest-performance industrial-grade kilowatt-class continuous wave (CW) ytterbium fiber lasers. With the smallest size and lowest weight in the industry, these lasers deliver unmatched performance in an ultra-compact form factor with a record power-to-volume ratio. All such factors are anticipated to boost the demand of the laser welding system market growth.

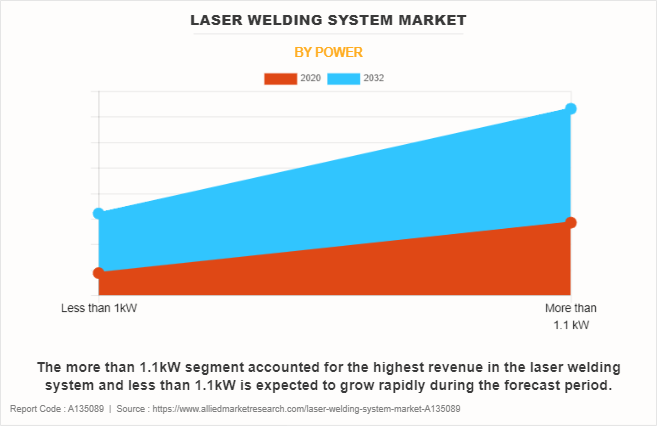

By Power:

The laser welding systems market is classified into less than 1kW and more than 1.1kW. The more than 1.1kW segment accounted for the highest revenue in the laser welding system and is expected to grow rapidly during the forecast period. Lasers with a power capacity of more than 1.1kW are effective for applications such as cutting, welding, and others, in various end-user industries that include automotive and electronics. Key companies are adopting advanced strategies to promote the progress of the industry. For instance, in March 2020, Coherent Inc. extended its thermopile sensors PowerMax Series to enable laser power measurement as high as 6 kW. the new PM1K+, PM3K+, and PM6K+ offer reliable power measurements of modulated lasers up to 6 kW within the spectrum range of 190nm to 11um.

In addition, innovative technological advancements such as the use of industrial motion controllers and multilevel security access systems in laser systems are creating favorable opportunities for the industry. Furthermore, lasers ranging from 1 to 2kW power capacity offer improved efficiency, high wall plug efficiency, and delivery performance. Manufacturers produce lasers with this capacity that are compact, rugged, perform maintenance-free operation, are easy to install, and have excellent beam parameter product (BPP). These lasers are suitable for performing advanced welding, and additive manufacturing applications.

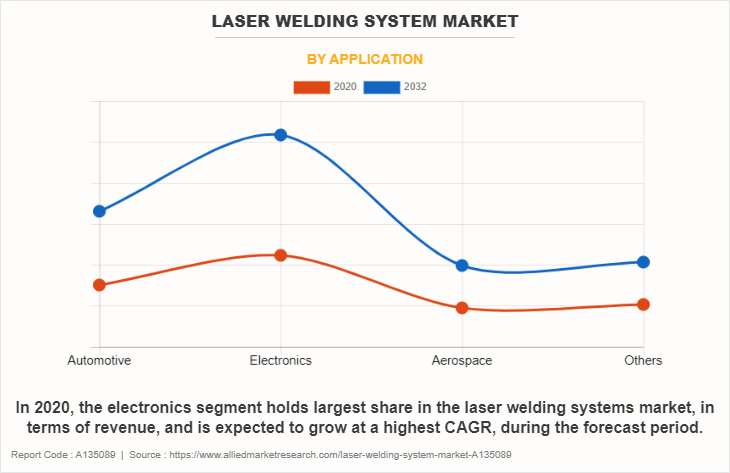

By application:

The laser welding systems market is divided into automotive, electronics, aerospace, and others. In 2020, the electronics segment dominated the laser welding systems market, in terms of revenue, and the automotive segment is expected to grow at a highest CAGR, during the forecast period. The electronics industry produces products for a variety of applications and purposes. However, the most advanced electronic devices are becoming more and more complex. The gap between pins can be as small as 0.3mm, too close to prevent bridging using traditional welding methods.

The electronics industry uses standard laser welding processes and uses Nd: YAG, continuous wave, fiber, and pulse laser welding systems. The advantage of using laser welding techniques is the ability to create precise welds for small, advanced electrical components. For example, laser welding in the electronics industry is the production of controllers, sensors, microelectronic components, circuit boards, and certain types of transistors. All such factors are expected to boost the laser welding systems market growth.

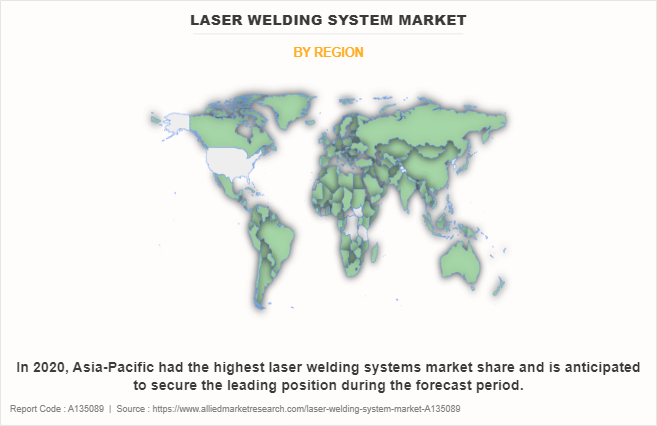

By Region:

The laser welding systems market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2020, Asia-Pacific had the highest share in laser welding system market share and is anticipated to secure the leading position during the forecast period, due to extensive demand in the automotive and electronics segment. Asia-Pacific exhibits the highest growth in the laser welding system market due to an increase in demand for laser welding in the electronics and automotive industries. For instance, According to IBEF, the Indian automotive industry (including component manufacturing) is expected to reach $282.8 billion by 2026 is expected to boost the demand laser welding system market. In addition, growth in the automobile industry is creating the demand for laser welding systems.

Moreover, fiber lasers are employed in various industries such as material processing and defense. Owing to higher cost savings and low maintenance, the traditional methods for machine marking in industrial applications are being replaced. Laser developments such as the production of new core lasers, laser machining, and high-end laser manufacturing equipment in Wuhan Optical Valley of China are the major contributors to the growth and development of the laser welding system market in this region. The emerging markets such as South Korea, Japan, India, and Taiwan are expected to majorly contribute to the growth and development of the laser welding systems market in the future owing to the rapid increase in electronics, medical, and automotive sector applications.

Furthermore, key players are expanding their laser welding system business to Asia-Pacific for a wide range of automotive, electronics, aerospace, and medical applications. For instance, in March 2021, II-IV Incorporated opened its new application laboratory in China to support the growing laser systems applications. As a result, the new laser materials processing applications laboratory is expected to provide close customer assistance, in-depth application counseling including practical hands-on training, and extensive feasibility assessments. All such factors are anticipated to boost the laser welding system market opportunity.

Competition Analysis

Competitive analysis and profiles of the major players in the laser welding systems market, such as Amada Co. Ltd (Amada weld tech), Alpha Laser, Baison Laser, Coherent, Hans Laser, IPG Photonics, Jenoptik, Laser Star Technologies, Panasonic Corporation, and TRUMPF are provided in this report. There are some important players in the market such as TRUMPF, IPG Photonics, and Jenoptik. Major players have adopted product launch, expansion, collaboration, and acquisition as key developmental strategies to improve the product portfolio of the laser welding systems market.

Some examples of product launches in the market

In November 2020, IPG Photonics Corporation introduced LightWELD, a new handheld laser welding system. The LightWELD product line enables fabricators to benefit from the greater flexibility, precision, and ease of use enabled by laser-based solutions over traditional welding products.

In July 2020, IPG Photonics Corporation introduced the new YLR-U series near-infrared 1-m fiber lasers. The YLR-U series are the world’s highest-performance industrial-grade kilowatt-class continuous wave (CW) ytterbium fiber lasers. With the smallest size and lowest weight in the industry, these lasers deliver unmatched performance in an ultra-compact form factor with a record power-to-volume ratio.

In October 2021, TRUMPF launched a new machine for moving into an automated laser welding system. The system is particularly suitable for manufacturers to weld control cabinets, sheet metal boxes, or covers, for example, programming is quick and easy, and the system has an integrated high-speed robot.

Expansion in the market

In September 2023, TRUMPF opened a new Southeast European headquarters in Hungary. TRUMPF lasers are used in factories of Korean car battery manufacturers who produce in Hungary for the European market.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging laser welding system market trends and dynamics.

- In-depth laser welding system market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the laser welding systems market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The laser welding system market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the laser welding systems market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the laser welding system industry.

Laser Welding System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.3 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2020 - 2032 |

| Report Pages | 270 |

| By Laser Type |

|

| By Power |

|

| By Application |

|

| By Region |

|

| Key Market Players | LaserStar Technologies Corporation, Hans Laser Technology Industry Group, Co. LTD., Foshan Huibaisheng Laser Technology Co., Ltd, Coherent Corp., ALPHA Laser GmbH, IPG Photonics, JENOPTIK, TRUMPF, Amada Co., Ltd., Panasonic Corporation |

Analyst Review

The global laser welding systems market is expanding owing to the rise in the adoption of laser systems in automotive, electronics, medical, and tool and die manufacturing sectors. Furthermore, the rise in green manufacturing and increase in material processing have made laser systems the preferred choice. In addition, there is rise in demand for laser welding in the electronics industry owing to the application of standard laser welding processes and the use of Nd: YAG, continuous wave, fiber, and pulse laser welders. The major advantage of using laser welding techniques is the ability to produce precision welds for small, advanced electrical components. laser welding function as a beam of light that provides a concentrated heat source to melt material, which then fuse upon cooling. The processing speed of laser welding is much greater than traditional methods, which is making it more efficient.

Prominent laser manufacturers are developing energy-efficient, eco-friendly lasers, which offer high peak power, vibrational stability, maintenance-free turnkey operation, and superior quality edge finish. For instance, in September 2022, TRUMPF Group launched BrightLine Scan, to enhance the robustness and quality of laser welding. It is developed to enable users to point the laser beam with the laser scanner. Such strategies adopted by the key players are providing lucrative growth opportunities for the global market.

The global laser welding system market was valued at $2,857.1 million in 2020, and is projected to reach $6,262.5 million by 2032, registering a CAGR of 6.9%

The base year considered in the global Laser Welding Systems market report is 2022.

The electronics segment is the leading application of the Laser Welding System Market.

The Asia-Pacific is the largest regional market for the Laser Welding System market.

An increase in demand for precise welding solutions across various industries such as automotive, electronics, and medical devices are the upcoming trends of the Laser Welding System Market in the world.

Amada Co. Ltd (Amada weld tech), Alpha Laser, Baison Laser, Coherent, Hans Laser, IPG Photonics, Jenoptik, Laser Star Technologies, Panasonic Corporation, and TRUMPF are the top companies to hold the market share in Laser Welding Systems.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...