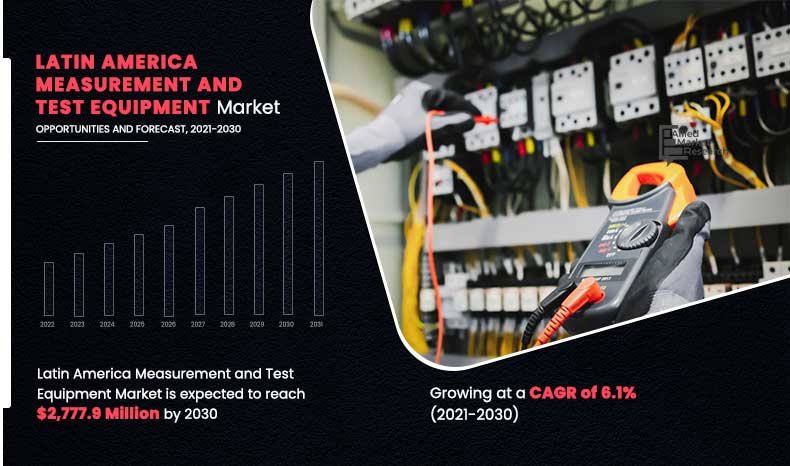

Latin America Measurement and Test Equipment Market Outlook – 2030

Latin America measurement and test equipment market size was valued at $1,539.2 million in 2020, and is projected to reach $2,777.9 million by 2030, registering a CAGR of 6.1% from 2021 to 2030. Measurement and test equipment are enhanced electronics devices designed to generate signals and record responses from various applications. To evaluate the performance of the application and gadgets under test, the measurement and test equipment generate signals and analyze their response. Power supplies, signal generators, and pulse generators are among the instruments used to test stimulus signals.

In addition, devices such as oscilloscopes, are intended to monitor the system reactions to incoming signals. Moreover, rise in deployment of advanced networking and communications technologies is anticipated to offer significant growth opportunities for the Latin America measurement and test equipment market growth.

The measurement and test equipment market share is expected to witness notable growth during the forecast period, owing to rise in demand for modular instruments by product designers and manufacturers. Furthermore, increase in adoption of electronic devices has driven the growth of the market. Moreover, rise in demand for high-performance and power-efficient electronic devices is expected to propel the Latin America measurement and test equipment market growth during the forecast period.

However, strong inclination of customers toward adoption of measurement and test equipment on rental basis is one of the prime factors restraining the measurement and test equipment market outlook. On the contrary, advent of 5G technology and deployment of LTE and LTE-Advanced (4G) networks is expected to provide lucrative opportunities for the growth of the measurement and test equipment market during the forecast period.

The outbreak of COVID-19 significantly impacted the growth of the outdoor manufacturing and industrial sectors in 2020; however, surge in deployment of advanced networking and communication technologies witnessed relatively high growth during 2021. Nevertheless, the Latin America measurement and test equipment market was principally hit by several obstacles created amid the COVID-19 pandemic such as lack of skilled workforce availability and delay or cancelation of projects owing to partial or complete lockdown in Latin America. In contrast, rise in penetration of measurement and test equipment such as frequency counter and insulation resistance tester across industrial, manufacturing, automotive, and healthcare sectors is expected to drive the growth of the measurement and test equipment industry during the forecast period.

By Product Type

General Purpose Test Equipment segment will maintain the lead during the forecast period

Segment Overview

The Latin America measurement and test equipment market is segmented on the basis of product type, service type, and industry vertical. The product type segment includes general purpose test equipment and mechanical test equipment. The general-purpose test equipment segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period. By service type, the market is segmented into calibration services, repair or after sale services, and others.

By Service Type

Calibration Services segment will dominate the market throughout the forecast period

The calibration services segment dominated the Latin America measurement and test equipment market in 2020 and is anticipated to drive the market in coming years. Based on industry vertical, it is classified into automotive, aerospace & defense, it & telecommunication, industrial, healthcare, semiconductor & electronics, education & government, manufacturing, and others. The healthcare segment acquired the largest share in 2020, and the automotive segment is expected to grow at a high CAGR from 2021 to 2030.

By Industry Vertical

Automotive segment will grow at a highest CAGR of 8.5% during 2021 - 2030

Top Impacting Factors

Significant factors that impact the growth of the Latin America measurement and test equipment industry include growing adoption of electronic devices paired with surge in demand for high-performance and power-efficient electronic devices. Moreover, increasing demand for modular instruments by product designers and manufacturers is expected to drive the market opportunity. However, strong inclination of customers toward adoption of measurement and test equipment on rental basis is acting as a prime barrier for early adoption, which hampers the growth of the market. On the contrary, advent of 5G technology is offering potential growth opportunity for the Latin America measurement and test equipment market share during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major Latin America measurement and test equipment market players, such as Rigol, Instek, Uni-T, Owon, Hantek, Fortive Corporation, Rohde & Schwarz Gmbh, Anritsu Corporation, Keysight Technologies, Yokogawa Electric Corporation, and National Instrument Corporation are provided in this report. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the Latin America measurement and test equipment market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall Latin America measurement and test equipment market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current Latin America measurement and test equipment market forecast is quantitatively analyzed from 2021 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart display.

- The report includes the market share of key vendors and Latin America measurement and test equipment market trends.

Latin America Measurement and Test Equipment Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Service Type |

|

| By Industry Vertical |

|

| Key Market Players | Rigol, Owon, National Instrument Corporation, Hantek, Keysight Technologies, Uni-T, Instek, Fortive Corporation, Yokogawa Electric Corporation, Anritsu Corporation, Rohde & Schwarz Gmbh |

Analyst Review

The measurement and test industry have enormous development potential globally. Furthermore, the contribution to the worldwide market is predicted to grow considerably in coming years. In addition, rise in demand for the Internet of Things, smart infrastructure, and artificial intelligence solutions across the industrial, commercial, and healthcare sectors is projected to drive the growth of the measurement and test market in the coming years.

The Latin America measurement and test equipment market is highly competitive, owing to strong presence of existing vendors. Measurement and test vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The key players profiled in the report include such as Rigol, Instek, Uni-T, Owon, Hantek, Fortive Corporation, Rohde & Schwarz Gmbh, Anritsu Corporation, Keysight Technologies, Yokogawa Electric Corporation, and National Instrument Corporation.

The Latin America Measurement and Test Equipment Market is anticipated to grow at a CAGR of 6.1% from 2021 to 2030.

The Latin America Measurement and Test Equipment Market is projected to reach $2777.9 million by 2030.

To get the latest version of sample report

Rise in demand for modular instruments by product designers and manufacturers etc. boost the market growth.

The key players profiled in the report include Rigol, Instek, Uni-T, Owon, Hantek, Fortive Corporation, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Latin America Measurement and Test Equipment Market is segmented on the basis of product type, service type, and industry vertical.

The key growth strategies of market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Automotive segment will grow at a highest CAGR of 8.5% during the forecast period.

General Purpose Test Equipment segment will dominate the market during 2021 - 2030.

Loading Table Of Content...