The Latin America unsecured business loans market is experiencing significant growth during the projection period. This is attributed to region's dynamic and varied business environment. With the flourishing of small and medium-sized enterprises (SMEs), there has been a surge in demand for fast and easily accessible financing options. Moreover, appeal of unsecured loans lies in their flexibility and simplicity, making them an appealing choice for businesses seeking to expand or meet their working capital needs. In addition, the market is propelled by emergence of technology-driven financial services and innovative lending platforms that streamline the loan application and approval process, providing businesses with quick and convenient access to funds.

On the other hand, the Latin America unsecured business loans market encounters specific limitations. One significant obstacle is rise in risk linked to these loans. To offset this risk, lenders frequently demand higher interest rates, which discourage potential borrowers. In addition, the market contends with regulatory challenges as government authorities aim to safeguard businesses against exploitative lending practices. Although these regulations are crucial for consumer protection, they introduce intricacies to the lending procedure and impede approval timelines.

However, there are numerous opportunities available in the market that are waiting to be utilized. The ongoing digitalization of financial services presents a vast scope for innovation in developing more efficient, transparent, and streamlined loan application procedures. In addition, expansion of financial inclusion initiatives unlocks the potential for unsecured business loans in underserved markets, thereby providing a range of growth prospects. Furthermore, rise in trend of sustainable and ethical lending practices offers a specialized market for lenders who adopt a socially responsible approach.

The Latin America unsecured business loans market is set to experience substantial expansion. The market is expected to be influenced by ongoing digitalization of financial services, which is anticipated to result in faster and more convenient loan applications and approvals. The incorporation of big data and artificial intelligence in risk assessment is expected to improve the efficiency of lending processes, and implementation of open banking initiatives simplify access to unsecured business loans.

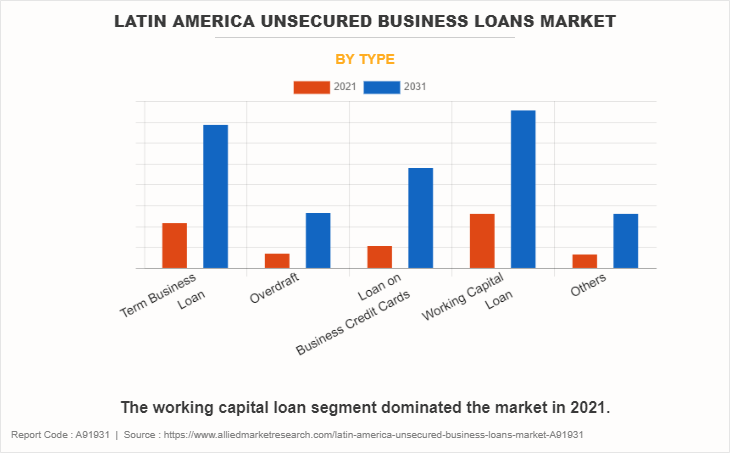

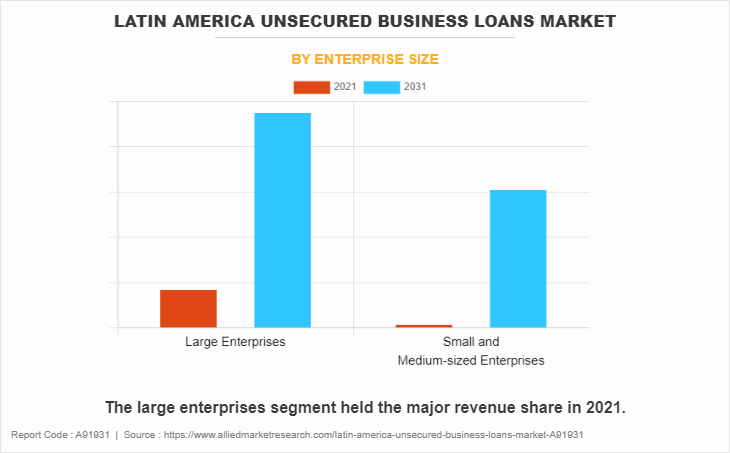

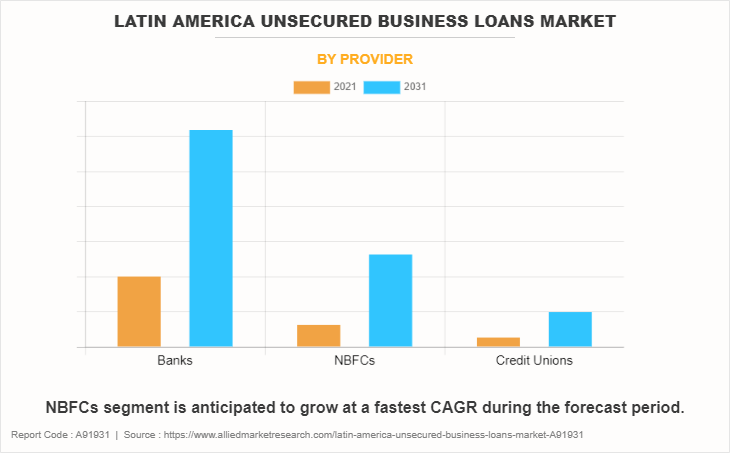

The market is segmented into type, enterprise size, and provider. Further, on the basis of type, the market is segregated into term business loan, overdraft, loan on business credit cards, working capital loan, and others. Depending on enterprise size, it is bifurcated into large enterprises, small and medium-sized enterprises. By provider, the market is classified into banks, NBFCs, and credit unions.

In this market, it is crucial to have innovative product development. Lenders are currently exploring new methods to structure unsecured business loans that cater to the changing needs of businesses. For instance, credit lines that are personalized based on transaction history and cash flow patterns are becoming increasingly popular. As a result, businesses are seeking customized solutions, making the market even more intricate.

To enhance their risk assessment models and fraud detection systems, lending institutions are investing heavily in R&D. They are utilizing advanced analytics and machine learning algorithms to provide more precise credit evaluations. This continuous evolution of R&D ensures that the market remains dynamic and constantly evolving.

Moreover, pricing strategies within the unsecured business loans market encompass various aspects. Lenders are required to find a middle ground between providing competitive interest rates to entice borrowers and safeguarding their own risk. The market exhibits tiered pricing structures, wherein businesses with robust credit profiles benefit from lower rates, while riskier borrowers face higher rates. This intricate pricing model enables lenders to accommodate a diverse array of businesses while effectively managing their exposure to risk.

The Porter’s five forces analysis analyzes the competitive scenario of the Latin America unsecured business loans market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry. The market consists of financial institutions and lenders as suppliers, who possess substantial bargaining power as they control the provision of unsecured loans. Nevertheless, presence of diverse providers like banks, NBFCs, and credit unions fosters a competitive environment. Conversely, the bargaining power of buyers or businesses in search of unsecured loans is considerable, given the multitude of options at their disposal to negotiate for more favorable terms and interest rates. The accessibility of information regarding various loan products on digital platforms has empowered buyers.

The Latin America unsecured business loans market presents a moderate threat of new entrants, despite regulatory barriers. The SME sector's growing demand for unsecured loans creates an attractive opportunity for new players, including fintech startups. Traditional bank loans requiring collateral serve as the primary substitute for unsecured loans. However, the market caters to businesses lacking valuable assets, creating a niche segment with limited threat of substitutes. The unsecured loans market has fierce competitive rivalry, with banks, NBFCs, and credit unions vying for borrowers. This competition has led to innovative loan products and service delivery, ultimately benefiting borrowers.

A SWOT analysis provides a comprehensive overview of the strengths, weaknesses, opportunities, and threats in the Latin America unsecured business loans market. The strengths of this market include a diverse range of unsecured loan products, accessible financing options for businesses of all sizes, innovative lending platforms, and technology-driven solutions. In addition, there is a strong demand from small and medium-sized enterprises (SMEs) for working capital and expansion.

However, there are weaknesses that need to be considered. These include high risk associated with unsecured loans, regulatory challenges, compliance requirements, variability in interest rates based on credit risk, and potential for predatory lending practices.

On the other hand, there are opportunities for growth and development in this market. These opportunities include continued digitalization of financial services, expansion of financial inclusion initiatives, promotion of sustainable and ethical lending practices, and development of tailored loan products specifically designed for SMEs. Nevertheless, there are threats that impact the Latin America unsecured business loans market. These threats include stringent regulatory landscape, intense competition among market players, economic downturns that affect loan demand, and consumer skepticism and apprehension.

Key players in the Latin America unsecured business loans market are Banco Santander, Banco Bradesco, Banco do Brasil, Itaú Unibanco, Banco de Crédito del Perú, Banco de Chile, Banco de Bogotá, Banorte, Banco Santander México, and Banco Popular Dominicano.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Latin America unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of Latin America unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Latin America unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Latin America Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 74 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | Banco Bradesco, Banco Popular Dominicano, Banco do Brasil, Banco Santander, Banorte, Banco Santander México, Banco de Bogotá, Itaú Unibanco, Banco de Chile, Banco de Crédito del Perú |

The Latin America Unsecured Business Loans Market is projected to grow at a CAGR of 13.3% from 2021 to 2031

Banco Santander, Banco Bradesco, Banco do Brasil, Itaú Unibanco, Banco de Crédito del Perú, Banco de Chile, Banco de Bogotá, Banorte, Banco Santander México, and Banco Popular Dominicano are the leading players in Latin America Unsecured Business Loans Market.

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in latin america unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of latin america unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the latin america unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Latin America Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...