Global Lawn Mowers Market Overview

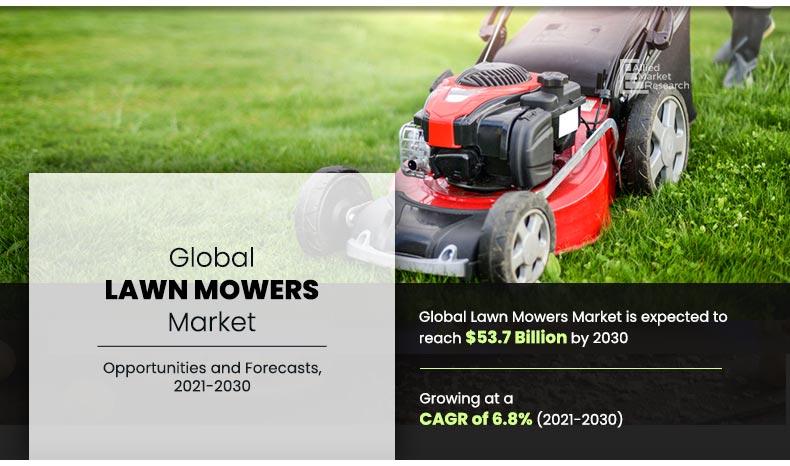

The Global Lawn Mowers Market Size was valued at $26,248.5 million in 2020, and is projected to reach $53,715.1 million by 2030, registering a CAGR of 6.8% from 2021 to 2030. The lawn mowers market has seen substantial growth over the past decade, driven by higher spending on lawn care in developed nations and the introduction of advanced, user-friendly models. Many industry players are expanding their operations to reinforce their presence and competitiveness in the global market.

Market Dynamics & Insights

- The lawn mowers industry in North America held a significant share of over 47.7% in 2020.

- The lawn mowers industry in India is expected to grow significantly at a CAGR of 11.6% from 2021 to 2030

- By product type, ride-on mowers segment is one of the dominating segments in the market and accounted for the revenue share of over 59% in 2020.

- By end user, non-residential end user segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2030 Projected Market Size: $53.7 Billion

- 2020 Market Size: $26.2 Billion

- CAGR (2021-2030): 6.8%

- North America: Largest market in 2020

- Asia Pacific: Fastest growing market

What is Meant by Lawn Mowers

Lawn mowers are machines that cut grass to an even height with the help of one or more revolving blades. The blades of lawn mowers can be manually powered or have a self-contained power source such as electric motor or internal combustion engine. Lawn mowers are equipped with a wide range of cut height adjustments that enable the operator to achieve desired height of the grass.

Lawn mowers are mechanical devices used for cutting grass in outdoor areas consisting of lawns, gardens, or parks. They generally consist of a motorized blade mount within a deck that spins unexpectedly to trim grass as per required size. Lawn mowers are available in diverse sorts, it includes push mowers, self-propelled mowers, and ride-on mowers, suitable for different garden sizes and terrains.

They are critical system for keeping properly manicured lawns and landscapes, enhancing the classy attraction out of doors areas. Modern garden mowers have a few additional functionalities which includes mulching, bagging, and discharge alternatives to deal with grass clippings efficiently. Regular mowing with garden mowers promotes healthy grass increase through encouraging even and uniform reducing, contributing to a lush and vibrant lawn look.

The garden mowers market is developing because of growing urbanization, growing disposable incomes, and expanding residential and commercial green areas. Technological improvements, which include robotic and electric mowers, are enhancing efficiency and attraction. Additionally, growing environmental awareness is riding demand for eco-friendly, battery-powered models. Seasonal gardening tendencies and the popularity of landscaping also contribute to marketplace growth.

For instance, in October 2023, Honda brought the all-electric prototype Honda Autonomous Work Mower (AWM), the corporation's first battery-powered electric zero-turn riding (ZTR) mower aimed at boosting worksite efficiencies through autonomous solutions. The Honda AWM was featured at the Equip Exposition, Oct. 17-20 in 2023, at the Kentucky Exposition Center in Louisville, Kentucky.

Small lawns and backyard gardens are an important component of housing units in North American and European regions as they significantly increase the aesthetical appearance of the property. This has surged the number of lawn maintenance activities, which has created a demand for lawn mowers, and fueled consumer interest in gardening activities and boosted demand for lawn mowers market growth.

Furthermore, the availability of a wide range of lawn mowers in various cutting capacities makes it suitable for use in small as well as large lawns. Thus, lawn mowers are extensively used for maintaining turf in recreational gardens, resorts, golf courses, and playgrounds. The development of advanced battery technologies has helped to ease the process of owning and operating lawn mowers. In addition, integration of GPS and other mapping technologies have fueled the development of robotic lawn movers that require minimal operator input.

Major players in the industry have focused on development of high-performance cordless lawn mowers and robotic lawn mowers. For instance, in March 2020, Makita U.S.A., Inc., a leading provider of power equipment launched XML06, XML07, XML08, which are three brushless cordless lawn mowers that are powered by two 18V LXT batteries. These lawn mowers consist of a commercial-grade steel deck, IPX4 rated weather-resistant construction, and a single lever cutting height adjustment feature that offers 10 optional cutting heights. Advancements in mapping technologies have played a key role in development of new robotic lawn mowers.

For instance, iRobot Corporation, which is primarily involved in developing innovative home robots, has developed Terra t7 Robot Mower that is an autonomous robotic lawn mower used for smart mapping technology for mowing operations and is capable of avoiding obstacles. The Terra t7 Robot Mower is capable of handling rough terrains and can be controlled using smart phones through iRobot HOME App.

By Type

Ride-on Mowers is expected to hold a majority share of the market throughout the study period

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic has halted the production of many components of lawn mowers due to lockdown. The economic slowdown initially resulted in reduced spending on lawn equipment from home owners and commercial users. Furthermore, the number of COVID-19 cases is expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of lawn movers manufacturing companies at their full-scale capacities. This is expected to help the market to recover by the start of 2022.After COVID-19 infection cases begin to decline, lawn mowers manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Furthermore, the increased global tourism has significantly boosted the number of hospitality buildings such as hotels, resorts, and amusement parks across the globe, thereby increasing the use of lawn mowers for maintaining the aesthetical appearance of these properties. In addition, rise in popularity of Do-It-Yourself culture has surged the number of home owners involved in lawn maintenance activities and has positively influenced the lawn mower industry.

By End-user

Non-residential segment is projected to grow at a significant CAGR

Lawn Mowers Market Segment Overview

The global lawn mowers market is segmented on the basis of type, end user, fuel type and region. By type, the market is categorized into ride-on mower, push mower, and robotic mower. On the basis of end user, it is categorized into residential, and non-residential. And on the basis on fuel type, the market is categorized into electronic and non-electronic. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increase in spending of lawn maintenance activities from residential and non-residential users.

Competition Analysis

Key companies profiled in the lawn mowers market report include Andreas Stihl AG & Co. KG, Deere & Company, Honda Motor Co., Ltd., Husqvarna Group, Koki Holdings Co., Ltd., Robert Bosch GmbH, Stanley Black & Decker Inc., Stiga S.p.A, Textron and The Toro Company.

By Region

North America held a dominant position in 2020 and would continue to grow at a significant CAGR during the forecast period.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging lawn mowers market trends and dynamics.

- In-depth lawn mowers market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the lawn mowers market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing lawn mowers market opportunities.

- The global lawn mowers market forecast analysis from 2021 to 2030 is included in the report.

- The key players within lawn mowers market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the lawn mower industry.

Lawn Mowers Market Report Highlights

| Aspects | Details |

| By Type |

|

| By END USER |

|

| By FUEL TYPE |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The lawn mowers market has witnessed significant growth in past few years, owing to surge in spending on lawn maintenance activities.

The rise in trend of gardening activities, especially in high income countries such as U.S, Canada, UK, and Germany has fueled the demand for lawn mowers. Furthermore, increased popularity of golf courses in countries such as China and India has increased the demand for lawn mowers from non-residential users. Non-electronic lawn mowers are extensively used for mowing large lawns owing to their long range. In addition, advancements in battery technologies have helped lawn mower manufacturers to expand the range of their cordless products, thereby increasing its usability for residential users.

Moreover, integration of GPS and other mapping technologies has played a key role in development of autonomous lawn mowers that require minimal operator input, thereby, providing lucrative opportunities for the growth for the market

The global lawn mowers equipment market size was $26.2 billion in 2020 and is projected to reach $53.7 billion in 2030, growing at a CAGR of 6.8% from 2021 to 2030.

The forecast period considered for the lawn mowers market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The base year considered in the lawn mowers market is 2020.

The report for global lawn mowers market doesn’t provides Value Chain Analysis, but if there is a requirement for the same, it could be added as an additional customization.

On the basis of type, the ride-on mowers segment is expected to be the most influencing segment.

Based on the end user industry, in 2020, the residential segment generated the highest revenue, accounting for over half of the market, and is projected to grow at a CAGR of 5.9% from 2021 to 2030.

The report contains an exclusive company profile section, where leading 25 companies in the market are profiled. These profiles typically cover company overview, geographical presence, and market dominance (in terms of revenue).

The market value of global lawn mowers equipment market is $26.2 billion in 2021.

Loading Table Of Content...