Lead Mining Software Market Overview

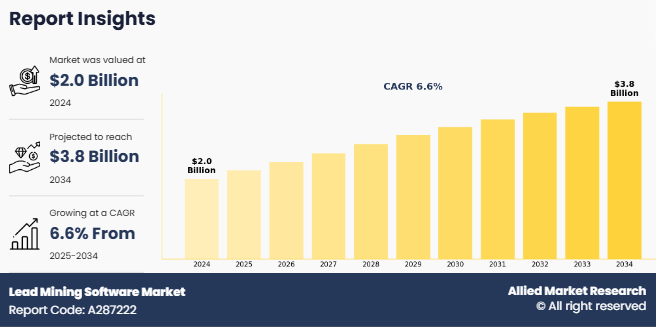

The global lead mining software market was valued at USD 2 billion in 2024, and is projected to reach USD 3.8 billion by 2034, growing at a CAGR of 6.6% from 2025 to 2034.

Lead mining software is a specialized digital tool designed to help businesses identify, extract, and analyze potential sales leads from vast datasets. By leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics, these platforms enable companies to segment audiences, predict lead behavior, and personalize marketing strategies effectively. In addition, the integration of lead mining software with customer relationship management (CRM) systems enhances workflow efficiency and data accuracy. The lead mining software industry is experiencing robust growth, driven by the increasing demand for data-driven decision-making and personalized customer engagement strategies. The lead mining software market trends includes a shift towards cloud-based solutions, offering scalability, flexibility, and real-time data access, which are particularly beneficial for small and medium-sized enterprises.

Key Takeaways

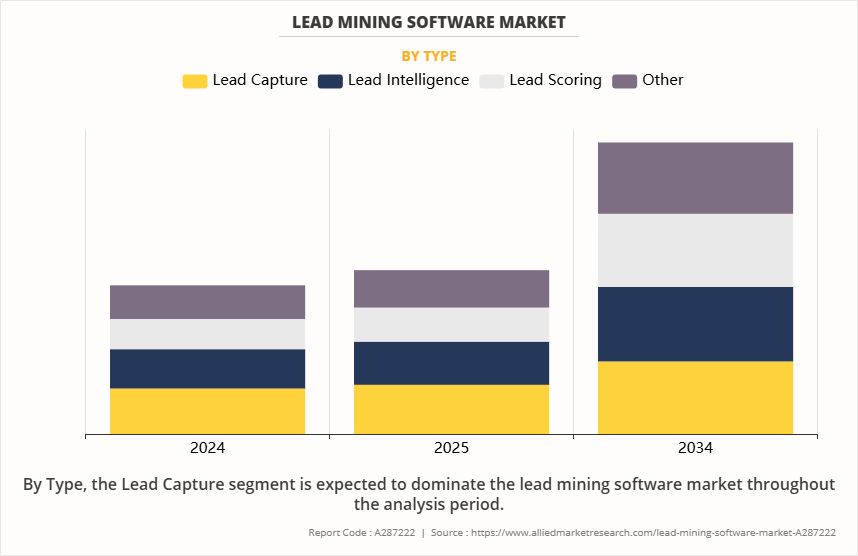

- By Type, the lead capture segment held the largest share in the lead mining software market for 2024.

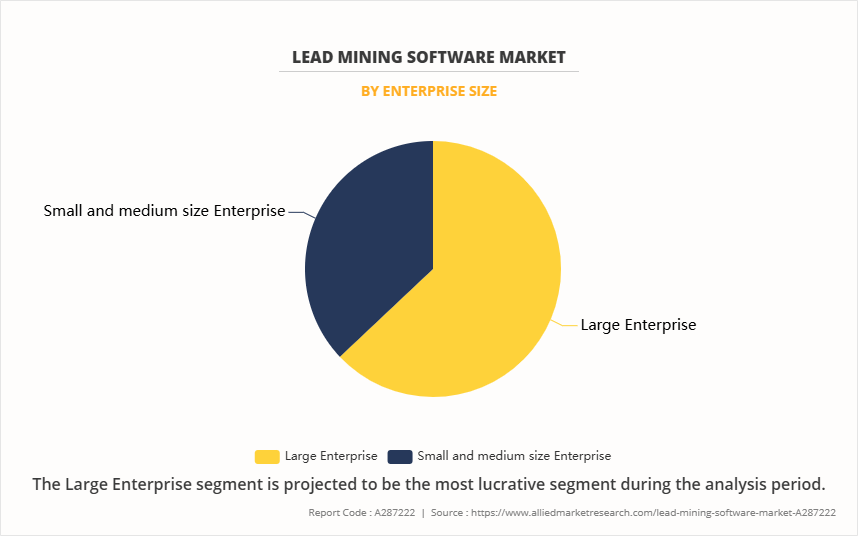

- By Enterprise Size, the large enterprise segment held the largest share in the lead mining software market for 2024.

- By industry vertical, the BFSI segment held the largest share in the lead mining software market for 2024.

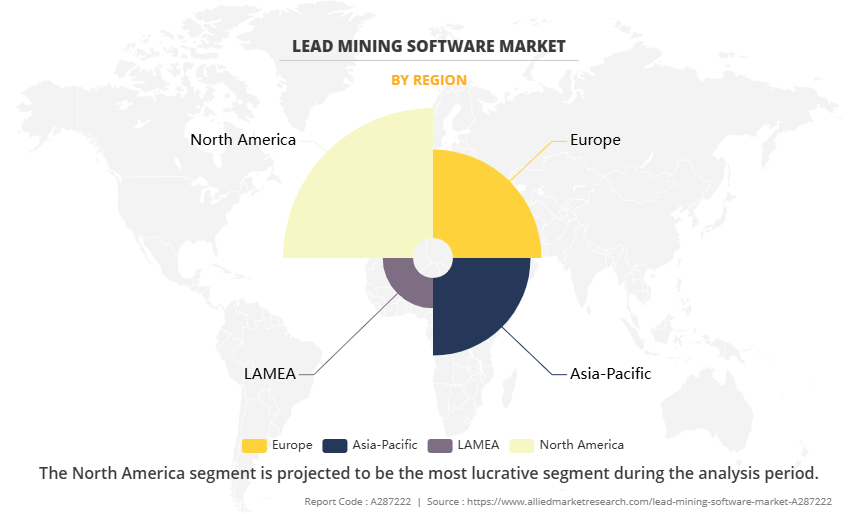

- Region-wise, North America held largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The lead mining software market is growing as companies look for smarter ways to find potential customers. With the increase in online sales, businesses need tools that can gather and analyse data from websites, emails, and social media to find quality leads. This has increased demand for lead mining software that can identify the right prospects faster. Companies now want flexible software that fits their unique sales needs, pushing providers to offer customisable options. Features like real-time lead scoring, automatic data updates, and detailed customer profiles are helping vendors and fueling the lead mining software market share. As competition increases, many firms are also using these tools to support their sales teams and improve decision-making. In addition, businesses in finance, tech, and retail are adopting lead mining software to grow their customer base. However, high initial setup costs for advanced or customized lead mining solutions are significantly hindering the market's overall growth potential.

Furthermore, the growing focus on sales automation is driving the lead mining software market. Businesses are increasingly adopting these tools to shorten sales cycles and reduce manual tasks. With automated lead generation and data analysis, companies can quickly identify high-potential leads and improve conversion rates. This shift toward smarter, faster sales processes is boosting demand for lead mining software, helping businesses work more efficiently and close deals more effectively.

Segment Review

The lead mining software market is segmented on the basis of type, enterprise size, industry vertical, and region. By type, it is classified into lead capture, lead intelligence, lead scoring and others. By enterprise size, it is bifurcated into large enterprises and small and medium sized enterprise. By industry vertical, it is segmented into BFSI, Retail, IT and Telecommunications, Healthcare, Manufacturing, and others, and By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, it is segmented into lead capture, lead intelligence, lead scoring and others. The lead mining software market share was dominated by the lead capture segment in 2024. This is attributed to the growing need for businesses to collect lead information quickly and accurately from multiple sources such as websites, social media, and online forms. Lead capture tools help automate data collection, reduce manual entry, and improve lead quality, making them essential for efficient sales and marketing efforts.

However, the lead scoring segment is expected to register the highest CAGR during the forecast period, its ability to prioritise leads based on their likelihood to convert. This helps sales teams focus on high-potential prospects, improve efficiency, and increase conversion rates. The growing use of AI and data-driven decision-making further supports the adoption of lead scoring tools.

On the basis of enterprise size, it is classified into large enterprises and small & medium enterprises. The large enterprises segment dominated the market share in 2024 and is expected to register the highest CAGR during the forecast period. This was attributed to to their greater need for handling large volumes of customer data, complex sales processes, and global operations. Large enterprises are more likely to invest in advanced tools like AI-powered lead intelligence, CRM integration, and predictive analytics to improve sales efficiency, enhance customer targeting, and support long-term growth strategies.

However, the small and medium-sized enterprise segment is expected to register the highest CAGR during the forecast period. This is attributed to growing adoption of affordable, cloud-based lead mining solutions by SMEs to improve sales efficiency, automate lead generation, and compete with larger firms. Easy integration, user-friendly interfaces, and scalable features make these tools ideal for small businesses aiming to boost customer acquisition and growth.

Region-wise, the lead mining software market was dominated by North America in 2024 and is expected to retain its leading position during the forecast period. This growth is driven by the widespread adoption of advanced sales and marketing technologies, significant investments in data analytics tools, and a mature digital infrastructure that supports efficient lead generation and conversion. Both private and public sectors are heavily investing in solutions that help improve targeting, streamline marketing operations, and boost customer acquisition. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to rapid digital transformation, growing internet usage, and increasing awareness of the importance of data-driven sales strategies. Additionally, the expanding startup ecosystem and rising demand for automated lead generation tools are fueling market growth, while government initiatives supporting digitalization further accelerate the adoption of lead mining software across the region

Top Impacting Factors

Driver

Increasing Demand for Data-Driven Sales Strategies

The lead mining software market is witnessing significant growth, fueled by the rising need for data-centric sales strategies. in a competitive business landscape, companies are turning to analytics to better understand their sales performance and customer behavior. Lead mining software market insights reveal that businesses are increasingly leveraging these tools to pinpoint, evaluate, and rank leads more effectively by analyzing data from multiple sources, including social media, website visits, and customer interactions. These insights enable organizations to focus on high-potential leads, thereby enhancing conversion rates.

organizations across sectors are shifting away from manual lead generation methods in favor of intelligent software that offers real-time, actionable insights. By using advanced algorithms and machine learning, lead mining software delivers accurate lead predictions and helps anticipate customer actions. This enables sales teams to engage prospects with better timing and messaging, leading to higher sales efficiency and improved outcomes. The increasing reliance on such technology is a key driver of lead mining software market demand.

Moreover, the integration of lead mining software with crm platforms and other sales tools streamline operations by automating routine tasks like lead scoring and follow-up scheduling. This allows sales professionals to concentrate on building client relationships and closing deals. automation also reduces errors and ensures no promising lead is missed, further accelerating lead mining software market growth by driving productivity and revenue generation.

Restraints

Data Privacy and Security Concerns

The lead mining software industry is increasingly affected by growing concerns over data privacy and security. These platforms process large volumes of consumer data often containing personal identifiers and behavioral insights which raises significant concerns in today’s highly regulated digital environment. With laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., businesses are under pressure to ensure transparent data practices, obtain user consent, and implement stringent protection measures.

Non-compliance with these regulations can result in severe penalties, legal liabilities, and long-term reputational damage. For companies relying on lead mining software, staying compliant adds complexity to their operations, as they must ensure every stage of data handling—from collection to processing follows legal standards. This becomes even more challenging for firms operating in multiple countries or highly regulated sectors like finance and healthcare.

Furthermore, the increase in frequency of cyber threats make these software platforms attractive targets for hackers. A breach can result in the exposure of sensitive customer information and loss of trust. As a result, vendors are compelled to invest heavily in advanced cybersecurity solutions, including encryption, access cotrols, and ongoing system monitoring, further increasing operational costs and market entry barriers.

Opportunity

Expansion into Emerging Markets with Growing Digital Marketing Ecosystems

Emerging markets present a significant lead mining software market opportunity, driven by the rapid expansion of digital marketing ecosystems. As businesses in regions such as Asia-Pacific, Latin America, the Middle East, and Africa increasingly adopt digital tools to reach wider audiences, the need for efficient lead generation solutions is rising. These regions are contributing substantially to the lead mining software market size, fueled by rising internet penetration, smartphone usage, and social media activity—factors that generate vast volumes of consumer data for lead mining platforms to leverage. in addition, small and medium-sized enterprises (smes) in these areas are prioritizing digital transformation to remain competitive, making them ideal adopters of scalable and affordable lead mining tools.

The growing presence of e-commerce platforms and digital advertising channels further boosts demand for automated solutions capable of identifying, segmenting, and converting leads efficiently. Vendors offering localized, cloud-based, and user-friendly solutions have a strong chance to expand their footprint. With proper investment in language support, compliance with regional data regulations, and partnerships with local digital marketing firms, companies can tap into a largely underpenetrated yet high-potential customer base. This trend is expected to significantly influence the lead mining software market forecast, driving long-term global growth and further increasing the overall lead mining software market size.

Competition Analysis

The report analyzes the profiles of key players operating in the lead mining software market such as ZoomInfo Technologies LLC, LeadIQ, Inc., AeroLeads, Inc., BuiltWith Pty Ltd, LeadGenius, Anteriad LLC, snapADDY GmbH, Agile CRM Inc., LeadGibbon, HubSpot, Inc., Lusha Systems Inc, UpLead, Dealfront Group GmbH, FindThatLead, Cognism Limited, Apollo, Growbots Inc., Salespanel, UnboundB2B and Snov.io. These players have adopted various strategies to increase their market penetration and strengthen their position in the lead mining software market.

Recent Key Developments in the Lead Mining Software Market

In December 2024, TechTarget, Inc. expanded its reach in the lead-mining software market by acquiring Xtelligent Healthcare Media. This acquisition is expected to grow TechTarget's customer base and significantly expand its audience reach.

In December 2024, ZoomInfo Technologies LLC announced significant enhancements to its lead mining software, including improved location-based data matching technologies, an enhanced data pipeline, and machine learning capabilities. These upgrades have made more than 100 million businesses available to its customers, bolstering lead generation efforts.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lead mining software market analysis from 2024 to 2034 to identify the prevailing lead mining software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the lead mining software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global lead mining software market trends, key players, market segments, application areas, and market growth strategies.

Lead Mining Software Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.8 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 228 |

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Type |

|

| By Region |

|

| Key Market Players | LeadGibbon, Agile CRM Inc., AeroLeads, Inc., Growbots Inc., Dealfront Group GmbH, LeadGenius, HubSpot, Inc., Anteriad LLC, Salespanel, LeadIQ, Inc., UnboundB2B, Apollo, UpLead, FindThatLead, Cognism Limited, snapADDY GmbH, ZoomInfo Technologies LLC, Lusha Systems Inc, BuiltWith Pty Ltd, Snov.io |

Analyst Review

As the lead mining software industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The lead mining software market is growing as more businesses adopt CRM platforms with built-in lead mining tools. These tools help companies automatically collect, sort, and analyse customer data to find strong sales leads. When integrated with CRM systems, lead mining software makes it easier to track where leads come from and how likely they are to convert. This saves time and helps sales teams focus on the most promising prospects. As more companies rely on digital sales and marketing, using lead mining software within CRM platforms has become a smart way to boost performance. Businesses also like how these tools can give real-time updates and clear lead scores. The growing use of CRM platforms is driving the need for better lead mining solutions, making this software an important part of modern sales strategies.

Furthermore, the growth in B2B e-commerce and digital selling channels is driving demand for lead mining software. As more businesses sell products and services online, they need tools to find and manage leads effectively. Lead mining software helps identify potential buyers, reduce sales effort, and improve targeting. This shift to digital platforms makes it easier for companies to reach the right audience and grow their customer base efficiently.

Moreover, the advancements in AI and machine learning algorithms is driving the growth of the lead mining software market. Businesses are increasingly using these technologies for smarter lead scoring and prediction. AI helps companies analyse large amounts of customer data to find patterns, rank leads by quality, and predict which ones are most likely to convert. This reduces manual effort, improves targeting, and saves time for sales teams. Machine learning also allows systems to get better over time, making lead predictions more accurate. This approach helps businesses focus their efforts on high-potential customers, leading to better results and higher ROI. However, challenges remain, such as ensuring that AI models are easy to understand and align with business goals. Integrating AI tools with existing systems can also be complex. Despite these challenges, demand continues to grow as more firms adopt AI-driven lead mining tools to boost sales performance.

Increased adoption of AI for automated lead identification, real-time data analysis, and personalized targeting is the upcoming trend of the Lead Mining Software Market globally.

Lead capture is the leading type of Lead Mining Software Market.

North America is the largest regional market for Lead Mining Software.

$3.8 billion is the estimated industry size of Lead Mining Software.

ZoomInfo Technologies LLC, LeadIQ, Inc., AeroLeads, Inc., BuiltWith Pty Ltd, LeadGenius, Anteriad LLC, snapADDY GmbH, Agile CRM Inc., LeadGibbon, HubSpot, Inc., Lusha Systems Inc, UpLead, Dealfront Group GmbH, FindThatLead, Cognism Limited, Apollo, Growbots Inc., Salespanel, UnboundB2B and Snov.io. are the top companies to hold the market share in Lead Mining Software

Loading Table Of Content...

Loading Research Methodology...