Leather Luggage And Goods Market Research, 2033

Market Introduction and Definition

The global leather luggage and goods market size was valued at $285.3 billion in 2023, and is projected to reach $466.9 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033. Leather luggage comprises products such as trolley bags and suitcases used for carrying personal belongings, whereas products such as purses, wallets & belts, footwear, handbags, and others are included in the leather goods segment. Factors such as growing disposable income, increasing domestic and international travel, and improving living standards foster the leather luggage and goods market growth. Global market players continuously launch the latest and most stylish leather goods according to the changing demand of consumers. In addition, stylish and compact luggage products offered by market players provide convenience and ease to consumers while traveling. Increased per capita income encourages consumers to opt for premium and high-quality leather products.

Key Takeaways

- The leather luggage and goods market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major leather luggage and goods industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Evolving fashion trends across the globe have encouraged market players to launch innovative and trendy products to cater to the demands of consumers and maintain a loyal customer base. Moreover, consumers also prefer leather goods and luggage which are compact yet stylish. Changing fashion trends have resulted in the expansion of men’s accessories including leather bracelets, neckpieces, and gloves. Thus, changing fashion trends would strengthen the growth of the market in the coming years.

An increase in domestic and international tours has fostered the growth of various industries. People are opting for easy-to-handle leather luggage bags. Extensive traveling needs leather luggage that can resist harsh handling at any point in time. Thus, consumers opt for premium and better quality leather luggage for convenient traveling.

Nowadays, consumers are very much aware of the fashion trends prevailing across the globe. The presence of social media has exposed consumers to various international brands. Market players such as Prada and Gucci are known for their premium quality products. They have a strong customer base and are increasingly expanding to developing countries. With growth in disposable income, consumers are also owning international leather brands bags, and accessories to complement their attires and improve living standards. Thus, awareness about branded products would foster the growth of the overall leather luggage and goods market.

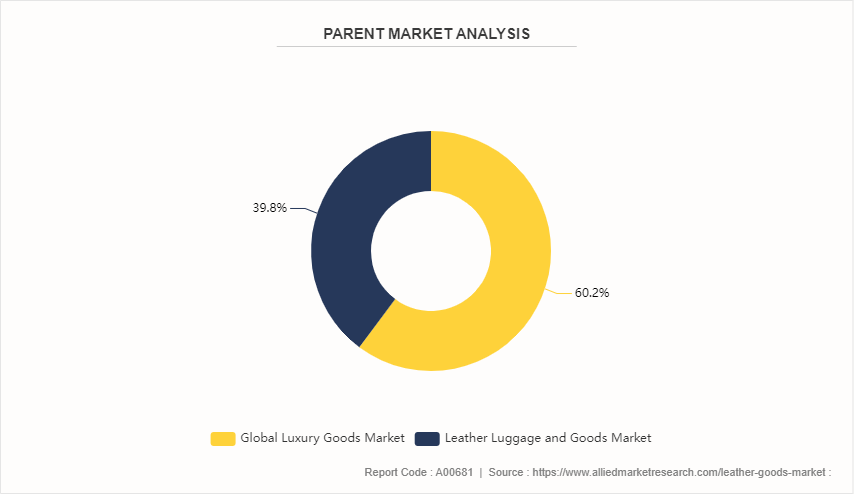

Parent Market Overview of the Global Leather Luggage and Goods Market

The global leather luggage and goods market is a prominent segment within the broader luxury goods sector. The product line comprises a wide variety of products, such as leather belts, wallets, travel bags, and purses. Growing customer preferences for high-end, long-lasting products and rising disposable income both boost this sector. Innovative technology in leather processing and trends like customization and sustainability are its main drivers. Growing fashion consciousness, the rise of online retail channels, and the growth of international tourism are major factors impacting the market.

Market Segmentation

The leather luggage and goods market is segmented into product type, end user, mode of sale, and region. On the basis of product type, the market is divided into leather luggage and leather goods. On the basis of end user, the market is bifurcated into men and women. On the basis of the mode of sale, the market is bifurcated into online stores and retail stores. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Strong consumer expenditure and a strong desire for high-end products are driving the North American market for leather goods and luggage. Driven by fashion-forward consumers and an increasing interest in premium travel accessories, the U.S. leads the region in demand. With growing urbanization and disposable incomes making high-quality leather products more accessible to consumers, Canada and Mexico also contribute to the market's expansion.

Germany, France, Italy, and other important nations in Europe constitute the largest markets for leather goods and luggage in Europe. A major participant is Italy, which is renowned for its excellent leather craftsmanship. Germany and France are expanding with robust domestic demand and a growing tourism sector. A strong heritage of leather craftsmanship and an appreciation for luxurious, durable products sustain the market in the region.

The Asia-Pacific region is growing rapidly due to shifting consumer tastes and rising incomes. Major contributors are China and India, where rising urbanization and growing middle classes are driving up leather luggage and goods market demand. Strong market success is also seen in South Korea and Japan, which are supported by rising living standards and design trends. The growing travel and tourism industries in these nations also contribute to the increased demand for high-quality leather products and luggage.

The main markets in Latin America include Brazil and Argentina, where there is a growing demand for high-end leather products. Variations in disposable income and economic conditions have an impact on the market, although increased international travel and improved economic conditions encourage market expansion.

The Middle East, especially Saudi Arabia and the United Arab Emirates, has a growing demand for luxury leather products due to increased disposable incomes and an emerging luxury retail sector. Even though the market in Africa is still relatively small, nations like South Africa and Nigeria are seeing fresh growth prospects as a result of expanding economic conditions and urbanization.

Industry Trends:

- A partnership between the World Wildlife Fund (WWF) and Tapestry, Inc., a New York-based luxury accessories and lifestyle brand house that includes Coach, Kate Spade, and Stuart Weitzman, was announced in April 2022 in conjunction with a $3 million philanthropic grant from the Tapestry Foundation, which advocates for social and environmental justice. With the help of this funding, a novel method for improving traceability along the leather value chain will be developed, to promote a more sustainable future for the Brazilian leather sector.

- The luxury clothing company Prada constructed a plant close to Sibiu, Romania, in October 2022. Prada will produce some of its leather products on the new site. The 31, 000-square-foot plant is run by Hipic Prod Impex, which is currently a part of the Prada group and is in Sibiu's West Industrial Zone.

- American Leather Holdings LLC launched a brand-new line of high-end leather products in 2024, aiming to attract wealthy customers who value exclusivity and elegance. Handmade leather accessories, such as belts, wallets, and handbags, are part of the collection. Skilled artisans carefully create each product from the finest materials.

Competitive Landscape

The major players operating in the leather luggage and goods market include Delsey S.A., Hermes International S.A., Louis Vuitton, Christian Dior SE, Kering SA, Samsonite International S.A., Prada S.p.A., VIP Industries Limited, and Coach, Inc.

Recent Key Strategies and Developments

- In August 2020, the first three pairs of PUMA SE's Xetic sneakers featuring Porsche designs are now available. The series featured 100% chrome-free leather, 30% algae-infused lining, and 100% recycled mesh fabric for both performance and casual wear.

- In January 2021, as part of their sustainability initiative, Adidas AG announced the release of a new range of trainers manufactured from mushroom leather. Stella McCartney, lululemon, and the biotech firm Bolt Threads have partnered with the company to produce plant-based, vegan leather footwear.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the leather luggage and goods market share, segments, current trends, estimations, and dynamics of the leather luggage and goods market analysis from 2024 to 2033 to identify the prevailing leather luggage and goods market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the leather luggage and goods market forecast, segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global leather luggage and goods market trends, key players, market segments, application areas, and market growth strategies.

Leather Luggage and Goods Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 466.9 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By End User |

|

| By Mode Of Sale |

|

| By Region |

|

| Key Market Players | Delsey S.A, Coach, Inc., Kering SA., Hermes International S.A., VIP Industries Limited, Prada S.p.A., Christian Dior SE, Samsonite International S.A, Louis Vuitton |

Analyst Review

The world leather luggage and goods market has witnessed a notable growth in the recent years, especially in the developing countries of Asia-Pacific and LAMEA, such as India, China, and Dubai. The market in these regions is driven by the increasing disposable income of consumers coupled and rising inclination towards premium designer leather bags and accessories.

The growth in the tourism industry has fostered the demand for new and innovative luggage products. Frequent domestic and international trips for personal and business purposes have led to a rise in the demand for compact and stylish leather travel bags. To cater to the needs of frequent travelers, market players are launching new products, such as suitcases and trolley bags with side handles and wheels, for easy maneuver during transit. Handbags are another popular leather goods category, anticipated to grow rapidly in the coming years. Rise in the number of working women worldwide, has led to increased demand for trendy and fashionable handbags. Moreover, men around the world are opting for stylish leather products, such as leather footwear, bags, and jackets, thereby raising the demand of leather goods. Leather accessories such as leather bracelets and leather cuff bracelets are also gaining popularity among both men and women.

Several companies operating in the global leather luggage and goods market have formulated different strategies to compete in the industry. Expansion and acquisition are the key growth strategies adopted by well-established companies, which enable them to increase their market presence and expand their customer base. Global companies, such as Coach, Inc. and Louis Vuitton, have established new retail outlets in Asia and Europe to mark their presence in the region. For instance, in 2014, Coach inaugurated its first flagship store in the most prestigious shopping districts in Paris. This expansion would enable the company to strengthen its market outreach in the European market. In addition, intensive marketing campaigns by prominent companies have increased brand awareness among consumers, thus leading to the growth of the leather luggage and goods market.

Upcoming trends in the leather luggage and goods market include sustainable materials, smart luggage technology, personalized products, e-commerce growth, minimalist designs, and a focus on multifunctional travel accessories.

The leading application of the leather luggage and goods market includes travel accessories such as suitcases, handbags, backpacks, and briefcases, primarily driven by increasing travel and luxury lifestyle trends.

The largest regional market for leather luggage and goods is North America, driven by high consumer demand, luxury brand presence, and a strong travel culture in the United States and Canada.

The global leather luggage and goods market was valued at $285.3 billion in 2023, and is projected to reach $466.9 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

The major players operating in the leather luggage and goods market include Delsey S.A., Hermes International S.A., Louis Vuitton, Christian Dior SE, Kering SA, Samsonite International S.A., Prada S.p.A., VIP Industries Limited, and Coach, Inc.

Loading Table Of Content...