LendTech Market Research, 2031

The global lendtech market was valued at $8 billion in 2021, and is projected to reach $61.9 billion by 2031, growing at a CAGR of 23.2% from 2022 to 2031.

Lend-Tech is a safe online method of offering loans and other financial services to customers. LendTech loans serves as a digital platform via which banks and other lending organizations can offer loans. Further, they assist students by offering study loans and other forms of financial assistance.

The lendtech market is growing as a result of shifting customer expectations and behavior owing to the numerous advantages provided by the digitalization of banking and financial services. Customers can come from a variety of backgrounds and may need the loan for a range of things, including personal loans, SME financing, and housing loans, among many other options. In addition, the advantages provided by digital lending platforms, such as improved loan optimization of the loan process, speedier decision-making, compliance with regulations and norms, and greater company efficiency, propel lendtech market growth.

However, high acquisition costs and security risks of digital lending hinder the growth of the lendtech market. On the contrary, technological advancements in the lendtech such as inclusion of machine learning (ML) and automations, are expected to fuel the growth of the lendtech market in upcoming years. Moreover, the increase in adoption of digital lending by banks, credit unions and NBFCs is expected to provide lucrative opportunities for the market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the lendtech market. The study provides Porter’s five forces analysis to understand the impact of several factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the lendtech market outlook.

The lendtech market is segmented into Component, Deployment Mode, Type, Organization Size and End User.

Segment Review

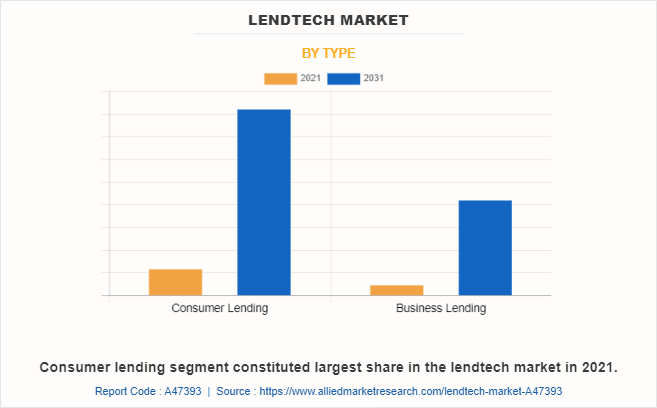

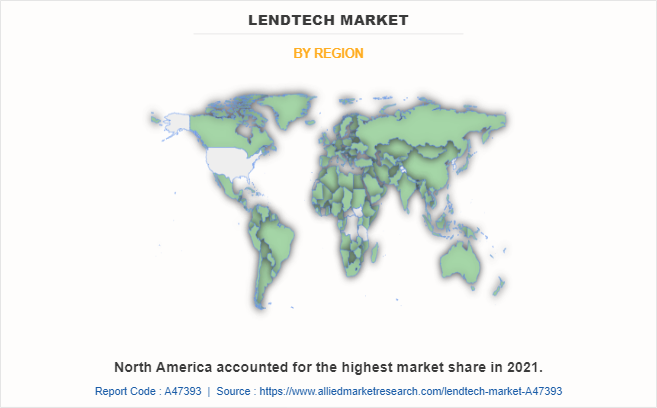

The lendtech market is segmented on the basis of component, deployment mode, type, organization size, end user and region. On the basis of component, it is categorized into solution and services. On the basis of deployment mode, it is classified into on-premise and cloud. On the basis of type, it is divided into consumer lending and business lending. By organization size, large enterprises, and small and medium-sized enterprises. By end user, it is segmented into banks, credit unions and NBFCs. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the business lending segment acquired a major lendtech market size in 2021. This is attributed to the increasing number of FinTech firms providing online lending services and the implementation of government regulations for promoting lender transparency. In addition, factors such as providing consultancy services before availing loans and extending lending options for businesses are expected to offer lucrative opportunities for market expansion in the upcoming years.

By region, the North America dominated the lendtech market share in 2021. This is attributed to rising demand for lending technology solutions from the lending corporations. In addition, the increasing technological advancements along with the existence of a large number of players are some other main factors that are providing support to the growth of the market in the region.

The report lendtech market analysis includes the profiles of key players operating in the lendtech market such as Visa, Inc., American Express, Fiserv, Inc., Finastra, Nelito Systems Pvt. Ltd., Q2 Software, Inc., Newgen Software Technologies Limited, FIS, Roostify, Inc., and Pegasystems Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the lendtech market.

Country Specific Statistics & Information

In the financial services sector, fintech is driving quick innovation. By increasing the scope of financial access and enhancing the quality and cost of financial services via efficiency, these innovations can increase financial inclusion. Further, fintech companies such as Cashfloat, are already using lendtech technology to measure risk more precisely. They do a more thorough study that allows them to evaluate a customer's ability to repay a loan in addition to their prior credit history. Shawbrook is one of a new generation of banks working with merchants to quickly determine the creditworthiness of customers who are shopping in-store online.

Furthermore, to reduce funding and origination expenses, digital lenders throughout the world are attempting to get banking licenses. For instance, in June 2020, the UK-based digital lending firm Zopa obtained a banking license. Additionally, SoFi Technologies, an internet lender, was given permission by American regulators to transform into a bank holding company in January 2022. Thus, the growing number of digital lenders with banking licenses is creating new opportunities for the market.

The COVID-19 pandemic outbreak had a positive effect on the market for digital lending platforms. In addition, credit unions and banks are especially improving their digital banking services to better serve their consumers. Furthermore, during the COVID-19 pandemic, banks have been using digital channels more frequently to disburse loans under the Paycheck Protection Program. Small companies can get funding for up to 8 weeks under the Paycheck Protection Program in the U.S. According to data released by Numerated, a supplier of a digital lending platform, 82% of U.S. firms elect to apply for PPP loans online during COVID-19 as opposed to through conventional methods.

Top Impacting Factors

The Rapid Adoption of Technology by all Levels of Lending Service Providers

Across the world, every business sector has found its route to accelerated transformation due to the outbreak of COVID-19 and rapid technological adoption, and the financial sector is not an exception. Technological advances combined with customer expectations are altering the way lenders operate. Furthermore, the increasing internet penetration and adoption of smartphone devices are pulling traditional and millennial borrowers towards lending technology solutions. The accelerated push towards the adoption of digital tools makes technology the key enabler of the lendtech industry.

In addition, various market players are adopting different key strategies to offer additional services to drive their revenue growth opportunities and to improve their lending technology service efficiencies, which fuels the lendtech market growth. For instance, in August 2019, Q2 Holdings, Inc., a leading provider of digital transformation solutions for banking and lending, announced that Athena Home Loans (Athena), one of Australia's first pure digital mortgage providers, selected Cloud Lending (CL), a Q2 company, as its digital lending platform provider. Leveraging the power of CL Originate and CL Loan, Athena chose CL for its digital-first capabilities, highly configurable solution, security features, and Salesforce integration designed to enhance the customer experience.

Increasing Adoption of Cloud Services and Automation in the Lending Process

The loan origination process is complex and highly fragmented. The manual process requires multiple touchpoints between different departments of the front office and back offices which further involves multiple parties and activities that are prone to errors and delays. The traditional process is outdated and no longer adapts to the present times. In today’s competitive business environment, it is imperative to streamline operations, reduce costs, and accelerate the application process so that the organization can maximize results by overcoming the challenges caused by the traditional loan origination process.

Implementation of Better Machine Learning Automation and Big Data

Banks, credit card companies, and lenders alike have been using machine learning and big data to not only improve their lending processes but as a security measure to ensure no fraudulent activity has taken place. Furthermore, this kind of security has become a core focus for FinTech startups, offering a more secure and fraud-free process for managing and handling their funds, protecting their money, log in details, and others. With the implementation of better machine learning automation and the Big Data landscape, lenders can make better-informed decisions. Therefore, these factors will provide major lucrative opportunities for the growth of the lendtech market industry.

In addition, major market players such as Finastra, are adopting key strategies to build connectivity and relationships between financial institutions and distributor organizations that embed lending solutions at merchants’ point-of-sale. For instance, in June 2022, Finastra unveiled its embedded consumer lending solution, enabling access to traditional regulated lending options for consumers at point-of-sale (POS). Financial institutions, distributors, and merchants get benefits from a platform that makes it easy for their customers to access lending options.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lendtech market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of lendtech market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lendtech market segmentation assists in determining the prevailing lendtech market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global lendtech market trends, key players, market segments, application areas, and market growth strategies.

LendTech Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 61.9 billion |

| Growth Rate | CAGR of 23.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 480 |

| By Component |

|

| By Deployment Mode |

|

| By Type |

|

| By Organization Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Finastra, Newgen Software Technologies Limited, American Express Company, Fiserv, Inc., Visa, Inc, Q2 Software, Inc., Pegasystems Inc., Nelito Systems Pvt. Ltd., Roostify, Inc., fis |

Analyst Review

The introduction of various technical innovations, such as the widespread usage of smartphones, has increased the adoption of digital banking across a variety of end-user industries. Further, banks and fintech profit from technology like artificial intelligence, machine learning, and cloud computing as they can analyze vast volumes of client data. This data and information are then compared to find the best services or solutions for clients, which has essentially helped in establishing relationships with consumers.

During the COVID-19 outbreak, lenders have suffered largely owing to delayed payments because of the moratorium imposed by respective country government. For instance, in India, Reserve Bank of India (RBI) has imposed moratorium on existing loans. Post-June 2020, disbursal volumes diminished by approximately 80% compared to pre-COVID levels, with 50% of lenders halting new disbursals altogether.

Some of the most well-known businesses in the financial sector that have made a significant AI investment include Aire, Kabbage, and Kasisto. For instance, Kabbage employs AI algorithms to evaluate all the risks associated with lending money to a specific consumer, allowing managers to approve loans quickly. The need for AI has been further bolstered by customers' requests for the customization of their demands in fintech and banking firms.

Furthermore, the increase in digital behavior is also augmented by government regulations. For instance, in September 2020, Thailand's central bank published new measures for the growing digital personal loan market. It also recommended that loan providers apply more digital technology for operational processes such as loan offering, debt repayment, and information disclosure, such as interest rates, fees, and penalties.

Therefore, with such advancements, the lendtech market is subjected to grow at a rapid speed in the upcoming years. Some of the key players profiled in the report include Visa, Inc., American Express, Fiserv, Inc., Finastra, Nelito Systems Pvt. Ltd., Q2 Software, Inc., Newgen Software Technologies Limited, FIS, Roostify, Inc., and Pegasystems Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The lendtech market is estimated to grow at a CAGR of 23.2% from 2022 to 2031.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as Visa, Inc., American Express, Fiserv, Inc., Finastra, Nelito Systems Pvt. Ltd., Q2 Software, Inc., Newgen Software Technologies Limited, FIS, Roostify, Inc., and Pegasystems Inc.

The lendtech market is projected to reach $61.86 billion by 2031.

The rapid adoption of technology by all levels of lending service providers, need for improved security and compliance in the lending process and increasing adoption of cloud services and automation in the lending majorly contribute toward the growth of the market.

The key growth strategies of lendtech market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...