Leukapheresis Market Research, 2031

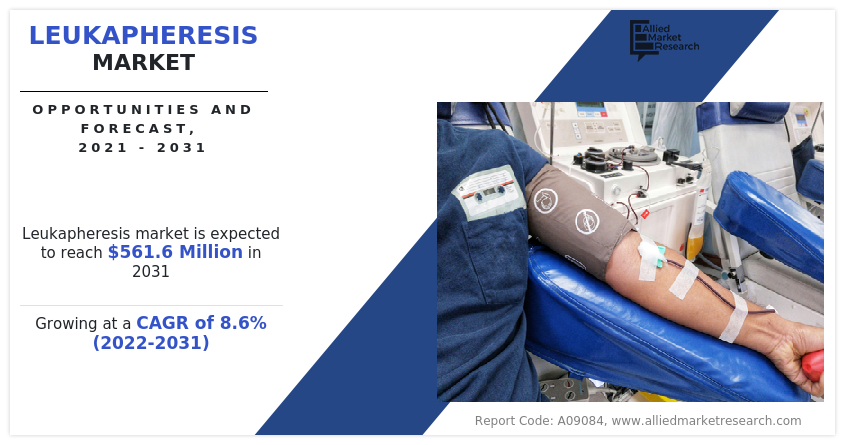

The global leukapheresis market size was valued at $245.7 million in 2021, and is projected to reach $561.6 million by 2031, growing at a CAGR of 8.6% from 2022 to 2031. Leukapheresis is laboratory procedure in which white blood cells are separated from sample of blood. It can be used for to lower an extremely high white blood cell count, to extract autologous or allogeneic blood cells for subsequent transplantation into the patient or for research purposes.

The leukapheresis is used in treatment of leukemia or patients with high white blood cells. In the case of hematological malignancies such as chronic leukemias, white blood cell counts may be high enough to cause leukostasis (acute leukemias have a more variable white cell count and chronic cases typically have higher white blood cell counts). This can affect vision changes, shortness of breath from decreased efficiency in oxygen exchange, as well as other organ systems. Thus, leukapheresis may be performed to obtain the patient's own blood cells for a later transplant. Leukapheresis, is typically for granulocytes, is a rarely performed in blood donation process.

Increase in prevalence of leukemia is the key factor that drives the growth of the global leukapheresis market size. For instance, according to National Library of Medicine in China 2022, is estimated the approximately 88,249 new cases of leukemia (50,213 male cases and 38,036 female cases). In addition, increase in number of clinical trials and increase in public and private investments for the development of CAR (chimeric antigen receptor)-T therapy in which leukapheresis is the first step for CAR-T therapy drive the market growth. However, high cost associated with leukapheresis therapeutics and leukopak and blood transfusion safety in developing countries may hinder the market growth. In contrast increase in demand for leukapheresis in pediatric patients are anticipated to provide lucrative leukapheresis market opportunity to the market players.

Impact of COVID-19

The outbreak of COVID-19 has disrupted workflows in the health care sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. However, COVID-19 pandemic positively impacted the leukapheresis industry.

Leukapheresis is a laboratory procedure in which white blood cells are separated from the blood. One symptom of COVID-19 is a reduction in the number of lymphocytes cells in the blood. With fewer lymphocytes, the body cannot effectively fight back against SARS CoV-2, the virus that causes COVID-19. For instance, in May 2020, the National Institutes of Health Clinical Center (CC) (National Institute of Allergy and Infectious Diseases (NIAID) initiated a clinical study to identify how SARS-CoV-2 affects lymphocytes, the immune, and the blood clotting system using the leukapheresis technique by collecting white blood cells from the patients who recovered from COVID-19.

LEUKAPHERESIS MARKET SEGMENTATION

The leukapheresis market is segmented into product, method, application, end user and region. By product, the market is categorized into devices and disposables. By method, it is classified into centrifugation, membrane separation, and selective adsorption. By application, the market is classified into therapeutics application and research application. On the basis of end user, the market is categorized into blood centers, hospitals, and others. Others segment further includes research institutes, biopharmaceutical manufacturers, and private medical settings. Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

Depending on product, the market is segmented into devices and disposables. The disposables segment was dominated the leukapheresis market share in 2021 and is remain dominant during the leukapheresis market forecast period. The major factor which drives the growth of this segment include, rise in demand for leukapheresis disposables due to rise in prevalence of leukemia which fuel the segment growth. For instance, according to Cancer Research UK, (2017-2019), leukemia is the 12th most common cause of cancer death with around 2,000 deaths every year in females. In addition, advantage associated with disposable leukapheresis such as it reduces the risk of infection during transfusion of blood which fuels the segmental growth.

By Product

The disposables segment held largest share in the global market in 2021.

On the basis of method, the market is segmented into centrifugation, membrane separation, and selective adsorption. The centrifugation segment was accounted for the largest revenue in 2021. This was attributed to increase in installation of centrifugal apheresis devices in hospitals for therapeutic leukapheresis. In addition, rise in utilized leukapheresis equipment developed by key market players perform leukocyte separation using centrifugation. For instance, spectra optia apheresis system developed by Terumo BCT.

However, the membrane separation segment is projected to register highest CAGR during the forecast period. This is attributed to rise in adoption of membrane separation leukapheresis due to increase in prevalence of leukemia which boost the leukapheresis industry.

By Method

The centrifugation segment held largest market share in 2021. However, membrane separation segment is anticipated to grow at the highest CAGR of 9.3% during the forecast period.

On the basis of application, the market is segmented into therapeutics application and research application. Therapeutics application segment was accounted for the largest revenue in 2021. This was attributed to strong network of the therapeutic leukapheresis service providers across the globe.

In addition, rise in geriatric population with leukemia cancer has increased the demand for leukapheresis procedure in hospitals which drive the market growth. For instance, according to the World Population Ageing report (2020), in South Korea, the population aged 65 years or over is expected to reach 5,232,000 (19.7%) of the total population in 2050 from 2,376,000 (9.3%) of the total population in 2019. Thus, increase in geriatric population is likely to require more leukapheresis procedure as it is prone to chronic disorders.

By Application

The therapeutics application segment dominated the market in 2021. However, research application segment is expected to grow at a CAGR of 9.1% during the forecast period.

On the basis of end user, the market is segmented into blood centers, hospitals and others. Others segment further includes research institutes, biopharmaceutical manufacturers, and private medical settings. The blood centers segment dominated the market in 2021. This was attributed to increase in the promotional activities performed by blood centers towards blood donation. In addition, increase in demand for blood components in clinical conditions such as cancer drive the blood centers segment growth. For instance, according to the Red Cross Blood Organization, the number of blood donors is 6.8 million a year in the U.S., and approximately 36,000 units of blood are required every day in the country.

By End User

The blood centers segment dominated the market in 2021. However, others segment is anticipated to grow at the highest CAGR of 9.3% during the forecast period.

Region wise, North America acquired a leukapheresis market share, owing to the presence of key players, rise in government initiatives, well-developed healthcare infrastructure, and increase in prevalence of leukemia. In addition, advanced technology for leukapheresis further boost the market growth.

However, Asia-Pacific is expected to witness the highest growth rate for the leukapheresis market throughout the forecast period. The major factors that drive the growth of the leukapheresis market in this region is the increase in prevalence of leukemia in this region. In addition, technological advancements, and increase in government initiatives to promote healthy lifestyle are driving the market growth. Moreover rise in number of hospitals and blood centers for leukapheresis in this region further boost the leukapheresis market growth.

By Region

North America held largest share in the global market in 2021. However, Asia-Pacific is anticipated to grow at the highest CAGR of 10.1% during the forecast period.

The key market players profiled in the report include are Adacyte Therapeutics, AllCells, LLC, Asahi Kasei Corporation, Cerus Corporation, Charles River Laboratories International, Inc. Fresenius Kabi, Haemonetics Corporation, Macopharma, SB-Kawasumi Laboratories, Inc. and Terumo BCT, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the leukapheresis market analysis from 2021 to 2031 to identify the prevailing leukapheresis market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the leukapheresis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global leukapheresis market trends, key players, market segments, application areas, and market growth strategies.

Leukapheresis Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 561.6 million |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 274 |

| By Product |

|

| By Method |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Asahi Kasei Corporation, AllCells, LLC., Haemonetics Corporation, Terumo BCT, Inc., Macopharma, Cerus Corporation, Adacyte Therapeutics, Fresenius Kabi, Charles River Laboratories International, Inc., SB-Kawasumi Laboratories, Inc. |

Analyst Review

Leukapheresis procedures consume multiple disposable parts and such intensive consumption of disposables significantly contributes toward revenue generation. Moreover, single-use products curb the risk of infection, which is of high significance in leukapheresis as well as transfusion procedures.

The global leukapheresis market is expected to exhibit high growth potential attributable to factors such as increase in demand for blood components globally is expected to offer profitable opportunities for expansion of the market. In addition, therapeutic apheresis is majorly carried out among patients suffering from leukemia, which has piqued the interest of several companies to manufacture efficient and advanced apheresis systems.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in awareness toward blood donations and rise in government initiatives promoting blood donations drive the market growth. Surge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for manufacturing leukapheresis devices and disposables during the forecast period.

Leukapheresis is a laboratory procedure in which white blood cells are removed from a sample of blood and other blood cells and plasma back into the bloodstream

Top companies such as Fresenius Kabi, Haemonetics Corporation, Terumo BCT, Inc., Charles River Laboratories International, Inc. held high market share in 2021.

The disposables segment is the most influencing segment owing to rise in demand for leukapheresis procedures for isolation of white blood cells, which requires disposables

Increase in demand for blood donations, rise in prevenece of leukemia and rise in demand for leukopaks in clinical research studies responsible for the market growth

The market value of leukapheresis market in 2031 is $561.64 million.

The base year is 2021 in leukapheresis market.

The total market value of leukapheresis market is $245.65 million in 2021.

The forecast period for leukapheresis market is 2022 to 2031

Loading Table Of Content...

Loading Research Methodology...