Liability Insurance Market Overview

The global liability insurance market size was valued at $252.34 billion in 2021, and is projected to reach $432.81 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031. Rising litigation cases, stricter regulations, growing business risks, increased awareness, expansion of small businesses, cyber threats, and demand for professional and product liability coverage contribute to the growth of the market.

Market Dynamics & Insights

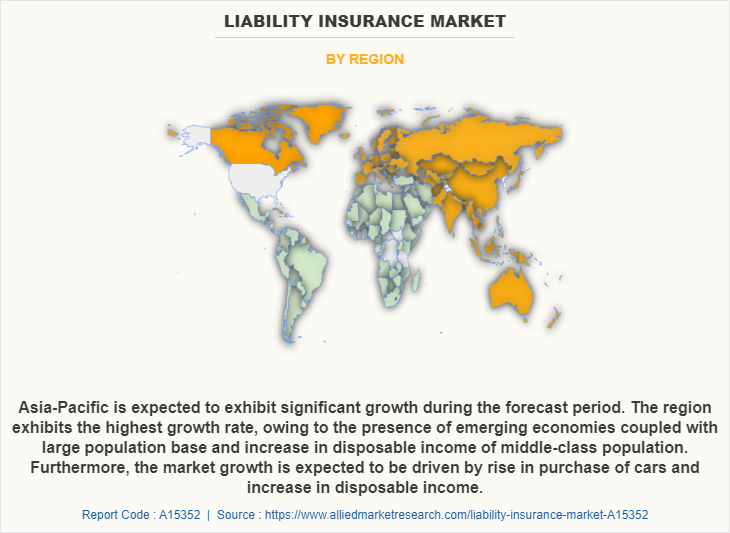

- The liability insurance market in North America held the largest market share in 2021.

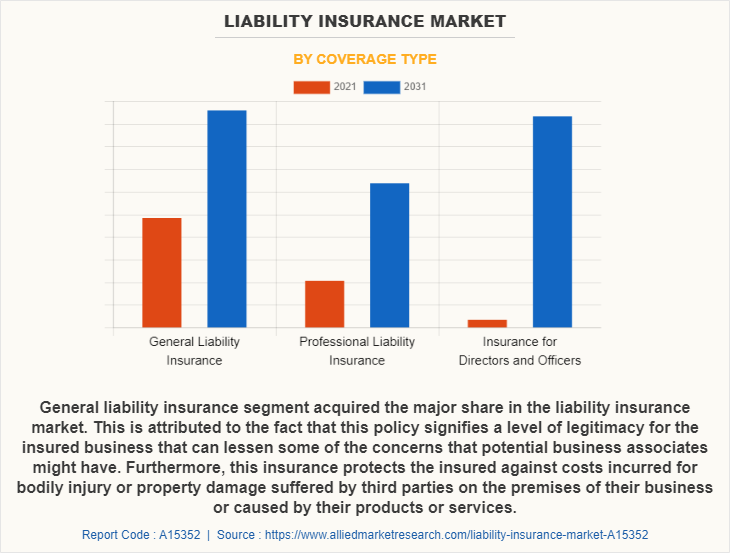

- By coverage type, the general liability insurance segment held the largest market share in 2021.

- By application, the commercial segment held the largest market share in 2021.

Market Size & Future Outlook

- 2021 Market Size: $252.34 Billion

- 2031 Projected Market Size: $432.81 Billion

- CAGR (2022-2031): 5.7%

- North America: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Liability Insurance

Liability insurance is a broad term that describes types of coverage to help protect the insured or their business, if someone files a lawsuit or reports a claim against their company. It helps to cover claims if the insured’s business causes bodily injury or property damage to someone else or their belongings. In addition, it helps to pay for repairs to damages from an accident caused by the insured or if they are responsible for.

Liability insurance minimizes the business risk, such as bodily injury caused to any person because of faulty machines or any other circumstances. In addition, it reduces out of pocket costs for the insured, since the importance of umbrella liability insurance is that every business faces claims that come up during normal operations. Without coverage, the insured have to pay out of pocket to cover claims, which can put their business at financial risk. Surge in awareness of third party liability insurance in developing countries are some factors that propel the liability insurance market growth.

However, increase in liability insurance premium cost and lack of knowledge about coverage included in liability insurance policy are some of the major factors that limit the liability insurance market. On the contrary, liability insurance is an essential coverage for providing compensation for employees to recover from a work-related injury or illness. Therefore, rise in cases of work related accidents is expected to provide major liability insurance market opportunity.

Liability Insurance Market Segment Review

The liability insurance market is segmented on the basis of coverage type, enterprise size, application, and region. By coverage type, it is segmented into general liability insurance, professional liability insurance (errors and omissions), and insurance for directors and officers. By enterprise size, it is divided into medium-sized enterprises, large enterprises, and small enterprises. By application, it is bifurcated into personal and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By coverage type, the general liability insurance attained the highest growth during the forecast period. This is attributed to the fact that general liability insurance is the highest demanded policy since insured are constantly under the risk of incurring bodily injury, which is expected to cause them to pay for medical bills and other compensation to the injured person. Medical liability insurance helps to pay for medical bills resulting from an accident caused by the insured and also pay for repairs to damages from an accident caused by the insured. Therefore, the demand for general liability insurance market has grown significantly.

By region, North America is expected to be the highest liability insurance market share during the forecast period. This is attributed to the fact that consumers in the U.S. and Canada are more aware about the policy coverage and premium cost of liability insurance. Moreover, the growing number of accidents in factories where manpower is involved has significantly grown in the U.S. Thus, chances of accidents and bodily injuries to workers has also grown simultaneously. Thus, consumers in North America, particularly in the U.S. are purchasing public liability insurance to cover such unforeseen circumstances.

The report focuses on growth prospects, restraints, and trends of the liability insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the liability insurance market outlook.

The report analyzes the profiles of key players operating in the liability insurance market, such as American International Group Inc, Allianz, AXA SA, CNA Financial Corporation, Chubb, IFFCO-Tokio General Insurance Company Limited, Liberty General Insurance Limited, The Hartford, The Travelers Indemnity Company, and Zurich American Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the liability insurance industry.

What are the Top Impacting Factors in Liability Insurance Market

Liability Insurance Minimizes Business Risk

Liability insurance provides ample amount of advantages for businesses, which help to stay protected from various types of risks. It protects the insured’s business if injuries are caused to the other person due to their business operation. In addition, it safeguards the insured for an offense like wrongful entry, false arrest, and slander. Furthermore, it covers their legal liability for various offenses, which may arise if the insured company’s marketing division violates someone’s copyright rules by liability insurance providers. Moreover, if damages are filed against the insured, or if they are sued by any third party, the liability insurance policy covers the investigation and attorney expenses, medical expenses in case of injury. Furthermore, a commercial liability insurance policy ensures that the insured can move forward without incurring unnecessary monetary losses. The policy not only protects them against unexpected losses but also ensures a safe future for their business. Therefore, this is a major driving factor for the growth of the liability insurance market.

Liability Insurance Saves Out of Pocket Cost

Liability insurance companies ensures that the insured does not have to incur any cost for the damages caused by them out of their own pocket. For instance, if an insured causes a car accident while driving, the damages caused to the other person who receives the damages on their car or on themselves, then the insured has to pay for all the damage caused to the car, medical bills, and any other cost. However, liability insurance saves the out of pocket cost for the insured and pays for all the damages caused to the other person, without causing any financial risk to the insured. Thus, liability insurance saves the insured from incurring any additional cost out of their pocket and provides financial stability to the insured person. Therefore, this is a major driving factor for the growth of the liability insurance market.

Lack of Knowledge about Liability Insurance

Liability insurance service is a policy, which is not common among consumers as they are aware about life insurance policies and general insurance policies. Most of the consumers are not aware if liability insurance exists and if they know, they are not aware of the coverage under the policy. Therefore, lack of understanding and awareness regarding liability insurance coverage is a major factor that restrains the growth of the liability insurance market. As per the Insurance Information Bureau (IIB), only 60-70 million vehicles have insurance cover against approximately 1.8 million registered vehicles on Indian roads. Consumer experiences with respect to frequent road accidents and low adoption of motor vehicle liability insurance act as the primary concerns and restrain the growth of the liability insurance challenge, which need to be addressed by eliminating knowledge gaps for motor vehicle liability insurance in the market. Therefore, this is a major factor that hampers the growth of the liability insurance industry.

Report Coverage & Deliverables

Coverage Type Insights

The liability insurance market is growing steadily due to the rising demand for coverage against legal liabilities across industries. As businesses face increasing risks in areas like cybersecurity, product liability, and professional indemnity, there is a greater need for comprehensive liability coverage. The growth is also driven by regulatory requirements and the increased awareness of potential risks businesses face today which drives liability insurance market growth.

Enterprise Size Insights

The liability insurance market share varies significantly by enterprise size, with large enterprises accounting for the majority due to their complex operations and higher risk exposures. However, small and medium-sized enterprises (SMEs) are increasingly recognizing the importance of liability coverage, contributing to the market's overall growth.

Application Insights

Liability insurance services encompass a wide range of coverage, including general liability, professional liability, product liability, and cyber liability. These services are crucial for protecting businesses from potential legal claims and financial losses arising from accidents, negligence, or operational risks.

Region Insights

In terms of regional outlook, North America and Europe lead the liability insurance market due to strict regulatory environments and the presence of numerous multinational corporations. Key companies such as Chubb, Allianz, and AIG hold significant market shares. The Asia-Pacific region is experiencing rapid growth, driven by economic expansion and increasing business activities, while Latin America and the Middle East are emerging markets with growing awareness of liability risk management.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the liability insurance market analysis from 2021 to 2031 to identify the prevailing liability insurance market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- In-depth analysis of the liability insurance market segmentation assists to determine the prevailing market opportunities.

- The report includes the analysis of the regional as well as global liability insurance market trends, key players, market segments, application areas, and market growth strategies.

Liability Insurance Market Report Highlights

| Aspects | Details |

| By Coverage Type |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | AXA SA, IFFCO-Tokio General Insurance Company Limited, The Travelers Indemnity Company, Liberty General Insurance Limited, Zurich American Insurance Company, The Hartford, American International Group Inc, Chubb, CNA Financial Corporation, Allianz |

Analyst Review

The adoption of liability insurance solutions has increased over the years to help organizations to cover liability of the owner of the business as well as to cover the liability of the other person. Furthermore, the type of coverage and the amount of premium depends on the type of damage that is being covered by the policy. Some policies even provide property coverage for the vehicle that damage the surroundings, which in turn is expected to drive the growth of the market.

Key providers of liability insurance market, such as Allianz, American International Group, Inc., and AXA account for a significant share in the market. For instance, in November 2020, AXA XL partnered with Xtract, to automate, accelerate, and revolutionize the commercial vehicle claims management process in the U.S. It is expected to enable the claims team to quickly gather and evaluate all data that is available on an incident, vastly speeding up decision-making process while also offering superior customer service to brokers and clients. Furthermore, many insurance agencies are collaborating with tech companies to enhance their existing AI system for better security and to upsurge the performance of the system. For instance, in January 2021, State Farm Mutual Automobile Insurance Company, America’s largest property and casualty insurance provider acquired GAINSCO, Inc., a leading provider of non-standard liability insurance products. The acquisition is expected to help State Farm to become a nationwide leader in the fastest growing segment of the liability insurance market.

Moreover, insurance providers are innovating and developing various solution to provide diverse solutions to the end users. For instance, in January 2021, The Hartford and Tractable started development of the product to analyze auto damage in its liability insurance claims processes in the U.S., with the goal of reducing paper work and to upgrade the system to use Tractable’s AI technology for managing claim processes.

The arrangement involves The Hartford using Tractable’s AI technology to analyze auto damage within its U.S. liability insurance claims operations, with a goal of accelerating how quickly claims can be processed for its customers. Thus, growing number of such developments across the globe is expected to drive the growth of the market.

Some of the key players profiled in the report include American International Group Inc., Allianz, AXA SA, CNA Financial Corporation, Chubb, IFFCO-Tokio General Insurance Company Limited, Liberty General Insurance Limited, The Hartford, The Travelers Indemnity Company, and Zurich American Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Liability insurance minimizes the business risk, such as bodily injury caused to any person because of faulty machines or any other circumstances. In addition, it reduces out of pocket costs for the insured, since the importance of liability insurance is that every business faces claims that can come up during normal operations.

General liability insurance segment acquired the major share in the liability insurance market. This is attributed to the fact that this policy signifies a level of legitimacy for the insured business that can lessen some of the concerns that potential business associates might have. Furthermore, this insurance protects the insured against costs incurred for bodily injury or property damage suffered by third parties on the premises of their business or caused by their products or services.

North America accounted for the major share of liability insurance market. North America has huge number of liability insurance consumers attributing to large number of companies demanding claims handling services of worker’s compensation, auto liability, medical claim assistance and other insurance. Therefore, this region has the highest penetration of third party administrators market.

The global liability insurance market size was valued at $252.34 billion in 2021, and is projected to reach $432.81 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

American International Group Inc, Allianz, AXA SA, and Liberty General Insurance Limited holds the market share in liability insurance market.

The global liability insurance market ia growing at a CAGR of 5.7% from 2022 to 2031.

Liability insurance minimizes the business risk, such as bodily injury caused to any person because of faulty machines or any other circumstances. In addition, it reduces out of pocket costs for the insured, since the importance of umbrella liability insurance is that every business faces claims that come up during normal operations. Without coverage, the insured have to pay out of pocket to cover claims, which can put their business at financial risk. Surge in awareness of third party liability insurance in developing countries are some factors that propel the liability insurance market growth.

The liability insurance market is segmented on the basis of coverage type, enterprise size, application, and region. By coverage type, it is segmented into general liability insurance, professional liability insurance (errors and omissions), and insurance for directors and officers. By enterprise size, it is divided into medium-sized enterprises, large enterprises, and small enterprises. By application, it is bifurcated into personal and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...