Lidar Drone Market Research, 2031

The global LiDAR drone market size was valued at $0.15 billion in 2021, and is projected to reach $1 billion by 2031, growing at a CAGR of 22.1% from 2022 to 2031. LiDAR drone is a remote sensing technology that utilizes a fast pulse laser beam by which the surface of the earth is mapped. LiDAR is known as a light detection and ranging technique that is commonly utilized in studying and diagramming topographical data. LiDAR is valuable when used to make high-goal advanced surfaces, height models, and territory utilized for different business applications, for example, aviation & defense, agribusiness, ranger service, gas, oil & mining investigation, and natural resources management. All these factors are positively affecting the LiDAR drone market globally.

The LiDAR drones are gradually utilized to execute the optical inspection of the high-risk areas of a construction site to map their height and thickness. The productivity of management and on-site communication is also bolstering by the capability to accumulate real-time data from drones. These drones also help surveyors and engineers to visualize and inspect high-rise structures or the project's progress through aerial shots.

Moreover, they also offer site managers with an impression of potential issues and enable key decision-making aspects to simplify the operations at a construction site. The rising demand has urged LiDAR drone companies to manufacture more drones, specifically for the mining and construction industry.

Factors such as rise in adoption of LiDAR drone for mining application, growth in investments in smart city projects, and expansion in applications in civil and defense engineering are the major drivers for the market. Moreover, the factors such as stringent restrictions and regulations related to use of drones in various countries, lack of trained personnel to operate LiDAR drone, and high operational and purchasing cost to restrain the growth of these drones.

Furthermore, factors such as rise in adoption of aerial data collection tools for environmental purposes and higher investments in the drone industry create lucrative opportunities for leading players of LiDAR drone products operating in the LiDAR drone market.

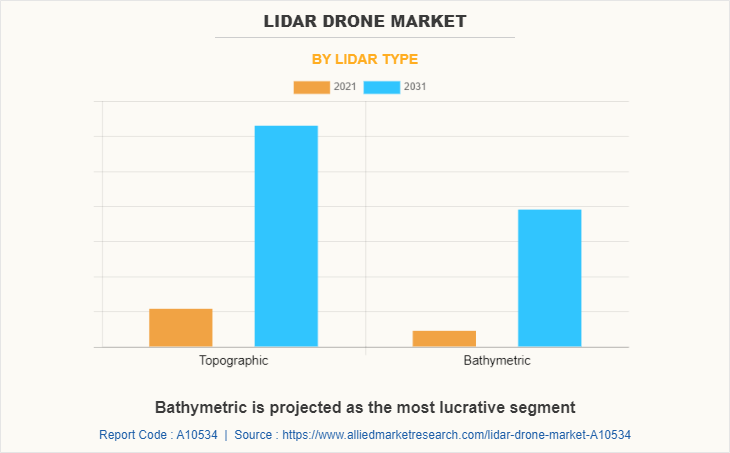

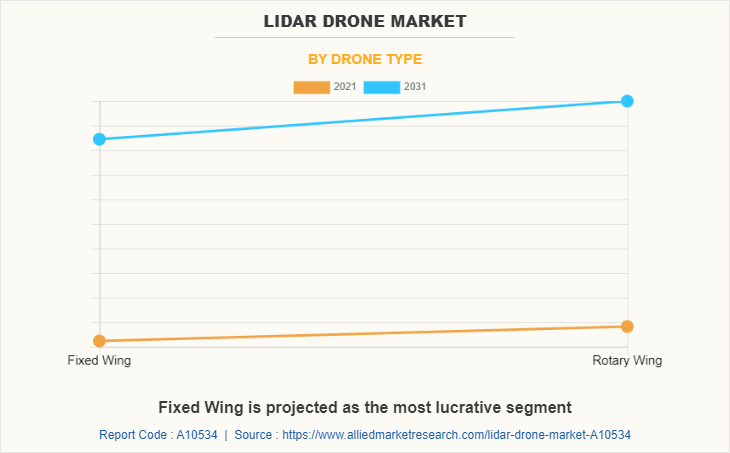

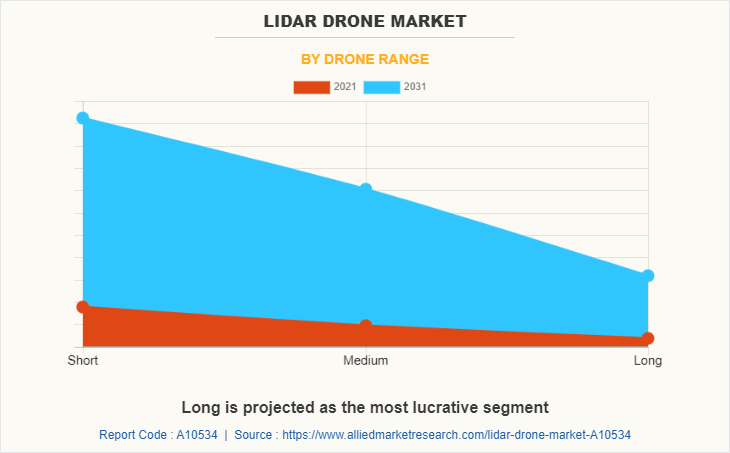

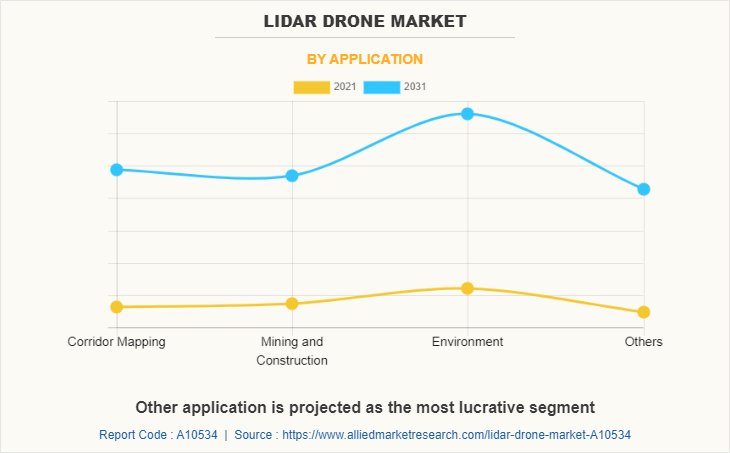

The LiDAR drone market is segmented on the basis of LiDAR type, drone type, drone range, application, and region. On the basis of LiDAR type, it is divided into topographic and bathymetric. On the basis of drone type, it is classified into fixed wing and rotary wing. On the basis of drone range, it is classified into short, medium, and long. On the basis of application, it is classified as corridor mapping, mining & construction, environment, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth drivers, restraints, and opportunities are explained in the study to better understand the market dynamics. This study further highlights key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The study features strategies adopted by key players to maintain their foothold across the globe.

The leading players operating in the LiDAR drone market are Leica Geosystems AG, Microdrones, OnyxScan, Phoenix LiDAR Systems, PolyExplore Inc., RIEGL Laser Measurement Systems GmbH, Teledyne Geospatial, Topodrone, UMS Skeldar, and Yellowscan.

Rising Adoption Of Lidar Drone for Mining Application

The mines across the globe are continuously under production. The various developments in mining involve precisely collecting and managing large amounts of data. The inaccurate measurements in iron or coal mines lead to uneconomical operations and may impact the preferred quality and output of products. There are four types of mines, namely, in-situ, underground, open pit, and placer.

The conventional method of measurements such as total station, GNSS, and other equipment need surveyors to go on-site and perform total measurements. These techniques are typically not safe and are time-consuming. Moreover, the data created through these methods cannot be pictured globally, thus limiting digital updates in modern mines.

The mining industry is considered as the most dangerous site, particularly for those working deep underground who are exposed to several dangers such as gas leaks, humid conditions, rock falls, dust, and flood explosions, which has shaped the need of using these drones in mining for inspection and monitoring application. In this sector, the demand for gathering critical information while significantly lowering workforce and time is the primary driving force that has boosted the sales of LiDAR drones in recent years.

The network in haul road has a substantial impact on the productivity of mining activities in which to monitor the condition of road is must to uniform the transit and accomplish safety, which are expected to power the sales over the forecast period, as these drones can simplify this process by amassing a large amount of aerial data, covering more expansive areas more clearly, which can then be used by engineers for maintenance, designing, planning, and construction activities.

LIDAR drone technology has emerged as an efficient solution to conquer the challenges like hazardous conditions, difficult topography, and other issues in mine sites. LiDAR is cutting-edge technology in the field of mapping and surveying. The LiDAR installed in drones empowers the measurement of three-dimensional coordination of objects on the ground, permeates the vegetation, and applies a point cloud filtering method to create a high-precision digital terrain model.

Expansion In Applications In Civil And Defense Engineering

Government bodies are heavily investing in LiDAR drones for civil and defense engineering applications to decrease the risk factors and increase the accuracy of operations engaged in these major industries. The need for unmanned air vehicle to decrease the loss of life on war field, protect perimeters, high precision of LiDAR-based monitoring, and keep locations under surveillance from the sky are the major factors that foster the demand for such drone for defense applications. Also, it has witnessed an increased demand in infrastructure projects. The use of such drones in all these projects and various government investments in defense are anticipated to fuel the LiDAR drone market.

Drones offer high-precision 3D models at a very minimal cost associated to other challenging technologies, such as satellites and airplanes. For instance, as per NASA, the cost of Landsat 8 imaging satellite was around $300,000; however, an automated mapping drone such as sense Flys eBee RTK costs around $25,000. Moreover, drones for consumer and professional applications cost around $1,000.

Apart from low cost, drones even render excellent results compared to the other two technologies. In the last five years, the price of LiDAR drones has witnessed a downfall owing to the reduced cost of its components and surge in its demand. Drones as a service is one of the breakthroughs in the market owing to its reduced cost and capability to provide accurate height information mainly for 3D mapping applications.

The number of drones globally has increased by two folds in the past one year. According to the annual report by Insurance Information Institute, Inc., the number of recreational drones in the U.S. has reached more than 5 lakhs units and commercial drones has reached more than 3 lakhs units by the end of 2021. Such a huge volume is expected to increase the sales of LiDAR drones during the forecast period.

High Operational And Purchasing Cost For Lidar Drones

LiDAR drones are complex systems that need high input power from batteries for surveying applications. The power consumption of such drones depends on the parts and components installed on them. The cost of such drones ranges from $ 50,000 to $ 300,000. LiDAR sensors are high-cost sensors installed on drones with high payloads to carry them safely. The use of heavy-weight LiDAR drones boosts their overall operational and purchasing costs.

The high-end drones have various parts, and components like global positioning systems (GPS), heavy batteries, UAV cameras, LiDAR sensors, initial measurement units (IMUs), and global navigation satellite systems (GNSS) installed on them, which increases their overall costs.

The rising adoption of wireless technologies, cloud computing, GIS, and LiDAR systems in drones with high precision cameras and others would encourage the overall growth. High demands for multidimensional patterns of topographical maps and land structures are also expected to favor the growth of the market. The private and government firms engaged in surveying, construction, mining, land management, and planning are expected to increase the demand for such drones in coming years.

LiDAR drones provide precise and safe location-based data useful in construction and excavation as well. The optimization in flow of traffic, detailed topographic models, better route planning and design, reconstruction, and 3D modelling are some factors leading to the rising utilization of image solutions in civil engineering.

Rising Adoption Of Aerial Data Collection Tools For Environmental Purpose

The insurance companies and environmental experts use DroneDeploy’s SkyClaim app to determine loss estimates and identify crop damage by using Al and computer vision. DroneDeploy customers have examined 75 different crop types in more than 100,000 acres using its app. PrecisionHawk (U.S.) uses different sensors, like thermal, multispectral in LiDAR and agriculture drones to collect raw crop data for analysis using its Precision Analytics software.

The LiDAR drone market share is expected to increase substantially over the forecast period due to rising investment from the private sector for drone deployment in environment businesses across the world. For instance, in 2021, DroneDeploy raised $50 million in Series E’ funding.

For complete environment monitoring operations, these drones are paired with advanced technologies such as RGB cameras, sensors, and other analytical tools. These drone skills help build 3D maps for real-time agriculture analysis to improve its rapid technological advancements. Rising demand for automatic devices for environmental purposes is expected to fuel the demand for such drones during the projected years.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lidar drone market analysis from 2021 to 2031 to identify the prevailing lidar drone market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the lidar drone market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global lidar drone market trends, key players, market segments, application areas, and market growth strategies.

LiDAR drone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1 billion |

| Growth Rate | CAGR of 22.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 388 |

| By LiDAR Type |

|

| By Drone Type |

|

| By Drone Range |

|

| By Application |

|

| By Region |

|

| Key Market Players | RIEGL Laser Measurement Systems GmbH, Teledyne Imaging, Topodrone, Microdrones, PolyExplore Inc., OnyxScan, Leica Geosystems AG, yellowscan, UMS Skeldar, Phoenix Lidar Systems |

Analyst Review

The market is expected to witness a steady growth as the innovative technologies are being implemented or developed to help bring new opportunities to projects and businesses. Over the past few years, with the rising attractiveness of drones in many applications across the world, the sales for LiDAR have been improving at a faster rate. The incorporation of modern positioning and navigation systems and mapping technologies brings many operating benefits to UAV based products. The innovation of vigorous sensor technologies, such as warning systems and accident prevention, expands the range of product and makes it more attractive, specifically for UAV-based LiDAR.

The particular sensors have technology of ocular altimeter integrated to define computations and accurate measurements based on the sizes and weights which are necessary for several investigations. The powerful photogrammetric software and lightweight gadgets and components are certainly installed on unmanned aerial vehicles (UAV). The image processing software creates better and more valuable data than conventional systems for critical corporate choices and government organizations. These LiDAR drones are intended to create accurate and high-quality image and 3D image processing of objects above the ground level in various product ranges.

The rising popularity of non-metric digital cameras fitted with rotary-wing and fixed-wing UAVs in the photogrammetric system industry is likely to boost the sales. Technology is most generally associated with airborne laser scanning. Since the past few years, the drone technology and innovation have seen rapid progress which has improved as a result of advances in laser and sensor components and laser drone cameras.

The digitization of infrastructures in emerging cities, optimization, and planning of resources is the base of the smart city, and a digital approach is key for a profitable transformation. With many undergoing smart city projects or already being launched, the digitalization of cities and the sight of urban development incorporated with communication and information technology is expanding. For projects in smart cities, the geospatial data act as the bedrock of any urban development plan. It consists of true ground information characterized in the form of mixed reality 3D models and maps. An accurate and reliable geospatial database is vital to manage and creating smart cities as well as serve as a revenue source for the city administrators.

The growing focus on infrastructure development signifies one of the key factors increasing the demand for LiDAR drones. The LiDAR drones are engaged in the construction sector for maintaining and inspecting the thickness and height of buildings, bridges, pavements, highways, and monitoring cracking and damages, mapping historical monuments, and maintaining facades. They also find huge applications in 3D modelling for reconstructing the building and photogrammetric uses, such as volume measurement. Besides this, these drones assist in making various improvements, such as improving safety conditions, boosting accuracy in reporting, streamlining workflow, and reducing costs. Apart from this, as they are managed remotely, the LiDAR drones can perform surveys in high-risk zones where fatalities may occur. This, combined with the rising construction of tall and high-rise buildings on account of rapid urbanization, is pushing the demand.

The market value of global LiDAR drone market in 2021 is $151.6 million

The estimated industry size of LiDAR drone is $1,022.0 million by 2031

North America is the largest regional market for LiDAR drone

Corridor mapping, mining And construction, environment, and others are the leading application of LiDAR drone Market

Rising adoption of aerial data collection tools for environmental purpose and higher investments in the drone industry are the upcoming trends of LiDAR drone Market in the world

Loading Table Of Content...