Life Sciences IT Market Statistics, 2033

The global life sciences IT market size was valued at $21.3 billion in 2023, and is projected to reach $62.5 billion by 2033, growing at a CAGR of 11% from 2024 to 2033. Growth of the global life sciences IT market is majorly driven by rise in adoption of the life science analytics software in the pharmaceutical industry. Furthermore, rise in prevalence of chronic diseases is also expected to drive the growth of the market owing to increased demand for the advance imaging and diagnosis software, which has resulted in increased accuracy of disease diagnosis.

Key Takeaways

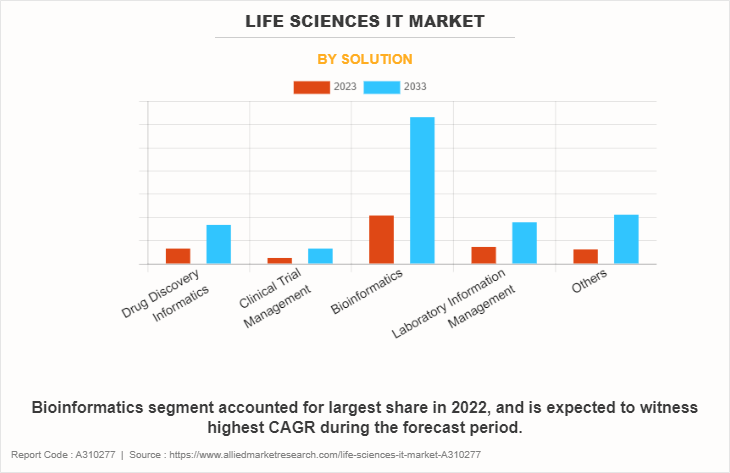

- By solution, the bioinformatics segment held the largest share in the life sciences IT market in 2022.

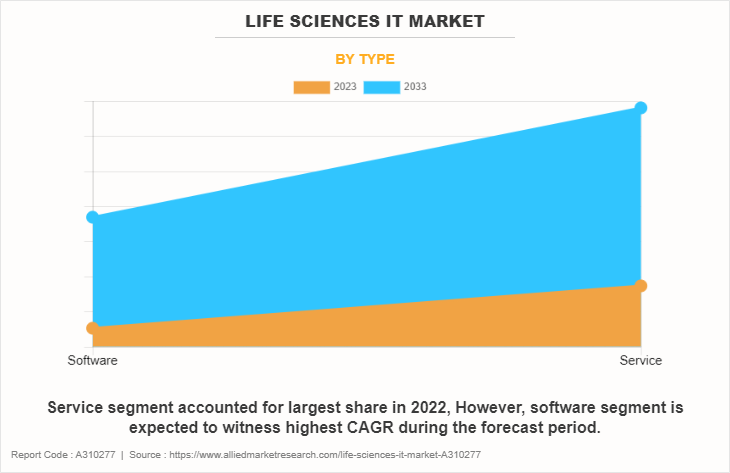

- By type, the services segment is expected to show the fastest market growth during the forecast period.

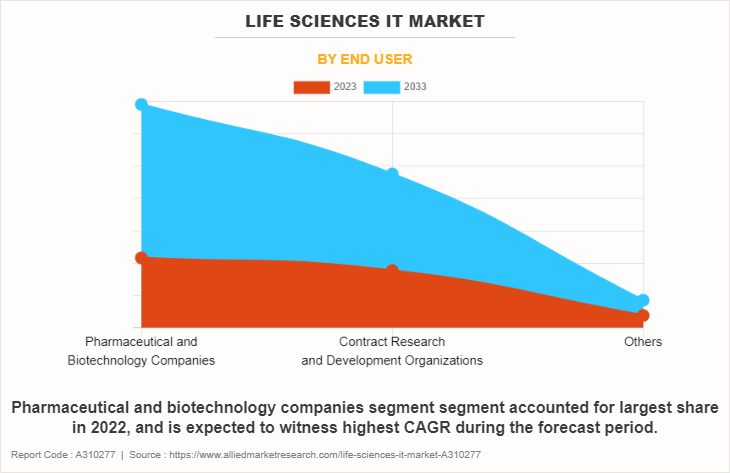

- By end user, pharmaceutical and biotechnology segment held the largest share in the life sciences IT market in 2022.

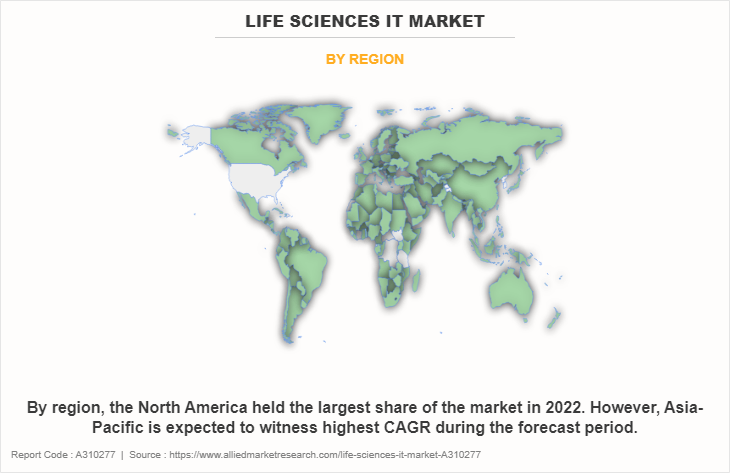

- Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Life science IT plays a crucial role in life sciences by providing sophisticated tools and solutions to manage, analyze, and interpret complex biological data. Life science IT solutions are designed to streamline various processes within the life sciences domain, including research, drug discovery, clinical trials, and healthcare management. Life science IT software typically includes applications for data management, analysis, and visualization, facilitating the collection, storage, and interpretation of complex biological and clinical data. Life science IT solutions enable researchers to conduct experiments, analyze results, and make informed decisions in areas such as drug discovery, genomics, proteomics, and personalized medicine. Additionally, life science IT software often incorporates features for regulatory compliance, quality control, and collaboration, ensuring that organizations adhere to industry standards and best practices while fostering teamwork and knowledge sharing among multidisciplinary teams.

Market Dynamics

The life sciences IT market size in expected to grow significantly, owing to high demand for advance analytical tool to analyze and manage large data generated in the healthcare sector, rise in adoption of the life science IT technology in the drug discovery and development, and growing trend towards digitalization of the healthcare system.

According to life sciences IT market forecast, rise in demand for advanced analytical tools is expected to act as a significant driver for the growth of the life sciences IT market. The exponential increase in the volume of data generated within healthcare, fueled by electronic health records, genomic information, and real-time patient monitoring systems, has resulted in increase in demand for sophisticated analytical solutions for efficient analysis and management. For instance, according to a 2023 report by the National Library of Medicine, over 80% of digital data in healthcare is available as unstructured data, requiring new forms of data processing and standardizing that prove challenging to health researchers.

Advanced analytical tools play a crucial role in extracting meaningful insights from large datasets, enabling healthcare professionals to make informed decisions, enhance patient outcomes, and optimize operational processes. Life science IT solutions empower organizations to harness the power of data-driven decision-making, leading to more personalized patient care, improved clinical research, and streamlined healthcare operations. Thus, rise in demand of advance analytical tool to effectively manage and analyze healthcare data is expected to drive the life sciences IT market growth.

In addition, rise in adoption of life science IT technology in the drug discovery and development is expected to significantly contribute to the growth of the life sciences IT market. Life science IT solutions offer invaluable support to manage the complex and vast datasets in drug discovery and development processes. life science IT technologies enable researchers to efficiently organize, analyze, and derive insights from immense volumes of biological, chemical, and clinical data, thereby expediting the identification of potential drug candidates and optimizing research outcomes.

Moreover, the integration of advanced computational tools, such as artificial intelligence (AI) and machine learning (ML), within life science IT platforms has revolutionized the drug discovery procedures. For instance, according to a 2020 report by the National Library of Medicine, recently developed artificial intelligence approaches such as deep learning and relevant modeling studies provide new solutions to efficacy and safety evaluations of drug candidates based on big data modeling and analysis.

AI algorithms can rapidly screen and prioritize drug targets, predict molecular interactions, and simulate biological processes with a level of precision and accuracy that was previously unattainable. The use of AI algorithm accelerates the identification of promising drug candidates but also enhances the understanding of disease mechanisms and drug behavior, paving the way for more targeted and effective therapeutic interventions. Thus, rise in adoption of life science IT solutions in drug discovery and development procedures is expected to drive the life sciences IT market share.

Furthermore, the growing trend towards laboratory automation is expected to drive the growth of the market. Atomization enables greater flexibility, efficiency, and collaboration, as researchers can tailor their setups to specific experiments and workflows. The transition towards atomization not only enhances operational efficiency but also fosters greater flexibility and adaptability in research environments. As laboratories become more atomized, the demand for sophisticated life science information technology (IT) solutions has surged. Researchers now require robust digital platforms and data management systems to seamlessly integrate and analyze vast amounts of data generated across various decentralized modules.

The life sciences IT market is responding to this demand by offering innovative solutions such as cloud-based platforms, artificial intelligence-driven analytics, and interconnected data repositories. Life science IT solution technologies not only streamline data management but also facilitate collaboration among researchers in disparate locations, ultimately accelerating the pace of scientific discovery and contributing to the advancement of life science research. Thus, the growing trend towards laboratory automation is expected to drive the life sciences IT market opportunity for growth.

However, data privacy and security concerns have emerged as significant restraints for the life sciences IT market, impacting its potential growth. Moreover, technological advancements such as integration of artificial intelligence and machine learning are expected to provide significant opportunity for the growth of the life sciences IT market share.

Segments Overview

The life sciences IT industry is segmented on the basis of solution, type, end user, and region. By solution, it is divided into drug discovery informatics, clinical trial management, bioinformatics, laboratory information management, and others. By type, it is bifurcated into software and services. By end user, it is segmented into pharmaceutical and biotechnology companies, contract R&D organizations, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Solution

On the basis of product, the life science analytics software market is categorized into rug discovery informatics, clinical trial management, bioinformatics, laboratory information management, and others. The bioinformatics segment was the highest revenue contributor in the market in 2022, owing to rise in use of life science IT solutions to analyze the vast genomic data generated during R&D activities. However, the others segment is expected to register fastest growth during the forecast period, owing to high adoption of the enterprise resource planning solution by middle and small-scale companies.

By Type

On the basis of type, the life sciences IT industry is categorized into software and services. The service segment was the highest revenue contributor in the market in 2022 and is expected to remain dominant during the forecast period, owing to cost effectivity of the services, which are especially beneficial for the small and medium scale life science companies.

By End User

On the basis of end user, the market is categorized into pharmaceutical and biotechnology companies, contract R&D organizations, and others. The pharmaceutical and biotechnology companies segment dominated the market in 2022, owing to high adoption of the life science IT solutions for the new drug discovery and clinical trials.

By Region

The life science analytics software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share in the life sciences IT market in 2022. This is attributed to the strong presence of key players in the region and high adoption of the life science analytics software by pharmaceutical and biotechnology companies. However, Asia-Pacific is expected to register a noteworthy CAGR during the forecast period, owing to rapidly growing pharmaceutical and biotechnology industry in the Asia-Pacific region and favorable government initiatives to support innovation in the information technology sector.

Competition Analysis

Some of the major companies that operate in the global life sciences IT market include Thermo Fisher Scientific Inc, Illumina, Qiagen N.V., Revvity, Inc, Agilent Technologies Inc, Oracle, Clario Inc, IBM Corp, DNAnexus Inc, and Genedata AG. These players have adopted different strategies such as collaboration, product launch, agreement, partnership and strategic alliance to increase their market share and maintain dominant shares in different regions.

Recent Development in Life Sciences IT Market

- In June 2023, Revvity, Inc. announced the launch of its Signals Research Suite, a unified, cloud-native SaaS platform that drives scientific collaboration across research and development disciplines from drug discovery to specialty chemicals material development. Signals research suite integrates the Revvity Signals Notebook, VitroVivo and Inventa applications into a single, robust solution that supports the entire drug development process, from early research and in vitro testing and safety to early development as well as specialty chemicals new product development. Signals research suite is avilable globally.

- In July 2023, Genedata AG announced a licensing agreement with Gilead Sciences, Inc. to help the company leverage the power of multi-omics data in the discovery of life-changing therapeutics across multiple indications. The agreement includes a software license to Genedata Profiler, state-of-art data integration and analytics platform, and access to consulting resources to support the adoption and integration of the solution within the company infrastructure.

- In December 2023, DNAnexus, Inc. announced a collaboration with Discovery Life Sciences to help streamline Discovery's next-generation sequencing data analysis. As part of the agreement, Discovery Life Sciences will use the DNAnexus cloud and analysis tools to optimize analysis pipeline performance, mitigate risk, and accelerate project turnaround times.

- In January 2024, DNAnexus, Inc. and Intelliseq announced a partnership to simplify and accelerate variant interpretation and clinical reporting. As part of the agreement, DNAnexus is adding Intelliseq's automated genome interpretation and reporting capabilities to its Precision Health Data Cloud. The integrated, one-click solution will streamline NGS data analysis and provide scientists with the ability to generate critical insights into somatic cancers, hereditary diseases, and other precision medicine and biomedical research applications.

- In January 2024, Qiagen NV. announced a strategic plan to step up investments over the next five years in its market leading Qiagen Digital Insights (QDI) business. These investments will support Qiagen Digital Insights, the bioinformatics market leader with sales of approximately $100 million in 2023. The investment will also extend Qiagen Digital Insights existing augmented molecular intelligence approach with additional Artificial Intelligence (AI) and Natural Language Processing (NLP) capabilities, and also a new regulatory-compliant secondary analysis solution for rapid next-generation sequencing (NGS) analysis within clinical labs.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the life sciences it market analysis from 2023 to 2033 to identify the prevailing life sciences IT market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the life sciences IT market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global life sciences it market trends, key players, market segments, application areas, and market growth strategies.

Life Sciences IT Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 62.5 billion |

| Growth Rate | CAGR of 11% |

| Forecast period | 2023 - 2033 |

| Report Pages | 268 |

| By Solution |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Revvity, Inc., Clario, Genedata AG, IBM Corporation, Agilent Technologies, Inc., DNAnexus, Inc., Thermo Fisher Scientific Inc. , Qiagen NV., Oracle Corporation, Illumina, Inc. |

Analyst Review

The life science IT market is experiencing robust growth, driven by increase in demand for advanced analytical tools and solutions in the life sciences industry. Rise in technological advancements and increasing complexities in the life sciences industry have propelled the demand for innovative IT solutions.

The integration of artificial intelligence, big data analytics, and machine learning has not only streamlined R&D processes but has also enhanced operational efficiency across the entire value chain. The shift towards cloud-based platforms and the adoption of digital technologies in areas such as precision medicine, genomics, and personalized healthcare are redefining the industry's approach to data management and analysis. The ongoing emphasis on regulatory compliance, data security, and interoperability further signifies the critical role of IT in facilitating seamless collaboration and information exchange within the life sciences ecosystem.

Region-wise, North America continues to dominate the life science IT market, owing to the presence of major key players, coupled with substantial investments in R&D in life sciences industry. However, the Asia-Pacific region is witnessing growth, driven by rapid growth in life sciences industry, owing to favorable government initiatives supporting growth and innovation in the information technology sector, and increase in awareness of the benefits of life sciences analytical software in drug discovery and development.

North America is the largest regional market for life sciences IT market.

The forecast period for life sciences IT market report is 2024 to 2033

The base year is 2023 in life sciences IT market.

Top companies such as Thermo Fisher Scientific Inc, Illumina, Qiagen N.V., Revvity, Inc, Agilent Technologies Inc, Oracle, Clario Inc, IBM Corp held high market share in 2022.

The estimated industry size of life sciences IT in 2033 is $62.5 billion.

Loading Table Of Content...

Loading Research Methodology...