Lightweight Materials Market Overview:

The global lightweight materials market size was valued at $168.1 billion in 2020 and is projected to reach $261.6 billion by 2030, growing at a CAGR of 4.5% from 2021 to 2030.

Lightweight materials are generally metal alloys and composites used to reduce the weight of automotive, aircrafts, and windmills without affecting the strength and efficiency of the structure. Lightweight materials have high strength-to-weight ratio, exceptional corrosion resistance, and greater design flexibility. The efficiency of lightweight materials depends upon the mixture of alloys or composites used during the manufacturing. They are made up of different grades &types and are used in the production of lightweight automobiles, aircrafts, packaging solutions, and medical equipment.

Factors, such as increase in disposable income, technological upgrades, rise in new product developments, and surge in number of original equipment manufacturers (OEMs) and aftermarkets led the automobile sector to witness a significant growth. Lightweight materials such as metal alloys, composites, and polymers are widely used in manufacturing various automotive parts. For instance, according to a report published by the National Promotion and Facilitation Agency of India, in March 2021, passenger vehicle industry of India is expected to rise between 22%-25% in 2022. This may boost the demand for lightweight materials in the growing automotive sector. Furthermore, both developed and developing counties, including the U.S., China, and India, are engaged in upgrading their fighter jets with modern facilities. Lightweight materials are used to make various aircraft parts, including aluminum alloys, composites, and hybrid materials. This may drive the growth of the lightweight materials market during the forecast period.

The lightweight materials market is segmented into Type and Application.

However, factors, including rapid fluctuations in raw material prices and high cost of carbon fiber restrict the use of lightweight materials in various end- use industries, including automotive, aircraft manufacturing, wind turbines, and marine. For instance, according to a report published by the National Center for Biotechnology Information, in November 2021, the price of 1kg automotive grade carbon fiber reinforced plastics (CFRP) can go up to 3900% more than the price of normal steel while the price for glass fiber reinforced plastics (GFRP) can go up to 400% more. These factors may hinder the growth of the lightweight materials market.

On the contrary, increase in awareness for environment friendly activities surged the popularity of electric vehicles in both developed and developing countries. Lightweight materials in this sector are widely used to reduce the overall weight of the vehicle by 20-30%. For instance, according to an article published by Business Today, in December 2021, the Indian electric vehicle (EV) market is estimated to grow at a compound annual growth rate (CAGR) of 90% from 2021 to 2030. This is anticipated to increase the sales of lightweight materials thus, providing lucrative growth opportunities for the market.

The global lightweight materials market is segmented on the basis of type, application, and region. Depending on type, the market is divided into metal alloys, composites, and polymers. On the basis of application, it is fragmented into automotive, aerospace, wind, marine, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include Alcoa Corporation, ArcelorMittal, Bayer AG, DuPont, ExxonMobil Corporation, Novelis Inc., PPG Industries, Inc., Saudi Basic Industries Corporation, Solvay, and Toray Industries, Inc.

Lightweight Materials Market By Region

Asia-Pacific lightweight materials market size is projected to grow at the highest CAGR of 5.2% during the forecast period, and accounted for 38.6% of the lightweight materials market share in 2020. This is attributed to increase in demand for lightweight materials in automotive, marine, aircraft, and wind turbines industries in Asia-Pacific. Countries such as India and China are leading marketplace for automotive sector. Lightweight materials are used in this sector for manufacturing various vehicle components. For instance, according to a report published by the India Brands Equity Foundation, in December 2021, the domestic automobile production increased at 2.36% from 2016-2020 with 26.36 billion vehicles being manufactured in the country in 2020. Furthermore, manufacturers across the globe find Asia-Pacific as an attractive market, owing to cheap labor cost, low cost of setting up manufacturing units, and cost-effective lightweight materials. These factors drive the lightweight materials market in this region.

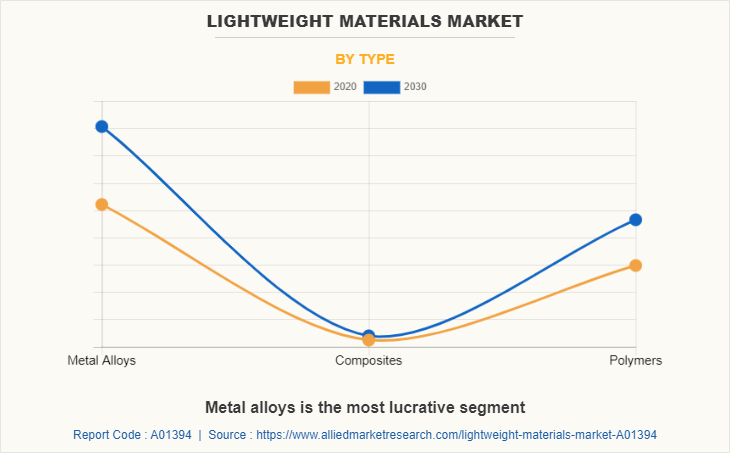

Lightweight Materials Market By Type

By Type, metal alloys segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 4.5% during the forecast period. This is attributed to the fact that metal alloys possesses excellent properties such as low density, high strength-to-weight ratio, and improved corrosive resistance that make them best-suited for forming, machining, and welding applications in various end-use industries, including automobile, aerospace, and wind. The aforementioned factors accelerate the growth of metal alloys segment in the global market.

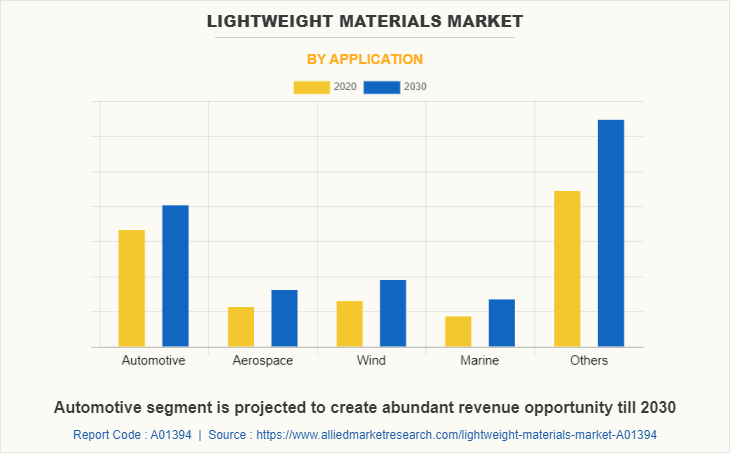

Lightweight Materials Market By Application

Depending on application, the automotive segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 4.6% during the forecast period. This is attributed to rise in middle class income and young population, which, in turn, has led the automobile sector to witness a significant growth. Lightweight materials in this sector are widely used for manufacturing various automotive components. For instance, according to a report published by the U.S. Bureau of Labor Statistics, in March 2022, the motor vehicles and parts manufacturing industry in the U.S. has registered year-on-year growth rate of 8.4% from February 2021 to February 2022. Moreover, the emergence of lightweight electric vehicles may aggressively penetrate the growth of the automotive segment in the global lightweight materials market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lightweight materials market analysis from 2020 to 2030 to identify the prevailing lightweight materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lightweight materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lightweight materials market trends, key players, market segments, application areas, and market growth strategies.

Lightweight Materials Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Solvay, EXXONMOBIL CORPORATION, TORAY INDUSTRIES, INC., NOVELIS INC., SABIC, ALCOA INC., ARCELORMITTAL SA, PPG INDUSTRIES INC., BAYER AG, E. I. DUPONT DE NEMOURS AND COMPANY |

| Other players in the value chain include | ThyssenKrupp AG, Henkel Corporation, Owens Corning Corporation, LyondellBasell Industries N.V., Hexcel Corporation, SGL Group, Nippon Graphite Fiber Corporation, Mitsubishi Rayon Co. Ltd., Zoltek Companies Inc, UC Rusal, Aluminium Corporation of China, Rio Tinto Alcan Inc., China Hongqiao Group Ltd., Kaiser Aluminium, US Magnesium LLC, A&S Magnesium Inc. |

Analyst Review

According to CXOs of leading companies, the global lightweight materials market is expected to exhibit high growth potential during the forecast period. Rise in demand for lightweight materials from end users, especially from developing countries, and continuous technological advancements are the key driving factors for the growth of the global lightweight materials market. However, the high material and processing cost of lightweight materials hinder the market growth. According to the CXOs, Asia-Pacific is projected to register significant growth compared to the markets of North America and Europe.

In addition, lightweight materials possesses excellent significant properties, including high thermal resistance, shock resistance, high strength-to-weight ratio, exceptional corrosion resistance, greater design flexibility, and chemical stability that make it best suited for manufacturing lightweight components of wind turbines, aircrafts, and automobile vehicles. Furthermore, the increase in awareness for eco-friendly activities surged the demand for lightweight materials for manufacturing various electric vehicle components, primarily in North America and European regions.

The CXOs further added that sustained economic growth and development of aircraft manufacturing sector have surged the popularity of lightweight materials.

The current trend towards lightweight vehicles and equipment is expected to drive the market growth.

the automotive segment dominated the global market in 2020. This is attributed to rising in middle-class income and the young population, which, in turn, has led the automobile sector to witness a significant growth.

Asia-Pacific lightweight materials market size is expected to dominate the market during the forecast period.

The major companies profiled in this report include Alcoa Corporation, ArcelorMittal, Bayer AG, DuPont, ExxonMobil Corporation, Novelis Inc., PPG Industries, Inc., Saudi Basic Industries Corporation, Solvay, and Toray Industries, Inc.

The global lightweight materials market growing at a CAGR of 4.5 from 2021 to 2030.

Loading Table Of Content...