Line Arresters Market Research, 2032

The global line arresters market size was valued at $360.4 million in 2022, and is projected to reach $723.1 million by 2032, growing at a CAGR of 7.6% from 2023 to 2032. The global line arresters market is experiencing growth owing to expansion of electrical grids and infrastructure, and renewable energy integration. As the world transitions towards cleaner and more sustainable energy sources, there is a growing deployment of solar panels, wind turbines, and other renewable energy systems. Governments and utilities are investing in the expansion and modernization of electrical grids to meet the increasing demand for electricity in residential, commercial, and industrial sectors.

Introduction

Line arresters are electrical devices designed to protect power distribution systems, electrical equipment, and sensitive electronics from transient overvoltage caused by lightning strikes, switching operations, or other disturbances in the electrical network. These devices are typically connected in parallel with the equipment or system they are intended to protect. When a voltage surge occurs, the line arrester rapidly diverts the excess energy to the ground, thereby limiting the voltage across the protected equipment and preventing damage or malfunction.

Key Takeaways

- The global line arresters market has been analyzed in terms of value ($Million). The analysis in the report is provided on the basis of type, voltage, application, end user, 4 major regions, and more than 15 countries.

- The global line arresters market report includes a detailed study covering underlying factors influencing industry opportunities and trends.

- The line arresters market is fragmented in nature with few players such as Elmac Technologies, Hitachi, Hubbell, KA Factor Group Inc., MacLean Power Systems, MAPPEC, Raychem RPG Private Limited., Siemens Energy, TE Connectivity, Toshiba International Corporation Pty Ltd., and Tridelta Meidensha GmbH.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global line arresters market.

Market Dynamics

The modernization and upgrade of existing electrical grids to meet evolving energy demands and regulatory requirements contribute to the demand for line arresters. According to the National Renewable Energy Laboratory (NREL), in the U.S. renewable energy constitutes more than 20% of annual electricity production. As utilities invest in upgrading aging infrastructure and integrating renewable energy sources such as solar and wind power into the grid, they must ensure the reliability and resilience of the system. Line arresters play a crucial role in protecting sensitive equipment and components from voltage surges that result from the intermittent nature of renewable energy sources. All these factors drive the line arresters market demand during the forecast period.

However, installation and maintenance challenges present significant obstacles that hamper the growth of the line arresters market. The installation process is time-consuming and labor-intensive, particularly for retrofitting line arresters into operational electrical grids. Accessing remote or elevated locations such as transmission towers or substations poses logistical challenges and safety concerns for installation crews. For instance, in some installations, the length and positioning of the arrester leads to compromise functionality. Long lead lengths result in whiplash effects during extreme weather conditions, potentially damaging the arrester. In addition, coordinating installation activities with ongoing grid operations and maintenance schedules further complicates the process, potentially leading to project delays and increased costs. All these factors hamper the line arresters market growth.

The integration of renewable energy sources such as solar and wind power into existing electrical grids presents significant opportunities for line arresters. According to the National Renewable Energy Laboratory (NREL), India has set an ambitious goal of integrating 175 gigawatts (GW) of renewable energy into its electricity grid. This includes 100 GW of solar and 60 GW of wind capacity. Renewable energy integration involves the installation of solar panels, wind turbines, and other renewable energy systems distributed across various locations within the grid. While renewable energy offers numerous benefits such as reduced greenhouse gas emissions and energy diversification, it also introduces unique challenges related to grid stability and reliability. Moreover, the trend towards distributed generation and microgrid development further amplifies the demand for line arresters. All these factors are anticipated to offer new growth opportunities for the line arresters market during the forecast period.

Segments Overview

The line arresters market is segmented on the basis of type, voltage, application, end user, and region. On the basis of type, the market is bifurcated into a non-gapped line arrester, and externally gapped line arrester. On the basis of voltage, the market is divided into medium, high, and low. On the basis of application, the market is bifurcated into transmission line, and distribution line. On the basis of end user, the market is segmented into power substations, telecommunications, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

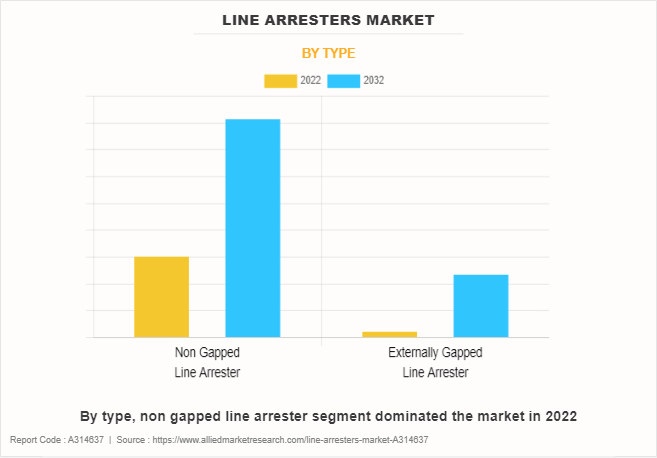

On the basis of type, the market is bifurcated into a non-gapped line arrester, and externally gapped line arrester. The non-gapped line arrester segment accounted for more than two-thirds of global line arresters market share in 2022 and is expected to maintain its dominance during the forecast period. The continuous evolution of electrical systems towards higher voltage levels and increased power demands necessitates advanced protection mechanisms. According to the International Energy Agency (IEA), global electricity demand is expected to rise at a faster rate over the next three years, growing by an average of 3.4% annually through 2026. Non-gapped line arresters offer superior protection against transient overvoltage compared to traditional gapped arresters.

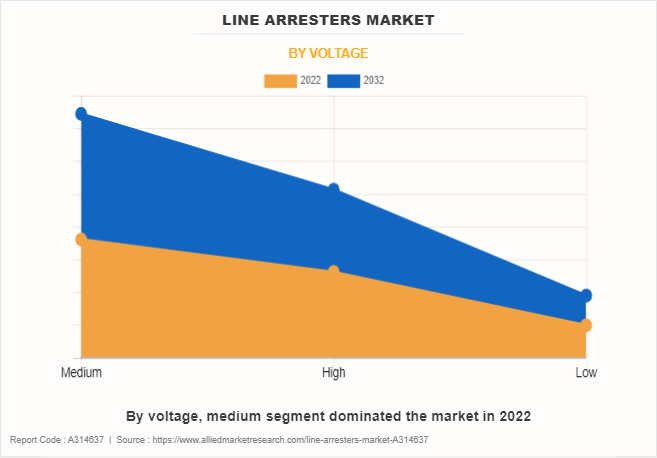

Based on voltage, the market is divided into medium, high, and low. The medium segment accounted for half of global line arresters market share in 2022 and is expected to maintain its dominance during the forecast period. Medium voltage line arresters help to prevent damage to electrical equipment and infrastructure, reducing the risk of power outages and ensuring the continuity of service for consumers. For instance, the 3EJ medium-voltage surge arresters protect generators, motors, arc furnaces, dry-type transformers, airfield lighting systems, cable sheathing and converters for drives from overvoltage. By swiftly diverting excess electrical energy away from sensitive components, these arresters safeguard the integrity of the power system and contribute to its overall reliability.

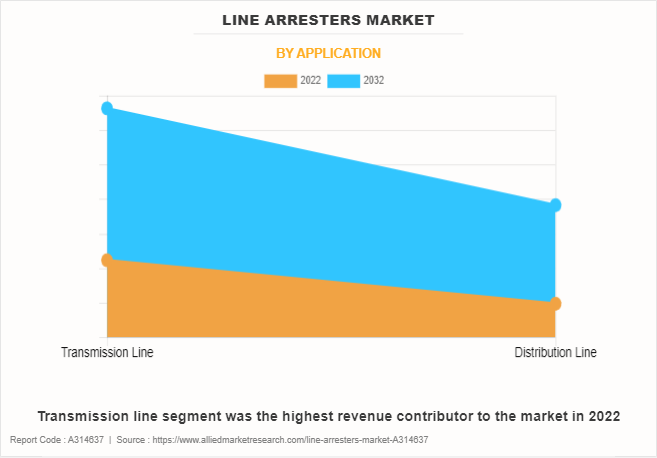

On the basis of application, the market is bifurcated into transmission line, and distribution line. The transmission line segment accounted for less than three-fifths of global line arresters market share in 2022 and is expected to maintain its dominance during the forecast period. The growing emphasis on grid reliability and resilience has led to the widespread adoption of line arresters. These devices help to enhance the overall reliability of the transmission system by providing a robust defense against transient voltage surges. By installing line arresters at strategic locations along transmission lines, utilities minimize downtime, improve system performance, and reduce the likelihood of widespread outages.

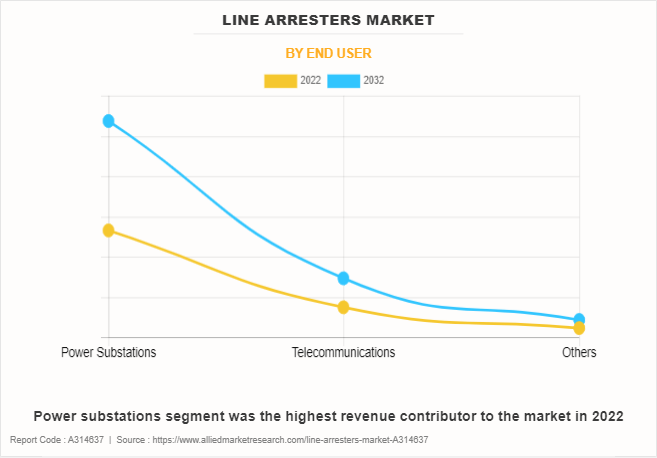

Based on end user, the market is segmented into power substations, telecommunications, and others The power substations segment accounted for less than three-fourths of global line arresters market share in 2022 and is expected to maintain its dominance during the forecast period. The surge in demand for electricity necessitates the expansion and enhancement of power transmission and distribution networks. As these networks grow, they become more susceptible to lightning strikes, switching surges, and other transient overvoltage events that damage equipment and disrupt power supply. Line arresters help mitigate these risks by providing a low-impedance path to ground for transient surges, diverting excess energy away from sensitive equipment and preventing damage.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for less than half of the global line arresters market share in 2022 and is expected to maintain its dominance during the forecast period. The surge in adoption of renewable energy sources such as solar and wind power in the Asia-Pacific region contributes to the need for line arresters. In addition, rapid industrialization in countries across Asia-Pacific has led to increased demand for electricity. According to International Energy Agency (IEA), in 2023, China’s electricity demand rose by 6.4%, driven by the services and industrial sectors. This surge in demand puts pressure on existing power infrastructure, including transmission and distribution lines, making them susceptible to voltage surges and overloads.

Competitive Analysis

Key players in the line arresters market include Elmac Technologies, Hitachi, Hubbell, KA Factor Group Inc., MacLean Power Systems, MAPPEC, Raychem RPG Private Limited., Siemens Energy, TE Connectivity, Toshiba International Corporation Pty Ltd., and Tridelta Meidensha GmbH. Apart from these major players, there are other key players in the line arresters industry. These include ABB Ltd, Bel Fuse Inc., Crompton Greaves Ltd, Eaton Corporation, Legrand SA, Mitsubishi Electric Corporation, Prysmian Group, and Schneider Electric SE.

Historical Trends of Line Arresters

- The early to mid-20th century marked the emergence of line arresters in electrical infrastructure, primarily in utility and industrial applications. Companies such as General Electric and Siemens were pioneers in developing and deploying these devices to protect power transmission and distribution systems from lightning strikes and overvoltage events.

- The 1970s witnessed significant advancements in line arrester technology with the introduction of metal oxide varistor (MOV) based designs. This era saw increased reliability and performance of line arresters, leading to expanded deployment in high-voltage transmission networks and critical industrial facilities.

- In the 1980s, line arrester technology experienced further evolution with the development of polymer-housed arresters and improved surge protection capabilities. This led to greater durability, extended service life, and enhanced safety of electrical systems, driving adoption in a wider range of industries such as telecommunications, oil and gas, and transportation.

- The 1990s marked a period of innovation in line arrester design, focused on compactness, modular configurations, and integrated monitoring systems. Manufacturers introduced smart arrester solutions with remote monitoring and predictive maintenance capabilities, improved reliability and reduced downtime for power grids and industrial installations.

- The early 2000s saw a surge in demand for line arresters driven by increasing awareness of the importance of surge protection in critical infrastructure. Companies invested in research and development to enhance the transient response characteristics, energy handling capabilities, and environmental sustainability of line arresters to meet evolving regulatory standards and customer requirements.

- By the 2010s, line arrester technology had evolved to incorporate advanced materials such as silicone rubber and improved coordination with protective relays and circuit breakers. This enabled more efficient and reliable protection of electrical systems against transient overvoltage, supporting the reliability and resilience of modern power grids and industrial facilities.

- In the 2020s, the line arresters market continued to evolve with a focus on sustainability and grid modernization. Innovations such as eco-friendly materials, integrated energy storage capabilities, and grid-connected smart arrester systems aimed to improve the efficiency, reliability, and resilience of electrical infrastructure in the face of evolving environmental and operational challenges.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the line arresters market analysis from 2022 to 2032 to identify the prevailing line arresters market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the line arresters market statistics and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global line arresters market trends, key players, market segments, application areas, and market growth strategies.

Line Arresters Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 723.1 million |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Voltage |

|

| By End User |

|

| By Region |

|

| Key Market Players | MAPPEC, Elmac Technologies, TE Connectivity, TOSHIBA CORPORATION, MacLean Power Systems., KA Factor Group Inc.., Hubbell Inc., Raychem RPG Private Limited., Siemens Energy, Hitachi, Tridelta Meidensha GmbH |

Analyst Review

According to the opinions of various CXOs of leading companies, the line arresters market is expected to witness growth during the forecast period owing to expansion of electrical grids and infrastructure, and technological advancements in arrester design have increased the demand for line arresters. Governments and utilities are investing in the expansion and modernization of electrical grids to meet the increasing demand for electricity in residential, commercial, and industrial sectors. This expansion involves the construction of new transmission lines, substations, and distribution networks, which require robust surge protection to safeguard against transient overvoltage. Line arresters play a crucial role in protecting the infrastructure, equipment, and electrical systems from damage caused by lightning strikes, switching operations, or other external factors.

Moreover, technological advancements in arrester design have contributed to increased demand for line arresters. Manufacturers are continuously innovating and improving the design, materials, and performance of line arresters to enhance their effectiveness in surge protection. Advanced materials such as metal oxide varistors (MOVs) and silicone rubber housings are being used to improve the energy-handling capabilities, transient response characteristics, and durability of line arresters. In addition, advancements in monitoring and diagnostic technologies enable real-time condition monitoring and predictive maintenance of line arresters, ensuring optimal performance and reliability. These technological advancements make line arresters more efficient, reliable, and cost-effective, driving their adoption across various industries and applications.

The global line arresters market was valued at $360.4 million in 2022, and is projected to reach $723.1 million by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Asia-Pacific is the fastest growing region for the Line Arresters Market

Expansion of electrical grids and infrastructure, and Renewable energy integration and grid stability are the leading drivers for the Line Arresters Market.

Surge in focus on grid resilience is the upcoming trends of Line Arresters Market in the world

Transmission line is the leading application of Line Arresters Market

Asia-Pacific is the largest regional market for Line Arresters

Key players in the line arresters market include Elmac Technologies, Hitachi, Hubbell, KA Factor Group Inc., MacLean Power Systems, MAPPEC, Raychem RPG Private Limited., Siemens Energy, TE Connectivity, Toshiba International Corporation Pty Ltd., and Tridelta Meidensha GmbH.

Loading Table Of Content...

Loading Research Methodology...