Lithium-Ion Battery Anode Materials Market Research, 2033

The global lithium-ion battery anode materials market was valued at $9.5 billion in 2023, and is projected to reach $38.4 Billion by 2033, growing at a CAGR of 15.1% from 2024 to 2033.

Market Introduction and Definition

Lithium-ion battery anode materials are substances used in the anode (negative electrode) of lithium-ion batteries. These materials play a crucial role in the battery’s overall performance, such as capacity, lifespan, and charging characteristics. The choice of anode material directly influences the efficiency, safety, and cost of lithium-ion batteries. A lithium-ion battery is a rechargeable electrochemical energy storage device that relies on the movement of lithium ions between the anode and cathode during charge and discharge cycles. The anode is a crucial component of the battery, playing an important role in overall performance and efficiency. Anode materials in lithium-ion batteries are selected based on their ability to effectively accommodate and release lithium ions, stability during cycling, and conductivity.

Key Takeaways

The lithium-ion battery anode materials market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

As the automotive industry undergoes a rapid transition towards sustainable and eco-friendly solutions, lithium-ion batteries have become the preferred energy storage technology for electric vehicles. The anode is an essential component in lithium-ion batteries, which plays a crucial role in determining the performance and efficiency of these energy storage systems. In addition, expansion in charging infrastructure for electric vehicles is increasing consumer confidence in electric mobility. This fuels the demand for advanced lithium-ion battery anode materials that meet the evolving requirements in the automotive industry. All these factors are expected to drive the growth of the lithium-ion battery anode materials market.

Availability of key raw materials for lithium-ion battery anode materials, such as natural graphite, synthetic graphite, and silicon, is a significant concern in the industry. Natural graphite, exceptionally sourced from countries such as China, Brazil, and Canada, faces supply constraints due to limited mining ability and environmental regulations. The concentration of natural graphite production in a few countries also raises geopolitical risks, as any alternate restrictions or political instability in these regions can disrupt the supply chain and lead to shortages. Synthetic graphite is produced from petroleum coke or coal tar pitch through a high-temperature process. The manufacturing process is tremendously energy-intensive and entails huge environmental impacts, leading to stricter regulatory policies. These factors contribute to greater production costs and restrict the expansion of synthetic graphite manufacturing capacity. Furthermore, the fine of synthetic graphite can vary, and reaching the consistency required for high-performance batteries provides to the complexity and cost of production. All these factors are expected to hamper the growth of the lithium-ion battery anode materials market.

Anode materials that store more energy allow lithium-ion batteries to store extra power without requiring additional space or weight. This benefits devices such as phones and electric cars by extending their usage time but also improves the efficiency of energy storage systems, such as those utilized in homes and large-scale power grids. Lithium-ion batteries with higher energy density perform more effectively in various applications, such as electric cars, smartphones, and large-scale energy storage systems. All these factors are anticipated to offer new growth opportunities for the lithium-ion battery anode materials market during the forecast period.

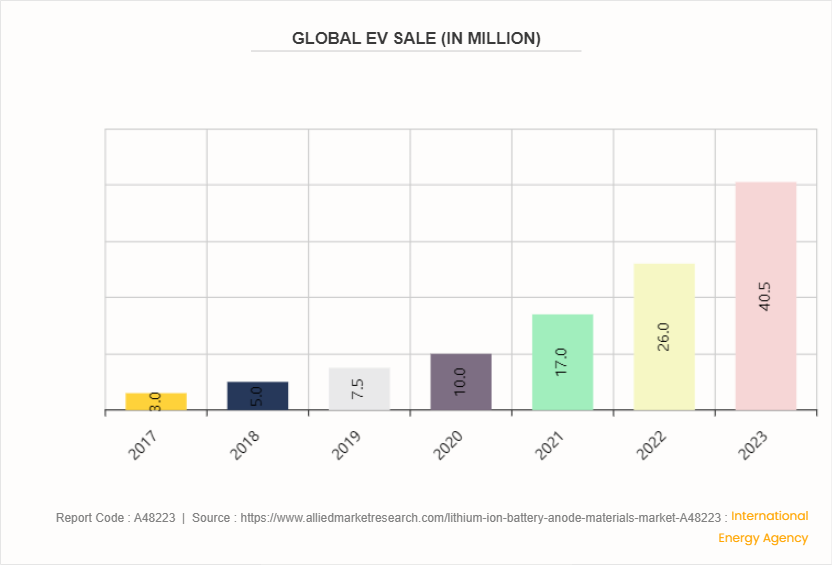

Increasing global EV sales will drive growth of lithium-ion anode materials market

The increasing global electric vehicle (EV) sales, which surged from 3.0 million in 2017 to 40.5 million in 2023, are significantly driving the growth of the lithium-ion anode materials market. Lithium-ion battery anode materials market expansion is attributed to the rising demand for efficient energy storage solutions, essential for EV batteries.

Market Segmentation

The lithium-ion battery anode materials market is segmented by material type and by region. By material type, the market is classified into active anode materials, anode binders, anode foils, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In the Asia-pacific region, graphite is the most common anode material used in lithium-ion batteries due to its high conductivity, stability, and low cost. China is a major producer of natural graphite, which is widely used in lithium-ion batteries. The country has a robust supply chain for battery manufacturing and is a major player in both consumer electronics and electric vehicles (EVs) . In recent years, China has focused on developing advanced anode materials to improve battery performance and reduce costs. Research efforts include exploring silicon-based anodes, solid-state electrolytes, and other next-generation materials.

According to India Brand Equity Foundation (IBEF) , India established an objective to elevate the proportion of electric vehicle (EV) sales to 30% in private cars, 70% in commercial vehicles, 40% in buses, and 80% in two-wheelers and three-wheelers by the year 2030. This equates to an ambitious objective of 80 million EVs on Indian roads by 2030.

Competitive Landscape

The major players operating in the lithium-ion battery anode materials market include Mitsubishi Chemical Group Corporation., BASF SE, Nippon Carbon Co Ltd, 3M, SK Inc, Tanaka Chemical Corporation, Johnson Controls., Hitachi High-Tech India Private Limited, SAMSUNG SDI CO., LTD., and GS Yuasa International Ltd.

Other players in the lithium-ion battery anode materials market include JFE Chemical Corporation, Sumitomo Chemical Co., Ltd. Nippon Carbon Co., Ltd., and SGL Carbon.

Recent Key Strategies and Developments

In May 2023, BASF SE announced an investment in the production of water-based anode binders to support the lithium-ion battery industry. The new binders are to be produced at two existing dispersion plants in Jiangsu and Guangdong, China.

In May 2022, Mitsubishi Chemical Holdings Group (MCHG) decided to enhance the production capacity of natural graphite anode materials, which are newly developed products for lithium-ion batteries featuring low swelling, from 2, 000 tons/year to 12, 000 tons/year at its Chinese subsidiary Qingdao Anode Kasei Co., Ltd.

Industry Trends:

As per the India Brand Equity Foundation, 329, 190 EVs were sold in India, in 2021, indicating a 168% YoY growth as compared to2020.

The China government planned to reduce subsidies for electric vehicles by 30% in 2022, with the aim of completely phasing them out by the end of the year. This decision comes in response to the rapid growth and maturation of the country's electric vehicle industry. By cutting these subsidies, the government aims to encourage manufacturers to become less dependent on state funding and foster innovation and development within the industry independently.

Public Policies

Emission standards according to the U.S. Environmental Protection Agency (EPA) :

Particulate Matter (PM) : During lithium-ion battery anode materials production, particulate matter can be generated from various processes such as grinding, mixing, and coating. Emission standards for particulate matter typically specify limits for PM10 (particulate matter with a diameter of 10 micrometers or less) and PM2.5 (particulate matter with a diameter of 2.5 micrometers or less) . The limits can range from a few milligrams per cubic meter (mg/m³) to tens of milligrams per cubic meter, depending on the specific manufacturing process and local regulations.

Nitrogen Oxides (NOx) : Emissions of nitrogen oxides, which include nitrogen dioxide (NO2) and nitrogen monoxide (NO) , can occur during high-temperature processes used in the manufacturing of anode materials, such as calcination and sintering. The emission standards for nitrogen oxides are usually specified as limits in parts per million (ppm) or milligrams per cubic meter (mg/m³) . The specific limits vary widely based on the type of manufacturing process, and technology used.

Carbon Monoxide (CO) : Carbon monoxide can be produced during the thermal processing stages of anode material production if incomplete combustion occurs. Emission standards for CO are generally expressed in parts per million (ppm) or milligrams per cubic meter (mg/m³) . These limits depend on the jurisdiction and the specific manufacturing setup, aiming to minimize CO emissions to protect air quality.

Volatile Organic Compounds (VOCs) : VOC emissions can result from the use of solvents and other organic chemicals in the production of lithium-ion battery anode materials. Emission standards for VOCs can vary; in some cases, specific limits are set, while in others, the focus might be on controlling overall emissions of hazardous air pollutants (HAPs) . Regulations may specify permissible concentrations in parts per million (ppm) or milligrams per cubic meter (mg/m³) , depending on the processes and the chemicals involved.

Key Sources Referred

1.World Intellectual Property Organization

2.International Energy Agency

3.Press Information of Bureau

4.Invest India

5.International Renewable Energy Agency

6.United Nations Development Programme.

7.India Brand Equity Foundation.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium-ion battery anode materials market analysis from 2024 to 2033 to identify the prevailing lithium-ion battery anode materials market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the lithium-ion battery anode materials market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global lithium-ion battery anode materials market trends, key players, market segments, application areas, and market growth strategies.

Lithium-Ion Battery Anode Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 38.4 Billion |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Material Type |

|

| By Region |

|

| Key Market Players | Mitsubishi Chemical Group Corporation., Tanaka Chemical Corporation, Johnson Controls. , Hitachi High-Tech India Private Limited , 3M, GS Yuasa International Ltd, SAMSUNG SDI CO.,LTD., SK Inc, BASF SE, Nippon Carbon Co Ltd |

Loading Table Of Content...