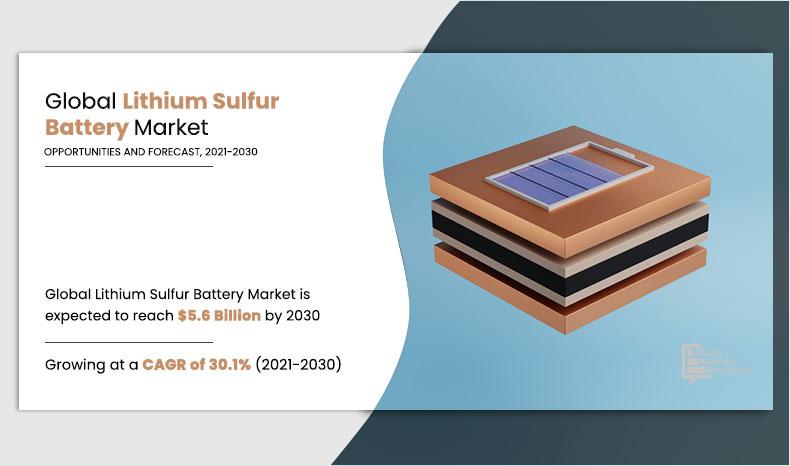

Lithium Sulfur Battery Market Forecast - 2030

The global lithium sulfur battery market size was valued at $0.4 billion in 2020 and is projected to reach $5.6 billion by 2030, with a CAGR of 30.1% from 2021 to 2030. Increase in demand for electric vehicles and other intensively electric power-driven transportation vehicles and government policies to the development of electric vehicles and their targets toward “zero carbon” are expected to drive the growth of the market during the forecast period. Increasing investments of major countries across the world in renewable energy sectors, such as wind farms and solar farms, after the energy crisis in the pandemic period have increased the demand for energy storage devices. The increase in temperature due to global warming led to major developed and developing countries to phase out thermal power plants and invest in renewable energy sources. Sudden increase in renewable energy power generation in China has put great load on the energy transmission and distribution system, which led to the application of battery to store excess power. The above-mentioned application and demand are the major factors fostering the growth of the lithium sulfur battery market.

The high cost of lithium sulfur compared to lithium-ion battery and the complex mechanism of the battery system to manufacture are the factors restraining the growth of the lithium sulfur battery market during the forecast period. The need for graphite-based composites to prevent from dendrites and micro short circuits and rapid innovation of manufacturers to improve lithium-ion batteries are another factors hampering the development of the market.

Increase in investment of government association and private enterprises to develop high energy density batteries for application in the aerospace and military sector will provide ample opportunities for the development of the lithium sulfur battery market.

The global lithium sulfur battery market is segmented on the basis of type, power capacity, end use, and region.

On the basis of type, the global market is segmented into low energy density and high energy density. The power capacities include 0-500mAh, 501-1,000mAh, and more than 1,000mAh. End uses include aerospace, automotive, electronic device, power & energy, and others.

Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share of the market, followed by Europe and Asia-Pacific.

The major companies profiled in this lithium sulfur battery industry report include Advanced Energy Materials, Ilika PLC, Johnson Matthey, LG Chem, Morrow Batteries, NOHMs Technologies, OXIS Energy, PolyPlus, Sion Power, and Williams Advanced. Due to rapidly increasing demand for energy in recent years, governments across the world have set sights on the development of renewable energy sources, which require high energy density storage batteries. Key manufacturers are innovating and expanding their production capacities to meet market demand across the globe. Additional growth strategies, such as new product developments, acquisition, and business expansion, are also adopted to attain key developments in the market.

Global Lithium Sulfur Battery Market, By Region

The North America dominates the lithium sulfur battery market due rapid innovation in monitoring and energy storage equipment in the region. U.S. is one of the major countries, which provide huge investment toward military sector to provide the soldiers with required comfort in unusual places. The increase in renewable energy share in national energy consumption has created high requirements for energy storage due to long-distance energy transmission and increase in efficiency for energy conversion. The presence of state policy toward electric vehicles and electric automotive giants, such as Tesla, has boosted the need for stable and low-cost battery packs. In addition, the presence of companies, such as Google, Microsoft, Apple, and other internet giants, has created positive impact on the need for emergency power backup for huge servers to provide better services for customers. These companies also produce smart electronic gadgets, such as computer, smart phones, smart bands, smart watches, and smart glasses, where lithium sulfur battery can be used in future. In addition, the presence of aerospace companies in this region and heavy investment by private sectors to develop space resources are the driving factors for the lithium sulfur battery market growth.

By Region

North America holds a dominant position in 2020

Global Lithium Sulfur Battery Market, By Type

The higher energy density dominates the lithium sulfur battery market due to the depletion of fossil fuel resources and uneven distribution of resources across the world, thereby boosting the demand for renewable energy sources and increasing the need for highly efficient and high energy density battery for energy storage. Rapid innovation and development of electric driven transportation vehicles, such as cars, aircraft, and military transport vehicles, are the major factors driving the growth of high energy density batteries. Increasing investments toward solar farms and wind farms have increased the demand for lithium sulfur battery. This power capacity of batteries has applications in hybrid energy storage systems and also as an energy source for unmanned aircraft, military transport vehicles, and large-scale energy storage devices. It can enable efficient electric transportation and government policies to phase out most of the fossil fuel-based vehicles, which played a major role in the development in the market. The above-mentioned applications and innovations in the transportation will provide ample opportunities for the growth of the lithium sulfur battery market.

By Type

High Energy Density is projected to create abundant $ opportunity till 2030

Global Lithium Sulfur Battery Market, By Power Capacity

The 0-500mAh segment dominates the lithium sulfur battery market due to wide range of applications in small-scale electronic gadgets such as cordless phones, small drones, GPS device, MP4 player, and other power-driven medical devices. Rapid development of small-scale electronic gadgets and their application in the real life is increasing the demand for this range of lithium sulfur battery. The increase in demand for small-scale electronic gadgets, such as Bluetooth devices, cordless phone, hearing aids, medical devices, and VR gadgets, is the main factor driving the market. The above-mentioned applications and their effect on daily life in the modern society will provide ample opportunities for the growth of the lithium sulfur battery market.

By Power Capacity

0-500mAh is projected as the most lucrative segment.

Global Lithium Sulfur Battery Market, By End-use

The aerospace segment accounted for a major share in the lithium sulfur battery market in 2020. Rapid growth in development of the electric vehicles from 2010 to the present and gradual decline in production of fuel-based vehicles are the factors driving the growth of the lithium sulfur battery market. The government plans to phase out fuel-based vehicles by 2050 and the “zero carbon” targets set by the governing bodies is also fostering the growth of EVs, which led to increase in demand for lithium sulfur battery. The International Energy Agency said in 2021 that governments should do more to meet climate goals, including policies for heavy electric vehicles. The global share of EVs increased from 2% in 2016 to 30% by 2030, and the global stock of electric vehicles has grown steadily through 2010s and reached nearly 11 million vehicles in 2020. The above-mentioned applications and innovation in EVs led to the development of more efficient battery, thereby providing ample opportunities for the growth of the market.

By End Use

Automotive is projected as the most lucrative segment.

COVID-19 analysis:

The outbreak of coronavirus has negative effect on the development of various industries as government actions to curb the spread of the virus have hampered the transportation sector across the globe. The lockdown decision of governments across the world to save mortal losses has hampered the lowwork force in industries. Improper distribution of resources across the world and many small countries being extremely dependent on the imports of raw materials from other countries led to shutdown of various industries. In this period, due to improper planning, many companies have issued bankruptcy and were closed down. During this period, economic and power crisis are created due to the outbreak of this virus and various restrains implemented by the state ruling members across the world have created various plans to overcome these restrains. Heavy investment in the development of renewable energy sources during this period also boosted the demand for highly efficient energy storage devices such as lithium sulfur battery. Increase in awareness among people has boosted the demand for eco-friendly products; hence, lithium sulfur batteries are being invested by top battery manufacturing companies and research institutes to get the commercialized product.

Key benefits for stakeholders

- This report provides a detailed quantitative analysis of the current lithium sulfur battery market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth lithium sulfur battery market analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the lithium sulfur battery market is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2021 to 2030 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global lithium sulfur battery market.

Key market segments

By Type

- Low Energy Density

- High Energy Density

- By Power Capacity

- 0-500mAh

- 501-1,000mAh

- More than 1,000mAh

By End Use

- Aerospace

- Automotive

- Electronic Device

- Power & Energy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- South Africa

- Rest of LAMEA

Lithium Sulfur Battery Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By POWER CAPACITY |

|

| By END USE |

|

| By Region |

|

| Key Market Players | NOHMs Technologies, Sion Power, Advanced Energy Materials, Williams Advanced, PolyPlus Battery, Ilika PLC, Johnson Matthey, OXIS Energy, LG Chem, Morrow Batteries |

Analyst Review

The global lithium sulfur battery is expected to witness increased demand during the forecast period due to rapid increase in the demand for high energy density batteries across the globe during the forecast period.

Lithium sulfur battery is a type of rechargeable battery with high specific energy. It may succeed lithium-ion cells due to higher energy density and reduced cost due to the use of sulfur instead of cobalt, which is mostly used in lithium-ion batteries. Increase in demand for electric vehicles and other intensively electric power driven transportation vehicles is one of the important factors driving the growth of the lithium sulfur battery market. Lithium sulfur battery is also used on the longest and highest altitude unmanned solar powered airplane flight. Airbus Defense and Space successfully launched its prototype high altitude pseudo satellite aircraft powered by solar energy during the day and by lithium sulfur batteries at night. Increase in demand for electric vehicles and government policies toward the development of electric vehicles and their targets toward zero carbon also driving the growth of the lithium sulfur battery market.

The practical applications of lithium sulfur batteries in various sectors and the lightweight, low cost, and higher energy density property compared to lithium-ion battery boosted its application in renewable energy storage devices. The increasing investments of major countries across the world in renewable energy sectors, such as wind farms and solar farms, have increased the demand for energy storage devices. This is also one of the factors driving the growth of the market.

Moreover, companies are adopting acquisition, product launch, and business expansion strategies to boost the growth of the lithium sulfur battery market during the forecast period. The presence of wide variety of applications of lithium sulfur battery in intensive power consuming sectors and huge investment from government and private sector to develop high energy density batteries for the military and aerospace industries will foster the growth of the lithium sulfur battery market.

The need for high energy storage devices in the automotive and aviation industry and adoption of renewable energy across the globe key factors boosting the lithium sulfur battery market growth

These players have adopted key development strategies such as new product developments, investments, joint venture, and acquisition to strengthen their foothold in the global lithium sulfur battery market.

The report sample for global Lithium Sulfur Battery Market report can be obtained on demand from the website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

North America will provide more business opportunities for Lithium Sulfur Battery in future

Advanced Energy Materials, Ilika PLC, Johnson Matthey, LG Chem, Morrow Batteries, NOHMs Technologies, OXIS Energy, PolyPlus, Sion Power, and Williams Advanced

The top ten market players are selected based on two key attributes - competitive strength and market positioning

High energy density segment holds the maximum share of the Lithium Sulfur Battery market

Automotive manufactures, electronic device manufacturers are the potential customers of Lithium Sulfur Battery industry

The global lithium sulfur battery market is segmented on the basis of type, power capacity, end use and region.On the basis of type, the global lithium sulfur battery market is segmented into low energy density, and high energy density. The power capacity introduced in the study includes 0-500mAh, 501-1,000mAh, more than 1,000mAh. In addition to this, end use is also covered in the study which includes aerospace, automotive, electronic device, power & energy, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Rapid innovation and need for environmentally friendly batteries is the key trend influencing the Lithium Sulfur Battery Market in the next few years

Aerospace, Automotive, Electronic Device,Power & Energy are expected to drive the adoption of Lithium Sulfur Battery

Loading Table Of Content...