Livestock Genomics Testing Market Research, 2034

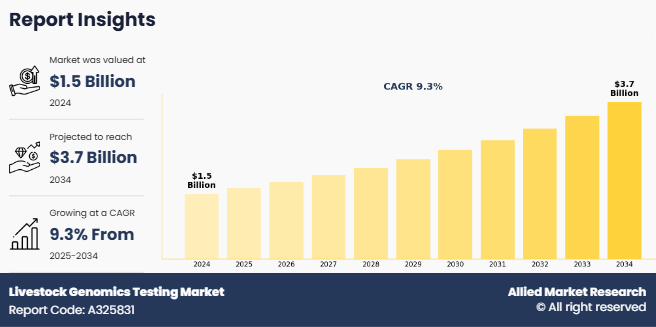

The global livestock genomics testing market size was valued at $1.5 billion in 2024, and is projected to reach $3.7 billion by 2034, growing at a CAGR of 9.3% from 2025 to 2034. Livestock genomics testing involves the analysis of animals' genetic material to gain insight into traits such as disease resistance, fertility, meat and milk production, feed efficiency, and adaptability to environmental conditions. Livestock genomics testing utilizes advanced technologies like DNA sequencing, SNP genotyping, and gene expression profiling to support selective breeding and improve overall herd quality. By identifying desirable genetic traits, farmers and breeders can make informed decisions to enhance productivity and sustainability. Livestock genomics testing is increasingly being integrated into modern animal agriculture practices due to its potential to reduce production costs, improve animal health, and meet the growing global demand for high-quality animal protein.

Key Takeaways

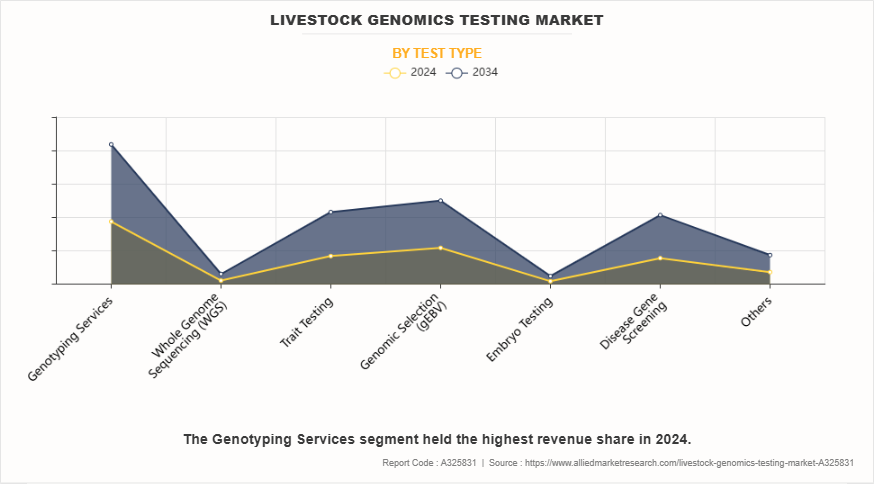

- By type, the genotyping services segment was the highest contributor to the market in 2024.

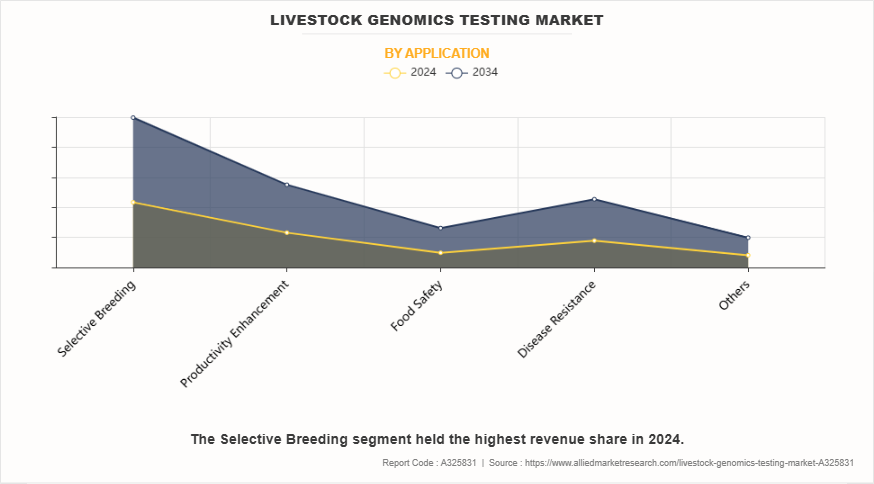

- By application, the selective breeding segment was the highest contributor to the market in 2024.

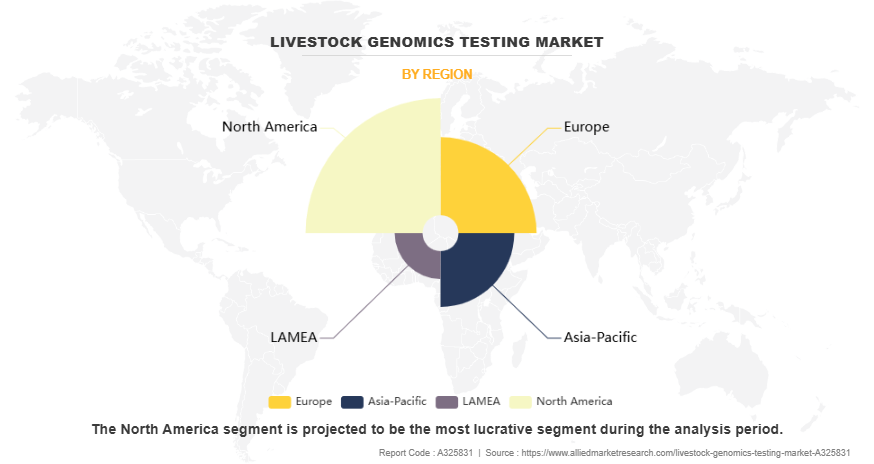

- By region, North America garnered the largest revenue share in 2024. However, Asia-Pacific is expected to grow at the fastest rate during the livestock genomics testing market forecast.

Market Dynamics

The livestock genomics testing market growth is driven by the surge in livestock population, increasing demand for animal-derived food products, advancements in genomic technologies, and a rising focus on improving livestock productivity and disease resistance. According to 2023 article by Our World by Data, global cattle population reached 1.54 billion in 2023. Farmers and breeders are increasingly adopting genomics testing to enhance traits such as growth rate, feed efficiency, fertility, and disease resistance, which leads to improved yield and economic gains. Additionally, government initiatives and funding for animal genetics research, along with the growing awareness of the benefits of genetic testing in livestock management, further support livestock genomics testing market expansion.

The livestock genomics testing market growth is driven by rising demand for animal protein, increased focus on breeding improvement, disease resistance, and technological advancements in genetic sequencing and bioinformatics tools. As populations expand and incomes increase particularly in developing regions there is a marked shift in dietary preferences toward higher consumption of meat, milk, and eggs. According to 2025 article by Organization for Economic Co-operation and Development, total growth in meat consumption is projected at 47.9 Mt over the next decade. This growing demand places pressure on the livestock industry to enhance productivity, efficiency, and disease resistance in animals.

Genomic testing enables the identification of desirable genetic traits, allowing breeders to select animals with superior growth rates, feed conversion efficiency, and reproductive performance. It also facilitates the development of disease-resistant breeds, which is essential for maintaining herd health and ensuring consistent protein supply. Moreover, genomics supports precision breeding strategies that reduce the time and cost associated with traditional selective breeding, helping producers meet the protein demand more sustainably.

Increased focus on breeding improvement is a major factor driving thethe livestock genomics testing market demand. According to 2025 article by Oxford University, Genetic improvement has a proven track record of productivity enhancements, and following implementation, genetic improvement is permanent and cumulative. Livestock producers are increasingly prioritizing genetic selection to enhance desirable traits such as disease resistance, reproductive efficiency, feed conversion, and meat or milk quality. Genomics testing enables precise identification of animals with superior genetic profiles, allowing for more informed breeding decisions and accelerated genetic gains across generations. As global demand for high-quality animal protein rises, producers are under pressure to optimize productivity and sustainability, which further fuels the adoption of advanced breeding technologies. Additionally, government and private sector initiatives aimed at improving national herd genetics and reducing economic losses due to disease and low productivity are boosting investments in genomics-based breeding programs. This growing emphasis on genetic improvement to meet both economic and consumer-driven demands is significantly propelling the expansion of the livestock genomics testing market.

Technological advancements in genetic sequencing and bioinformatics tools have emerged as a major factor driving the growth of the livestock genomics testing market. The development of next-generation sequencing (NGS) technologies has significantly reduced the cost and time required for whole-genome and targeted sequencing, making genomic testing more accessible and scalable for livestock breeders and researchers.

These technologies allow for high-throughput analysis of genetic markers associated with desirable traits such as disease resistance, productivity, fertility, and feed efficiency. Alongside sequencing innovations, bioinformatics tools have evolved to handle and interpret vast amounts of genomic data with greater precision. Advanced algorithms and machine learning models are now being used to identify complex gene-trait associations, predict phenotypic outcomes, and support genomic selection strategies. Technological advancements are enabling more informed breeding decisions, enhancing genetic gains, and accelerating the development of superior livestock breeds. As a result, the integration of cutting-edge sequencing platforms with sophisticated bioinformatics is fueling the demand for genomics testing services across the Livestock Genomics Testing Industry

Segmental Overview

The livestock genomics testing market is segmented on the basis of type, application, and region. On the basis of type, the market is divided into genotyping services, whole genome sequencing (WGS), trait testing, genomic selection (GEBV), embryo testing, disease gene screening, and others. On the basis of application, the market is classified into selective breeding, productivity enhancement, food safety, disease resistance, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, UAE, Australia and rest of LAMEA)

By Type

The genotyping services segment held the largest Livestock Genomics Testing market size in 2024. This is attributed to its critical role in improving the accuracy and efficiency of animal breeding programs. Genotyping enables the identification of specific genetic markers associated with desirable traits such as disease resistance, fertility, growth rate, and meat or milk quality. This allows breeders and livestock producers to make informed selection decisions, accelerating genetic gain and improving herd productivity. The growing demand for high-performing livestock, combined with advancements in genotyping technologies—such as high-throughput sequencing and SNP arrays—has made these services more accessible and cost-effective. Furthermore, the increased focus on sustainable animal agriculture and the need to optimize feed efficiency and health outcomes have further propelled the adoption of genotyping services.

By Application

The selective breeding segment held the largest Livestock Genomics Testing market share in 2024. This is attributed to its pivotal role in enhancing desirable traits in animals, such as growth rate, disease resistance, fertility, and meat or milk quality. Genomics testing enables precise identification of genetic markers associated with these traits, allowing breeders to make informed decisions and accelerate genetic improvement. This not only boosts productivity and profitability for livestock producers but also reduces production costs and environmental impact by minimizing the need for antibiotics and other interventions. Additionally, increasing global demand for high-quality animal protein has intensified the focus on optimizing breeding programs, further driving the adoption of genomics-based selective breeding.

By Region

North America held the largest livestock genomics testing market share in 2024. This is attributed to the early adoption of advanced genomic technologies, well-established infrastructure for animal health and agriculture, and strong presence of leading market players. The region benefits from a high level of awareness among farmers and breeders about the economic advantages of genomic testing in enhancing livestock productivity, disease resistance, and breeding efficiency. Additionally, significant government and private sector investments in animal genomics research, particularly in the U.S. and Canada, have further propelled the adoption of these technologies. The demand for premium quality animal products and the push for sustainable animal farming practices have also driven the use of genomics in improving livestock traits and performance, contributing significantly in North America’s leadership in the market.

However, Asia Pacific region is expected to register the highest CAGR in the livestock genomics testing market owing to its rapidly expanding livestock population, rising demand for animal protein, and growing awareness of the benefits of genetic testing among farmers. Countries like China, India, and Australia are witnessing a surge in investment in agricultural biotechnology and animal husbandry, driven by government initiatives and a growing focus on food security. As the region continues to modernize its agricultural practices, the adoption of genomics for selective breeding, disease control, and productivity enhancement is gaining momentum. Moreover, increasing collaborations between global genomics companies and local players, along with improvements in rural veterinary services, are expected to further accelerate market growth across Asia Pacific.

Competition Analysis

Major key players that operate in the livestock genomics testing market are Neogen Corporation, Genus Plc, Illumina, Inc., Zoetis Genetics, Semex Alliance, Agresearch Limited, CRV, Easy DNA, Animal Genetics and XytoVet. Key players, such as Stanford Health Care, have adopted product launch as a key developmental strategy to drive livestock genomics testing market expansion.

Recent Developments in the Livestock Genomics Testing Industry

- In January 2025, Neogen Corporation announced the launch of Igenity BCHF to improve overall bovine heart health standards. Bovine Congestive Heart Failure (BCHF)stands as a significant threat to cattle health and productivity, and this genomic test provides a new opportunity for improved selection for heart health. Testing with Igenity BCHF assesses an animal’s genetic predisposition for BCHF, scored on a 1-to-10 scale.

- In August 2023, Neogen Corporation announced that it has launched Igenity Enhanced Dairy, a new and progressive genomic data management tool. Igenity Enhanced Dairy is a new digital service that empowers dairy producers to make better selection and mating decisions. By integrating in-herd phenotypic data, pedigree information, and existing predicted transmitting abilities (PTAs) from the Council on Dairy Cattle Breeding (CDCB), the platform delivers a genomic evaluation of dairy cattle

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the livestock genomics testing market analysis from 2024 to 2034 to identify the prevailing livestock genomics testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the livestock genomics testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global livestock genomics testing market trends, key players, market segments, application areas, and market growth strategies.

Livestock Genomics Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.7 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 291 |

| By Test Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Semex alliance, CRV Holding B.V., Neogen Corporation, Agresearch Limited, Easy DNA, Illumina, Inc., Animal Genetics, Inc, Genus Plc, Zoetis Genetics, XytoVet |

Analyst Review

The livestock genomics testing market represents a strategic growth opportunity driven by the increasing demand for precision livestock farming, enhanced productivity, and sustainable animal husbandry practices. Executives recognize that genomics testing enables data-driven decisions in breeding, disease resistance, and trait selection, ultimately improving herd quality and profitability. Key players are prioritizing investments in genomic technologies that offer cost-effective, scalable, and rapid genetic insights, with rising global protein consumption and pressure to optimize livestock yields. Additionally, partnerships with genomics service providers and research institutions are seen as crucial to gaining a competitive advantage through innovation and differentiation.

The livestock genomics testing market registered a CAGR of 9.3% from 2024 to 2034.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the livestock genomics testing market report is from 2025 to 2034.

The top companies that hold the market share in the livestock genomics testing market include Neogen Corporation, Genus Plc, Illumina, Inc., Zoetis Genetics, and others.

The livestock genomics testing market was valued at $1,533.4 million in 2024 and is estimated to reach $3,691.4 million by 2034, exhibiting a CAGR of 9.3% from 2025 to 2034.

The livestock genomics testing market report has 2 segments. The segments are type and application.

The emerging regions in the livestock genomics testing market are likely to grow at a CAGR of more than 10.0% from 2025 to 2034.

North America will dominate the livestock genomics testing market by the end of 2034.

Loading Table Of Content...

Loading Research Methodology...