Livestock Insurance Market Research, 2031

The global livestock insurance market size was valued at $2.79 billion in 2021, and is projected to reach $5.77 billion by 2031, growing at a CAGR of 7.9% from 2022 to 2031.

Livestock insurance provides a cover in case of death of livestock animal resulting from disease or accidents, which include natural calamities and fatal injuries caused by other animals. In certain cases, cover may also extend to when the cattle is put down. However, this will have to be accompanied by a doctor’s certificate. In the event of death of cattle, the farmer suffers loss of income and disruption in the rearing program. If the loss exceeds a specified limit, then livestock insurance compensates the farmers so that the farmers can control the loss completely.

Livestock insurance provides protection from unforeseen perils such as fire, smoke, earthquakes and others, which can cause serious injuries to the animals. Therefore, livestock insurance covers the medical cost of such treatments. In addition, surge in number of diseases in livestock animals has led to the rise of purchase of livestock insurance among farmers and livestock owners. Moreover, livestock insurance provides liability coverage if the livestock accidently damages other people property or causes bodily injury. Therefore, these are some of the factors propelling the growth of livestock insurance market. However, the high rate of premium for livestock insurance restricts small farmers to purchase the insurance coverage, which is a major drawback for the livestock insurance market. On the contrary, various governmental initiatives and subsidies are provided for livestock insurance to protect the livestock from any risk and danger, which helps the farmers to increase their income. Therefore, it is expected to provide lucrative growth opportunities in the coming years.

Segment Review

The livestock insurance market is segmented on the basis of type, application, distribution channel, end user, and region. By type, it is segmented into commercial mortality insurance, and non-commercial mortality insurance. By application, it is bifurcated into dairy, cattle, swine, and others. By on distribution channel, it is segregated into direct sales, bancassurance, and agents and brokers. By end user, the livestock insurance market is divided into commercial and individuals. The commercial segment is further sub segmented into dairy farmers and groups. The groups sub segment is further bifurcated into Self- Help Groups (SHGs), and Joint Liability Groups (JLGs). By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

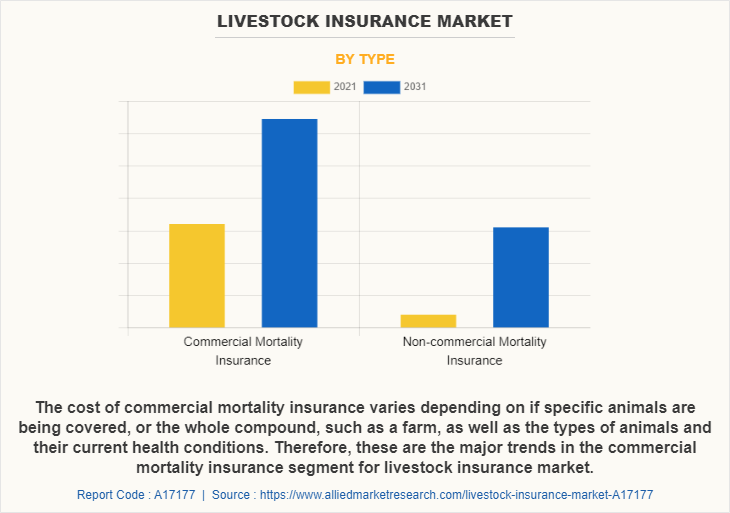

By type, the commercial mortality insurance segment attained the highest growth in 2021. This was attributed to the fact that it is used in industries in which animals are an important revenue-generating asset, such as dairy farming, zoos, aquariums, and professional horse stables. Commercial mortality insurance only covers deaths by non-natural causes, such as those due to accidental shooting, traffic accidents, or extreme weather events.

By region, North America attained the highest growth in 2021. This was attributed to the fact that the adoption for livestock insurance market has widely increased in the region as farmers and ranchers in the region strive to sustain & enhance animal byproducts such as beef meat, eggs, and dairy products by availing prominent livestock price insurance coverage. In addition, insurers are developing existing offerings & providing knowledge to livestock owners to enhance maximum safety of the livestock by providing medical claims, coverage for accidental deaths and permanent disability.

The report focuses on growth prospects, restraints, and trends of the livestock insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the livestock insurance market.

The report includes profiles of key players operating in the livestock insurance market analysis such as AXA SA, Farm Bureau Financial Services, Future Generali India Insurance Company Ltd, GramCover, HDFC ERGO General Insurance Company Limited, HUB International Limited, Howden Insurance & Reinsurance Brokers (Phil.), Inc, ICICI Lombard General Insurance Company Limited, Lloyd's, Liberty Specialty Markets, Nationwide Mutual Insurance Company, Rural Mutual Insurance Company, Stockguard, Inc., Shelter Mutual Insurance Company, The Hartford, The Accel Group, and The Bath State Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the livestock insurance industry.

COVID-19 impact analysis

The COVID-19 pandemic had a devastating loss on different sectors of the world. Out of which, livestock sector is one among these sectors which is not directly affected by the pandemic, but indirectly has created a great economic loss to the sector mainly because of the lockdown. The lockdown has created several issues i.e. decline in demand as well supply of animal products. Moreover, due to fall in demand for livestock, farmers could not afford to pay premiums for the livestock insurance and many small scale farmers could not afford to buy the cattle insurance coverage. However, due to lack of demand, many livestock could not be fed well which led to serious diseases for which farmers preferred to purchase livestock insurance in order to cover the medical cost for their livestock. Therefore, the COVID-19 had a moderate impact on the livestock insurance industry.

Top impacting factors

Surge in number of diseases in livestock

Infectious diseases of livestock are a major threat to global animal health and welfare and their effective control is crucial for agronomic health, for safeguarding and securing national and international food supplies and for alleviating rural poverty in developing countries. In addition, the cost for medicines and injections for these rare diseases are generally high which is difficult for an average farmer to bear the cost. Therefore, in order to provide the best medical facilities for the livestock, farmers tends to purchase livestock insurance which covers the cost of such high medicines and medical procedures to cure the animals. Therefore, the surge in number of diseases in livestock is one of the major driving factor of the livestock insurance market outlook.

High premium rates for livestock insurance

The premium rates for livestock insurance are generally high because of the unpredictable nature of the livestock. In addition, most of the owners of livestock are generally poor or average earners; thus, it is difficult for them to afford such high premiums rates to insure their livestock. Thus, most of the small scale farmers avoid purchasing these insurance policies. Therefore, this is a major limiting factor for the livestock insurance market growth.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, estimations, and dynamics of the livestock insurance market trends from 2021 to 2031 to identify the prevailing livestock insurance market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the livestock insurance market share assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global livestock insurance market forecast.

- The report includes the analysis of the regional as well as global livestock insurance market trends, key players, market segments, application areas, and livestock insurance market growth strategies.

Livestock Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Liberty, GramCover, The Bath State Bank, HDFC ERGO, Nationwide, Lloyd's, HUB International Limited, AXA XL, ICICI Lombard General Insurance Company Limited, The Accel Group, Shelter Insurance, Future Generali India Insurance Company Ltd., Howden Insurance & Reinsurance Brokers (Phil.), Inc., Farm Bureau Financial Services, Stockguard, Inc., Rural Mutual Insurance Company, The Hartford |

Analyst Review

Livestock sector is an important sector of national, especially rural economy of a country. The supplemental income derived from rearing of livestock is a great source of support to the farmers facing uncertainties of crop production, apart from providing sustenance to poor and landless farmers. Moreover, livestock insurance policy offers protection of rural people from financial loss due to death of their cattle, which is one the most valued possessions of the rural community. In addition, at the times of rising inflation, animal husbandry has also become a challenge, but the government is fully supporting the farmers to increase their income through animal husbandry.

Cattle are considered one of the foremost valued possessions of the agricultural community in various countries. Marginal, small, and medium farmers earn a considerable portion of their income from cattle rearing and allied activities like the selling of milk. Since the livelihood of farmers depends on such a lot, it becomes important to ensure the livestock for comprehensive coverage against cattle diseases or any unforeseen events such as the untimely death of cattle. Livestock insurance is another attempt of the government to guard the agro-based economy of a country. Some of the key players profiled in the report include AXA SA, Farm Bureau Financial Services, Future Generali India Insurance Company Ltd, GramCover, HDFC ERGO General Insurance Company Limited, HUB International Limited, Howden Insurance & Reinsurance Brokers (Phil.), Inc., ICICI Lombard General Insurance Company Limited, Lloyd's, Liberty Specialty Markets, Nationwide Mutual Insurance Company, Rural Mutual Insurance Company, Stockguard, Inc., Shelter Mutual Insurance Company, The Hartford, The Accel Group, and The Bath State Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global livestock insurance market is projected to grow at a CAGR of 7.9% from 2022 to 2031.

The global livestock insurance market size is projected to reach $5,770.88 million by 2031.

Livestock insurance provides protection from unforeseen perils such as fire, smoke, earthquakes and others, which can cause serious injuries to the animals. Therefore, livestock insurance covers the medical cost of such treatments. In addition, surge in number of diseases in livestock animals has led to the rise of purchase of livestock insurance among farmers and livestock owners. Moreover, livestock insurance provides liability coverage if the livestock accidently damages other people property or causes bodily injury. Therefore, these are some of the factors propelling the growth of livestock insurance market.

Farm Bureau Financial Services, Liberty Specialty Markets, Nationwide Mutual Insurance Company, The Hartford, and The Hartford are the leading players in the livestock insurance market.

The livestock insurance market is segmented on the basis of type, application, distribution channel, end user, and region. By type, it is segmented into commercial mortality insurance, and non-commercial mortality insurance. By application, it is bifurcated into dairy, cattle, swine, and others. By on distribution channel, it is segregated into direct sales, bancassurance, and agents and brokers. By end user, the market is divided into commercial and individuals. The commercial segment is further sub segmented into dairy farmers and groups. The groups sub segment is further bifurcated into Self- Help Groups (SHGs), and Joint Liability Groups (JLGs). By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

By type, the commercial mortality insurance segment attained the highest growth in 2021. This was attributed to the fact that it is used in industries in which animals are an important revenue-generating asset, such as dairy farming, zoos, aquariums, and professional horse stables. Commercial mortality insurance only covers deaths by non-natural causes, such as those due to accidental shooting, traffic accidents, or extreme weather events.

Loading Table Of Content...