Loan Management Software Market Research, 2031

The global loan management software market was valued at $5.9 billion in 2021, and is projected to reach $29.9 billion by 2031, growing at a CAGR of 17.8% from 2022 to 2031.

A loan management software is a digital platform that helps lenders to automate loan handling processes from the application stage to closing. It allows banks, credit unions, mortgage lenders, payday lenders, and other financial organizations to gather and verify customer data much faster, offer new loans, manage the existing ones, calculate interest rates, and more. Above all, these systems include tools for generating quick reports with detailed analytics, providing valuable insights for lenders. Loan management systems are especially popular among the North American financial institutions, contributing to the Loan management Software Market growth of up to 48%, followed by the EU, Japan, and other countries.

Loan management software also helps to increase efficiency in lending operations and is notably driving the global loan management software market growth. Moreover, banking and financial institutions have been modernizing their operations over the last decade by implementing digital technologies to streamline their procedures and save time. In addition, rising adoption of loan management software among the end user due to the easy access to solutions and the opportunity to carry out whatever activities they want easily from anywhere across globe. These are some of the factors that propel the growth of loan management software market.

However, cost of adopting loan management software is high, which led difficulties for the small lenders to adopt the software. Additionally, small and medium enterprises are unable to adopt these software because of its high cost. On the contrary, advances in technology and adoption of artificial intelligence and machine in the lending industry benefit the growth of the market and is expected to provide lucrative growth opportunities in the coming years.

The report focuses on growth prospects, restraints, and trends of the loan management software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the loan management software market.

Segment Review

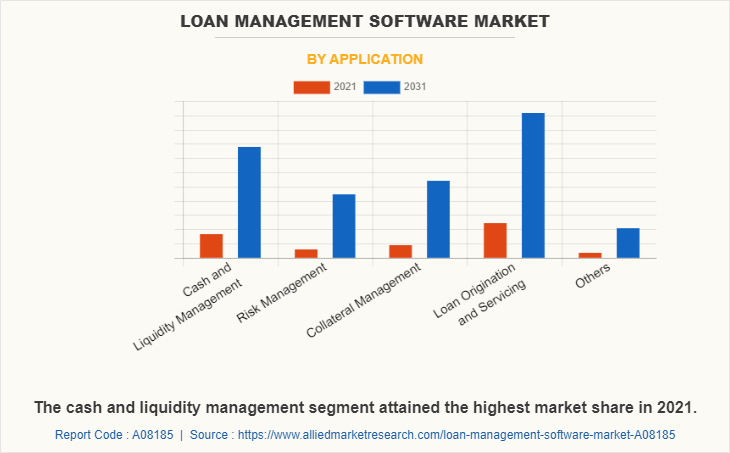

The loan management software market is segmented on the basis of component, deployment mode, enterprise size, application, end user, and region. By component, it is segmented into solution and service. By deployment mode, it is bifurcated into on-premise and cloud. By enterprise size, it is segregated into large enterprises and small & medium-sized enterprises (SMEs). By application, the loan management software market is fragmented into cash and liquidity management, risk management, collateral management, loan origination, and others. By end user, the loan management software market is segmented into banks, credit unions, NBFCs, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the loan origination & servicing segment attained the highest growth in 2021. This is attributed to the fact that loan origination in loan management software helps to automate the underwriting process with the help of custom loan approval rules and risk analysis algorithms. This reduces the need for manual calculation and accelerates decision-making at the credit approval stage. Furthermore, this software provides a self-service portal for customers to perform certain tasks on their own. This enhances efficiency and reduces costs for MLOs due to reduced administrative tasks. This is a major growth factor for the loan management software market share.

By region, North America attained the highest growth in 2021. This is attributed to the fact that most lending companies in this region are adopting loan management software to do the work fast and efficiently. Furthermore, companies in the U.S. are partnering with other companies to offer loan management software services. Also, rapid advancement in lending industry, due to modern technologies such as machine learning, blockchain, big data, cloud services and artificial intelligence contributes toward the growth of the loan management software market in this region. Therefore, companies in the region are adopting loan management software.

The report analyzes the profiles of key players operating in the loan management software market such as AllCloud, Aryza, Cyrus, Finastra, Finflux, Infinity Enterprise Lending Systems, LoanPro, Nelito Systems Pvt. Ltd., Nortridge Software, LLC., and TurnKey Lender. These players have adopted various strategies to increase their market penetration and strengthen their position in the loan management software industry.

Market Landscape and Trends

Digitalized workplaces and simplified operations along with accelerated performance are expected to drive the growth of the global loan management software market over the forecasted period. Demand for enhanced process, lower capital, and operational expenses, convergence, and centralization are anticipated to favour its growth. Moreover, one of the main driving forces behind the expansion of the global loan management software market is the high need for enhanced and efficient process of loan management. Such services streamline the purchasing process, improve client satisfaction, and make it simple for the operator to comprehend and monitor the data. In addition, companies are continuously attempting to reduce their capital expenditures and operational costs. Because of the current competitive environment and global economic crisis, the adoption of cost-effective strategies for restructuring existing business models has increased. Therefore, these are the major market trends for loan management software market forecast.

Top Impacting Factors

Efficiency in Lending Operations

The demand for efficiency in lending operations is notably driving the global loan management software market growth. Moreover, banking and financial institutions have been modernizing their operations over the last decade by implementing digital technologies to streamline their procedures and save time. Therefore, banks and other financial institutes are adopting digital technologies to streamline their operations and save time and costs. Furthermore, banks, mortgage companies, and financial institutions are also turning to third-party organizations or agencies to handle their loan management needs. In addition, lenders can monitor all operations from loan processing to loan repayment with the help of loan management software. Thus, this factors helps to drive the global loan management software market size.

Surge in Demand for Loan Management Software

There is a rising adoption of loan management software among the end user due to the easy access to solutions and the opportunity to carry out whatever activities they want easily from anywhere across globe. As consumer preferences shift, lenders have begun to focus on improving customer service through technology. For instance, according to a research report around 61% of the loan documents were already digitally generated in the year 2019. Furthermore, lenders were looking customizability, consistency and the ability to quickly gather the right information and a solution that increases recognition of the needs of customers. Additionally, loan management software reduces risk of human error through proper verification with data measurements, enhancing overall services to customers. Therefore, all such factors encouraged financial institutions and banks to adopt loan management software.

Loan Management Software helps to Reduce Processing Times

The Loan management software helps to reduces process turnaround time by automating loan processes which use to take a long time to do manually. Moreover, posting late fees, creating and delivering letters of default, and calculating penalty and fees are all just a few of the tasks which are done through software management. Also, this loan management software helps to streamlines many elements of day-to-day work, allowing the team to focus their efforts and energy on what is extremely crucial and simply eliminate lower-value, time-consuming duties.

However, major component of management function is monitoring loans and guaranteeing their collection. Furthermore, it helps in creating and generating the accounting reports and often invoices and statements for borrowers and investors which is another critical aspect. In addition, it helps to ensure the accuracy of the data and make it easy to extract the right information in real-time and when required for any reporting period, thus this helps to reduce the processing time. Therefore, this is a major factor to boost the loan management software market.

Consumer Data Security Concerns

Software applications is the use of technology and innovation to provide financial services through internet-based platforms. Companies in this market provide end-to-end process financial services and solutions to automate loan processes. It is used by end-user organizations on the back end to automate loan process and management.

Moreover, with the usage of cloud technology in financial services there rise the concern of data security. Additionally, consumer data is restraining the growth of the loan management software market. These loans providing firms/organizations collect a large quantum of data about their customers, which include personal information and other financial records and save the files on cloud for future use. Many companies also collect data on a customer’s online spending behavior and social media patterns, to trace their digital footprint. This collected data collected is used for analysis in decision-making like generating credit score to determine a customer’s risk profile. Additionally, a large amount of personal and sensitive data is potentially vulnerable to breaches and can be accessed by malicious entities. Thus, this factors are restraining the growth of the loan management software market.

The Installation of loan Management Software is Expensive

The cost of adopting loan management software is high, which led difficulties for the small lenders to adopt the software. Additionally, small and medium enterprises are unable to adopt these software because of its high cost. In addition, the process of learning to run the software requires training which further makes the investment amount huge and such huge cost can’t be afforded by SMEs. Therefore, such factors limit the growth of loan management software market.

Technological Advancement in the Field of Loan Management Software

With the integration of machine learning and artificial intelligence in the loan automation, it will benefit the growth of the market in the upcoming years. Moreover, cloud services and machine learning (ML) can help lenders to store data and make accurate loss mitigation decisions through automation. Furthermore, these decisions may include rejecting or approving loan modifications, forbearance agreements, and repayment plans. In addition, intelligent character recognition (ICR) can help extract useful information from loan documents. Such advance management technology helps to identify the final version of loan documents from a loan package, extract relevant data from these documents, and use it to automate the loan processing workflow. Therefore, technological advancement in the field of loan management will provide major lucrative opportunities in the growth of the market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the loan management software market analysis from 2022 to 2031 to identify the prevailing loan management software market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the loan management software market outlook assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global loan management software market trends, key players, market segments, application areas, and market growth strategies.

Loan Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 29.9 billion |

| Growth Rate | CAGR of 17.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 278 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Turnkey Lender, Finastra, finflux, Nelito Systems Pvt. Ltd., Allcloud, Aryza, Infinity Enterprise Lending Systems, LoanPro, Nortridge Software, LLC., Cyrus |

Analyst Review

A loan management software is a digital platform that helps to automate every stage of the loan lifecycle, from application to closing. The traditional loan management process is meticulous, time-consuming, and requires collecting and verifying information about applicants, their trustworthiness, and their credibility. Further, the process involves calculating interest rates and supervising payments. In addition, loan management software not only automates these procedures but also provides useful analytics and insights for lenders and borrowers.

It also refers to the borrower's obligation to make timely payments of principal and interest on a loan as a way to maintain creditworthiness with lenders and credit-rating agencies. Such loan management software also helps in creating & generating the accounting reports and often invoices & statements for borrowers & investors which is another critical aspect. Furthermore, loan management software ensures the accuracy of data, and makes it easy to extract the right information in real-time and when required for any reporting period. Furthermore, it offers users a beautiful design, a user-friendly interface, and an excellent user experience. Also, software is built on modern and secure web technologies like React and Java Spring Boot, and it performs admirably. In addition, AI/ML is at the heart of it. It offers the most customizable and extensible loan management software services.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in May 2022, Canadian based VoPay, a leading provider of integrated payment technology, has announced a strategic partnership with TurnKey Lender, a global leader in Unified Lending Management, delivering an AI-powered lending automation platform used by traditional, alternative, and embedded lenders in 50+ countries.

This partnership provides lenders with an entirely digitized end-to-end process automation, observed to deliver a massive boost to their bottom line. It will helps to handles the complete loan lifecycle and can be configured to support various lending propositions. Therefore, this strategy helps to grow the market. Moreover, some of the key players profiled in the report include AllCloud, Aryza, Cyrus, Finastra, Finflux, Infinity Enterprise Lending Systems, LoanPro, Nelito Systems Pvt. Ltd., Nortridge Software, LLC., and TurnKey Lender. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loan management software also helps to increase efficiency in lending operations and is notably driving the global loan management software market growth. Moreover, banking and financial institutions have been modernizing their operations over the last decade by implementing digital technologies to streamline their procedures and save time.

North America is the largest regional market for Loan Management Software

The global loan management software market was valued at $5,934.68 million in 2021, and is projected to reach $29,863.84 million by 2031, growing at a CAGR of 17.8% from 2022 to 2031

AllCloud, Aryza, Cyrus, Finastra, Finflux, Infinity Enterprise Lending Systems, LoanPro, Nelito Systems Pvt. Ltd., Nortridge Software, LLC., and TurnKey Lender.

Loading Table Of Content...