Loan Origination Software Market Research, 2032

The global loan origination software market was valued at $4.8 billion in 2022, and is projected to reach $12.2 billion by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

Loan origination software allows financial firms to automate and manage the workflow of various lending process processes. Loan application, underwriting, credit approval, documentation, pricing, funding, and disbursement or application rejection are all steps in the process. Furthermore, it enables firms to process, approve, or decline loans more quickly, as the program eliminates compliance risk and offers real-time activity monitoring. Lenders can streamline operations, set up standards, and improve operational efficiency at all levels, as it implies fewer mistakes and increased productivity. In addition, all aspects of the loan application, document verification, and credit approval are completed digitally. Moreover, anything related to loan procedure can be executed on the loan origination platform, including the application form, customer document submission, and approval.

Furthermore, during the loan origination process, users can enter the customer's information such as income and credit history into the system. The system will allow the customer to submit required documents for verification, and the system will handle the underwriting and approval.

Increased usage of AI, machine learning, and blockchain technologies in the loan origination software market has the potential to considerably fuel loan origination market growth by improving efficiency, accuracy, security, and customer experience. Furthermore, automated underwriting systems driven by AI can handle loan applications quickly and accurately.

To make informed lending decisions, these systems analyze borrower data, credit history, income sources, and other pertinent criteria. This accelerates the loan origination process, giving borrowers faster access to money while decreasing manual effort for lenders. In addition, as AI and machine learning can detect trends that indicate fraudulent activity, such systems can detect irregularities that indicate probable fraud by analyzing historical data and real-time transactions. This improves loan origination security and protects both lenders and borrowers from fraudulent actions. Furthermore, technological advancement in the loan origination and management are enhance the growth of loan origination software market.

However, concern regarding data security and compliance are hamper the growth of loan origination software market, as data breaches and privacy concerns are major challenges for the financial industry, particularly when dealing with sensitive borrower information. Cyberattacks and data breaches can occur if loan origination software systems are not appropriately secured. This can result in identity theft, financial fraud, and legal problems due to unauthorized access to personal and financial data. Fear of such breaches can stop lenders from using new technological solutions, delaying industry growth. Furthermore, rise in stringent government rules & regulations are create obstacle for the growth of loan origination software market. On the contrary, collaboration with fintech firms can open up new prospects for the loan origination market by utilizing technological improvements, optimizing procedures, increasing customer experiences, and expanding access to financing.

Furthermore, fintech firms are frequently at the forefront of technical innovation, as traditional lenders can obtain access to cutting-edge solutions such as sophisticated AI, machine learning, blockchain, and data analytics by cooperating with fintechs. These advancements have the potential to simplify loan origination processes, automate underwriting, and increase risk assessment accuracy. Moreover, fintech solutions are built to be flexible and efficient, as working with fintechs can help speed up the loan origination process by automating time-consuming procedures, decreasing manual paperwork, and removing bottlenecks. This results in quicker loan approvals and payments, which improves the borrower experience.

The report focuses on growth prospects, restraints, and trends of the loan origination software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the loan origination software market.

Segment Review

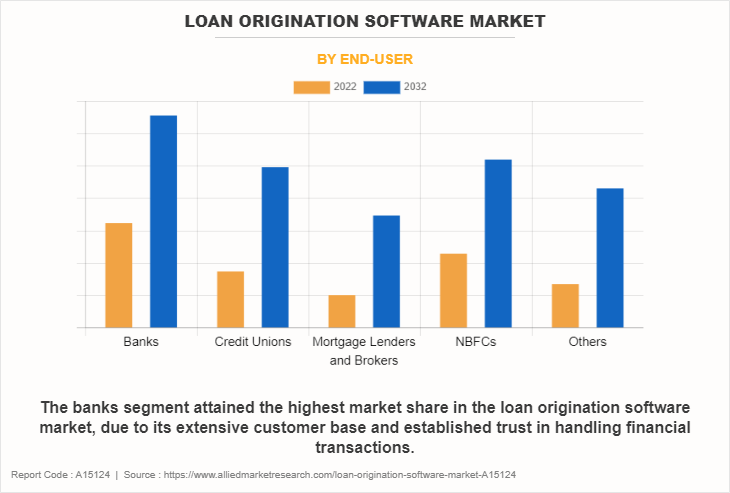

The loan origination software market outlook is segmented on the basis of component, deployment mode, end user, and region. On the basis of component, the market is bifurcated into solution, and service. Based on deployment mode, the market is segmented into on-premise, and cloud. By end user, it is bifurcated into banks, credit unions, mortgage lender and brokers, NBFCs, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of end user, the banks segment attained the highest loan origination software market share, as banks have an extensive record of lending and well-established lending operations, as they provide a variety of loan products, including mortgages, personal loans, auto loans, and business loans. The range of lending activities leads to their strong market position in the loan origination software market. Meanwhile, the mortgage lenders & brokers segment is expected to be the fastest-growing segment during the forecast period, as mortgage lenders and brokers deal with a high volume of loan applications, especially when interest rates are low. Loan origination software assists in efficiently managing loan volume, assuring timely processing and increasing client experience.

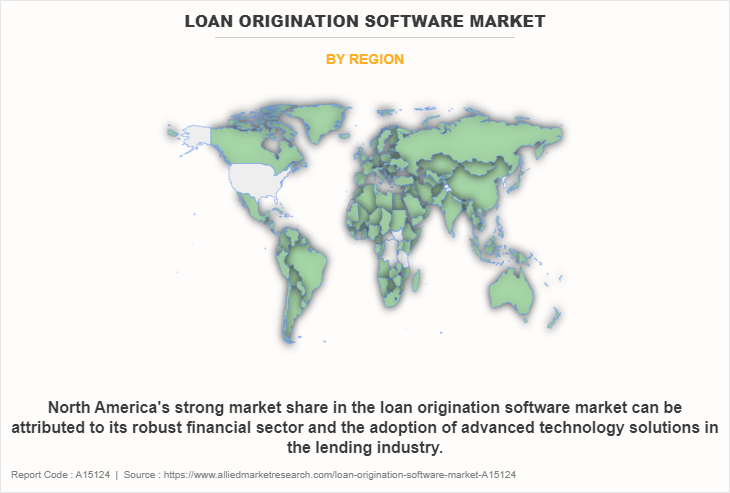

By region, North America attained the highest share in the loan origination software market, as the region is a technology innovation hotspot, with high uptake of financial technologies. North American bankers are early adopters of advance loan origination software tools, automation, data analytics, and artificial intelligence (AI). This has resulted in more efficient procedures, better client experiences, and stronger risk assessment skills. However, the Asia-Pacific region is expected to be the fastest-growing segment in the loan origination software market during the forecast period.

This growth can be attributed to the region's boom in e-commerce and small and medium-sized firms (SMEs), which has raised demand for business loans. With streamlined loan origination processes, online lenders and fintech platforms are meeting loan origination software needs. Furthermore, the Asia-Pacific region is linked to some of the world's fastest-growing economies, as rising income levels, urbanization, and an expanding middle class have resulted in increased consumer expenditure and borrowing. As economies grow, so does the demand for loan origination software for a variety of purposes, including mortgages, personal loans, and commercial loans.

The report analyzes the profiles of key players operating in the loan origination software market such as Bryt Software LCC, Finastra, Floify LLC, ICE Mortgage Technology, Inc., LendingPad Corp, LoanPro, llc nCino, Nelito Systems Pvt. Ltd., Software Advice, Inc., and Turnkey Lender, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the loan origination software market.

Market Landscape and Trends

Loan origination software is important in the lending sector as it automates and streamlines the loan application, approval, and processing processes. Due to the increasing desire for digital transformation in the lending sector, the loan origination software market was witnessing substantial growth. Furthermore, advance analytics and data integration have become essential components of loan origination software. Data is being used by lenders to assess borrower risk, make informed lending decisions, and personalize loan offerings based on individual financial profiles. Moreover, loan origination software companies are implementing an API-first strategy to allow for a smooth connection with other financial software and platforms, allowing lenders to develop customized ecosystems that met their specific needs. Therefore, these are the major loan origination software market landscape and trends.

Top Impacting Factors

Increased Adoption of AI, Machine Learning and Blockchain Technologies

The increased adoption of AI, ML, and blockchain technology has significantly impacted the loan origination software market, revolutionizing the way lenders assess, process, and manage loans. These technological advancements have brought forth enhanced efficiency, accuracy, and security, thus driving the growth of the loan origination software market. AI and ML are transforming the loan origination process by automating various stages, from application verification and credit risk assessment to fraud detection and customer profiling. Through data analysis, AI and ML algorithms can swiftly evaluate borrower creditworthiness, ensuring quicker decision-making and reducing manual intervention. This accelerates the overall loan origination software market, enhancing customer experience and increasing lender competitiveness.

Blockchain technology, known for its decentralized and tamper-resistant nature, addresses data security concerns in loan origination software market. By providing an immutable ledger of transactions, it ensures transparency and minimizes the risk of data manipulation. Smart contracts within blockchain facilitate the automated execution of loan agreements, streamlining the disbursement and repayment phases. This reduces administrative overhead, eliminates intermediaries, and enhances trust between lenders and borrowers.

The synergy between these technologies leads to a seamless and efficient loan origination process. AI and ML optimize risk assessment, enabling lenders to make informed decisions, while blockchain ensures the integrity and security of sensitive borrower information. This expedites the lending cycle as well as reduces the likelihood of errors, fraud, and compliance breaches. In conclusion, the increased adoption of AI, ML, and blockchain technology propels the loan origination software market growth by fostering efficiency, accuracy, and security throughout the lending process. This transformation is reshaping the loan origination software market landscape, empowering financial institutions to make faster, data-driven decisions while maintaining the highest standards of security and trust.

Improved Customer Experience

Improved customer experience has emerged as a pivotal driver of the flourishing loan origination software market. In a rapidly evolving financial landscape, customers are demanding streamlined, convenient, and personalized experiences throughout their borrowing journey. Loan origination software plays a central role in meeting these expectations. Traditionally, obtaining a loan involved cumbersome paperwork, prolonged processing times, and limited transparency. However, modern consumers, accustomed to seamless digital interactions, now seek frictionless processes that can be completed online. Loan origination software empowers lenders to offer user-friendly interfaces, allowing borrowers to submit applications, upload documentation, and monitor progress in real-time. This enhances transparency, reduces frustration, and accelerates decision-making, thereby enhancing customer satisfaction.

Furthermore, personalized offerings have become essential in today's competitive loan origination software market. Loan origination software leverages data analytics and AI to assess applicants' financial profiles swiftly and accurately. This enables lenders to craft tailored loan packages aligned with individual needs and risk profiles, fostering a sense of being understood and valued by the customer. The integration of automation and AI-driven tools within loan origination processes has significantly expedited application processing and risk assessment.

As a result, borrowers experience quicker approvals, faster disbursals, and lower error rates, reinforcing their confidence in the lending institution. In conclusion, the loan origination software market is being propelled by the imperative to elevate customer experience. By delivering convenience, personalization, efficiency, and security, these platforms reshape the borrowing journey into a positive, efficient, and secure endeavor. As customer expectations continue to evolve, the loan origination software market must remain dynamic, embracing innovative technologies to consistently exceed these expectations and drive the loan origination software market forward.

Concern regarding Data Security and Compliance

Data security and compliance concerns have significantly restrained the growth of the loan origination software market size. In today's digital landscape, where financial transactions and sensitive information are primarily processed electronically, ensuring the security and privacy of customer data is of paramount importance. However, the loan origination process involves the collection, storage, and transmission of highly confidential data, such as personal and financial information. Financial institutions and lending organizations are subject to strict regulations, including data protection laws such as GDPR and industry-specific regulations such as HIPAA in healthcare. Failure to comply with these regulations can result in severe penalties, reputation damage, and loss of customer trust. As a result, the demand for loan origination software that meets these stringent compliance requirements has surged.

Developing software that incorporates robust encryption, access controls, and secure data storage mechanisms is imperative. This requires substantial investments in technology, personnel, and ongoing maintenance. in addition, the complexity of compliance standards across various regions and sectors further complicates the development and deployment of loan origination software. Furthermore, the evolving nature of cybersecurity threats poses an ongoing challenge. Hackers continuously devise new tactics to breach systems and access sensitive data. This necessitates constant updates and improvements to software security measures, driving up costs and development timelines. Moreover, customer awareness of data security has risen, and individuals are more cautious about sharing their personal information online. This cautiousness extends to loan applications and financial transactions, leading potential borrowers to choose lenders that prioritize data protection.

Collaboration with Fintechs

Fintech collaborations offer several benefits to the loan origination software industry such as bringing agility and efficiency to the historically cumbersome loan approval process. By integrating advanced algorithms and data analytics, fintechs enable lenders to make more informed decisions, reducing the time it takes to assess borrower eligibility and creditworthiness. In addition, these partnerships often lead to the development of user-centric platforms. Fintech’s, with their focus on customer experience, help design intuitive interfaces that simplify application submissions and document exchanges. This improves customer satisfaction as well as attracts a younger, tech-savvy demographic in the loan origination software market.

Moreover, collaboration with fintechs opens doors to new data sources. These partnerships allow lenders to tap into alternative data sets, such as social media behavior or transaction history, enhancing the accuracy of risk assessment models. This, in turn, expands lending opportunities to individuals or businesses that might have been overlooked using traditional credit evaluation methods. Furthermore, fintech collaborations foster innovation in risk management. The infusion of artificial intelligence and machine learning capabilities aids in detecting fraudulent activities and assessing potential risks more comprehensively. This proactive risk mitigation bolsters lenders' confidence in approving loans, leading to increased lending volumes.

Overall, collaboration with fintechs accelerates the digitization of the loan processing software, aligning it with the demands for the modern financial landscape. As technology continues to reshape the financial sector, these partnerships enable traditional lenders to stay competitive, agile, and relevant in an increasingly digital economy. Thus, the symbiotic relationship between the loan origination system market and fintech collaborations creates fertile ground for innovation, efficiency, and growth

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the loan origination software market forecast from 2022 to 2032 to identify the prevailing loan origination software market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the loan origination software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Loan origination software market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global loan origination software market trends, key players, market segments, application areas, and market growth strategies.

Loan Origination Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.2 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 309 |

| By Deployment Mode |

|

| By End-User |

|

| By Component |

|

| By Region |

|

| Key Market Players | LendingPad Corp., nCino, Nelito Systems Pvt. Ltd., Software Advice, Inc., Floify LLC, LoanPro, LLC, ICE Mortgage Technology, Inc., Bryt Software LCC, TurnKey Lender, Inc., Finastra |

Analyst Review

The loan origination software market is focusing on customer experience and digital transformation is a prominent trend, as borrowers increasingly demand easy-to-use online application processes, real-time loan status notifications, and efficient digital document management. To meet these expectations, loan origination software market players are including solutions such as customer-facing interfaces that give transparency, interactivity, and self-service alternatives. Furthermore, the loan origination landscape is being transformed by cloud computing, as cloud-based solutions provide scalability, flexibility, and cost savings, allowing lenders to optimize their operations without the burden of on-premise infrastructure maintenance. This trend is particularly appealing to lenders who are looking to swiftly react to changing demands.

Furthermore, loan orignination software market players are adopting various strategies for enhancing their services in the loan orignination software market and improving customer satisfaction. For instance, in May 2023, Flueid Encompass integrated with ICE Mortgage Technology to accelerate loan origination with critical title data and insights. Furthermore, this integration makes Flueid's title data and insights available to lenders when analyzing their loan applications, saving time and improving the consumer experience. Moreover, in July 2021, LendingPad integrated with balck knight's optimal blue PPE to streamline loan origination process. LendingPad, a cloud-based mortgage loan origination system (LOS), assists organizations in streamlining and managing loan origination procedures, as well as improving the client experience. LendingPad now effortlessly leverages the Optimal Blue PPE through this multi-point interface, allowing wholesale, correspondent, and retail lenders to develop real-time, compliance pricing scenarios regardless of their business channel. Therefore, these strategies by the loan orignination software market players operating at a global and regional level are expected to help the loan orignination software market to grow significantly during the forecast period.

Some of the key players profiled in the loan orignination software report include Bryt Software LCC, Finastra, Floify LLC, ICE Mortgage Technology, Inc., LendingPad Corp, LoanPro, llc nCino, Nelito Systems Pvt. Ltd., Software Advice, Inc., and Turnkey Lender, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the loan origination software market.

Loan origination software is important in the lending sector as it automates and streamlines the loan application, approval, and processing processes. Due to the increasing desire for digital transformation in the lending sector, the market for loan origination software was witnessing substantial growth.

North America is the largest regional market for Loan Origination Software

The global loan origination software market was valued at $4782.34 million in 2022 and is projected to reach $12233.47 million by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

Bryt Software LCC, Finastra, Floify LLC, ICE Mortgage Technology, Inc., LendingPad Corp, LoanPro, llc nCino, Nelito Systems Pvt. Ltd., Software Advice, Inc., and Turnkey Lender, Inc.

Loading Table Of Content...

Loading Research Methodology...