Loan Servicing Software Market Overview

The global loan servicing software market size was valued at $2.3 billion in 2021, and is projected to reach $9.5 billion by 2031, growing at a CAGR of 15.2% from 2022 to 2031. Growing demand for automation in loan management, regulatory compliance, rising digitalization in financial services, improved customer experience, and the demand for efficient loan tracking and processing contribute to the growth of the market.

Market Dynamics & Insights

- The loan servicing software industry in North America held the largest share of 39% in 2021.

- The loan servicing software industry in India is expected to grow significantly at a CAGR of 21.2% from 2022 to 2031.

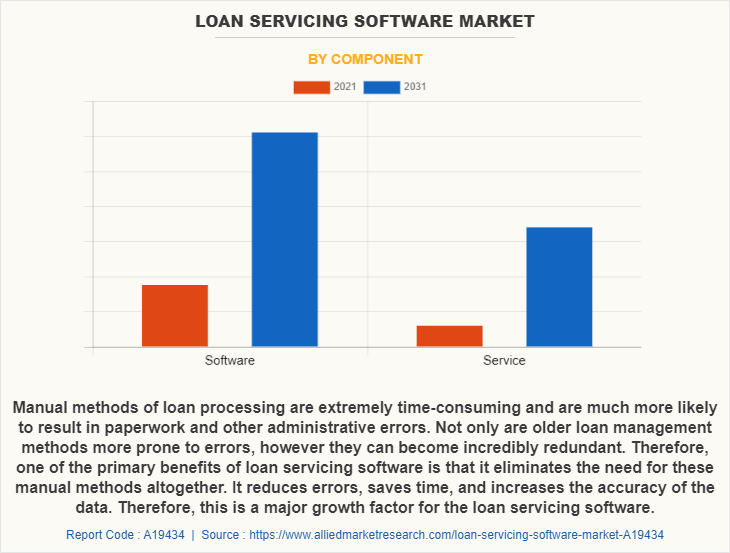

- By component, the software segment is one of the dominating segment in the market, accounting for the revenue share of 75% in 2021.

- By deployment mode, the cloud segment is the fastest growing segment in the market, growing at a CAGR of 19.8% from 2022-2031.

Market Size & Future Outlook

- 2021 Market Size: $2.3 Billion

- 2031 Projected Market Size: $9.5 Billion

- CAGR (2022-2031): 15.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

What is Meant by Loan Servicing Software

Loan servicing refers to the administrative aspects of a loan from the time the proceeds are dispersed to the borrower until the loan is paid off. Loan servicing includes sending monthly payment statements, collecting monthly payments, maintaining records of payments & balances, collecting & paying taxes & insurance and managing escrow funds, remitting funds to the note holder, and following up on any felonies. Loan servicing software automates and manages the loan lifecycle, from origination to reporting. Many lenders opt to service their own loans, as this allows for increased profits and greater control over regulatory compliance.

Loan servicing software helps to increase the revenue for the company by notifying loan servicers about outstanding payments or approaching due dates and facilitates follow ups, online payments, and offline collections. In addition, it helps in ensuring accuracy in calculating repayment, interest, and the principal amount. Moreover, loan servicing software reduces turnaround time. Therefore, these are some of the factors that propel the growth of loan servicing software. However, high cost of installing loan servicing software is a major factor limiting the growth of loan servicing software market. On the contrary, advances in technology and adoption of artificial intelligence and machine in the lending industry are expected to provide lucrative growth opportunities in the coming years.

Loan Servicing Software Market Segment Review

The loan servicing software market is segmented on the basis of component, deployment mode, enterprise size, application, end user, and region. By component, it is segmented into software and services. By deployment mode, it is bifurcated into on-premises and cloud. By enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises (SMEs). On the basis of application, the loan servicing software market is bifurcated into commercial loan software, loan servicing software, and loan origination software. The commercial loan software is further sub segmented into credit analysis software, tracking & exception management systems, customer relationship software (CRM), and others. The credit analysis software is further divided into credit spread risk, concentration risk, and others. By end user, the loan servicing software market is segmented into banks, credit unions, mortgage lenders & brokers, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the software segment attained the highest growth in 2021. This is attributed to the fact that manual methods of loan processing are extremely time-consuming and are much more likely to result in paperwork and other administrative errors. Not only are older loan management methods more prone to errors, but they can also become incredibly redundant. Therefore, one of the primary benefits of loan servicing software is that it eliminates the need for these manual methods altogether. It reduces errors, saves time, and increases the accuracy of the data. Therefore, this is a major factor for the loan servicing software market growth.

By region, North America attained the highest growth in 2021. This is attributed to the fact that most lending companies in the U.S. are adopting digital services to offer loans of the customers. Therefore, the loan servicing software is increasingly used by companies to serve their customers. Moreover, personal loans and home loans are increasing in the U.S. for which customers demand a robust loan settlement procedure. Therefore, companies in the region are adopting loan servicing software industry.

The report focuses on growth prospects, restraints, and trends of the loan servicing software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the loan servicing software market.

The report profiles of key players operating in the loan servicing software market analysis such as Applied Business Software, Inc., Bryt Software LLC, C-Loans, Inc., Emphasys Software, FICS, Fiserv, Inc., GOLDPoint Systems, Inc., Grants Management Sysytem (GMS), Graveco Software Inc., LoanPro, Margill, Nortridge Software, LLC, Q2 Software, Inc., Shaw Systems Associates, LLC, The Constellation Mortgage Solutions, Neofin (SECURITY), and TurnKey Lender. These players have adopted various strategies to increase their market penetration and strengthen their position in the loan servicing software market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a moderate impact on the loan servicing software market. COVID-19 has caused disruptions across all industries globally. Therefore, as surge in unemployment and job loss during the pandemic, people were not comfortable to take home loan, personal loan or any other type of mortgage loan. In addition, due to tighter government regulations and a rise in non-performing assets, banks and other financial institutions were reluctant to make new loans. Thus, this fall demand in loan services industry, led to the fall in demand for loan servicing software market. However, lockdown have forced banks and financial institutions to physically prevent themselves from collecting loans. Therefore, SMEs, along with some large enterprises, have adopted the path of lending loans to sustain business operations. As a result, the platforms for loan servicing software were used more frequently than usual. In addition, these software were easy to access and time saving for both lenders and borrowers. Thus, the demand for the loan servicing software increased during the pandemic. Therefore, the COVID-19 had a moderate impact on the loan servicing software market.

What are the Top Impacting Factors in Loan Servicing Software Market

Loan Servicing Software helps to Increase Revenue for the Company

Loan servicing solutions automate payment tracking and collections, which directly impacts revenue. The tool notifies loan servicers about outstanding payments or approaching due dates and facilitates follow-ups, online payments, and offline collections. The efficiency that is gained helps reduce delinquency which in turn increases revenue. Furthermore, loan servicing software helps to clearly identify critical situations in order to be able to react quickly before delinquent accounts reach a point of no return or payments become impossible to collect. Furthermore, it helps in saving time and money as such software allows to regulate cash flow and avoid unfortunate losses, thereby keeping the cash flow positive and reducing the annual financial costs Therefore, this is one of the major driving factor of the loan servicing software market.

High Cost of Installing Loan Servicing Software

The cost of adopting loan servicing software is higher for which it is difficult for the small lenders to adopt the software. Furthermore, small and medium enterprises are unable to adopt these software because of its high cost. Furthermore, the process of learning to run the software requires training which further cost huge amount of money which cannot be afforded by SMEs. Therefore, these factors limit the growth of loan servicing software market overview.

Technological Advancement in the Field of Loan Servicing Software

With the integration of machine learning and artificial intelligence in the loan automation, it will benefit the growth of the market in the upcoming years. Machine learning (ML) can help lenders make accurate loss mitigation decisions through automation. These decisions may include rejecting or approving loan modifications, forbearance agreements, and repayment plans. Furthermore, intelligent character recognition (ICR) can help extract useful information from loan documents. The technology can identify the final version of loan documents from a loan package, extract relevant data from these documents, and use it to automate the servicing workflow. Therefore, technological advancement in the field of loan servicing will provide major lucrative loan servicing software market opportunity.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the loan servicing software market forecast from 2022 to 2031 to identify the prevailing loan servicing software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the loan servicing software market share assists to determine the prevailing market opportunities.

- The report includes the analysis of the regional as well as global loan servicing software market trends, key players, market segments, application areas, and market growth strategies.

Loan Servicing Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | GOLDPoint Systems, Inc., Shaw Systems Associates, LLC, C-Loans, Inc., Margill, Emphasys Software, Fiserv, Inc., Neofin, Q2 Software, Inc., Grants Management System (GMS), LoanPro, Bryt Software LLC, Graveco Software Inc., TurnKey Lender, FICS, The Constellation Mortgage Solutions, Applied Business Software, Nortridge Software, LLC |

Analyst Review

Loan servicing can be carried out by the bank or financial institution that issued the loans, a non-bank entity specializing in loan servicing, or a third-party vendor for the lending institution. Loan servicing refers to the borrower's obligation to make timely payments of principal and interest on a loan as a way to maintain creditworthiness with lenders and credit-rating agencies. In addition, monitoring loans and ensuring their collection is one aspect of loan servicing software. Creating & generating the accounting reports and often invoices & statements for borrowers & investors is another critical aspect. Therefore, quality loan servicing software ensures the accuracy of data, and makes it easy to extract the right information in real-time and when required for any reporting period. Moreover, several servicing software packages allow the generation of more advanced statistical reports based on socio-economic factors. For instance, it could determine the average amount of loans granted by region, by industry, city and gender of the borrower. The same applies to the interest income which can be sorted by various criteria.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in July 2022, Mahindra group’s non-banking financial arm Mahindra Finance, announced a partnership with Credgenics. The partnership aims to digitally empower the retail loan collections. Credgenics platform, which provides SaaS (Software as a Service) based collections and debt resolution technology, will help the company in streamlining and digitizing borrower communications including litigation modules across the loan portfolio. By consolidating capabilities distributed across multiple vendors, the Credgenics platform is reduce the processing time and provide comprehensive tracking and monitoring capabilities at pin code & village level to the loan teams. Some of the key players profiled in the report include Applied Business Software, Inc., Bryt Software LLC, C-Loans, Inc., Emphasys Software, FICS, Fiserv, Inc., GOLDPoint Systems, Inc., Grants Management Sysytem (GMS), Graveco Software Inc., LoanPro, Margill, Nortridge Software, LLC, Q2 Software, Inc., Shaw Systems Associates, LLC, The Constellation Mortgage Solutions, Neofin (SECURITY), and TurnKey Lender. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loan servicing software helps to increase the revenue for the company by notifying loan servicers about outstanding payments or approaching due dates and facilitates follow up, online payments, & offline collections.

The commercial loan software segment was the highest revenue contributor to the market.

By region, North America attained the highest growth in 2021. This is attributed to the fact that most lending companies in the U.S. are adopting digital services to offer loans of the customers. Therefore, the loan servicing software is increasingly used by companies to serve their customers. Moreover, personal loans and home loans are increasing in the U.S. for which customers demand a robust loan settlement procedure. Therefore, companies in the region are adopting loan servicing software industry.

The global loan servicing software market size was valued at $2,340.22 million in 2021, and is projected to reach $9,488.85 million by 2031, growing at a CAGR of 15.2% from 2022 to 2031.

Applied Business Software, Inc., Emphasys Software, FICS, Fiserv, Inc., and GOLDPoint Systems, Inc., hold the market share in loan servicing software market.

Loading Table Of Content...