Location-Based Services Market Overview

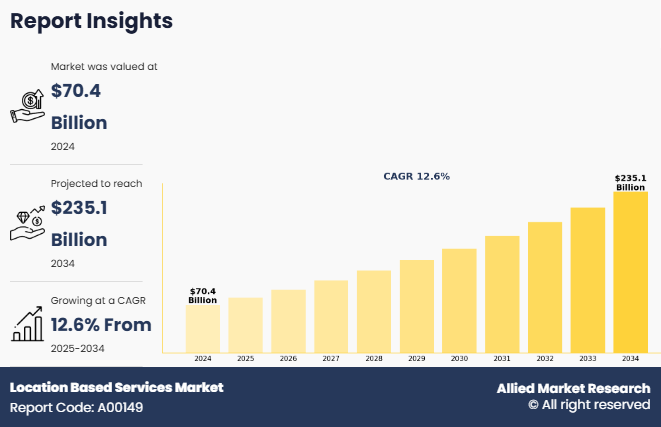

The global location-based services market was size was valued at USD 70,357.3 million in 2024, and is projected to reach USD 235,062.8 million by 2034, growing at a CAGR of 12.6% from 2025 to 2034. The location-based services market is mainly driven by rise in the adoption of mobile commerce & social media and the increase in the advancements in GPS, GIS, and IoT technologies. In addition, the surge in the proliferation of smartphones and wearable devices is expected to fuel the growth during the location-based services market forecast period.

Furthermore, the upsurge in the integration of LBS with Augmented Reality (AR) and AI for personalized and context-aware experiences is anticipated to open new avenues for innovation and drive further expansion of the LBS market size. Moreover, the increase in the demand for real-time location analytics across industries such as retail, transportation, and healthcare, enabling businesses to enhance operational efficiency, improve customer engagement, and deliver more targeted services, is expected to provide lucrative opportunities for growth in the location based services industry, further boosting the location based services market size.

Key Market Insights

- By Component, the software segment held the largest share in the location-based services market for 2024.

- By Technology, the GPS segment held the largest share in the LBS market for 2024.

- By Application, the location-based advertising segment held the largest share in the location-based services market for 2024.

- By Industry Vertical, the retail segment held the largest share in the LBS market for 2024.

- Region-wise, LAMEA is expected to witness the highest CAGR during the forecast period.

Market Size & Forecast

- 2034 Projected Market Size: USD 235,062.8 Million

- 2024 Market Size: USD 70,357.3 Million

- Compound Annual Growth Rate (CAGR) (2025-2034): 12.6%

How to Describe Location-Based Services (LBS)

Location-Based Services (LBS) are digital services that use geographic data to provide information or functionality based on a user's physical location. These services utilize technologies like GPS, Wi-Fi, or cellular networks to determine location and deliver relevant content, such as navigation assistance, local weather updates, nearby business listings, or real-time traffic conditions. Commonly used in smartphones and mobile applications, location-based services applications enhances user experience by offering personalized, context-aware services. They are widely used in areas such as transportation, marketing, emergency response, and social networking. The effectiveness of LBS depends on accurate location data and user consent for location tracking.

LBS Market Segment Review

The location-based services market is segmented into component, technology, application, industry vertical, and region. On the basis of component, the market is classified into software and services. By technology, the market is segregated into GPS, Cell ID, Wi-Fi, and others. As per application, the market is fragmented into mapping and navigation, business intelligence and analytics, fleet management, location-based advertising, social networking and entertainment, asset tracking, and others. Depending on industry vertical, the market is segmented into transportation and logistics, manufacturing, government and public utilities, retail, healthcare and life sciences, media and entertainment, IT and telecom, BFSI, hospitality, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of technology, the global location-based services market share was dominated by the GPS segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the integration of location-based services with emerging technologies such as IoT, AI, and 5G technologies, enhancing real-time data processing and user experience. In addition, there is a growing trend in the development of infrastructures such as malls and airports, which has led to the growing demand for indoor navigation solutions. However, the Wi-Fi segment is expected to experience the highest growth during the forecast period. This segment is experiencing increasing penetration of smartphones, along with ubiquity of Wi-Fi networks in urban areas, and increase in use of location based advertising, leading to increased adoption of this technology.

Region wise, Asia-Pacific dominated the market share in 2024 for the location-based services market. This is due to the increase in the adoption of smartphones in countries such as China and India, driven by the rise in demand for LBS applications, including navigation, social networking, and location-based advertising, contributing significantly to the region’s market growth. However, LAMEA is expected to experience the fastest growth during the forecast period, driven by factors such as the growth of e-commerce fueling the demand for LBS, enabling businesses to offer location-based promotions, optimize delivery logistics, and enhance customer experience.

What are the Top Impacting Factors in Location-based Services Market

Driver

Rising adoption of mobile commerce & social media

The widespread use of smartphones and mobile apps has led to rise in the demand for location based services (LBS) due to their GPS capabilities and constant connectivity. Mobile commerce apps utilize location data to provide personalized promotions, store locators, and delivery tracking. In addition, social media platforms such as Instagram and Facebook incorporate location tagging and geo-targeted ads to enhance user engagement and marketing effectiveness, contributing to the location-based services market growth. Furthermore, the surge in social media usage with location tagging has resulted in an abundance of location-tagged content, which platforms leverage to improve ad targeting. Features such as check-ins, stories, and location-based filters generate valuable geospatial data that help advertisers deliver more relevant and localized campaigns. These factors are expected to fuel the growth of the LBS market.

Moreover, the upsurge in advancements in technology, such as AI, 5G, and IoT, are revolutionizing location-based services industry by enabling real-time, intelligent, and highly connected LBS applications. High speed mobile networks like 5G support real-time location tracking with minimal latency. AI and machine learning process location data to predict behavior and enable smarter marketing. For instance, in July 2023, Chronos Technology, a provider of advanced timing, synchronization, and smart technology solutions, had announced a collaboration with WiTTRA, a Swedish-based company specializing in IoT solutions. This partnership aims to enhance positioning technologies by combining Chronos Technology's expertise in telecom frequency distribution and GNSS GPS fiber solutions with WiTTRA's mesh and LPWAN solutions. The collaboration is expected to empower businesses with precise, secure, and versatile location-based solutions, optimizing processes, reducing costs, and improving efficiency, which in turn, propels the growth of the LBS market.

Restraints

High cost of infrastructure deployment

The major challenge for the growth of the location-based services market is the high initial cost of infrastructure deployment. Location based services (LBS) depend on a complex network of technologies, including GPS, Wi-Fi positioning systems, beacons, geofencing tools, and cellular triangulation. Establishing and maintaining this infrastructure, especially over large geographic areas or in densely populated urban settings, requires substantial capital investment. In addition, for organizations aiming to provide precise, real-time location data, investments are necessary not only in hardware but also in software development, data storage, analytics platforms, and integration with existing systems. Furthermore, upgrading legacy systems to meet the evolving demands of LBS can be extremely costly, particularly for small and medium-sized enterprises (SMEs).

In addition, the financial burden is further intensified by the need for continuous updates and maintenance, as well as compliance with regional regulations and privacy standards, which may require additional technology or workforce. In developing countries, the lack of foundational digital infrastructure exacerbates the issue, making initial deployment and scaling even more challenging, delaying the expansion of the LBS market size. Moreover, the high cost barrier limits widespread adoption, particularly in emerging markets, and slows innovation by deterring new entrants. While large corporations may have the resources to overcome these challenges, the high upfront investment remains a key deterrent for many stakeholders, thereby restraining the overall expansion and potential of the LBS market.

Opportunity

Integration with Augmented Reality (AR) and AI

The increase in the integration of location based services applications with augmented reality and artificial intelligence presents a significant location based services market opportunity to enhance user engagement, deliver highly personalized experiences, and unlock new revenue across industries such as retail, tourism, transportation, and urban planning. Rise in the demand for immersive and data-driven experiences, integrating AR and AI with LBS, enhances user engagement, offers personalized experiences, and transforms industries such as retail, tourism, and logistics.

In addition, the increase in the adoption of intelligent navigation and routing, integration (Artificial Intelligence) and AR (Augmented Reality) enhances travel experiences. AI optimizes routes by analyzing real-time data such as traffic conditions, weather, and user habits. While AR provides intuitive guidance by overlaying turn-by-turn arrows directly on the ground or buildings. For example, in smart cities, the integration of AI and AR helps to guide drivers or pedestrians along the most efficient and context-aware paths, significantly improving convenience and safety.

Moreover, the increase in operational efficiency in logistics and field services is achieved through the integration of AI and AR technologies. AI predicts optimal delivery routes, schedules, and fleet usage, ensuring efficient logistics operations. Meanwhile, AR assists technicians by overlaying instructions or component data at service locations. For instance, in May 2024, ARway.ai launched its ARway SDK 3.1 marking a significant advancement in large-scale, location-based augmented reality (AR) navigation. This update introduces major improvements in the range and accuracy of AR experiences across expansive venues, enhancing user experience in diverse environments such as shopping malls, airports, universities, hospitals, and corporate campuses. Key features include increased range of AR tracking & navigation, mini map navigation, and network failure back-up flow. The introduction of ARway SDK 3.1 is expected to significantly enhance operational efficiency and user experience in complex, large-scale environments. This update has substantial implications for sectors that heavily rely on location-based services, such as logistics, retail, and facility management.

In summary, the evolution of the location-based services industry through AI and AR integration is delivering powerful tools for personalization, efficiency, and intelligent navigation, setting new standards for the LBS industry and offering valuable location based services market insights for organizations aiming to stay ahead in a rapidly transforming digital landscape.

Which are the Leading Companies Location-based Services

The following are the leading companies in the market. These players have adopted various strategies to increase the location-based services market size and strengthen their position in the LBS industry.

AT&T Inc.

Microsoft Corporation

Google LLC

IBM Corporation

Apple, Inc.

Qualcomm Technologies, Inc.

Oracle Corporation

ALE International

HERE

ROHDE & SCHWARZ GmbH & Co. KG

Cisco Systems, Inc.

Telefonaktiebolaget LM Ericsson

Bharti Airtel Limited

Esri

Intellias

Foursquare.

Recent Developments in the Location Based Services Market

In January 2025, Apple partnered with Tech Mahindra to enhance its Apple Maps service in India by improving the "Look Around" feature, which provides 360-degree panoramic street views. This collaboration involves large-scale ground surveys using both vehicular and portable systems to collect high-quality map data across various states. The initiative aims to ensure precise and up-to-date mapping information while complying with Indian geospatial regulations, strengthening the LBS Industry in the region.

In October 2024, Sensitech partnered with Qualcomm Technologies, Inc. to advance real-time monitoring solutions for the cold chain industry. This partnership leverages Qualcomm's Aware Platform to enhance Sensitech's product suite with advanced global location precision and reliability. The collaboration aims to improve real-time visibility, connectivity, and energy efficiency in supply chains, ensuring that perishable goods like food and medications reach their destinations safely. This initiative is part of a broader effort to make supply chains more connected, automated, and sustainable.

In September 2024, IBM launched its IBM TRIRIGA Application Suite v11.6 introduces key enhancements to improve real estate and facility management. The new AI-powered Maximo Monitor offers real-time insights into occupancy, energy, and asset data for better decision-making. Additionally, TRIRIGA Location Service for Esri integrates with ArcGIS on Kubernetes, enabling advanced indoor mapping, wayfinding, and outdoor GIS visualization to enhance space utilization and portfolio analysis.

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the location-based services market size analysis from 2024 to 2034 to identify the prevailing location-based services market opportunities.

The location based services market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth location-based services market analysis of the segmentation assists to determine the prevailing location-based services market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global location-based services market trends, key players, market segments, application areas, and market growth strategies.

Location Based Services Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 235.1 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | HERE, Apple, Inc., Qualcomm Technologies, Inc. , IBM Corporation, Cisco Systems, Inc., ALE International, Google LLC, Esri, ROHDE & SCHWARZ GmbH & Co. KG, Intellias, Telefonaktiebolaget LM Ericsson, Bharti Airtel Limited, Microsoft Corporation, Foursquare, AT&T Inc., Oracle Corporation |

Analyst Review

The location based services (LBS) market is experiencing robust growth, fueled by increasing demand for real-time location data and the expanding use of smartphones and GPS-enabled devices. As businesses seek to deliver personalized and context-aware experiences, LBS has emerged as a critical enabler across sectors such as retail, transportation, healthcare, and tourism. The technology provides valuable insights for targeted marketing, efficient logistics, and enhanced customer engagement. Additionally, the rise of smart cities, IoT integration, and mobile commerce has further accelerated adoption. These factors collectively are expected to drive sustained growth in the LBS market.

Furthermore, technological advancements in geolocation accuracy, mobile connectivity, and real-time data processing are further propelling the growth of the location-based services market. Modern LBS platforms now offer enhanced features such as indoor navigation, geofencing, location-aware advertising, and seamless integration with mobile apps, which are enabling businesses to deliver highly personalized and context-sensitive experiences. These innovations are particularly appealing to digital-native consumers such as millennials and Gen Z, who expect on-demand services that are intuitive, fast, and hyper-relevant. The rise of tech startups and increasing collaborations between telecom providers, app developers, and data analytics firms presents numerous opportunities for retailers, transportation providers, and service industries to capitalize on the expanding market for location based services.

Moreover, government policies and regulations aimed at enhancing digital infrastructure, promoting smart city initiatives, and improving public safety are also driving the growth of the location based services market. In many regions, governments are encouraging the use of LBS for traffic management, emergency response, and public transportation optimization, thereby boosting the adoption across both public and private sectors. However, challenges persist, particularly related to privacy, data security, and regulatory compliance, as safeguarding individuals' location data remains a critical concern. Despite these challenges, the location based services market is expected to witness considerable growth, driven by increasing demand for real-time location intelligence and the growing integration of geospatial technologies into everyday applications.

The location based services market is projected to reach $235,062.8 million by 2034.

The location based services market is estimated to grow at a CAGR of 12.6% from 2025 to 2034.

The location based services market is expected to witness notable growth due to rise in adoption of mobile commerce and social media and increase in the advancements in GPS, GIS, and IoT technologies.

The key players profiled in the report include AT&T Inc., Microsoft Corporation, Google LLC, IBM Corporation, Apple, Inc., Qualcomm Technologies, Inc., Oracle Corporation, ALE International, HERE, ROHDE & SCHWARZ GmbH & Co. KG, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Bharti Airtel Limited, Esri, Intellias, and Foursquare.

The key growth strategies of location based services market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...