Logistics Automation Market Overview

The global logistics automation market was valued at USD 49.7 billion in 2020, and is projected to reach USD 147.4 billion by 2030, growing at a CAGR of 11.9% from 2021 to 2030. Growth is driven by rising e-commerce adoption, demand for faster logistics, and deployment of robotics, AI, and Industry 4.0 technologies for efficiency. Emerging trends like autonomous vehicles, drones, and smart warehouses further accelerate market expansion.

Key Market Trends & Insights

- Software segment is set to record significant growth in the near future.

- Transportation management segment is expected to grow significantly.

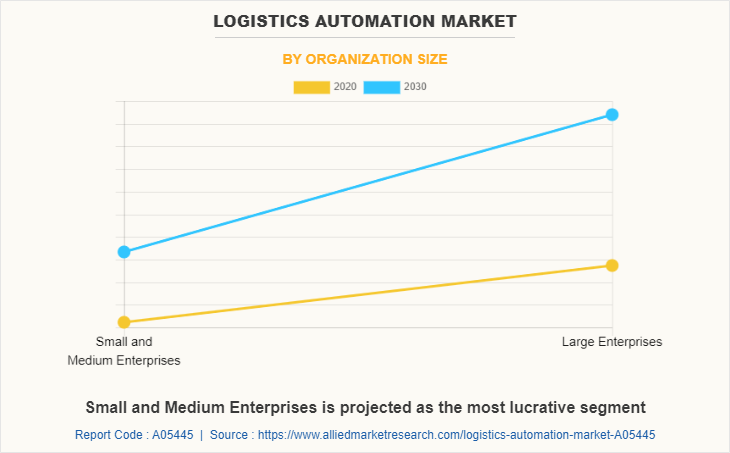

- SMEs are anticipated to witness notable growth during the forecast period.

- Retail & e-commerce segment is projected to show strong market growth.

- Asia-Pacific is expected to register the highest CAGR in the coming years.

Market Size & Forecast

- 2030 Projected Market Size: USD 147.4 billion

- 2020 Market Size: USD 49.7 billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 11.9%

Introduction

Logistics automation involves integration of machinery, control systems, and software to improve the efficiency of logistic processes. Logistics automation offers improved efficiency, control, and organization for procurement, production, inventory management, distribution, customer service, and recovery. Logistics automation systems comprise a variety of automated storage and transportation systems such as automatic guided vehicles, robotic arms, autonomous mobile robots, automated storage & retrieval systems (AS/RS), warehouse management software, and transportation management software. Logistics automation provides several benefits such as real-time access to loading & data analysis, organizational control, improved customer service, and scalability & speed.

There has been a rapid growth in adoption of e-commerce over the past few years. Supply chains and logistics management is increasingly evolving to adapt and cater to the growing switch to online delivery platforms, click-and-collect models, and curbside collections. Logistics providers are investing in warehouse robotics, sorting systems, and warehouse management software. Robotics platforms such as collaborative robots are also being used in automating tasks. Large-scale conveyor systems, automated storage, and retrieval systems are used in automated warehouses for greater productivity. Integration of technologies such as artificial intelligence, machine learning, and data analytics, is gaining increased traction for simplified and informed operational decisions.

Improved efficiency & workforce safety, growth in e-commerce, adoption of industry 4.0 technologies, and advancements in robotics technologies drive the growth of the market. However, high initial investment is expected to hamper the growth of the market. Moreover, adoption of autonomous vehicles and drones, and greater demand for warehouse automation from emerging economies are expected to offer opportunities for the growth of the market.

By Component

Software is projected as the most lucrative segment

Market Segmentation

The logistics automation market is segmented into Organization Size, End-Use Industry, Component and Application. By organization size, it is fragmented into small and medium enterprises and large enterprises. On the basis of end-use industry, it is classified into manufacturing, healthcare & pharmaceuticals, fast-moving consumer goods, retail and e-commerce, automotive, and others. Based on component, the market is categorized into hardware, software, and services. The application segment has been divided into warehouse & storage management, and transportation management. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top Logistics Automation companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the logistics automation industry.

- Beumer Group GmbH & Co. KG

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- Kion Group AG

- Knapp AG

- Mecalux, S.A.

- Murata Machinery, Ltd.

- SSI Schaefer Group

- TGW Logistics Group GmbH

What are the Top Impacting Factors

Key Market Driver

Improved efficiency and workforce safety

Automation has become popular among companies due to its cost-cutting, and increased efficiency benefits. Automation technology can aid in improving workplace safety as automated systems can reduce the risk of accidents, prevent work injuries, resulting in safer workplace for workers. Robotic lifting devices in workplace reduce the risk of lifting and bending injuries. Automation also reduces strain injuries by taking over repetitive tasks.

In addition, automated systems such as autonomous mobile robot (AMR) contribute in improving efficiency as AMRs handle & move dangerous materials across factory floors avoiding potentially costly injuries to human workers and boosting their productivity.

Moreover, automated systems monitor performance on an ongoing basis. This enables automated systems to respond to emergency situations much faster than human reactions. Automated systems prevent accidents, and equipment damage by shutting down equipment or alerting employees before a potentially dangerous situation escalates.

Growth in E-commerce

E-commerce refers to the buying and selling of goods by utilizing internet. Growth in e-commerce industry across the globe has resulted in need for efficient warehousing and inventory management. Increase in e-commerce activities, and customer demand has forced companies to adopt automation solutions in order to fulfill rising consumer demand.

For instance, in August 2021, FedEx subsidiary FedEx Ground implemented a new AI-enabled robotics system to handle thousands of small packages daily as it seeks new innovations to meet demand in e-commerce delivery. The robotic product operates at FedEx Ground’s station in Queens, New York. In addition, it can autonomously pick, identify, sort, collect, and containerize small packages at scale.

Moreover, customer demand for same day delivery is also creating the need for automation systems, which in turn is expected to drive the growth of the logistics automation industry during the forecast period.

Adoption of industry 4.0 technologies

Industry 4.0 refers to fourth industrial revolution. It describes growing trend toward automation and data exchange technology & processes within the manufacturing industry. Industry 4.0 technologies comprises Big data & artificial intelligence, data analytics, cloud computing, augmented reality, industrial internet of things, additive manufacturing, autonomous robots, and digital twins.

Manufacturers and logistics companies are adopting these technologies for improved productivity & efficiency, better flexibility & agility, and improved customer experience. Amazon, Fetch, DHL, Ceva Logistics, and Geek+ are some companies already employing robotic solutions such as autonomous mobile robots, to automate operations of warehouses or distribution centers.

By Region

Asia-Pacific would exhibit the highest CAGR of 13.4% during 2021-2030

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the logistics automation market analysis from 2020 to 2030 to identify the prevailing logistics automation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the logistics automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global logistics automation market trends, key players, market segments, application areas, and market growth strategies.

Logistics Automation Market Report Highlights

| Aspects | Details |

| By Organization Size |

|

| By End-Use Industry |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Beumer Group GmbH & Co. KG, Honeywell International Inc., Murata Machinery, Ltd., SSI Schaefer Group, Jungheinrich AG, TGW Logistics Group GmbH, Daifuku Co., Ltd., Knapp AG, Mecalux, S.A., Kion Group AG |

Analyst Review

Growth of the logistics automation market is propelled by factors such as growth in e-commerce, and adoption of industry 4.0 technologies. There has been increasing focus on development of advanced automation technologies to improve efficiency of logistics operations. Several companies are focusing on integration of robotics solutions and automated guided vehicles to increase efficiency of warehouses. For instance, in March 2022, Siemens established a partnership with Parmley Graham and AR Controls to produce smart automated guided vehicle (AGVs). The partnership will focus on producing customized automated guided vehicles across industries.

Several developments have been carried out by key players operating in the logistics automation industry. In May 2021, Jungheinrich AG introduced EKS 215a, a new automated guided vehicle at its virtual trade press conference INNOVATIONS & HIGHLIGHTS 2021. EKS 215a can independently store loads weighing 700kgs at height of six meters. Moreover, in September 2021, KION Group AG and Fraunhofer Institute for Material Flow & Logistics collaborated for development of LoadRunner, which is an Artificial Intelligence-assisted vehicle that can operate as a swarm. LoadRunner is designed to lift the high speed Automated guided vehicles to a new level of swarm robotics.

Rise in demand for logistics automation from emerging economies such as Asia-Pacific coupled with growth in e-commerce and adoption of automation solutions as a result of labor shortages in the region are expected to supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different regions.

The upcoming trends in the logistics automation market include adoption of digital twin technology, Artificial Intelligence of Things (AIoT), augmented intelligence, eco-logistics, advanced integration of supply chain, and last mile delivery automation.

The leading application of logistics automation is warehouse and storage management.

North America is the largest regional market for logistics automation.

The global logistics automation industry was valued $49,700.0 million in 2020 and is projected to reach $147,386.4 million in 2030, registering a CAGR of 11.9%.

Some top companies in the logistics automation market include Beumer Group GmbH & Co. KG, Daifuku Co., Ltd., Honeywell International Inc., Jungheinrich AG, Kion Group AG, Knapp AG, Mecalux, S.A., Murata Machinery, Ltd., SSI Schaefer Group, and TGW Logistics Group GmbH.

Loading Table Of Content...