Logistics Market Overview

The global logistics market size was valued at USD 10.2 trillion in 2023, and is projected to reach USD 20.1 trillion by 2033, growing at a CAGR of 7.3% from 2024 to 2033. Factors, such as the growing e-commerce industry coupled with rise in reverse logistics operations and rise in trade related agreements, fuel the logistics market trends. In addition, rise of tech-driven logistics services and growing adoption of IoT-enabled connected devices are also expected to drive the logistics market share. However, lack of control of manufacturers on logistics service, poor infrastructure, and higher logistics costs hinder the market growth. Furthermore, the emergence of last mile deliveries, logistics automation, and cost cutting & lead time reduction due to adoption of multi-modal system are some of the factors that are anticipated to foster the logistics market growth.

Key Market Trends & Insights

- Rising dominance of roadways as the primary mode of logistics transport.

- Growing reliance on manufacturing sector to drive logistics demand.

- Increased adoption of 4PL model for end-to-end supply chain solutions.

- Asia-Pacific emerging as the logistics hub with the largest market share.

Market Size & Forecast

- 2033 Projected Market Size: USD 20.1 trillion

- 2023 Market Size: USD 10.2 trillion

- Compound Annual Growth Rate (CAGR) (2024-2033): 7.3%

Introduction

Logistics refers to the planning, implementation, and management of the movement and storage of goods, services, or information within a supply chain. It ensures that resources are efficiently transported from their point of origin to the intended destination while meeting customer requirements. Logistics encompasses activities such as transportation, warehousing, inventory management, packaging, and order fulfillment. It plays a critical role in industries such as manufacturing, retail, and e-commerce by optimizing operations, reducing costs, and ensuring timely delivery. Modern logistics relies heavily on technology, including IoT, automation, and data analytics, to enhance visibility and streamline processes. Effective logistics is essential for economic growth, supporting global trade, and meeting the demands of businesses and consumers in a competitive environment.

Market Dynamics

Logistics industry is widely known as the process of coordinating and moving resources, such as equipment, food, liquids, inventory, materials, and people, from one location to the storage of the desired destination. It is the management of the flow of goods from one point of origin to the point of consumption, to meet the requirements of customers. Logistics management focuses on the efficiency and effective management of daily activities concerning the production of the company’s finished goods and services. This type of management forms a part of the supply chain management; and plans, implements, & controls the efficient, effective forward, reverse flow, and storage of goods. Logistics market mainly comprises various markets such as Third-Party Logistics (3PL) market, Fourth-Party Logistics (4PL) market, inbound logistics market, outbound logistics market, reverse logistics market, green logistics market, construction logistics market, digital logistics market, military logistics market, and others logistics services market.

For instance, in June 2023, GEODIS, a global leader in transport and logistics, expanded its presence in Mexico by opening a 145,000-square-foot multi-user warehouse and distribution center in Mexico City in July 2023. Through this expansion, GEODI supports omnichannel operations, including e-commerce, retail, and wholesale, for two customers. This addition brings GEODIS' total footprint in Mexico to seven facilities and over 1.6 million square feet, further strengthening its regional operations.

For instance, in May 2023, FedEx Express, a subsidiary of FedEx Corp. and a global leader in express transportation, launched a comprehensive logistics solution for shipping dangerous goods in Cebu. Local businesses can now ship over 2,200 types of regulated items, including paints, perfumes, bleaches, and lithium battery-powered devices, to international markets with ease. Dangerous goods, which pose potential health, safety, or environmental risks, are meticulously packed, labeled, documented, and handled by FedEx-trained personnel to ensure safe and compliant delivery to their destinations.

Moreover, in September 2024, FedEx Corp. partnered with Nimble Robotics to enhance FedEx Fulfillment using Nimble’s fully autonomous 3PL model. As part of this strategic alliance, FedEx is also making an undisclosed investment in Nimble, aiming to improve automation and efficiency in its fulfillment operations.

Market Segmentation

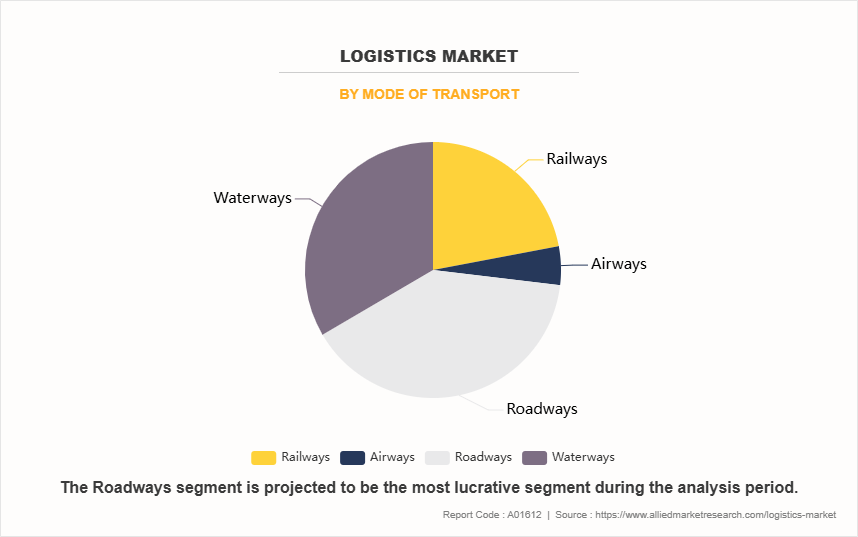

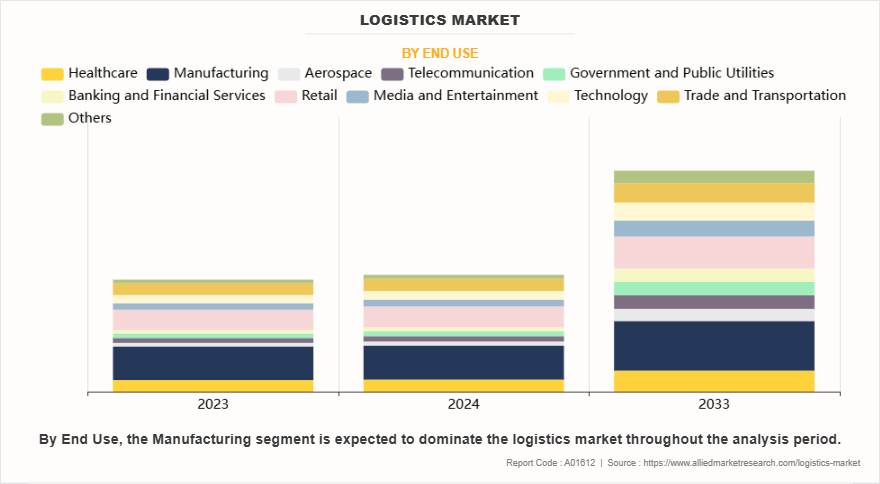

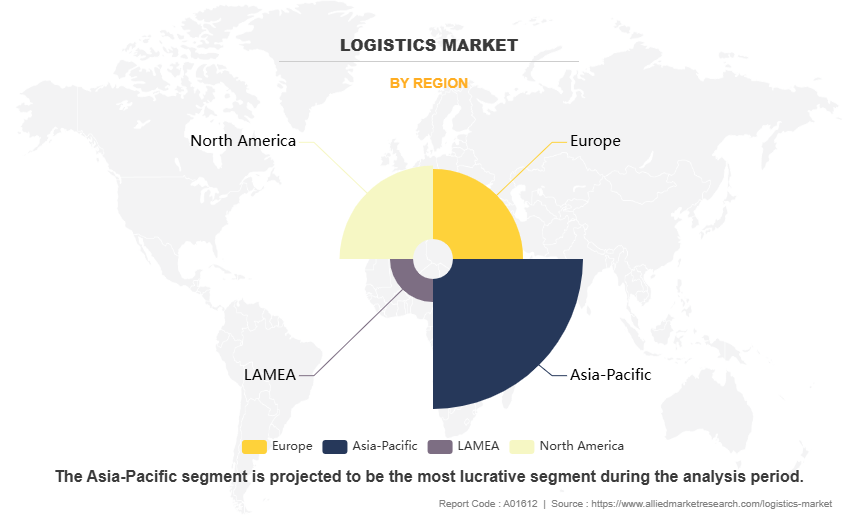

The global Logistics market is segmented on the basis of mode of transport, end use, and region. On the basis of mode of transport, the market is divided into railways, airways, roadways, and waterways. On the basis of end use, it is categorized into healthcare, manufacturing, aerospace, telecommunication, government & public utilities, banking & financial services, retail, media & entertainment, technology, trade & transportation, and others. On the basis of the model, it is classified into 1 PL, 2PL, 3 PL, and 4 PL. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Mode of Transport

On the basis of mode of transport, the roadways segment is domaniting in the logistics market share in 2023 . This is due to its flexibility, cost-effectiveness, and extensive connectivity. Road transport enables seamless door-to-door delivery, making it ideal for e-commerce, retail, and perishable goods. It supports first-mile and last-mile logistics, ensuring efficient supply chain operations. Advancements in infrastructure, fleet management technology, and government investments in highway networks have boosted road transport efficiency. Growing urbanization and demand for faster deliveries further drive the dominance of road logistics.

By End Use

On the basis of end use, the manufacturing segment acquired the highest market share in 2023 in the logistics market size. This is due to its crucial role in global supply chains. Manufacturing industries require efficient transportation, warehousing, and inventory management to ensure seamless production and distribution. Rising industrialization, automation, and just-in-time inventory practices have increased logistics demand. In additon, growth in sectors like automotive, electronics, and consumer goods has driven the need for robust logistics solutions. Advancements in technology and supply chain optimization further strengthen the dominance of manufacturing in logistics.

By Region

Region wise, Asia-Pacific attained the highest market share in 2023 and emerged as the leading region in the logistics market. This is due to rapid industrialization, strong manufacturing hubs, and expanding e-commerce. Countries like China, India, and Japan drive demand with large-scale production and global exports. Government investments in infrastructure, smart logistics solutions, and trade agreements enhance supply chain efficiency. The region’s growing middle-class population fuels retail and online shopping, increasing logistics needs. Additionally, technological advancements and expanding cross-border trade further strengthen Asia-Pacific’s dominance in the global logistics market.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to strong e-commerce expansion, advanced supply chain technologies, and increasing trade activities. The U.S., Canada, and Mexico benefit from well-developed infrastructure, automation in warehousing, and efficient transportation networks. The rise of nearshoring, particularly in Mexico, has boosted cross-border logistics. Additionally, innovations in last-mile delivery, cold chain logistics, and sustainability initiatives drive market growth. Government investments and evolving consumer demand further accelerate logistics expansion in North America.

The report focuses on growth prospects, restraints, and trends of the logistics market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Logistics market.

Which are the Top Logistics companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Logistics industry.

- GEODIS

- FedEx

- Nippon Express Co., Ltd.

- DB Schenker

- A.P. Moller - Maersk

- Kuehne+Nagel

- DSV

- C.H. Robinson Worldwide Inc.

- United Parcel Service of America, Inc.

- Deutsche Post AG

What are the Top Impacting Factors

Key Market Driver

Rise in Number of Sophisticated Cyberattacks

The rise in sophisticated cyberattacks is driving the demand for advanced logistics solutions as companies prioritize supply chain security and resilience. For instance, in September transportation and logistics companies in North America were targeted by a phishing campaign delivering information stealers and remote access trojans, compromising sensitive data and system integrity. Moreover, cyber threats targeting transportation networks, warehousing systems, and digital freight platforms pose significant risks, leading businesses to invest in robust cybersecurity measures. With the increasing reliance on digital technologies, cloud-based logistics management, and IoT-enabled tracking systems, companies are enhancing cybersecurity frameworks to protect sensitive data and operational integrity. The growing threat of ransomware attacks, data breaches, and hacking incidents has accelerated the adoption of secure logistics platforms with encryption, real-time monitoring, and AI-driven threat detection.

In addition, governments and regulatory bodies are implementing stricter cybersecurity policies, pushing logistics providers to strengthen their digital defenses. As cyber risks continue to evolve, the demand for secure, technology-driven logistics solutions is increasing, ensuring seamless and protected supply chain operations across industries, thereby driving market growth. Therefore, rise in number of sophisticated cyberattacks is increase the demand of logistics market demand

Rise in Need to Secure Critical Infrastructure

The growing need to secure critical infrastructure is driving demand in the logistics market as governments and industries prioritize supply chain resilience. Transportation networks, ports, warehouses, and digital logistics platforms are vital to global trade but face increasing risks from cyber threats, geopolitical tensions, and physical disruptions. Ensuring the security of these infrastructures requires advanced monitoring, secure transportation systems, and real-time tracking technologies. Investments in risk management, automated security protocols, and AI-driven logistics solutions are rising to protect against potential threats. In addition, regulatory bodies are enforcing stricter compliance measures to safeguard logistics operations from cyberattacks and supply chain vulnerabilities. With the expansion of smart warehouses and IoT-enabled tracking, securing logistics infrastructure has become a top priority for businesses. As threats evolve, the demand for robust, technology-integrated logistics solutions continues to grow, ensuring safe, efficient, and uninterrupted supply chain operations across industries. Therefore, rise in need to secure critical infrastructure is increase the demand for the logistics industry insights

Increase in the Number of Vehicles

The extensive adoption and deployment of digital technologies are driving demand in the logistics market by enhancing efficiency, visibility, and security across supply chains. Technologies such as artificial intelligence (AI), the Internet of Things (IoT), blockchain, and cloud computing are revolutionizing logistics operations, enabling real-time tracking, predictive analytics, and automated inventory management. Digital platforms streamline warehouse operations, optimize transportation routes, and reduce costs, improving overall supply chain performance. The growing reliance on e-commerce and last-mile delivery services further accelerates the need for smart logistics solutions.

In addition, advancements in autonomous vehicles, drones, and robotic process automation (RPA) are transforming freight management and order fulfillment. As companies prioritize digital transformation to remain competitive, investments in data-driven logistics infrastructure continue to rise. This technological shift enhances operational resilience, minimizes disruptions, and ensures seamless global trade, making digitalization a crucial driver of growth in the logistics industry insights.

Restraints

High Cost Associated with Threat Intelligence Solutions

The high cost associated with threat intelligence solutions is hampering the demand for the logistics market, as many companies struggle to balance security investments with operational expenses. Implementing advanced cybersecurity measures, including threat detection systems, real-time monitoring, and AI-driven analytics, requires substantial financial resources. Small and medium-sized logistics firms often find it challenging to afford these solutions, leaving them vulnerable to cyber threats, data breaches, and supply chain disruptions.

In additional, ongoing maintenance, software updates, and skilled cybersecurity personnel add to the financial burden. The complexity of integrating threat intelligence with existing logistics systems further increases costs, discouraging widespread adoption. While large enterprises invest in robust security frameworks, many smaller companies rely on traditional methods, exposing the industry to growing risks. Without affordable, scalable cybersecurity solutions, logistics providers face challenges in securing their digital operations, limiting overall market growth despite the increasing need for secure and resilient supply chains.

Lack of Skilled Professionals and Technical Complexities in Deployment of Threat Intelligence Solutions

The lack of skilled professionals and technical complexities in the deployment of threat intelligence solutions are significant barriers to the growth of the logistics market. Logistics companies are increasingly reliant on advanced cybersecurity technologies to protect their digital infrastructure, but the shortage of cybersecurity experts makes it difficult to implement and manage these complex solutions effectively. Skilled professionals are needed to interpret data, configure systems, and respond to emerging threats, yet there is a global shortage of qualified talent in the cybersecurity field.

In addition, deploying threat intelligence solutions often requires extensive technical expertise to integrate them with existing logistics platforms and infrastructure. These challenges result in delayed implementations and higher costs for companies. As a result, many logistics providers struggle to adopt robust security measures, leaving their operations vulnerable to cyberattacks and hindering overall market growth. Addressing the talent gap and simplifying solution deployment are crucial to overcoming these barriers.

Opportunity

Favourable Government Initiatives and Investments to Strengthen Security Infrastructure

Government initiatives and investments aimed at strengthening security infrastructure present a logistics market opportunity for the logistics market. As countries focus on improving transportation safety, implementing advanced security systems, and enhancing border controls, the demand for secure logistics services is rising. These efforts often lead to increased investments in technology such as GPS tracking, surveillance, and real-time monitoring, which logistics companies can leverage to improve their service offerings. Furthermore, the growing emphasis on secure supply chains, especially in industries like pharmaceuticals, food, and e-commerce, drives the need for reliable logistics solutions. Governments may also offer incentives or funding to logistics providers that align with security goals, creating a favorable environment for businesses in this sector. This presents a significant growth avenue for logistics companies, allowing them to capitalize on both public and private sector demand for secure, efficient, and technologically advanced solutions.

The Increase in Globalization of Trade

The increasing globalization of trade presents a lucrative opportunity for the logistics market, as companies seek efficient solutions to manage the flow of goods across borders. With more countries engaging in international trade, the demand for logistics services that can handle cross-border transportation, customs clearance, and compliance with varying regulations is growing. Logistics companies play a critical role in facilitating global supply chains by providing services such as air, sea, and road transportation, warehousing, inventory management, and distribution. The expansion of global trade networks has led to the development of large-scale infrastructure, including ports, airports, and distribution centers, further boosting the logistics sector's growth. Additionally, as companies pursue cost-effective and timely deliveries, logistics providers are expected to adopt advanced technologies, such as automation, AI, and real-time tracking, to optimize operations. As trade volumes continue to rise, the logistics market stands to benefit from increased demand for efficient, scalable, and innovative solutions across diverse industries.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ogistics market analysis from 2023 to 2032 to identify the prevailing Logistics market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 20.1 trillion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 393 |

| By End Use |

|

| By Model |

|

| By Mode of Transport |

|

| By Region |

|

| Key Market Players | DB Schenker, Deutsche Post AG, A.P. Moller - Maersk, Nippon Express Co., Ltd., DSV, C.H. Robinson Worldwide Inc., Kuehne+Nagel, GEODIS, United Parcel Service of America, Inc., FedEx |

Analyst Review

Currently, healthcare, manufacturing and trade & transportation segments have witnessed large-scale adoption of global logistics market. Increasing adoption of logistics in these end user industries are expected to rise with highest market share and are identified as one of the lucrative targets for investment. As compared to the other segments, these applications possess larger market size by value. The application of logistics has expanded its reach and it is more inclined towards the developing economies. The revenue generated is mostly coming out from the developing economies rather than the developed economies. The demand for various goods is expected to increase at an exponential rate which would further increase the demand for logistics firms in the years to come.

Asia-Pacific holds the largest market share in the global logistics market in 2015. The growth of global logistics market in Asia-Pacific region is driven by burgeoning demand in China, and India. The second highest share is LAMEA followed by North America and Europe. The global logistics market is highly fragmented with the presence of large number of local players that occupy around 50% market share in the overall global logistics market.

Upcoming trends in the global logistics market include automation, AI-driven supply chains, sustainable logistics, blockchain for transparency, drone and autonomous deliveries, real-time tracking, and the rise in demand for cold chain solutions.

The leading application of the logistics market is e-commerce, driven by the rise in online shopping, demand for fast deliveries, and the need for efficient supply chain management across global markets.

Asia-Pacific is the largest regional market for Logistics

$20,124.5 billion

GEODIS, FedEx, Nippon Express Co., Ltd., DB Schenker, A.P. Moller - Maersk, Kuehne+Nagel, DSV, C.H. Robinson Worldwide Inc., UNITED PARCEL SERVICE OF AMERICA, INC., and Deutsche Post AG.

Loading Table Of Content...

Loading Research Methodology...