Low-Cost Carrier Market Outlook, 2032

The global low-cost carrier market size was valued at $196.1 billion in 2022, and is projected to reach $595.1 billion by 2032, growing at a CAGR of 12.1% from 2023 to 2032. The low-cost carrier market refers to a subset of the aviation industry that focuses on providing air travel services at a low cost. Low-cost carriers (LCCs) differentiate themselves from traditional full-service carriers by implementing streamlined operational models aimed at lowering operating costs, allowing them to offer lower ticket prices to passengers.

Key Highlighters:

Key Highlighters:

The low-cost carrier industry report covers segments such as narrow body aircraft, and wide body aircraft. The report is studied across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Factors such as liberalization of aviation markets and open skies agreements, low maintenance costs associated with aircraft, and growth of the tourism industry drive the growth of the low-cost carrier market.

However, high competition, and fluctuations in fuel prices hinder the growth of the market. Furthermore, innovative service offering from low-cost airlines, and adoption of latest technologies by LCCs for ticket sales, check-ins, baggage processing offer remarkable growth opportunities for the players operating in the market.

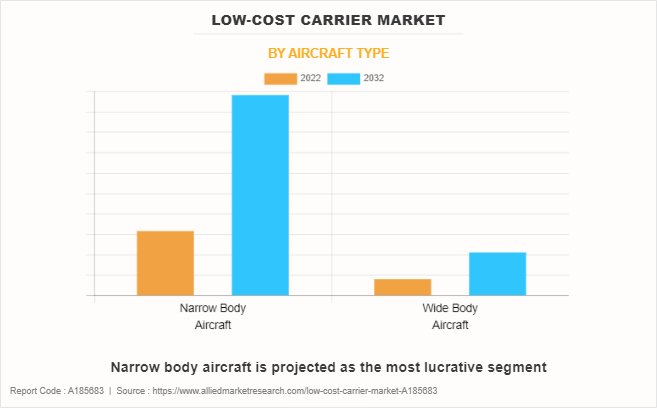

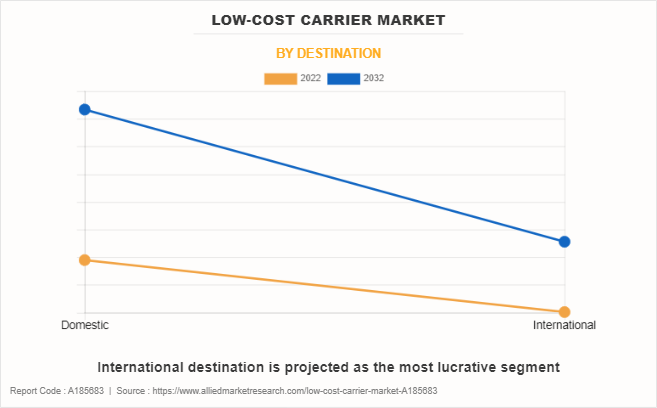

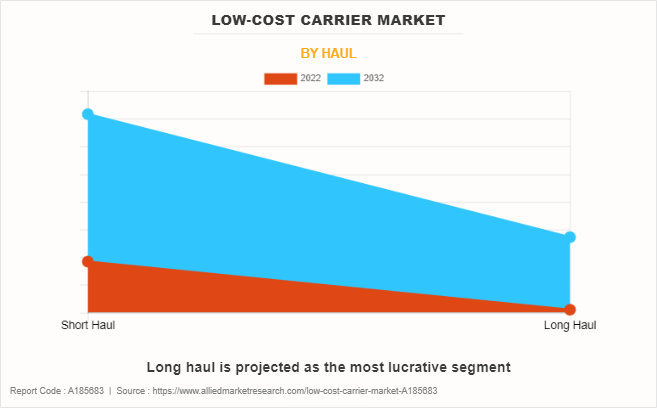

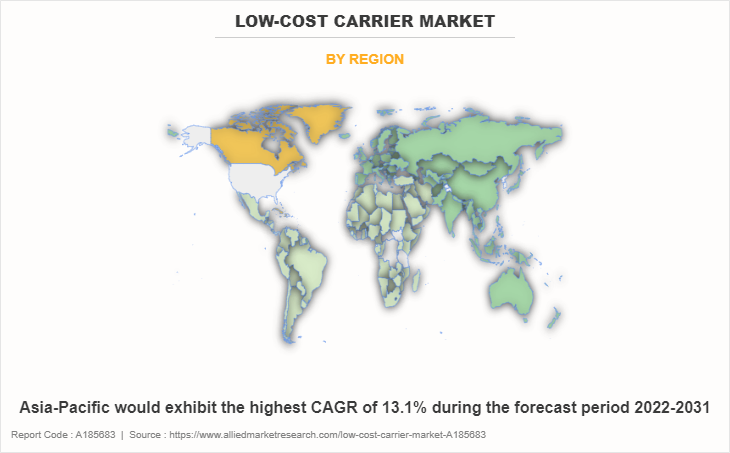

The low-cost carrier market is segmented on the basis of aircraft type, destination, haul, and region. On the basis of aircraft type, the market is bifurcated into narrow body and wide-body. On the basis of destination, the market is bifurcated into domestic, and international. On the basis of haul, the market is bifurcated into long-haul, and short haul. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific includes countries such as China, Japan, India, South Korea, and the rest of Asia-Pacific. The low-cost carrier market in Asia-Pacific has witnessed significant growth, led by AirAsia, IndiGo, and Cebu Pacific, which benefited from economic growth, policy reforms, acquisitions such as Japan Airlines, and the expansion of international networks by Indian carriers such as IndiGo.

Rapid economic development in Asia-Pacific. has seen aviation emerge as a key regional connectivity enabler with low-cost carriers at the forefront leveraging the price-sensitive, fast-growing middle class and youth demographic. AirAsia, IndiGo, Cebu Pacific are among leading low-fare airlines stimulated by progressive policy reforms. Moreover, large populations in China, India, and Indonesia provide scale economies that improve international viability while catering to sizable captive domestic audiences.

In addition, Japanese airlines have acquired the low-cost carriers to fulfill the increased demand. For instance, in May 2021, The Japanese flag carrier, Japan Airlines (JAL), acquired a controlling stake in the Chinese budget carrier Spring Airlines Japan, effectively making it a subsidiary. The acquisition was made to fulfil the demand increased after COVID-19 pandemic. The consolidation process was completed, and Spring Airlines Japan officially became a subsidiary of JAL on June 29, 2021.

Moreover, Indian LCCs have expanded its international network to increase its presence in low-cost carrier market. For instance, in October 2023, IndiGo, a low-cost carrier of InterGlobe Aviation Limited expanded its business by introduction of 20 international flights across Central and Southeast Asia, Africa, and the Middle East in the last six months. Overall, the airline established a network connecting 32 international destinations. Notable routes include connections to Jakarta, Nairobi, Almaty, Tashkent, Baku, and Tbilisi. Such instances propel the growth of the low-cost carrier industry in the region.

Narrow-body aircraft typically have a single aisle and are well-suited for short to medium-haul routes, providing an ideal solution for carriers focusing on point-to-point travel. These aircraft, such as the Boeing 737 and Airbus A320 families, offer a balance between fuel efficiency and passenger capacity. Regional jets refer to a category of small to medium-sized commercial airplanes designed for short to medium-haul flights, typically connecting regional airports and smaller cities.

Narrow body planes such as A320s and Boeing 737s have been the workhorse for low-cost carriers given right sizing for their operational models typically involving shorter 1-4 hour point-to-point routes. Familiarity of mechanics with maintaining common single-aisle models keeps maintenance overheads lower as well. Their operational flexibility to service smaller airports also enables connecting secondary cities.

In the regional jets segment, technological advancements play a crucial role in shaping market trends. The development of more fuel-efficient engines, enhanced avionics, and improved materials is driving the evolution of regional jet models.

Moreover, bulk purchase discounts and commonality benefits accrued make the A320/737 the unambiguous long-term platform of choice for airlines such as Ryanair, easyJet, Southwest et al barring major leapfrogs in single-aisle technology.

In addition, Indian LCCs have acquired the narrow body aircrafts to expand their fleet. For instance, in June 2023, the Indian budget carrier, Akasa Air, confirmed an order for 4 narrow-body aircraft Boeing 737 Max jets to expand its passenger capacity. Such instances further contribute to the growth of thelow-cost airlines market.

The leading companies profiled in the report include AirAsia, easyJet plc, Eurowings GmbH, flynas, InterGlobe Aviation Limited, Jetstar Airways Pty Ltd., Ryanair Group, Scoot Pte Ltd, Southwest Airlines Co., Volotea. These companies are adopting various strategies such as partnerships and collaborations to enhance their low-cost carrier market share.

Liberalization Of Aviation Markets And Open Skies Agreements

Open skies agreements bring strategic shift in aviation policies that has fundamentally altered the landscape, promoting competition, stimulating market dynamics, and opening avenues for market players. Liberalized markets afford low-cost carriers greater flexibility in designing their operational models. This flexibility includes route planning, frequency adjustments, and fare structuring, allowing low-cost carriers (LCC) to adapt swiftly to market demands and optimize operational efficiency.

Moreover, open skies agreements facilitate expanded market access, which enables low-cost carriers to establish routes across borders with greater ease. This accessibility broadens the geographical scope of LCC operations, fostering network expansion and increased passenger reach.

The low-cost carrier industry has prepared for significant changes in the constantly evolving world of air travel. Key agreements and partnerships are shaping the future of this market, driving the growth of the market.

For instance, in February 2023, Canada and the Dominican Republic signed an open skies agreement to enhance connectivity, trade, and tourism. This agreement eliminates restrictions for airlines from both countries, which allow them more flexibility in flight frequency and routes. Airlines can now operate direct flights between any airport in the Dominican Republic and Canada with this bilateral air transport deal in place. As a result, travelers can expect more affordable tickets due to the agreement. Such developments further drive low-cost carrier market demand.

Low Maintenance Costs Associated With Aircraft

Aircraft designed with an emphasis on low maintenance costs contribute to cost-efficient operations. This is achieved through thoughtful engineering that simplifies maintenance procedures, reduces component wear, and minimizes the need for frequent and resource-intensive overhauls.

The ability to maintain an aircraft at lower costs extends its service life. This becomes particularly significant for operators seeking to maximize the return on their investment by ensuring that the aircraft remains operationally viable over an extended period, reducing the need for premature replacements.

In addition, airlines across the globe have partnered with aircraft maintenance providers to extend the life and safety of their feet. For instance, in November 2023, Cebu Pacific, airline company, collaborated with Lufthansa Technik Philippines (LTP), aircraft maintenance company for base maintenance services and started series of maintenance events for the expansion of A330neo fleet of low-cost carrier. LTP is set to offer extensive maintenance services for Cebu Pacific A330neo aircraft. This collaboration and A330neo base maintenance ensure the safety and reliability of the fleet of Cebu Pacific.

Therefore, higher asset utilization, discounted long-term maintenance contracts reduce upkeep overheads for LCCs aiding lean budgets, which in turn support the low-cost carrier market growth.

High Competition

The intense rivalry among low-cost carriers often leads to price wars. It puts pressure on the profit margins of LCCs while this can benefit passengers with lower fares. Airlines may engage in aggressive pricing strategies to attract customers, impacting their overall financial health. The constant need to offer competitive prices in a crowded market can result in thin profit margins for low-cost carriers.

Moreover, in a highly competitive landscape, passengers are expected to choose flights on the basis of the lowest available fares rather than brand loyalty. This makes it challenging for low-cost carriers to build and retain a loyal customer base, as consumers are often swayed by the most affordable option.

Low-cost carriers need to employ effective differentiation strategies beyond price to stand out in a crowded market. This could involve offering unique services, focusing on specific routes, or providing exceptional customer experiences.

Fluctuations In Fuel Prices

Fuel is a major component of operating costs for airlines. Fluctuations in fuel prices can lead to unpredictable and volatile operating costs, making it challenging for low-cost carriers to plan and budget effectively.

Sharp increases in fuel prices can erode the profitability of low-cost carriers, especially if they are unable to pass these cost increases on to passengers through higher fares. This is anticipated to result in financial challenges and, in some cases, operational losses. Fuel price fluctuations add complexity to risk management for low-cost carriers.

Low-cost carriers may need to be flexible in adjusting ticket prices based on changing fuel costs to navigate fuel price fluctuations. This requires a dynamic pricing strategy that responds to market conditions.

Recent Developments:

- In April 2022, The Jetstar Group collaborated with IndiGo to enable Jetstar customers to book connections and flights on IndiGo services through its Jetstar Connect platform.

- In May 2023, Ryanair Holdings plc ordered 300 new Boeing 737-MAX-10 aircraft for delivery between 2027 to 2033 to expand its fleet and strengthen its market presence.

The low-cost carrier market is segmented into Aircraft Type, Destination and Haul.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the low-cost carrier market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global low-cost carrier market trends, key players, market segments, application areas, and market growth strategies.

Low-Cost Carrier Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 595.1 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Aircraft Type |

|

| By Destination |

|

| By Haul |

|

| By Region |

|

| Key Market Players | Jetstar Airways Pty Ltd., AirAsia, Scoot Pte Ltd, Ryanair Group, easyJet plc, InterGlobe Aviation Limited, Volotea, Southwest Airlines Co., Eurowings GmbH, flynas |

The global low-cost carrier industry generated $196.1 billion in 2022, and is anticipated to generate $595.1 billion by 2032, witnessing a CAGR of 12.1% from 2023 to 2032.

The global low-cost carrier industry is anticipated to witness a CAGR of 12.1% from 2023 to 2032.

The leading companies include AirAsia, easyJet plc, Eurowings GmbH, flynas, InterGlobe Aviation Limited, Jetstar Airways Pty Ltd., Ryanair Group, Scoot Pte Ltd, Southwest Airlines Co., Volotea.

Asia-Pacific region accounted for the largest low-cost carrier market share.

Factors such as liberalization of aviation markets and open skies agreements, low maintenance costs associated with aircraft, and growth of the tourism industry drive the growth of the low-cost carrier market.

Loading Table Of Content...

Loading Research Methodology...