Low-End FPGA Market Summary, 2032

The global low-end FPGA market was valued at $2.4 billion in 2022, and is projected to reach $5.8 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032. A low-end Field-Programmable Gate Array (FPGA) refers to an FPGA device that is relatively small in terms of logic capacity and features compared to higher-end counterparts. FPGAs are integrated circuits that can be programmed to build custom digital logic circuits, making them adaptable and flexible for a wide range of applications such as telecommunication, automotive, industrial control, and data centers.

Low-end FPGAs are often built for simpler and smaller-scale projects that do not necessitate as much logic capacity or advanced capabilities. These FPGAs are frequently less expensive and easier to use, making them ideal for amateurs, students, and small-scale applications with restricted resources. Examples of low-end FPGAs are Altera's Cyclone family, Xilinx's Spartan family, Microsemi's Fusion family, and Lattice Semiconductor's Mach XO/ICE40.

The low-end FPGA market is segmented into Technology, Node Size and Application.

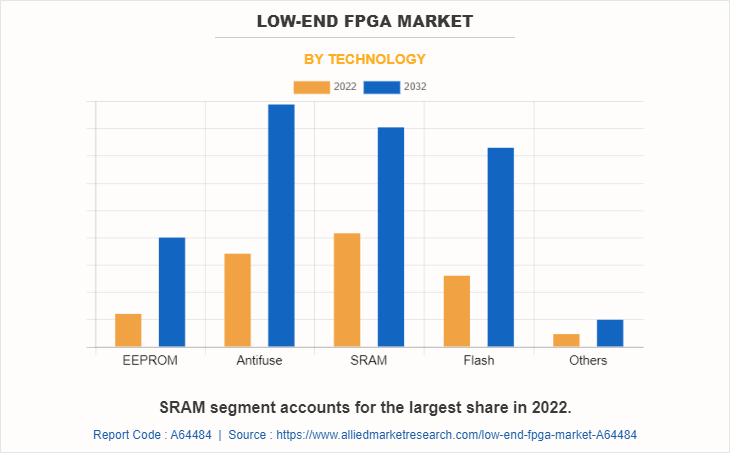

On the basis of technology, the market is classified into EEPROM, SRAM, anti-fuse, flash, and others. In 2022, SRAM segment dominate the market in terms of revenue.

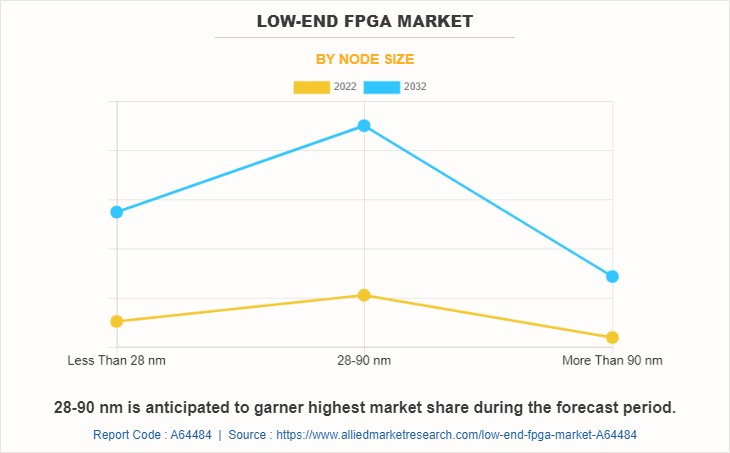

On the basis of node size, the market is divided into Less than 28 nm, 28-90 nm, and more than 90 nm. In 2022, 28-90 nm segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032

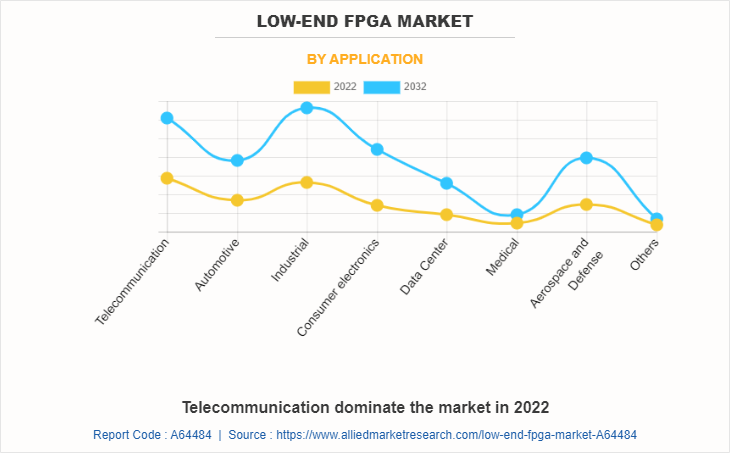

On the basis of application, the market is segmented into telecommunication, automotive, industrial, consumer electronics, data center, healthcare, aerospace & defense, and others. In 2022, the telecommunication, segment acquired the largest share in 2022 and consumer electronics is expected to grow at a significant CAGR from 2023 to 2032.

Region-wise, the low-end FPGA industry are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).The Asia-Pacific low end FPGA market industry is expected to grow at the highest CAGR during the forecast period.

One of the important drivers of the low-end FPGAs market is the increased prevalence of smart technologies across the globe. Smart technologies cover a wide range of applications, including smart homes, smart cities, industrial automation, Internet of Things (IoT) devices, and wearable devices. These technologies rely on efficient and adaptive hardware solutions to conduct complicated tasks and process massive volumes of data.

Low-cost FPGAs with flexible programmability are well-suited for various applications, offering a cost-effective alternative to complex ASIC development. Their affordability and adaptability make them an attractive choice for developers and manufacturers seeking to create unique hardware solutions quickly.

The rise in demand for smart technologies and the need for rapid prototyping and customization are key drivers behind the adoption of low-end FPGAs. They empower businesses and individuals to design and produce intelligent products that enhance connectivity, efficiency, and overall usefulness across diverse industries. For instance, the growing popularity of smart home devices, such as voice-controlled assistants and connected appliances, has driven the demand for low-end FPGAs. These programmable circuits provide an economical and versatile solution for integrating multiple features and processing real-time data.

Consequently, smart devices can promptly respond to user commands and adapt to changing environmental conditions. Moreover, the increase in the usage of smart devices such as laptops, and smartphones factors is driving the growth of the market.

For instance, during the design and prototyping phase of these devices, low-end FPGAs can be utilized to simulate and verify specific functions or interface with peripherals, enabling engineers to validate and modify their designs before finalizing the ASIC or SoC implementations.

Furthermore, the rise in adoption of semiconductors in advanced driver assistance systems is driving the growth of the low-end FPGAs market. ADAS technologies such as collision avoidance systems, lane departure warning systems, adaptive cruise control, and automated parking systems demand high-performance and real-time processing capabilities.

Low-end FPGAs are an appropriate alternative due to their ability to efficiently handle sophisticated algorithms and data-intensive jobs. The programmability of low-end FPGAs enables algorithm customization and optimization to satisfy unique ADAS requirements.

Moreover, low-end FPGAs have minimal power consumption, making them perfect for incorporation into vehicles with limited power supplies. For instance, ADAS systems rely on accurate and real-time detection of objects such as pedestrians, vehicles, and barriers to ensure safe driving. Low-end FPGAs provide the processing capacity and parallel computing capabilities required to perform complicated algorithms involved in object recognition, categorization, and tracking. Automotive makers can efficiently incorporate ADAS functionalities while keeping a cost-performance balance by utilizing low-end FPGAs.

The proliferation of the Internet of Things (IoT) and connected devices is another important driver for the Low-end FPGA market growth. The increase in the adoption of IoT and connected devices across various sectors, such as smart homes, industrial automation, healthcare, and agriculture, has fueled the demand for low-end FPGAs. The Internet of Things ecosystem consists of a massive network of interconnected devices that gather and transfer data, allowing for seamless communication and automation.

Low-end FPGA market share provide various advantages for IoT applications, including flexibility, low power consumption, and the capacity to perform real-time data processing. These programmable chips enable customization and adaptation to a wide range of IoT devices and application cases.

They provide the processing capability and networking options needed to interface with sensors, actuators, and communication protocols, allowing for smooth incorporation into IoT networks. For instance, IoT technologies are being utilized to monitor and optimize crop growth, automate irrigation systems, and manage livestock.

Moreover, by utilizing low-end FPGAs, farmers and agricultural businesses can enhance productivity, reduce resource waste, and optimize crop yield.

On the other hand, high power consumption hinders the growth of the market as low-end FPGAs generally require a significant amount of power to run because of their inherent programmability and complicated architecture. Low-end FPGAs reconfigurable logic blocks interconnect, and I/O interfaces all contribute to power consumption, particularly when working with larger and more sophisticated systems.

Low-end FPGAs high-power consumption presents issues in a variety of applications, notably those with low power budgets or battery-powered devices. It can result in increased energy consumption, decreased battery life, and thermal management difficulties. For instance, small segment of low-end FPGA manufacturers is utilizing advanced process technologies such as FinFET or FD-SOI to improve power efficiency.

They are also collaborating with tool providers to develop power-aware design techniques that will allow designers to optimize power consumption. These efforts aim to make low-end FPGAs more suitable for power-constrained applications and overcome the restraint of high-power consumption in the low-end FPGA industry.

Separately, the surge in penetration and technological advancements present a significant future opportunity for the low-end FPGA market in the coming year. The demand for efficient and adaptable hardware solutions, such as low-end FPGAs, is increasing as industries embrace digital transformation and incorporate smart technologies. The expansion of applications such as IoT, smart homes, automotive electronics, industrial automation, and healthcare devices necessitates cost-effective and adaptable solutions.

Low-end FPGAs enable rapid prototyping and customization by allowing you to develop and optimize hardware functionality to match specific application needs. Furthermore, technological advances in low-end FPGAs architectures, manufacturing techniques, and design tools have improved their performance, power efficiency, and ease of use.

These developments, together with the increased knowledge and availability of low-cost FPGAs, provide opportunities for organizations and developers to capitalize on their benefits and boost innovation. For example, edge computing involves processing data closer to the source, reducing latency, and improving real-time responsiveness.

The demand for low-end FPGAs increases as more industries adopt edge computing for applications such as autonomous vehicles, smart cities, and industrial IoT. These FPGAs provide the flexibility and processing capacity needed by edge devices to accomplish complicated operations locally rather than relying entirely on cloud services. Thereby creating an opportunity for the market.

Segment Overview

The global low-end FPGA market trends are analyzed across various segments including node size, technology, application, and region. By node size, the low-end FPGA market size is divided into Less than 28 nm, 28-90 nm, and more than 90 nm. By technology, the market is classified into EEPROM, SRAM, anti-fuse, flash, and others. By application, the market is segmented into telecommunication, automotive, industrial, consumer electronics, data center, healthcare, aerospace & defense, and others.

The regional segmentation of the market includes North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific low-end FPGA industry is expected to grow at the highest CAGR during the forecast period, owing to the increased investments in consumer electronics and automotive industries, majorly in central and southern regions.

Top Impacting Factors

The market for low-end FPGAs market is anticipated to expand significantly during the forecast period owing to the rise in adoption of FGPA in advanced driver assistance systems. In addition, the proliferation of the Internet of Things (IoT) and connected devices, and the increased prevalence of smart technologies across the globe fuels the market growth.

Moreover, low-end FPGAs are anticipated to benefit owing to the surge in penetration and technological advancements and are expected to present enormous opportunities for the market over the forecast period. On the other hand, high power consumption is anticipated to restrain the market growth during the forecast period.

Competitive Analysis

The key players profiled in the report include Enclustra, Intel Corporation, Efinix, Inc., Flex Logix Technologies, Inc., Achronix Semiconductor Corporation, Advanced Micro Devices, Inc, Gowin Semiconductor Corp., QuickLogic Corporation, Microchip Technology Inc., Lattice Semiconductor Corporation, such as product portfolio investments, expansion, and product launch to enhance their position in the low-end FPGA market overview.

Historical Data & Information

The low-end FPGA market is highly competitive, owing to the strong presence of existing vendors. Vendors in the low-end FPGA market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Enclustra, Intel Corporation, Efinix, Inc., Flex Logix Technologies, Inc., Achronix Semiconductor Corporation, Advanced Micro Devices, Inc, Gowin Semiconductor Corp., QuickLogic Corporation, Microchip Technology Inc., Lattice Semiconductor Corporation are the top companies holding a prime share in the global low-end FPGA market. Top market players have adopted various strategies, such as expansion and investment to expand their foothold in the aeroponics market.

In November 2022, AMD launched these new Xilinx FPGAs as part of its product portfolio. These cost-optimized FPGAs are designed to offer improved performance and flexibility while targeting price-sensitive markets. The integration of Xilinx FPGAs into AMD's lineup aims to provide customers with more options for designing and implementing customizable solutions for various applications.

In August 2023, Efinix launched Trion T20 FPGA. This Trion T20 WLCSP delivers high compute performance in a tiny, low power package and has been selected for many IoT and vision applications worldwide.

In February 2022, QuickLogic Corporation announced about PolarPro 3 family of low power, SRAM-based FPGAs, which are available to solve semiconductor supply availability challenges. This highly flexible family features power consumption as low as 55uA and a tiny footprint in small packages, as well as die options.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the low-end FPGA market analysis from 2022 to 2032 to identify the prevailing low-end FPGA market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the low-end FPGA market Forecast assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global low-end FPGA market opportunity, key players, market segments, application areas, and market growth strategies.

Low-End FPGA Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.8 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 271 |

| By Technology |

|

| By Node Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | FlexLogix, Intel Corporation., GOWIN Semiconductor Corp., Lattice Semiconductor Corporation, Advanced Micro Devices, Inc., Microchip Technology Inc., Achronix semiconductor corporation, Efinix, inc., Enclustra., QuickLogic Corporation |

Analyst Review

The global low-end FPGA market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for low-end FPGA devices, particularly in developing regions, such as China, India, U.S., UK, and others. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings.

The rise in adoption of low-end FGPAs in advanced driver assistance systems, increase in adaptation of smart technologies across the globe, and proliferation of the Internet of Things (IoT) and connected devices drive the growth of the market. However, high power consumption impedes this growth. Further, an increase in penetration and technological advancements are expected to create lucrative opportunities for the key players operating in this market.

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. For instance, QuickLogic Corporation announced the launch of its PolarPro 3 family of low-power, SRAM-based FPGAs that were available to solve semiconductor supply availability challenges. This extremely adaptable series includes power consumption as low as 55uA and a tiny footprint in small packages, as well as die options.

EEPROM and SRAM technology is the upcoming trend in low-end FPGA market.

The Power over Ethernet (PoE) Lighting Market to grow at a compound annual growth rate (CAGR) of 31.6% from 2023 to 2032.

North America is the largest regional market for low-end FPGA.

The Power over Ethernet (PoE) Lighting Market was valued at $0.7 billion in 2022 and is forecasted to escalate to $11.3 billion by 2032.

Enclustra, Intel Corporation, Efinix, Inc., Flex Logix Technologies, Inc., Achronix Semiconductor Corporation, Advanced Micro Devices, Inc, Gowin Semiconductor Corp., QuickLogic Corporation, Microchip Technology Inc., Lattice Semiconductor Corporation are the top companies to hold the market share in low-end FPGA market.

Loading Table Of Content...

Loading Research Methodology...