Low Voltage Contactor Market Research, 2033

The global low voltage contactor market was valued at $5.6 billion in 2023, and is projected to reach $8.0 billion by 2033, growing at a CAGR of 3.7% from 2024 to 2033.

Market Introduction and Definition

Low voltage contactors are electromechanical devices used to control electrical circuits where lower voltage ratings are required, typically up to 1000 volts AC. They serve as switches that engage or disengage electrical power to motors, heaters, lighting, and other loads in industrial, commercial, and residential applications. These contactors consist of a coil that, when energized, creates a magnetic field to attract a movable contact. This action closes the contacts, allowing current to flow through the main circuit. When the coil is de-energized, a spring or other mechanism returns the contact to its original position, breaking the circuit and stopping the flow of electricity.

Low voltage contactors are crucial for automating processes, ensuring safety, and preventing overload or short circuits. They are designed to handle varying currents and are often modular, allowing for easy installation and maintenance. These devices are integral components in electrical control panels, providing reliable operation and longevity in diverse electrical systems.

Key Takeaways

- The low-voltage contactors market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major low-voltage contactors industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The expansion in telecommunications and infrastructure significantly drives the growth of the low-voltage contactors market. The demand for sophisticated data cabling, fiber optics, and network installations rises as businesses and homes increasingly rely on robust, high-speed internet and seamless communication networks. Low-voltage contactors play a crucial role in setting up and maintaining these essential systems, ensuring reliable connectivity and efficient data transfer. This trend is further accelerated by the proliferation of cloud computing, remote work, and the need for advanced cybersecurity measures, driving the importance of low-voltage contactors in the evolving digital landscape.

The expansion of construction and infrastructure projects significantly drives the growth of the low voltage contactor market. There is an increased demand for residential, commercial, and industrial buildings, all requiring efficient electrical systems as urbanization accelerates globally. Low voltage contactors play a crucial role in controlling and managing electrical circuits in these constructions, ensuring reliable power distribution to lighting, HVAC systems, pumps, and other essential equipment. This trend is further bolstered by investments in smart cities and sustainable infrastructure, where advanced contactors with digital capabilities are sought-after for their ability to enhance energy efficiency and operational reliability.

However, high initial investment costs limit the growth of the low-voltage contactors market. Implementing low voltage systems, which include advanced technologies like security systems, telecommunications infrastructure, and building automation, often requires substantial upfront expenditures. These costs encompass purchasing equipment, acquiring specialized tools, and investing in skilled labor. For contractors, especially smaller firms or startups, accessing capital for these investments can be challenging and may limit their ability to compete or expand services. In addition, the financial risk associated with these upfront costs can deter potential clients from committing to projects, further impacting market growth.

The rising demand for smart city initiatives presents a lucrative opportunity for the low-voltage contactor market. As cities worldwide adopt technologies to enhance efficiency, sustainability, and quality of life, there is a growing need for advanced low voltage systems. These systems are integral to smart city infrastructure, supporting applications such as intelligent lighting, traffic management, environmental monitoring, and public safety. Low-voltage contactors play a vital role in designing, installing, and maintaining these systems, leveraging their expertise in telecommunications, data networks, and automation. This trend underscores a significant growth avenue as cities increasingly invest in modernizing their infrastructure to meet evolving urban challenges.

Market Segmentation

The low-voltage contactors market is segmented into type, current rating, application, end-user, and region. By type, the market is bifurcated into AC contactor and DC contactor. By current rating, the market is segmented into Below 100A, 100A-250A, 250A-500A, 500A-750A, and Above 750A. By application, the market is divided into motor application, power switching, telecommunication, automation, renewables, and others. As per end-user, the market is categorized into industrial, residential and commercial. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key market players operating in the low-voltage contactors market include Schneider Electric, Siemens, ABB Group, Rockwell Automation, Mitsubishi Electric Corporation, Fuji Electric, C&S Electric Limited, Durakool, Yueqing Liyond Electric Co., Ltd., Sensata Technologies, Inc., and others.

Regional Market Outlook

In the Asia-Pacific region and North America region, the growth in commercial building projects, expanding smart city initiatives, and the rapid development of telecommunications and data infrastructure are driving the low-voltage contactor market. Countries such as China, India, and Singapore are investing heavily in modernizing urban areas and enhancing digital connectivity. This investment demands advanced low voltage systems for efficient communication, security, and automation. The push towards smart cities further accelerates the need for sophisticated low voltage installations, while the ongoing expansion of 5G networks and data centers creates numerous opportunities for low-voltage contactors, ensuring sustained market growth in the region.

- According to Invest India, the telecom industry is one of the most important sectors in the Indian economy, with a 6.5% contribution to the country's GDP. In the last quarter of FY 2022-2023, the industry’s gross revenue was $11.38 billion. The industry includes Infrastructure, Equipment, Mobile Virtual Network Operators (MNVO) , White Space Spectrum, 5G, Telephone service providers and Broadband.

- As per the Associated General Contractors (AGC) of America, construction is a major contributor to the U.S. economy. There were more than 919, 000 construction establishments in the U.S. in the 1st quarter of 2023. The industry employs 8.0 million employees and creates nearly $2.1 trillion worth of structures each year. Construction is one of the largest customers for manufacturing, mining and a variety of services. Thus, the rising building construction activities further drives the growth of low-voltage contactors market.

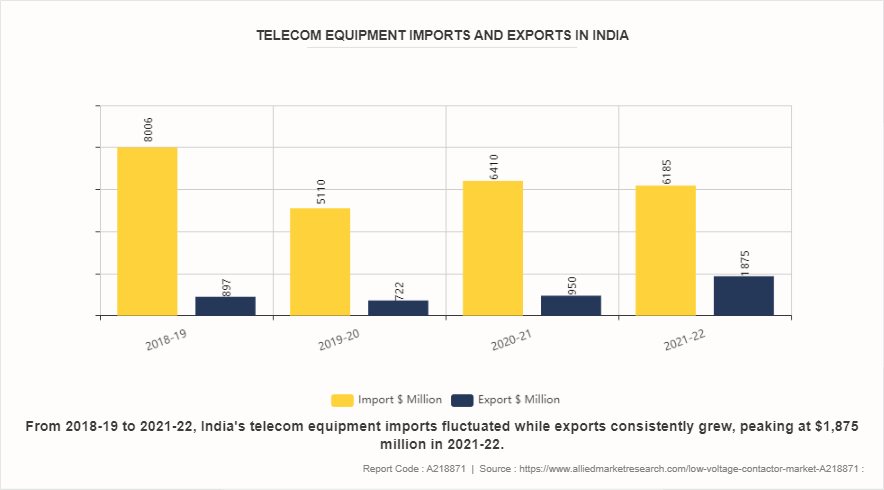

Telecom Equipment Imports and Exports in India

The trends in import and export values of telecom equipment from 2018 to 2022 suggest dynamic shifts in the low voltage contactor market. The initial decrease in both imports and exports in 2019-20 reflects a period of market contraction, likely influenced by economic uncertainties or disruptions in global supply chains. However, the subsequent recovery and steady increase in exports from 2020-21 to 2021-22 indicate a resurgence in market demand. This upward trend in exports points towards growing international competitiveness and heightened global demand for low voltage contactors. For manufacturers and suppliers in the low voltage contactor market, these fluctuations underscore the importance of adaptability and resilience in response to changing market conditions. It highlights opportunities in international markets where exports are expanding, potentially encouraging investment in production capacity and innovation to meet rising global demand.

Industry Trends

- Integration of low voltage contactors with IoT enables remote monitoring and control, facilitating real-time operational insights. This connectivity supports predictive maintenance strategies, identifying potential issues before they escalate. By leveraging IoT, users can optimize efficiency, reduce downtime, and enhance overall reliability of electrical systems.

- The rollout of 5G networks is driving substantial opportunities for low-voltage contactors due to the need for extensive new telecommunications infrastructure. This rapid expansion requires the installation of numerous small cell networks, fiber optic cables, and enhanced base stations, all of which are critical components of 5G technology. Low-voltage contactors are essential for these installations, ensuring that the infrastructure is properly set up to handle the increased data speeds and connectivity demands.

- Modern low voltage contactors are integrating digital interfaces and smart features like diagnostics, Modbus/Ethernet communication, and programmable functions. These advancements enable remote monitoring, proactive maintenance, and seamless integration into automation systems, enhancing flexibility and operational efficiency in industrial applications.

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- The Construction Association

- World Bank

- National Association of Home Builders

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the low voltage contactor market analysis from 2024 to 2033 to identify the prevailing low voltage contactor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the low voltage contactor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global low voltage contactor market trends, key players, market segments, application areas, and market growth strategies.

Low Voltage Contactor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.0 Billion |

| Growth Rate | CAGR of 3.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By End-User |

|

| By Current Rating |

|

| By Region |

|

| Key Market Players | Fuji Electric, Mitsubishi Electric Corporation, Durakool, ABB Group, Schneider Electric, C&S Electric Limited, Rockwell Automation, Siemens, Yueqing Liyond Electric Co., Ltd., Sensata Technologies, Inc. |

The low-voltage contactors market was valued at $5.6 billion in 2023 and is estimated to reach $8.0 billion by 2033, exhibiting a CAGR of 3.7% from 2024 to 2033.

Rising demand for smart city initiatives is the upcoming trend of Low Voltage Contactor Market in the globe

Automation is the leading application of Low Voltage Contactor Market

Asia-Pacific is the largest regional market for Low Voltage Contactor

The key market players operating in the low-voltage contactors market include Schneider Electric, Siemens, ABB Group, Rockwell Automation, Mitsubishi Electric Corporation, Fuji Electric, C&S Electric Limited, Durakool, Yueqing Liyond Electric Co., Ltd., Sensata Technologies, Inc., and others.

Loading Table Of Content...