Lte Base Station System Market Statistics, 2030

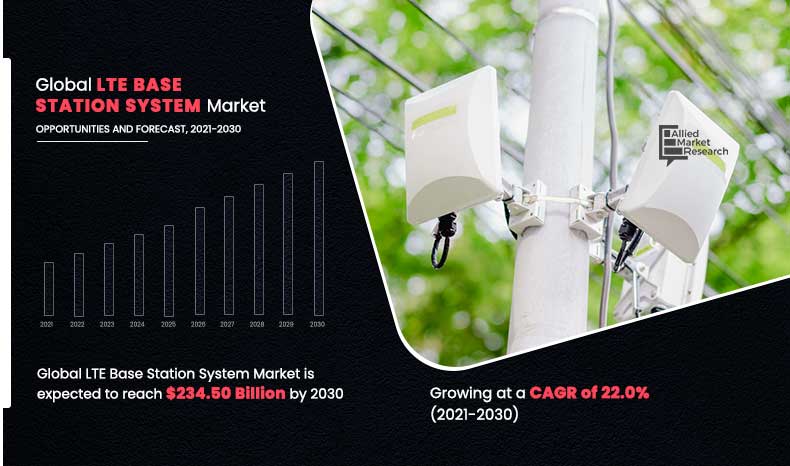

The global LTE base station system market size was valued at $32.80 billion in 2020, and is projected to reach $234.50 billion by 2030, growing at a CAGR of 22.0% from 2021 to 2030.

Long-term evolution (LTE) base station systems are energy-saving and cost-cutting devices that use cutting-edge technology to enhance installation and drastically reduce power usage. It is a standard system for high-speed wireless communication for mobile phones and data terminals that uses a new radio interface in conjunction with core network enhancements to boost capacity and speed. In the W-CDMA system, the base station equipment (evolving Node B (eNodeB)) is equipped with radio access & control technology, which is provided by IP-Radio Network Controllers (IP-RNC) and Base Trans receiver Station (BTS).

Rise in demand for high-speed broadband services and growth in consumer awareness of IoT applications, such as connected homes & automobiles, drive the global LTE base station system market. In addition, growth of overall telecom market and increase in need for high data transfer rate fuel the growth. However, stringent norms for telecom operators in some countries and lack of availability of compatible devices restrict the market growth.

Moreover, increase in development of wireless communication technology, growth of complementary technologies such as software-defined networking (SDN) &network functions virtualization (NFV), and increase in telecom customer base are expected to offer remunerative opportunities for expansion of the market during the forecast period.

In terms of product type, TDD-LTE segment holds the largest share of the LTE base station system market, as it reuses the frequency sources, mixers, fiLTErs, and synthesizers, by eliminating the complexity and costs associated with isolating the transmitting antenna and the receiving antenna. However, the FDD-LTE segment is expected to grow at the highest rate during the forecast period, owing to symmetric low latency services such as voice calls that have symmetric traffic, in which data can be transmitted and received at the same time.

By Product Type

TDD-LTE segment is projected as one of the most lucrative segments.

Region wise, the LTE base station system market size was dominated by North America in 2020, and is expected to retain its position during the forecast period, due to the presence of a large number of LTE subscribers in the U.S. and Canada. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rise in number of number of subscribers in key regional markets such as China, India, Japan, and South Korea.

By Region

Asia-Pacific would exhibit the highest CAGR of 23.9% during 2021-2030.

The report focuses on growth prospects, restraints, and analysis of the global LTE base station system market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global LTE base station system market share.

By End User

Residential & SOHO segment is projected as one of the most lucrative segments.

Segment Review

The LTE base station system market is segmented based on product type, end user, and region. By-product type, it is divided into TDD-LTE and FDD-LTE. On the basis of end user, it is classified into residential & small office or home office (SOHO), enterprise, urban, and rural. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global LTE base station system market analysis includes major players such as Airspan Networks, Alpha Networks Inc., AT&T Intellectual Property, Cisco system, Inc., COMMSCOPE Inc., ERICSSON, Huawei Technologies Co. Ltd., Motorola Solutions, Inc., Nokia Corporation and ZTE Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the LTE base station system industry.

Top Impacting Factors

Rise In Consumer Awareness For Iot Applications Including Connected Homes & Automobiles

Increase in number of IoT devices and growth in awareness regarding cloud computing technology benefits such as scalability, flexibility, security, and recovery are some of the major factors that are expected to drive the adoption of IoT devices. Artificial intelligence and machine learning have an impact on most aspects of modern life such as healthcare, commerce, and entertainment. All this data collected by the IoT can be used for very detailed personal profiling, which can generate great value for targeting and understanding behavioral patterns however also have potential for predicting trends. Here artificial intelligence (AI) can provide substantial improvements in all areas. These are some of the major factors that drive the growth of the LTE base station system industry.

Moreover, rise in demand for AI for governments around the world to predict and prevent crime is expected to fuel the market growth. For instance, law enforcement agencies in city governments of New Orleans and Los Angeles in the U.S. have worked with the private sector to create predictive policing programs. These programs use data collected from IoT devices under smart city plans such as traffic cameras, smart phones and various devices to analyze social media posts, outline criminal histories, and trace people’s ties to other gang members. This is projected use statistics and AI to assess the risk of someone committing or becoming a victim of these crimes, so that agencies can intervene.

Furthermore, machine learning and artificial intelligence provide considerable improvements to all areas of healthcare from treatment to diagnostics. AI tools facilitate and enhance human work and ready to support healthcare personnel with a variety of tasks from patient outreach to clinical documentation and administrative workflow as well as specialized support such as in-patient monitoring, medical device automation, and image analysis.

Increase In Demand For High-speed Broadband Services

COVID pandemic actually preponed the requirement of high-speed broadband internet. During lockdown, people had to remain in their homes. People had to continue working from home to earn their livelihood and students had to attend online classes from home only. These situations brought psychological, social, and professional need of meeting people and the only option left was to connect with them online. These requirements brought realization that one would need high speed broadband internet. The high-speed internet is provided on wireline/fiberoptic network by broadband internet service providers. Demand started triggering for high-speed broadband internet in 2020 and the trends are continuing in 2021. Looking at the developments of various new applications for retail customers, movies getting released on OTT (Over The Top), work from home becoming an accepted work culture, and online classes breaking boundaries of geographies, wireline broadband internet is going to be a Fast-Moving Consumer Service.

Covid-19 Impact Analysis

The global LTE base station system industry has been significantly impacted by the COVID-19 outbreak. Production and manufacturing facilities across the globe have been shut down, owing to the outbreak of the global health crisis and unavailability of workforce. This has further impacted the global economy, and is causing economic hardship for business and communities, globally. Countries across the globe have suffered major loss in terms of business & revenue, owing to lockdown and lack of availability of raw material across the world. Production and manufacturing sectors globally have been strongly impacted by the outbreak of the COVID-19 disease, which, in turn, led to economic downfall, thereby declining the growth of the LTE base station system market in 2020.

However, rise in the number for datacenters has boosted the growth of LTE base station system during COVID-19 pandemic. In addition, the ongoing pandemic is expected to escalate the need for high-end datacenters solutions, which is expected to offer potential opportunities for the LTE base station system market growth.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global LTE base station system market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global LTE base station system market trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the LTE base station system market from 2021 to 2030 is provided to determine the market potential.

LTE Base Station System Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Long-term evolution (LTE) base station systems are devices that are meant to save energy and money by utilizing cutting-edge technology to enhance installation and drastically reduce power usage. Furthermore, the market for LTE base station systems is primarily driven by the phenomenal rise of the telecom business and the increased penetration of smartphones & tablets. Moreover, the industry has benefited greatly from the surge in network traffic and the growth in need for fast data transfer rates among end users.

Key providers of the market such as AT&T Intellectual Property, Huawei Technologies Co. Ltd, Cisco system, Inc. account for a significant share in the market. With the larger requirement from LTE base station, various companies have partnered to increase the LTE base station capabilities. For instance, in August 2021, AT&T and Cisco partnered up to boost the performance of IoT applications with dedicated 5G network capabilities. The sub-6GHz 5G network from AT&T already covers more than 251 million people and provides industries such as manufacturing, automotive, and entertainment with low latency and high bandwidth for cutting-edge applications. AT&T’s Control Center is powered by Cisco and gives businesses near real-time updates of IoT devices on their network. Anomalies can be quickly identified to mitigate security threats.

Moreover, 5G is anticipated to empower businesses across all industries to digitize faster and reshape business models. In addition, it also enables AT&T Control Center customers to harness the power of 5G in order to connect industrial and business-critical devices for ultimate IoT visibility.

With increase in demand for LTE base station, various companies have expanded their current services to continue with the rise in demand. For instance, in July 2021, Nokia partnered with Taiwan Star Telecom (TST) to extend its 5G footprint across Taiwan. Nokia is expected to provide equipment from its latest 5G AirScale portfolio to support TST’s 5G standalone (SA) network with seamless integration and a fast deployment time. In addition, Nokia is projected to supply equipment from its comprehensive AirScale portfolio to meet a variety of deployment scenarios. This includes its enhanced, next-generation AirScale Indoor (ASiR) system for retail and office environments. The compact, flexible indoor system is designed to simply and seamlessly upgrade to 5G NR via plug-and-play with minimal on-site work.

Loading Table Of Content...