Luxury Car Rental Market Overview

The global Luxury Car Rental Market size was valued at USD 30.3 billion in 2022, and is projected to reach USD 70.4 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032. Booming tourism and rising preference for premium travel experiences are fueling demand for luxury car rentals. Convenience, flexibility, and personalized high-end options further drive market growth.

Key Market Trend & Insights

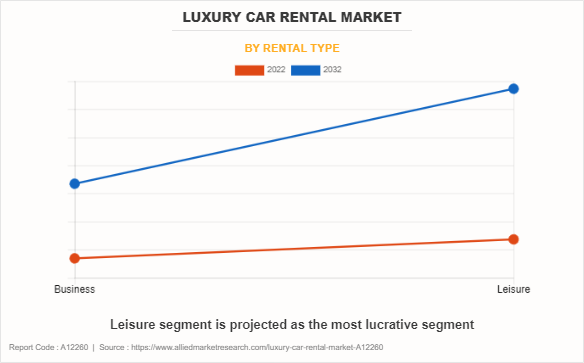

- Leisure luxury car rentals are growing due to demand for special occasions.

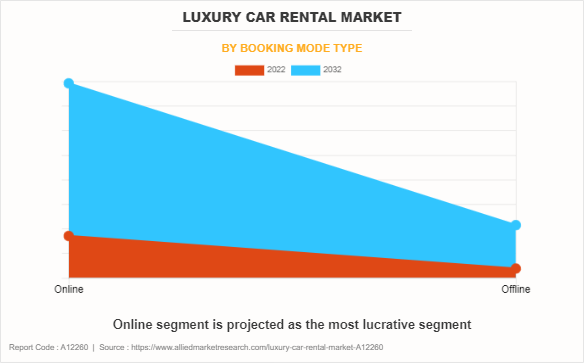

- Online booking platforms boost accessibility and convenience.

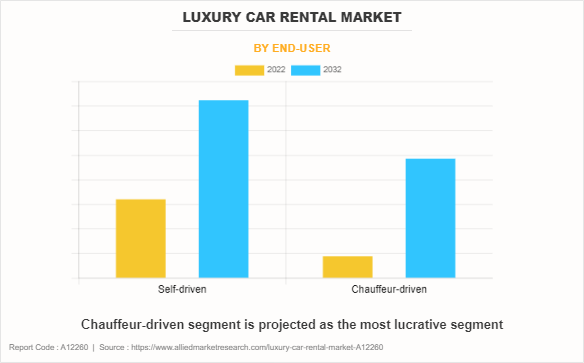

- Chauffeur-driven rentals gain popularity for premium comfort.

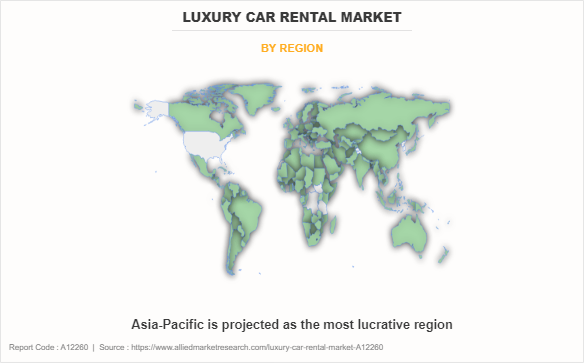

- Asia-Pacific expected to register highest CAGR with rising luxury adoption.

- Consumer shift from ownership to experience fuels market growth.

- Flexible mobility choices attract occasional luxury users.

- Diverse luxury fleets tailored to events enhance market appeal.

Market Size & Forecast

- 2032 Projected Market Size: USD 70.4 billion

- 2022 Market Size: USD 30.3 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 9.4%

Report Key Highlighters:

The luxury car rental market study covers more than 15 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Introduction

Luxury car rental refers to the service of hiring high-end, prestigious vehicles for a temporary period. These cars are equipped with advanced features, offering superior driving experience and comfort. Typically, luxury car rentals include brands such as BMW, Mercedes-Benz, or Rolls-Royce, among others providing passengers with sophistication and elegance. This service caters to individuals seeking a special occasion ride, business professionals desiring a stylish image, or tourists exploring the places in their comfort zone. Unlike regular car rentals, luxury car rentals often come with personalized services, ensuring a memorable and luxurious travel experience for those who indulge in them.

The demand for luxury car rentals is on the rise, contributing to increased sales in the luxury car rental market. Several factors drive this upward trend. People are increasingly valuing experiences over ownership. Renting a luxury car allows individuals to enjoy the thrill and prestige of driving a high-end vehicle without the financial commitment of ownership. This shift in consumer preferences is boosting the demand for luxury car rental services. Additionally, special occasions and events often call for a touch of sophistication. Individuals are deciding to make travel in style or a grand entrance for weddings, anniversaries, or important business meetings. This rise in demand for luxury cars for specific events stands as a pivotal means, propelling the expansion of the market.

Moreover, the rise in tourism industry plays an important role. Tourists, both domestic and international, seek a premium travel experience. Renting a luxury car enhances their journey, providing comfort and a sense of exclusivity. This trend not only boosts individual rentals but also contributes to the overall expansion of the luxury car rental market. Furthermore, the convenience and flexibility offered by luxury car rentals are attracting a broader customer base. As the market responds to diverse needs, including personalized services and a variety of high-end vehicle options, more individuals are inclined to choose luxury car rentals over traditional transportation methods. The growth in demand for luxury car rentals is intricately connected to the desire for luxury experiences, marking a positive trajectory for the market and contributing to increased sales in the industry.

Market Segmentation

The global luxury car rentals market is segmented by rental type, booking mode, end-user, and region. On the basis of rental type, the market is divided into business, and leisure. By booking mode, it is bifurcated into online and offline. By end-user, it is divided into self-driven, and chauffeur driven. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In North America, the increasing desire for premium travel experiences and the rise in corporate events create opportunities for luxury car rentals. The region's cultural inclination toward opulent lifestyles and corporate extravagance contributes to a rising demand for high-end vehicle rentals. As individuals and businesses increasingly prioritize premium transportation for special occasions and professional engagements, luxury car rental companies have a chance to tap into this selective customer base who are celebrating weddings and other significant milestones. By tailoring services to meet these evolving preferences, companies in North America can unlock avenues for increased sales and sustained growth in the dynamic luxury car rental market.

Europe, with its rich cultural tapestry and the prevalence of destination events, is witnessing a surge in demand for luxury car rentals. Tourists seeking opulent travel experiences and Europeans valuing stylish transportation for special occasions contribute significantly to the market's growth. The allure of exploring historic sites or attending grand events in a high-end vehicle is driving the demand for luxury car rentals in the region. Companies that align their offerings with these preferences stand to capitalize on the opportunities, potentially leading to increased sales and a strengthened position in the European luxury car rental industry.

Which are the Top Luxury Car Rental companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Luxury car rental industry.

- Auto Europe

- Avis Prestige

- Budget Rent A Car System Inc.

- Enterprise Holdings Inc.

- Europcar

- Hertz Dream Collection

- Paddock Rent a Car

- Red Fox Luxury Lifestyle Ltd.

- Sixt Luxury Cars

- Thrifty Car Rental

What are the Top Impacting Factors

Key Market Driver

Special Occasions to Drive Sales in the Luxury Car Rental Market

The rise in sales within the luxury car rental industry is intricately tied to the pivotal role that special occasions play in people's lives. The events like weddings, anniversaries, and milestone celebrations, there is a growing inclination to elevate the experience, and luxury car rentals seamlessly align with this desire for heightened moments. Weddings, where couples aspire to make a lasting impression with a grand entrance. Luxury car rentals offer sleek designs and prestigious brands, with an elegant means for the bride and groom to arrive in style. The allure of these opulent vehicles enhances the overall ambiance of the celebration, contributing to a memorable and visually striking event.

Similarly, anniversaries and other significant milestones gain an extra layer of importance when graced by the presence of a luxurious high-end car. Whether it is a birthday treat or a memorable night in the town, the luxury car seamlessly integrates into the celebration, serving as a symbolic representation of the occasion's significance. The luxury car rental strategically taps into this demand by offering a diverse fleet of vehicles tailored for various occasions. This specialization in catering to celebratory needs not only broadens the market's appeal but also becomes a key factor in boosting sales. The market not only provides access to prestigious brands and models but also ensures personalized services, allowing customers to choose a luxury car that seamlessly complements the theme and tone of their celebration.

These special occasions act as a powerful driver behind the increasing sales within the luxury car rental market. The desire to enhance celebratory moments with a touch of luxury has become a defining factor, reflecting the market's responsiveness to consumer preferences for experiential and memorable transportation options during significant life events.

Change in Consumer Preferences is Expected to Increase the Sales of Luxury Car Rentals

The increasing sales in the luxury car rental market are closely related to a fundamental shift in consumer preferences. Increasingly, individuals are opting for experiences over ownership, marking a significant shift that impacts the demand for luxury car rentals. Traditionally, possessing a high-end car signified status and success. Yet, evolving consumer preferences signal a transition towards placing greater value on the experience of driving a luxury car rather than the enduring commitment of ownership. This shift is propelled by various factors, including a yearning for diversity, financial considerations, and a preference for flexible transportation choices.

Luxury car rentals perfectly align with this evolving consumer mindset, providing individuals with the chance to relish the thrill and prestige of driving a high-end vehicle, all without the inherent responsibilities and costs tied to ownership. Within the rental market, a rich array of luxury cars becomes accessible, granting consumers the freedom to select various models tailored for specific occasions, whether it is a weekend retreat, a noteworthy celebration, or a business trip. Moreover, changing work dynamics, including the rise of remote work, contributes to the preference for luxury car rentals. With fewer daily commuting needs, individuals may not find it practical to own an expensive car full-time. Instead, they opt for the flexibility that comes with renting a luxury vehicle when needed, aligning with their changing lifestyle.

The luxury car rental market, recognizing and responding to this shift in consumer preferences, has tailored its offerings to meet the demand for flexible, experience-driven transportation. As a result, sales of luxury car rental continue to rise as more individuals prioritize the enjoyment of the journey over the burdens of ownership, marking a significant transformation in the way people approach luxury transportation.

Restraints

Competition from Various Other Segments to limit the Luxury Car Rental Sales

Competition from various other segments poses a significant challenge, putting a limit on the sales growth of luxury car rentals. The world of transportation is diverse, with alternatives ranging from traditional car rentals to ride-sharing services and chauffeur-driven options. This variety provides consumers with multiple choices, creating a competitive landscape that affects the luxury car rental market.

Traditional car rental services offer a more budget-friendly option compared to luxury car rentals. For individuals primarily seeking practicality and cost-effectiveness, these conventional rental services may be more appealing, diverting potential customers away from the luxury segment. The emergence of ride-sharing services introduces an additional dimension of competition. Platforms such as Uber and Lyft deliver convenient and on-demand transportation with diverse pricing options. Although these services might not embody the luxury and opulence linked to high-end cars, they resonate with a broader audience looking for hassle-free and cost-effective travel solutions. Chauffeur-driven services, often associated with premium experiences, also compete with luxury car rentals. Some individuals prefer the convenience and comfort of having a dedicated driver, especially for events or business travel, reducing the demand for self-driven luxury rentals.

Moreover, the increasing popularity of subscription-based models in the automotive industry provides consumers with flexibility. Subscription services allow users to access a variety of vehicles without the long-term commitment of ownership, offering an alternative to luxury car rentals for those seeking diverse driving experiences. To navigate this competitive landscape, luxury car rental companies are also differentiating themselves by emphasizing the unique aspects of their service, such as personalized experiences, a curated fleet of high-end vehicles, and flexibility in rental plans.

Opporutnity

Expanding Tourism Industry to Create Lucrative Opportunities in the Market

The expanding tourism industry stands as a significant opportunity, propelling the increasing sales within the luxury car rental market. With an increasing number of individuals setting out on adventures to discover novel destinations, there is a growing demand for exclusive and comfortable transportation experiences, establishing an advantageous landscape for high-end vehicle rentals. Beyond the simple need for transportation, tourists are now looking for more premium travel experience that enhances the charm of their chosen destination. In accordance with this, luxury car rental offers a sophisticated and memorable way to explore unfamiliar surroundings. The comfort and prestige associated with driving a high-end vehicle align perfectly with the elevated expectations of tourists looking to make the most of their travel experiences.

In popular tourist destinations or cities with vibrant attractions, the market finds ample opportunities to cater to the discerning tastes of travelers. Whether it is a scenic drive along coastal roads, a visit to iconic landmarks, or a luxurious transfer from the airport to a high-end hotel, the demand for luxury car rentals in these tourism hotspots continues to soar. The expanding tourism industry not only introduces rental companies to a diverse global audience but also allows them to showcase their fleet of prestigious vehicles to individuals who might not have considered such services in their home countries. This exposure broadens the market reach, attracting a steady influx of customers eager to enhance their travel experiences with the sophistication and comfort offered by luxury car rentals.

The growth in the tourism sector provides a thriving platform for the market. The increasing number of travelers seeking an exceptional and stylish way to explore unfamiliar territories contributes to the rising sales and sustained success of luxury car rentals in the dynamic landscape of the tourism industry.

What are the Recent Developments in the Luxury Car Rental Market

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In November 2023, Hertz partnered with EVgo Inc. to offer one year of special charging rates to drivers renting any EV model at a Hertz location across the country. EVgo is one of the leaders in charging solutions, building and operating the infrastructure and tools needed to expedite the mass adoption of electric vehicles for individual drivers, rideshare and commercial fleets, and businesses.

In February 2023, Sixt Luxury Cars opened a new rental car branch service for passengers arriving at Toronto Pearson International Airport (YYZ) to supply Canada's largest city with premium rental cars. It serves two markets in Canada, Vancouver andamp; Toronto, as it continues to expand its coverage throughout the Canadian market.

In August 2022, Enterprise Holdings Inc. partnered with GO Rentals to extend its global network. Furthermore, GO Rentals has secured the right to operate the Enterprise Rent-A-Car, National Car Rental, and Alamo Rent a Car brands in New Zealand. This strategy further helps in expansion in the New Zealand market, especially given the recent reopening of New Zealand to international travel.

In June 2022, Avis Australia expanded its business and started a new brand Avis Prestige. Avis Prestige enables customers to hire Sports Cars, Supercars, and Premium Luxury Cars, with models including the Lamborghini Huracan, Rolls-Royce Ghost, McLaren 57OS, Ferrari 488, Bentley Continental GT plus, and many more.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury car rental market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Luxury Car Rental Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 70.4 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 305 |

| By End-User |

|

| By Rental Type |

|

| By Booking Mode Type |

|

| By Region |

|

| Key Market Players | Paddock Rent a Car, Hertz Dream Collection, Sixt Luxury Cars, Europcar, DTG Operations, Inc. (Thrifty Car Rental), Enterprise Holdings Inc., Red Fox Luxury Lifestyle Ltd., Auto Europe, Avis Prestige, Budget Rent A Car System Inc. |

Expanding tourism industry and corporate partnerships and events are the upcoming trends of luxury car rental market in the world

Leisure by rental type holds more than half of global market share in luxury car rental market

North America is the largest regional market for luxury car rental.

The estimated industry size of luxury car rental is $ 70.4 Bn in 2032.

The market size of global luxury car rental market in 2022 was $ 30.3 Bn.

Loading Table Of Content...

Loading Research Methodology...