Luxury Hotel Market Research, 2034

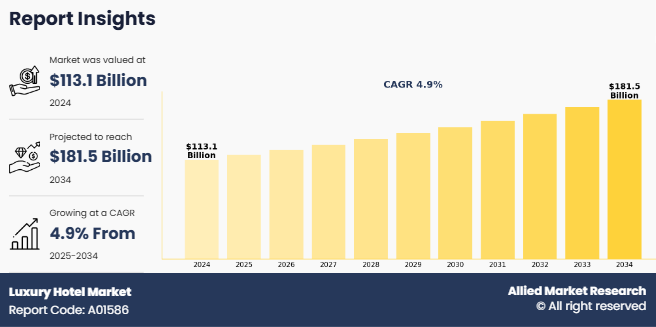

The global luxury hotel market size was valued at $113.1 billion in 2024 and is projected to reach $181.5 billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034. The luxury hotel market refers to the segment of the hospitality industry that provides top-tier accommodations, services, and experiences designed for affluent and discerning travelers. These hotels provide exclusivity, comfort, and exceptional service quality, offering premium amenities such as fine dining, personalized concierge services, spa and wellness centers, and bespoke guest experiences. Often located in prime urban areas, exotic destinations, or historic settings, luxury hotels aim to deliver memorable and immersive stays. The market is driven by high-net-worth individuals, a rise in tourism, and demand for unique, high-quality hospitality experiences that combine elegance, privacy, and personalized attention.

Market Dynamics

In today’s evolving hospitality sector, sustainability has moved beyond being a mere trend—it now defines what luxury truly means. Today's affluent travelers are highly conscious of their environmental footprint and actively seek out luxury hotels that align with their values. This shift has elevated eco-friendly practices from optional amenities to essential elements of premium offerings, which is expected to propel the growth of the luxury hotel industry. High-end hotels are now investing in green architecture, renewable energy sources, organic dining options, and zero-waste operations to appeal to this evolving consumer mindset. Features like rainwater harvesting, plastic-free rooms, and local sourcing of materials not only reduce operational impact but also enhance the storytelling and authenticity that guests crave. By positioning sustainability as a core part of the guest experience, luxury hotels are not only attracting a growing segment of environmentally aware travelers but also differentiating themselves in a competitive market. This value-driven approach helps build brand loyalty, justifies premium pricing, and supports long-term resilience in a sector where ethical luxury is becoming the new gold standard.

However, high operational costs significantly restrain the growth of the luxury hotel market by putting immense financial pressure on owners and operators. Unlike mid-scale or budget accommodation, luxury hotels require a higher level of service, premium materials, and constant innovation to meet the evolving expectations of affluent guests. From hiring and retaining skilled staff, including multilingual concierges and specialized chefs, to maintaining high-end amenities such as spas, fine dining restaurants, and smart-room technologies, the associated expenses are substantial. These costs are further compounded by the need to invest in sustainability practices and personalized guest experiences, which are now becoming non-negotiable in the premium segment. In regions with fluctuatingmakeism demand or economic uncertainty, the inability to maintain consistent occupancy rates makes it difficult to recover such overheads. As a result, profitability becomes highly sensitive to external disruptions, limiting expansion plans and deterring new entrants into the luxury segment. This financial burden makes it challenging for many operators to sustain long-term growth in an already competitive market.

Moreover, long-stay luxury living concepts are creating new growth opportunities in the luxury hotel market by catering to affluent travelers, digital nomads, and corporate clients seeking extended, premium accommodation. These offerings combine the elegance of high-end hotels with the comfort and privacy of upscale residences, often including kitchens, private workspaces, and wellness amenities. In addition, rising global mobility and flexible work trends have increased demand for long-stay options among high-net-worth individuals and executives on international assignments. In cities like Dubai, Singapore, and New York, luxury hotels are redesigning suites as hybrid living-working spaces, allowing them to maintain higher occupancy rates and attract long-term clientele. This segment offers recurring revenue and deeper brand loyalty in an otherwise seasonal market.

Segmental Overview

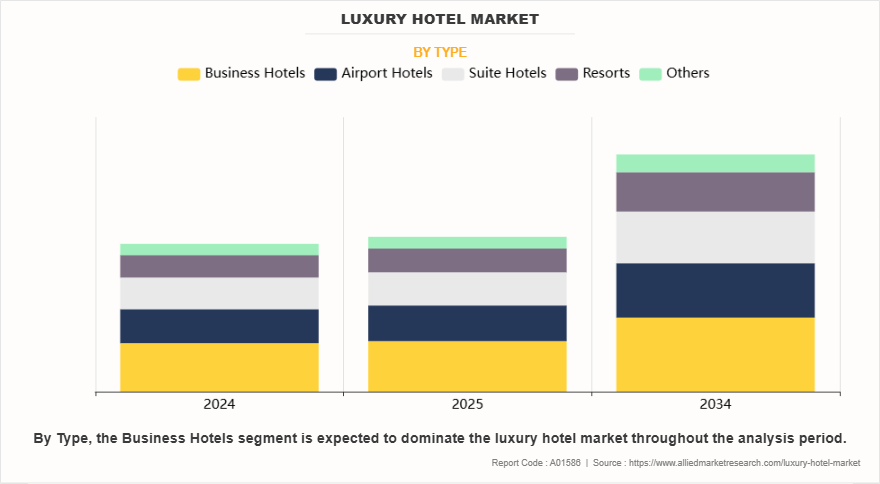

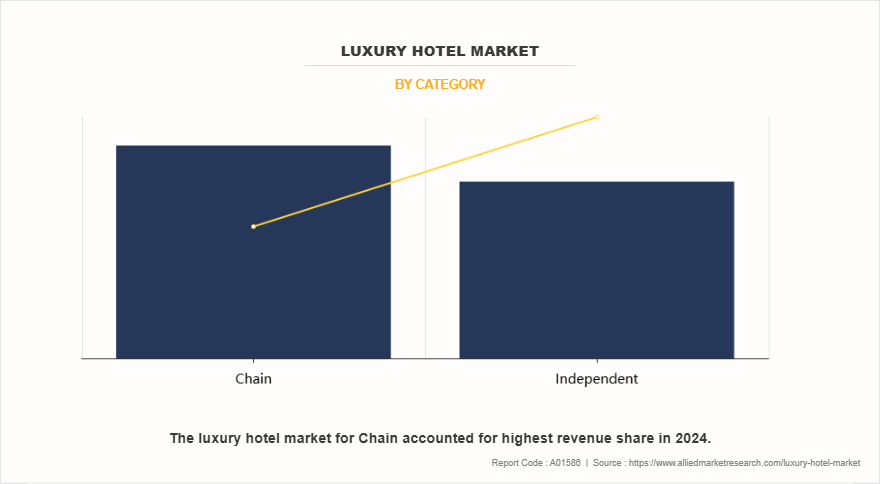

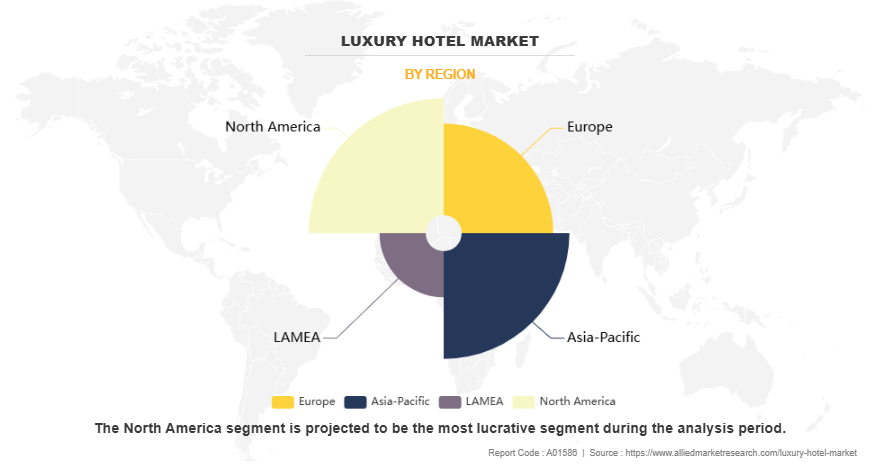

The luxury hotel market is segmented into type, category, and region. By type, the luxury hotel market is segmented into business hotels, airport hotels, suite hotels, resorts, and others. By category, the luxury hotel market is divided into chain hotels and independent hotels. By region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By Type

By type, the business hotels segment held the major luxury hotel market share in 2024. As companies resumed in-person meetings, conferences, and international trade interactions post-pandemic, the need for well-equipped, strategically located luxury hotels grew significantly. Business hotels typically offer features that cater to the specific needs of executives such as high-speed Wi-Fi, dedicated meeting rooms, express check-in/check-out, 24/7 concierge services, and proximity to major business districts and airports, which enhances convenience and productivity for corporate travelers. In addition, the expansion of global business hub,s especially in financial, technological, and industrial cities, has increased footfall in these properties. The rise of hybrid work models has also contributed, as professionals often seek “work-from-hotel” experiences that blend comfort and functionality. Luxury business hotels are capitalizing on this trend by offering quiet workspaces, wellness amenities, and flexible stay options, which is expected to boost the luxury hotel market growth.

By Category

By category, the chain segment dominated the luxury hotel market in 2024 and is anticipated to maintain its dominance during the forecast period. Chain hotels such as Marriott, Hilton, Hyatt, and Accor benefit from strong brand equity, standardized service offerings, and global loyalty programs that attract both business and leisure travelers. These hotels ensure consistency in quality, amenities, and guest experiences across locations, which builds trust and repeat business. Their financial strength allows them to invest heavily in modern technologies, such as mobile check-in/check-out, AI-driven customer service, and smart room features, enhancing operational efficiency and guest satisfaction.

Moreover, chain hotels are also at the forefront of adopting sustainable practices, including energy efficiency, waste reduction, and eco-friendly designs appealing to environmentally conscious travelers. Their ability to scale quickly in emerging markets through franchising and partnerships further expands their reach and influence. With effective marketing campaigns, global distribution systems, and data-driven personalization, chain hotels can effectively target a wide range of customer segments. These collective strengths reinforce the segment's continued dominance in the market during luxury hotel market forecast.

By Region

By region, the North America region segment dominated the luxury hotel market in 2024 and is anticipated to maintain its dominance during the forecast period. The U.S., in particular, drives regional growth with top-tier cities like New York, Los Angeles, Miami, and Chicago serving as global business, fashion, entertainment, and financial hubs. These urban centers attract a high volume of both international and domestic travelers, including affluent tourists and corporate clients.

North America is also a pioneer in integrating advanced technologies and innovations in hospitality, such as contactless services, voice-activated rooms, AI-based concierge systems, and personalized guest experiences. The region's luxury hotel brands consistently invest in upgrading property standards, wellness offerings, and sustainability measures to stay competitive. Additionally, a strong preference for premium travel experiences, combined with the region’s world-class airports, event venues, and scenic destinations, supports consistent occupancy in the luxury segment. With the recovery of travel post-COVID and increased demand for unique, high-end stays, North America remains a top choice for both luxury leisure and business travelers. These factors collectively contribute to its continued leadership in the global luxury hotel market.

Competition Analysis

Key players in the luxury hotel market report include Kempinski Hotels SA, InterContinental Hotels Group, Hyatt Corporation, The Indian Hotel Companies Limited, Jumeirah International LLC, Four Seasons Holdings Inc., ITC Hotels Limited, Jardine Matheson Holdings Ltd, Marriott International Inc., and Shangri-La International Hotel Management Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury hotel market analysis from 2024 to 2034 to identify the prevailing luxury hotel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luxury hotel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luxury hotel market trends, key players, market segments, application areas, and market growth strategies.

Luxury Hotel Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 181.5 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 267 |

| By Type |

|

| By Category |

|

| By Region |

|

| Key Market Players | JUMEIRAH INTERNATIONAL LLC, KEMPINSKI HOTEL SA, FOUR SEASONS HOLDINGS INC., ITC HOTELS LIMITED, Jardine Matheson Holdings Ltd., MARRIOTT INTERNATIONAL INC., HYATT CORPORATION, INTERCONTINENTAL HOTELS GROUP, SHANGRI-LA INTERNATIONAL HOTEL MANAGEMENT LTD, THE INDIAN HOTEL COMPANIES LIMITED |

Analyst Review

The luxury hotel market is undergoing a transformative shift driven by evolving consumer expectations, rapid technological advancements, and a renewed focus on experiential travel. From a CXO standpoint, one of the key perspectives shaping market growth is the increasing demand for personalization and immersive experiences. Today’s luxury travelers seek more than opulence they value authenticity, sustainability, and unique cultural engagements. Hotels that offer tailor-made services, wellness retreats, local culinary experiences, and eco conscious operations are attracting high-value guests. This shift is pushing executives to reevaluate brand positioning and diversify service offerings to create a more meaningful and lasting guest impact.

Another driving factor from a CXO viewpoint is the integration of technology across all levels of operations. Smart room automation, AI-driven concierge services, contactless check-in/out, and mobile key access are no longer optional—they're expected by tech-savvy luxury consumers. Digital transformation not only enhances guest satisfaction but also streamlines back-end efficiency, allowing luxury hotel operators to optimize costs and deliver high-quality service consistently. Furthermore, leveraging data analytics to anticipate guest preferences and personalize offerings helps build long-term loyalty. CXOs are increasingly investing in tech partnerships and internal innovation teams to stay ahead in this competitive space.

Moreover, geographic expansion and market diversification remain critical to sustaining long-term growth. North America and Europe have traditionally been strongholds, but emerging regions such as Asia-Pacific, the Middle East, and parts of Africa are now showing robust demand, driven by a rise in affluent population and increased tourism investments. Strategic expansion into these regions presents both opportunity and complexity, requiring in-depth market research, localization strategies, and strong brand adaptation. Additionally, partnerships with travel platforms, airlines, and high-end lifestyle brands are increasingly being leveraged to enhance visibility and cross-market services. The luxury hotel market holds immense growth potential, but capitalizing on it demands agile leadership, innovation, and a uest-centric mindset.

The global luxury hotel market was valued at $113.1 billion in 2024, and is projected to reach $181.5 billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034.

The luxury hotel market is segmented into type, category, and region. By type, the luxury hotel market is segmented into business hotels, airport hotels, suite hotels, resorts, and others. By category, the luxury hotel market is divided into chain hotels and independent hotels. By region, the market is segmented into the North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for luxury hotel

The key players profiled in the luxury hotel market report include Kempinski Hotels SA, InterContinental Hotels Group, Hyatt Corporation, The Indian Hotel Companies Limited, Jumeirah International LLC, Four Seasons Holdings Inc., ITC Hotels Limited, Jardine Matheson Holdings Ltd, Marriott International Inc., and Shangri-La International Hotel Management Ltd.

The global luxury hotel market report is available on request on the website of Allied Market Research.

The forecast period considered in the global luxury hotel market report is from 2025 to 2034. The report analyzes the market sizes from 2024 to 2034 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Loading Table Of Content...

Loading Research Methodology...