Luxury Yacht Market Research, 2031

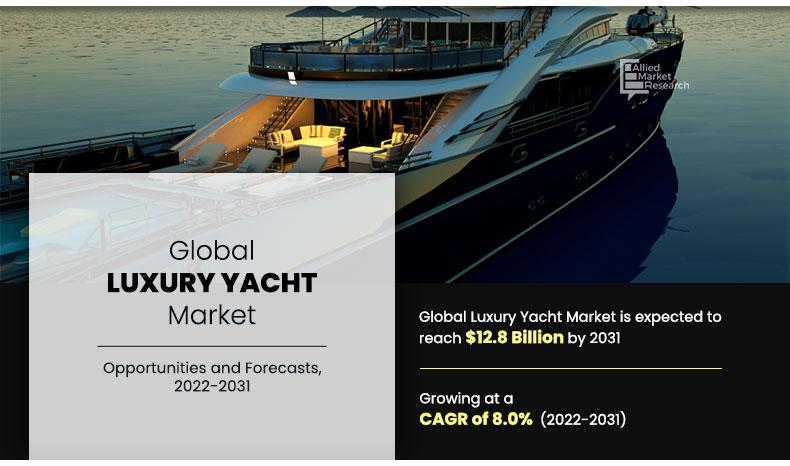

The luxury yacht market size was valued at $5.8 billion in 2020 and is expected to reach $12.8 billion by 2031, registering a CAGR of 8.0% from 2022 to 2031.Luxury yachts are large, luxurious, professionally crewed motors or sailing yachts with length varying from 75 feets and expanding to more than 250 feet. Luxury yachts are often available for chartered providing as well as private purpose to provide seamless luxury experience full of high standard and comfort. Traditionally manufactured using woods, fiber reinforced polymers and composites gain huge popularity in the last few years. Demand for luxury yachts have increased steadily in the last few years. This can be attributed to change in lifestyle of people fueled by growth in high net worth individuals, rise in inclination toward recreational and leisure activities, and surge in trend of yacht tourism.

The 75-120 feet segment dominated the overall luxury yacht market share in 2017 and is expected to remain dominant during the forecast period. Improved design, style, comfort, livability, technological innovations, and performance drive the growth of the global market for 75-120 feet luxury yacht. Furthermore, excellent optimization of both interior and exterior spaces result in high consumer preference toward this segment.

Motor yacht is a broad term that encompasses a number of styles, including fly bridge, aft cabin, Sedan Bridge, large express-style, and yachts pilothouse. The motor yacht segment is expected to exhibit robust growth rate in the luxury yacht market during the forecast period. The growth of this segment is mainly attributed to more on board facilities, more room space and more opportunities for recreational activities.

By Size

The120-250 feet segment dominates the Global Luxury Lacht Market and is expected to retain its dominance throughout the forecast period.

It is evident from reviewing recent technology advances that material development plays a key role in the production of yachts hull. Selection of material for yacht construction depends on different parameters such as strength to weight ratio, size, stiffness, and payload. Thus, material selection holds importance during yacht manufacturing. FRP materials offer tremendous potential for applications in a marine environment. Fiber reinforced plastic is the most preferred material by the yacht manufacturers owing to its numerous advantages. FRP is light weight, which enables increased speed, increased payload, and reduction of fuel consumption. Furthermore, FRP has low stiffness and high corrosion resistance thus providing necessary flexibility during yacht construction.

The report focuses on the growth prospects, restraints, and opportunities of the global luxury yacht market. The study provides Porters five forces analysis to understand the impact of various factors such as competitive intensity of competitors, bargaining power of suppliers, threat of substitutes, threat of new entrants, and bargaining power of buyers of the luxury yacht market.

By Type

The Motorized Luxury Yacht segment dominates the global Luxury Lacht market and is expected to retain its dominance throughout the forecast period.

Segment Review

The global luxury yacht market is segmented based on size, type, and material. Based on size, the luxury yacht market is segmented into 75-120 feet, 121-250 feet, and above 250 feet. Based on type, the market is divided into sailing luxury yacht, motorized luxury yacht, and others. Based on material, the market is analyzed across FRP/composites, metal/alloys, and others. Based on region, the market is studied across Americas, Europe, Asia-Pacific, and Middle East & Africa.

Some of the key players in the luxury yacht market are Alexander Marine Co Ltd, Damen Shipyards Group, AzimutBenettiS.p.A., Feadship, FERRETTI S.P.A., Horizon Yacht USA, Princess Yachts International plc, Sanlorenzo Spa, Sunseeker International Limited, and Viking Yacht Company.

By Hull Material

The FRP& Composites segment dominates the global Luxury Lacht market and is expected to retain its dominance throughout the forecast period.

Current and future luxury yacht industry trends are outlined to determine the overall attractiveness of the luxury yacht market. Top impacting factors highlight opportunities during the forecast period. Factors such as growth in high net worth individuals and yacht tourism drive the growth of the luxury yacht market. In addition, chartering of yachts is also one of the major factors that fuels the growth of the global luxury yacht market. However, stringent government regulations and environmental policies along with increase in maintenance and associated cost are some of the major factors that might hamper the growth of the luxury yacht market.

Italy is the leading producer of luxury yacht followed by UK, U.S., the Netherlands, Taiwan, and others. The Italian industry holds the overall global leadership position in the luxury yacht segment with total production amounting to more than 42% of the global production for 2020. In the last decade, because of reduced domestic demand, Italian shipbuilders focus on international and emerging markets where Italian brands are well received. Favorable government initiatives such as lower mooring and marine resort taxes, reform of the maritime code, and measures for easy leasing augment market expansion in the region. Furthermore, continuous focus on trade and internationalization through commercial strategies and strategic alliances by leading domestic manufacturers such as AzimutBenetti, Sanlorenzo and Ferretti have ensured Italy to remain hub for luxury yacht manufacturing in the region. On the other hand, Taiwan is emerging as promising region for yacht manufacturing in Asia Pacific region. With steady growth in revenue as well average yacht length Taiwan has gained attention from around the world for its cheap but high-quality luxury yachts.

By Region

The Europe region dominates the global Luxury Lacht market and is expected to retain its dominance throughout the forecast period.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the Luxury Yacht market trends, estimations, and dynamics of the seeds market size from 2020 to 2030 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing Luxury Yacht market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the Luxury Yacht market.

- The market player positioning analysis facilitates benchmarking and provides a clear understanding of the present position of the market players in the Luxury Yacht industry.

Luxury Yacht Market Report Highlights

| Aspects | Details |

| By Hull Material |

|

| By Type |

|

| By Region |

|

| By SIZE |

|

| By Key Market Players |

|

Analyst Review

In accordance to several interviews conducted, the CXOs of the leading companies stated that luxury yacht market is expected to witness a significant growth in the future. In addition, global luxury yacht market is expected to remain influenced by eternal need for luxury. Moreover, rise in trend of remote exploration provides new growth avenues for luxury yachts. Furthermore, introduction of new materials such as structural glass have allowed yacht architectures to reach new levels of sophistication.

Growth in number of millionaires and swathes of millennial population have developed a voracious taste for luxury yachts in the past few years. Featuring helipads, swimming pools, saunas, hot tubs, and more, yachts are epitome of luxury. The new generation increasingly focuses on pursuing rare, tailored experiences over accumulating things. With on-board beach toys, such as motorboats & jet skis, top-deck Jacuzzi, lavish swimming pools, and private screening rooms, yachts represent pinnacle of luxurious life.

The luxury yacht market remained one of the few bright spots in an otherwise troubled global economy. With strong underlying drivers such as rise in ultra-net worth individuals, surge in inclination toward recreational & expeditions, and rise in trend of yacht tourism, the market is expected to witness significant growth during the forecast period. At the same time, the sector is facing challenges driven by high maintenance cost, stringent rules and regulations, and rapid technological innovation.

The luxury yacht market size was valued at $5.8 billion in 2020 and is expected to reach $12.8 billion by 2031

The global Luxury Yacht market is projected to grow at a compound annual growth rate of 8.0% from 2022 to 2031, $12.8 billion by 2031

The top companies in the Luxury Yacht market are Alexander Marine Co Ltd, Damen Shipyards Group, Azimut Benetti S.p.A., Feadship, FERRETTI S.P.A., Horizon Yacht USA, Princess Yachts International plc, Sanlorenzo Spa, Sunseeker International Limited, and Viking Yacht Company.

The European region will dominate the market by the end of 2031.

Growth in high-net-worth individuals and yacht tourism drive the growth of the luxury yacht

Loading Table Of Content...