Lyocell Market Research, 2034

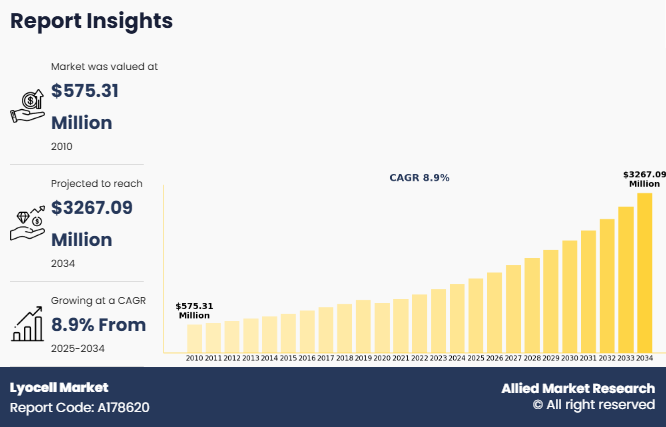

The global lyocell market size was valued at $575.3 million in 2010, and is projected to reach $3,267.1 million by 2034, growing at a CAGR of 8.9% from 2025 to 2034.

Introduction

Lyocell is a form of regenerated cellulose fiber that is primarily derived from the wood pulp of trees like eucalyptus, beech, and spruce. Lyocell is known for its eco-friendly production process and impressive performance characteristics. It belongs to the rayon family but stands out due to its sustainable manufacturing method. Lyocell is produced using a closed-loop process where more than 99% of the solvents used typically N-Methylmorpholine N-oxide (NMMO) are recovered and reused. This process significantly minimizes environmental impact and toxic emissions.

Lyocell is most widely known for its use in the textile and fashion industry. It is commonly used in garments that prioritize both comfort and long-lasting durability due to its soft texture, exceptional moisture-wicking properties, and high breathability. Clothing made from lyocell includes casual wear such as T-shirts, dresses, blouses, skirts, and denim jeans. It is particularly popular in activewear and loungewear due to its ability to keep the skin dry and comfortable. Brands like Levi’s, Patagonia, and H&M have integrated lyocell into their collections, thus highlighting its growing market appeal.

Key Takeaways

- The lyocell market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global lyocell industry and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the lyocell market are Sateri, Yibin Grace Group Co.,Ltd, Hyosung Advanced Materials, Asia Pacific Rayon Limited, Tangshan Sanyou Xingda Chemical Fiber CO., Ltd., Baoding swan Fiber Co., Ltd., Marchi and Fildi Group, Tintex Textiles, FORMOSA TAFFETA CO., LTD, Aditya Birla Yarn, Lenzing AG, and AceGreen Eco-Material Technology Co., Ltd. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the lyocell market share.

Market Dynamics

Growth of fast fashion and premium fashion brands is expected to drive the lyocell market growth. The rising demand for sustainable fashion driven largely by Millennials and Gen Z—has accelerated the adoption of eco-friendly fabrics like Lyocell across both fast fashion and premium segments. Consumers increasingly seek transparency, ethical sourcing, and environmentally responsible materials. In response, fast fashion brands are introducing eco-conscious lines using Lyocell, valued for its biodegradability, closed-loop production, and renewable wood pulp origins. For example, in April 2023, Zara launched a circular capsule collection in partnership with Circ, using lyocell-like fibers made from recycled polycotton waste. Luxury brands are also embracing Lyocell for its premium qualities such as smooth texture, sheen, and excellent drape—making it a sustainable yet high-performance alternative to silk and fine cotton. Reflecting this trend, Lenzing’s sales of TENCEL™ Luxe filament yarn surged fivefold in July 2022, prompting a planned 25% capacity expansion to meet growing demand in the luxury and eco-couture market.

However, volatility in raw material (pulp) prices is expected to hinder the growth of the lyocell market. Volatility in raw material (pulp) prices is a significant restraint in the production and cost stability of lyocell, which is directly affecting the profitability and operational planning of manufacturers. Lyocell is made from dissolving wood pulp, primarily sourced from sustainably managed forests. However, the prices of this key raw material are subject to frequent fluctuations due to a combination of global supply-demand dynamics, environmental policies, and market disruptions. The production process is capital-intensive, requiring advanced closed-loop systems and specialized solvent recycling technologies. This complexity already makes lyocell more expensive than conventional fibers like cotton or polyester, with lyocell fibers often priced 30–40% higher than alternatives. When the price of wood pulp fluctuates such as the 15% increase observed in 2022, manufacturers experience significant cost pressures, which can erode profit margins and limit the ability to offer competitive pricing.

Segments Analysis

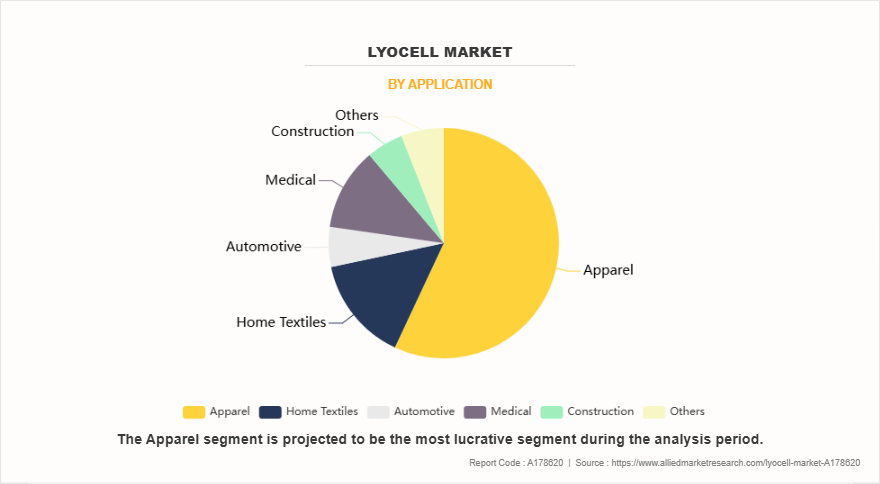

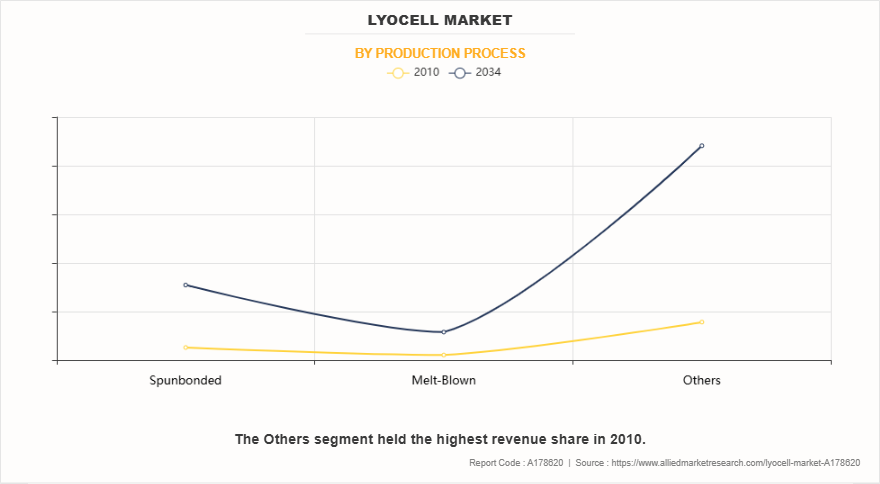

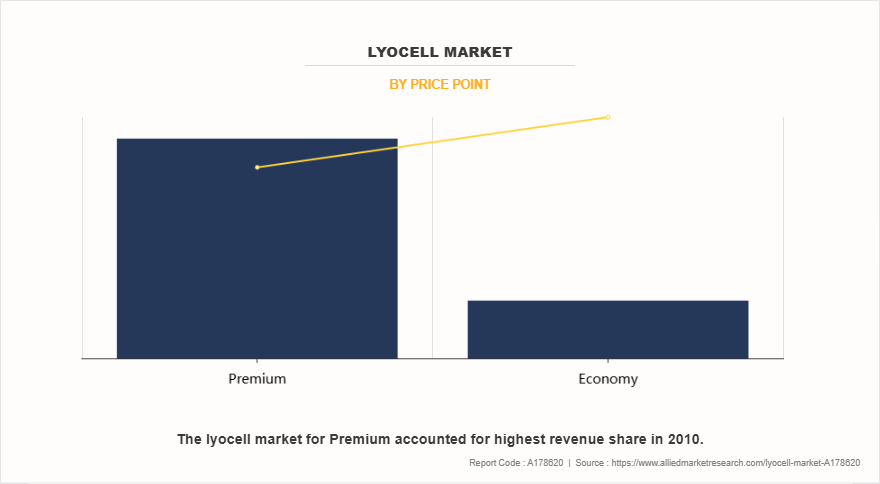

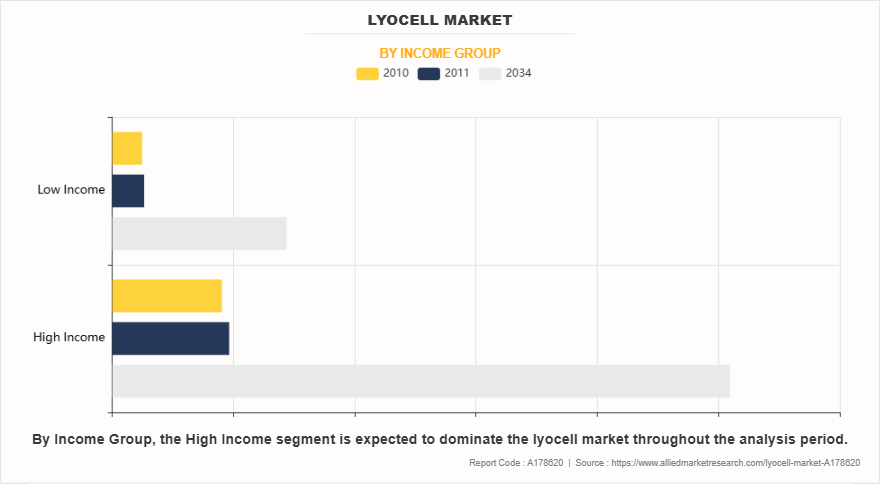

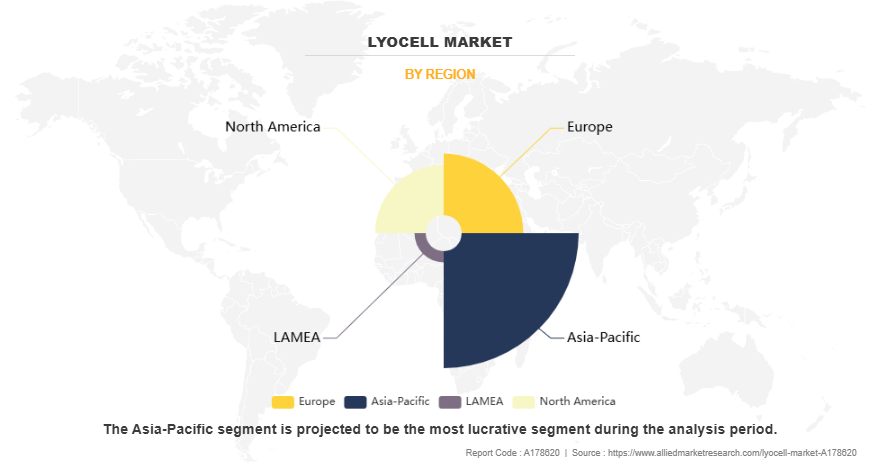

The lyocell market is segmented into application, sales channel, production process, price point, income group, and region. On the basis of application, the market is divided into apparel, home textiles, automotive, medical, construction, and others. On the basis of sales channel, the market is classified into online and offline. On the basis of production process, the market is classified into spunbonded, melt-blown, and others. On the basis of price point, the market is bifurcated into premium, and economy. On the basis of income group, the lyocell market is divided into high income, and low income. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the apparel segment dominated the market, accounting for more than half of the market share in 2024. Fashion designers and apparel manufacturers are increasingly turning to lyocell as a sustainable alternative to conventional fibers. The material’s versatility allows it to mimic the aesthetics of silk, cotton, or wool, enabling creative flexibility while aligning with the growing consumer demand for sustainable and ethical fashion. In March 2025, NIKE, Inc. partnered with TOGETHXR Inc. to launch the Everyone Watches Women’s Sports apparel collection. The collection features T-shirts, hoodies, and caps and reinforces NIKE's commitment to encourage sports for women through innovation, investment, improved visibility, and inspiration

On the basis of sales channel, the offline segment dominated the market in 2024. Offline retail supports brand storytelling and education regarding lyocell’s sustainable properties. Through in-store displays, promotional material, and trained sales staff, retailers can communicate lyocell’s environmental benefits, such as its low water usage, closed-loop production process, and biodegradability. This direct interaction with consumers helps build trust and enhances product value in the eyes of environmentally aware shoppers.

On the basis of the production process, the spunbonded segment was the most lucrative segment in the market in 2024. The integration of lyocell into spunbonded fabrics is particularly significant in hygiene and personal care sectors. Here, lyocell imparts a soft, cloth-like feel, high absorbency, and skin-friendliness, making it ideal for applications such as baby wipes, feminine hygiene products, and adult incontinence items. Moreover, in medical textiles, lyocell-based spunbonded fabrics are gaining attention due to their purity, reduced chemical reactivity, and reduced risk of skin irritation.

On the basis of the price point, premium segment was the highest revenue contributor in the market in 2024. In premium fashion, lyocell is appreciated for its smooth, silky texture and natural sheen, which are comparable to silk and high-grade cotton. These qualities make it ideal for use in high-end shirts, dresses, suits, and intimate wear. Its draping capabilities and moisture-wicking properties add to its appeal, especially in luxury activewear and loungewear, where both aesthetics and functionality are key selling points. The fiber's ability to hold dye well also contributes to rich, vibrant colors in premium garments, further justifying a higher price tag.

On the basis of income group, the high income segment dominated the lyocell market in 2024. High-income consumers are increasingly steering their fashion choices toward sustainability, often opting for materials that offer transparency in sourcing and production. Lyocell is marketed as a low-impact textile, produced in a closed-loop process where non-toxic solvents are reused, thus reducing chemical waste. As a result, brands targeting affluent demographics are integrating lyocell into their product lines to satisfy the rising demand for eco-luxury. This trend is evident in upscale brands such as Stella McCartney, Eileen Fisher, and Hugo Boss, which have embraced Lyocell in their collections. Moreover, as these consumers are willing to pay a premium for clothing that combines comfort, elegance, and sustainability, lyocell garments are positioned in higher price brackets, thereby reinforcing their appeal in wealthier markets.

Based on region, Asia-Pacific was the highest revenue contributor in the battery recycling market in 2024. In the Asia-Pacific region, lyocell fiber has seen significant growth due to increasing environmental awareness, evolving fashion trends, and government support for sustainable textile practices. China, as a global textile manufacturing hub, leads the regional lyocell market. Major producers like Lenzing AG and Sateri, have expanded production facilities in the country, and are supported by the rising domestic demand for sustainable apparel. The Chinese government’s policies promoting green manufacturing and its “dual carbon” goals (carbon peak by 2030 and carbon neutrality by 2060) are further accelerating lyocell’s adoption in both domestic and export-oriented garment production.

Competitive Analysis

The major prominent players operating in the lyocell market include Sateri, Yibin Grace Group Co.,Ltd, Hyosung Advanced Materials, Asia Pacific Rayon Limited, Tangshan Sanyou Xingda Chemical Fiber CO., Ltd., Baoding swan Fiber Co., Ltd., Marchi and Fildi Group, Tintex Textiles, FORMOSA TAFFETA CO., LTD, Aditya Birla Yarn, Lenzing AG, and AceGreen Eco-Material Technology Co., Ltd.

In March 2022, Lenzing AG inaugurated a 100,000‐‘ton/year lyocell facility near Bangkok, Thailand—boosting its TENCEL capacity and supporting its sustainability-focused sCore TEN strategy.

On July 1, 2022, Sateri introduced three carbon‐‘neutral lyocell lines—EcoCosy, FINEX, and Lyocell—targeting both environmental and performance credentials.

Recent Key Developments in the Lyocell Market

In October 2024, U.S.-based Circ inked an agreement with Aditya Birla’s Birla Cellulose to supply at least 5,000 tons of lyocell pulp annually from a commercial plant.

In March 2025, Spain's Xunta de Galicia approved Project GAMA, a joint venture by Altri and Greenfiber, to establish Europe’s first fully integrated lyocell production facility in Galicia. Powered by biomethane and featuring on-site processing, the plant aims to cut 5.3 million tons of COâ‚‚ emissions over a decade. It is expected to generate around 2,500 jobs during construction and operations. With a planned annual capacity of approximately 60,000 tons starting in 2028, the project will reduce Europe’s dependence on lyocell imports from Asia.

Trump’s Tariff Impact on Lyocell Market

According to Richmond Fed, average effective tariffs on apparel and textile imports climbed from ~7% to ~10–18% in early 2025, with raw textile inputs notably impacted. Even with lyocell itself untaxed, its blending and processing partners faced higher costs for other inputs. Tariff increases on Bangladesh (35%) and the U.S. swing away from China have driven an 8% rally in stocks of Indian manufacturers like Gokaldas Exports and Vardhman, hinting at shifting buying patterns.

Major U.S. fashion brands such as Nike, Gap, and Ralph Lauren have warned of “existential threats” from tariffs as high as 49%, and have begun passing costs to consumers to protect margins.

Aditya Birla’s Grasim Industries, another major lyocell producer, shifted focus to developing multi-fiber blends within India and Southeast Asia, capitalizing on India’s favored trade status with the U.S. post-2024 tariff restructuring. The firm’s 2024 Annual Report noted a 12% increase in lyocell yarn exports to the U.S., directly linked to increased cost competitiveness over tariff-laden Chinese viscose exports.

Sateri Holdings (China) faced dual pressure: from U.S. tariffs on viscose and restrictions tied to Xinjiang-origin cotton. Although lyocell itself wasn’t directly impacted, U.S. buyers significantly reduced exposure to Chinese suppliers by late 2023. As per a Textile Exchange 2024 study, Sateri’s U.S. export volume declined by over 30% between 2022 and 2024, prompting the company to pursue joint ventures in Vietnam and Indonesia.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lyocell market analysis from 2010 to 2034 to identify the prevailing lyocell market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the lyocell industry.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lyocell market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lyocell market trends, key players, market segments, application areas, and market growth strategies.

Lyocell Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.3 billion |

| Growth Rate | CAGR of 8.9% |

| Forecast period | 2010 - 2034 |

| Report Pages | 576 |

| By Price Point |

|

| By Sales channel |

|

| By Income Group |

|

| By Production Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sateri, Asia Pacific Rayon Limited, Yibin Grace Group Co., Ltd., Baoding swan Fiber Co., Ltd., Aditya Birla Yarn, Hyosung Innovative Materials Co. Ltd., Marchi and Fildi Group, Lenzing AG, FORMOSA TAFFETA CO., LTD., AceGreen Eco-Material Technology Co., Ltd., Tangshan Sanyou Xingda Chemical Fiber Co., Ltd., Tintex Textiles |

Analyst Review

According to the opinions of various CXOs of leading companies, strong demand in hygiene & medical sectors is expected to drive the growth of lyocell market. Strong demand in the hygiene and medical sectors is a major driver for the growth of lyocell, owing to its exceptional softness, high absorbency, breathability, and skin-friendly properties. As a naturally derived, biodegradable fiber produced from wood pulp in a closed-loop process, Lyocell offers a safer, more sustainable alternative to synthetic materials often used in disposable hygiene products and medical textiles. One of Lyocell’s standout features is its smooth surface and gentle texture, which minimizes skin irritation and makes it highly suitable for sensitive skin. This is particularly important in medical and personal care products that come in direct contact with the body for extended periods. In comparison to synthetic fibers like polypropylene or polyester, lyocell is naturally breathable and helps regulate moisture, thereby reducing the risk of skin rashes, infections, or discomfort, which are important considerations in hospitals, elderly care facilities, and baby care. In November 2023, Sateri launched a crosslinked lyocell variant specifically designed for nonwoven applications such as medical wipes and personal care products. This advanced material offers improved moisture management and enhanced biodegradability. The innovation has gained significant traction, with adoption by over 30 manufacturers across the Asia-Pacific region.

However, competition from other sustainable fibers is expected to hamper the growth of the lyocell market. Competition from other sustainable fibers such as organic cotton, bamboo, and hemp presents a considerable challenge to the wider adoption of lyocell in the global textile and apparel industry. While Lyocell is praised for its environmental credentials, such as biodegradability, closed-loop manufacturing, and renewable wood pulp sourcing, several other fibers offer similar sustainability advantages and are often more established in both production and consumer awareness. These alternative fibers have carved out strong positions in the sustainable fashion market, making it more difficult for lyocell to differentiate itself or capture significant market share in certain applications.

The major prominent players operating in the Lyocell market include Sateri, Yibin Grace Group Co.,Ltd, Hyosung Advanced Materials, Asia Pacific Rayon Limited, Tangshan Sanyou Xingda Chemical Fiber CO.,Ltd, Baoding swan Fiber Co., Ltd., Marchi and Fildi Group, Tintex Textiles, FORMOSA TAFFETA CO., LTD, Aditya Birla Yarn, Lenzing AG, and AceGreen Eco-Material Technology Co., Ltd.

The global lyocell market was valued at $575.3 million in 2010, and is projected to reach $3,267.1 million by 2034, growing at a CAGR of 8.9% from 2025 to 2034.

Asia-Pacific is the largest region for the Lyocell market.

Apparel is the leading application of lyocell market.

Expansion of blending with recycled fibers are the upcoming trends of lyocell market in the globe

Loading Table Of Content...

Loading Research Methodology...