Machine Learning In Banking Market Research, 2031

The global machine learning in banking market size was valued at $1.33 billion in 2021, and is projected to reach $21.27 billion by 2031, growing at a CAGR of 32.2% from 2022 to 2031.

Machine learning (ML) has proven to be a success in the banking sector as it provides a massive boost to security. Banking in cyber security comes in the form of chatbots, which convert frequently asked questions into simulated conversations. In addition, they can reset forgotten passwords or grant additional access where necessary. Moreover, customer service is one of the most prominent areas of the banking sector that has been improved by ML. Increase in sophistication of ML has resulted in chatbots, virtual helpers, and ML interfaces that can reliably interact with customers. The ability to answer basic queries offers massive potential in reducing front office and helpline costs.

Productivity of banks has improved owing to adoption of ML as ML reduces the overall costs of the banks and financial institutions. Moreover, faster banking operations using ML facilitate quicker responses and results to the organizations. In addition, effective risk assessment through machine learning in financial industry and efficient customer service boost the growth of the market across the globe. However, factors such as higher cost of implementation of ML technology and risk of unemployment owing to adoption of ML are limiting the growth of the market. On the contrary, technological advancements in ML technology are expected to provide major machine learning in banking market opportunity in the upcoming years.

The machine learning in banking market is segmented on the basis of component, enterprise size, application, and region. Depending on component, the market is segregated into solution and service. On the basis of enterprise size, it is fragmented into large enterprises and small & medium-sized enterprises (SMEs). As per application, the market is divided into credit scoring, risk management compliance & security, payments & transactions, customer service, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

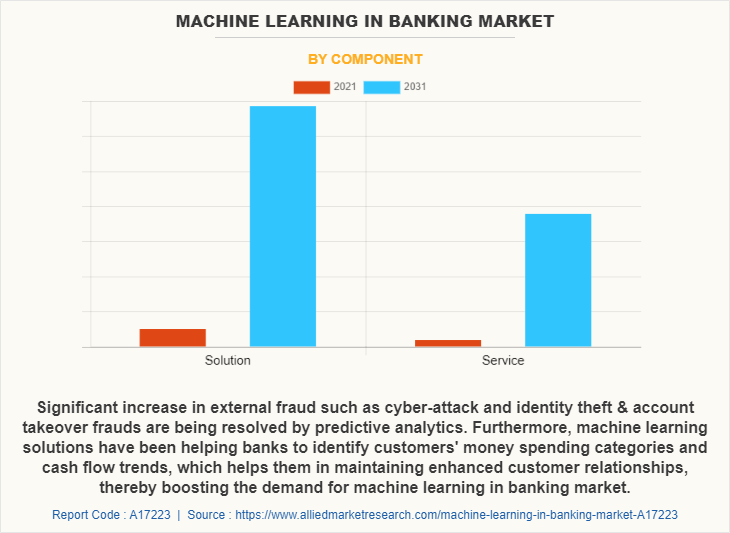

On the basis of component, the solution segment attained the highest growth in 2021. This is attributed to the fact that most of the organizations have started adopting AI and advance ML algorithms to manage the massive volume of data being generated for meaningful insights and better-informed decisions. Moreover, companies majorly focus on creating novel opportunities for growth and revenue generation, thereby increasing the preference for advance ML algorithms across industries. Furthermore, key players of the market are adopting numerous strategies such as product development to improve their product portfolio, which is expected to drive the growth of the market.

Region wise, North America attained the highest growth in 2021. This is owing to growing pressure in managing risk along with increasing governance and regulatory requirements to improve personalized banking and to provide better customer service. In addition, rapid digitization in financial firms all across the region and adoption of machine learning in financial industry to monitor data for unusual transactions to detect and prevent fraudulent activities and keep end users accounts secure drive the growth of the machine learning in banking industry.

The report focuses on growth prospects, restraints, and trends of the ML in banking market analysis. The study provides the Porter’s five forces analysis to understand the impact of various factors on the market, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the ML in banking market.

The report includes the profiles of key players operating in the machine learning in banking market analysis such as Affirm, Inc., Amazon Web Services, Inc., BigML, Inc., Cisco Systems, Inc., FICO, Google LLC, Mindtree Ltd., Microsoft Corporation, SAP SE, and SPD-Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the machine learning in banking industry.

COVID-19 impact analysis

The COVID-19 pandemic had a positive impact on the machine learning in banking market overview, since most of the banks have adopted technologies such as ML which is helping the banking sector since the onset of the COVID-19 economic crisis by making both credit repair and credit monitoring faster and more accurate. From process automation to using biometric identification to reduce credit fraud, ML is fueling improvements that deliver better results for consumers. In addition, it is helping machine learning in banking sector leaders operate more efficiently and profitably. Moreover, many banks have experienced a surge in demand as working practices and customer banking habits changed during the COVID-19 era. The advent of ML-based financial services has created faster, more efficient, and cheaper banking compared to traditional financial services. Thus, the COVID-19 pandemic had a positive impact on the machine learning in banking sector.

Top impacting factors

Improved productivity of banks owing to adoption of ML

ML can readily perform routine operations, freeing up managers' time to focus on more complex problems rather than paperwork. In addition, greater earnings can be generated as a result of automation throughout the company. Furthermore, the requirement for less workforce owing to automated activities reduces the overall costs of the banks and financial institutions. Moreover, faster banking operations using ML provides quicker responses and results to the organizations. Furthermore, the accuracy and precision of machine learning in banking sector have increased system productivity and dependability. Thus, the improved productivity of banks owing to adoption of ML is fueling the growth of the market.

High costs of implementation of ML technology

The complexity of technology that is involved in developing AI-based machines, computers, and other devices implies huge expenditures. Additionally, the costs such as repair and maintenance can easily exceed tens and thousands of dollars. Furthermore, the acquisition of software costs around $200 million. These costs cannot be incurred by small banks and financial institutions. Thus, high cost of implementation of ML technology is restraining the machine learning in banking market growth.

Key benefits for stakeholders

- This report provides a quantitative analysis of market segments, current trends, estimations, and dynamics of the machine learning in banking market share from 2021 to 2031 to identify the prevailing market opportunities.

- In-depth analysis of the machine learning in banking market forecast segmentation assists to determine the prevailing machine learning in banking market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global machine learning in banking market trends, key players, market segments, application areas, and market growth strategies.

Machine Learning in Banking Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cisco Systems, Inc., Big ML, Inc., Affirm, Inc., Mindtree, Amazon Web Services, Inc., Microsoft, Google LLC, SPD-Group, SAP SE, FICO |

Analyst Review

Adoption of machine learning (ML) in banking solutions has increased over the years to help organizations monitor production processes and to provide enhanced customer services. In addition, ML in banking technology is being used across a number of applications to help drive productivity, improve efficiency, and save people time & organizational funds. Furthermore, ML in banking tools is used to clean data sets, give predictions, improve decision-making, and respond to customer service needs, which are expected to fuel the market growth. Moreover, surge in adoption of cloud as well as mobile applications is expected to drive the growth of the market.

Financial institutes are collaborating with ML companies to enhance their existing systems for better and secure systems. For instance, in August 2021, RBL Bank partnered with Amazon Web Services (AWS) to strengthen its ML-powered banking solutions and drive digital transformation at the bank, adding significant value to the bank’s innovative offerings, saving costs, and tightening risk controls. In addition, it is leveraging Amazon Textract, a machine learning service, that automatically extracts text, handwriting, and data from scanned documents, across the bank’s risk and operations divisions to analyze documents such as financial statements, stock statements, and stock audit reports to predict default risk. Moreover, many open banking platforms are leveraging solutions from financial technology providers to improve their management technology. Some of the key players profiled in the report include Affirm, Inc., Amazon Web Services, Inc., BigML, Inc., Cisco Systems, Inc., FICO, Google LLC, Mindtree Ltd., Microsoft Corporation, SAP SE, and SPD-Group. These players have adopted various strategies such as product development to increase their market penetration and strengthen their position in the industry.

Faster banking operations using ML facilitate quicker responses & results to the organizations and technological advancements in ML technology are the major trends in the market.

On the basis of component, the solution segment attained the highest growth in 2021. This is attributed to the fact that most of the organizations have started adopting AI and advance ML algorithms to manage the massive volume of data being generated for meaningful insights and better-informed decisions. Moreover, companies majorly focus on creating novel opportunities for growth and revenue generation, thereby increasing the preference for advance ML algorithms across industries. Furthermore, key players of the market are adopting numerous strategies such as product development to improve their product portfolio, which is expected to drive the growth of the market.

Region wise, North America attained the highest growth in 2021. This is owing to growing pressure in managing risk along with increasing governance and regulatory requirements to improve personalized banking and to provide better customer service. In addition, rapid digitization in financial firms all across the region and adoption of machine learning in financial industry to monitor data for unusual transactions to detect and prevent fraudulent activities and keep end users accounts secure drive the growth of the market.

The global machine learning in banking market size was valued at $1,325.67 million in 2021, and is projected to reach $21,270.46 million by 2031, growing at a CAGR of 32.2% from 2022 to 2031.

Affirm, Inc., Amazon Web Services, Inc., Google LLC, Mindtree Ltd., and Microsoft hold the major share in machine learning in banking market.

Loading Table Of Content...