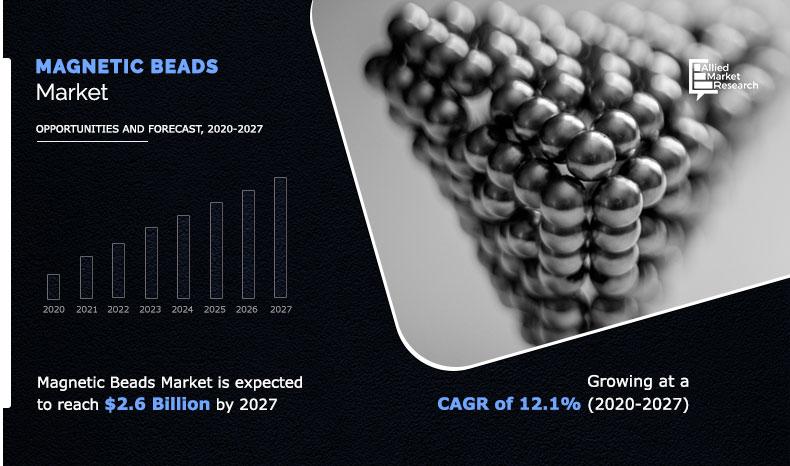

Magnetic Beads Market Outlook -2027

The global magnetic beads market forecast was valued at $1.1 billion in 2019, and is projected to reach $2.6 billion by 2027, growing at a CAGR of 12.1% from 2020 to 2027.

Magnetic bead, is a tool that rotates and generates stirring action when immersed in appropriate liquid. It is incorporated for effective separation of micrometer-sized para-ferromagnetic and ferromagnetic particles from chemical or biological suspensions. In addition, magnetic beads are used for extraction of DNA and RNA as well as for co-extraction of DNA and RNA from sputum. Magnetic beads embedded with magnetic nanoparticles in a suitable matrix are used in diagnosis and therapeutic application in the medical sector. Moreover, they are used for purification of cells, protein, nucleic acid, and other molecules in proficient and precise manner. Magnetic beads are available in different sizes, chemical composition, and shapes depending upon type of application. They are widely adopted for bio-separation process by coating them with specific ligands for targeting molecule and cell.

The growth of the global magnetic beads market is majorly driven by surge in adoption of magnetic beads in life science applications, including molecular biology, immunoassays, and medical applications. In addition, alarming rise in acute respiratory infections (ARIs) is increasing the susceptibility of developing severe diseases, such as pneumonia. Pneumonia, in turn, leads to high morbidity and mortality rates among children. Thus, development of effective way for diagnosis and providing timely treatment has increased the burden on healthcare system. Nucleic acid amplification is widely adopted diagnosis method for detection of respiratory tract infections and ARIs. Recently, magnetic beads are used for nucleic acid amplification, which, in turn, has reduced the mortality rate due to ARI. Hence, the global magnetic beads market size is expected to witness steady growth during the forecast period. However, protein and cellular purification is a time-consuming process and requires additional accelerators such as addition of fine particles, which incur extra cost, thereby hampering the growth of global magnetic beads market. On the contrary, increase in need for improved medical care at reduced cost is anticipated to offer lucrative opportunity for the expansion of the global market during the forecast period. Coupled with aging population and reduction of in vitro diagnostic (IVD) cost, key players in the medical sector are adopting magnetic beads as an alternative choice for diagnosis. This factor is further expected to act as a potential opportunity for the global magnetic beads market growth.

The global magnetic beads market analysis is done based on magnetic core, size, application, and region. Depending on magnetic core, the market is segmented into ferrimagnetic and superparamagnetic. By size, it is fragmented into less than 5um, 5-20 um, 20-40 um, and 40 um &above. The applications covered in the study include sample preparation, biomolecules separation & purification, molecular & immunodiagnostics, and others.Region wise, the magnetic beads market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share in the global market, followed by Europe and Asia-Pacific. The major companies profiled in this report include Thermo Fisher Scientific Inc., Advanced BioChemicals (ABC), Promega Corporation, Zeesan Biotech Co. Ltd., New England BioLabs Inc., Calbiotech, MagBio Genomics, Teja Scientific Glass Works, Vazyme Biotech Co. Ltd., and Alcon Scientific Industries.

Magnetic beads market, by region

The Asia-Pacific magnetic beads market is projected to grow at the highest CAGR of 13.6% during the forecast period, accounting for 37.8% of the magnetic beads market share by 2027.Conversely, North America accounted for largest share in 2019, and is predicted to reach $1.1 billion by 2027.This is attributed to rise inadoption of magnetic beads for integrated DNA and RNA extraction in parts of the U.S. In addition, the medical sector in Canada is witnessing increased adoption of magnetic beads for immunoassay, which is predicted to propel the growth of the market in this region.

By Region

North America holds a dominant position in 2019 while Asia0Pacific is projected as the most lucrative region.

Magnetic beads market, by magnetism

In 2019, the ferrimagnetic beads segment was the largest revenue contributor, and is anticipated to grow at CAGR 10.4% in the forecast period, whereas the superparamagnetic beads segment is estimated to register a CAGR of 11.2%.

By Magnetic Core

Superparamagnetic is projected as the most lucrative segment.

Magnetic beads market, by size

In 2019, the less than 5um sized magnetic beads segment garnered the highest revenue, and is anticipated to grow at a CAGR of 11.4% during the forecast period. On the other hand, the 5-20 um sized magnetic beads segment is anticipated to grow with 10.5% CAGR in the near future.

By Size

Less than 5 um is projected as the most lucrative segment.

Magnetic beads market, by application

In 2019, the biomolecules segment led the global market, in terms of revenue generation, and is anticipated to grow at a CAGR of 11.3% during the forecast period, whereas the sample preparation segment is anticipated to grow with 10.7% CAGR.

By Application

Next generation sequencing (NGS) is projected as the most lucrative segment.

Key benefits for stakeholders

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current magnetic beads market trends and future estimations from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Magnetic Beads Market

- The COVID-19 pandemic has negatively affected the global economy and is subsequently shrinking the GDP, thereby changing consumer spending patterns globally.

- Large-scale testing of coronavirus infection by using RT-qPCR and RT-LAMP requires the use of magnetic beads, and these magnetic beads that are made up of in-house reagents and are performed in 96-well plates supporting large-scale testing.

- Current standard testing for SARS-CoV-2 detection is based on viral RNA extraction method. In addition, other test methods such as nucleocapsid (N), envelope protein (E), S glycoprotein (S), or RNA-dependent RNA polymerase (RdRp) are used for detection of large-scale samples. Thus, the need for commercial RNA extraction kits is increasing significantly, which, in turn, has augmented the demand for magnetic beads market during the pandemic.

- Product development of magnetic beads for detection of COVID-19 infection has pushed the demand for global magnetic beads market during this global crisis. For instance, in October 2020, Now Norwegian University of Science and Technology developed a highly sensitive and efficient test method for COVID-19 infection detection that uses magnetic nanoparticles to extract viral RNA.

Magnetic Beads Market Report Highlights

| Aspects | Details |

| By MAGNETIC CORE |

|

| By SIZE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | MagBio Genomics, Vazyme Biotech Co. Ltd, Thermo Fisher Scientific Inc, Alcon Scientific Industries, Calbiotech, Promega Corporation, Advanced BioChemicals (ABC), New England BioLabs Inc, Teja Scientific Glass Works, Zeesan Biotech Co. Ltd |

Analyst Review

The global magnetic beads market is a gaining importance in regards to an extremely essential role played by magnetic beads in applications such as next-generation sequencing (NGS), biomolecules separation & purification, molecular & immunodiagnostics, and magnetic activated cell sorting. In addition, apart from mainstream applications of magnetic beads, other uses such as utilization of magnetic beads during COVID-19 testing method, T-cell activation, immunoprecipitation, and testing & research activities due to their capacity/yield, reproducibility, purity, and cost for small-scale isolation of specific proteins are predicted to offer lucrative growth opportunities for market expansion in the future.

In addition, streptavidin covalently attached magnetic beads offers isolation and helps efficient handling of biotinylated molecule. These types of magnetic beads are widely incorporated in applications such as mRNA isolation that can be completed within 15 minutes, nucleic acid capture assays, preparation of single strand templates, and pyro-sequencing. CardioGenics proprietary magnetic beads are advanced type of magnetic beads that are used to target cells and help to improve testing sensitivity. These magnetic beads are light colored beads and offer optimal collecting light signals in binding tests, which are predicted to augment the growth of the global market.

Rising utilization of magnetic beads in medical applications, bioassays, DNA & RNA extraction method, and life science application are the other major growth factors in the global market

The magnetic beads market size is projected to reach $2,618.7 million by 2027.

Thermo Fisher Scientific Inc., Advanced BioChemicals (ABC), Promega Corporation, Zeesan Biotech Co. Ltd., New England BioLabs Inc., Calbiotech, MagBio Genomics, Teja Scientific Glass Works, Vazyme Biotech Co. Ltd., and Alcon Scientific Industries.

Biomolucules separation & purification industry is projected to increase the demand of magnetic beads market

Ferrimagnetic segment is leading segment in magnetic beads market

Rising utilization of magnetic beads in medical applications is the major growth factor in the global market.

Next generation sequencing (NGS) application is expected to drive the demand of magnetic beads market

COVID-19 will impact positively on the global magnetic beads market. This is attributed due to • The COVID-19 pandemic has negatively affected the global economy and is subsequently shrinking the GDP, thereby changing consumer spending patterns globally. • Large-scale testing of coronavirus infection by using RT-qPCR and RT-LAMP requires the use of magnetic beads, and these magnetic beads that are made up of in-house reagents and are performed in 96-well plates supporting large-scale testing. • Current standard testing for SARS-CoV-2 detection is based on viral RNA extraction method. In addition, other test methods such as nucleocapsid (N), envelope protein (E), S glycoprotein (S), or RNA-dependent RNA polymerase (RdRp) are used for detection of large-scale samples. Thus, the need for commercial RNA extraction kits is increasing significantly, which, in turn, has augmented the demand for magnetic beads market during the pandemic. • Product development of magnetic beads for detection of COVID-19 infection has pushed the demand for global magnetic beads market during this global crisis. For instance, in October 2020, Now Norwegian University of Science and Technology developed a highly sensitive and efficient test method for COVID-19 infection detection that uses magnetic nanoparticles to extract viral RNA.

Loading Table Of Content...