Margarine & Shortening Market Research, 2033

Market Introduction and Definition

The global margarine & shortening market was valued at $26.8 billion in 2023, and is projected to reach $36.5 billion by 2033, growing at a CAGR of 3.1% from 2024 to 2033. Shortening is a fat that is solid at room temperature and may be used to give meals a crisp and fresh texture, such as pastries, breads, and confectioneries. Butter, soybean, margarine, vegetable oils, lard, and animal fat are some examples of fats used as shortening. Shortening is often manufactured from vegetable oils such as soybean, cottonseed, or refined palm oil, which are fluid at room temperature.

Margarine is a spreadable, butter-like product frequently used to replace butter in food preparation, baking, and as a table spread. It is manufactured from vegetable oils such as soybean, palm, or canola oil, which are hydrogenated to solidify the product. Margarine is produced by a process known as hydrogenation, in which unsaturated fats in oils are transformed into saturated fats, which results in a semi-solid texture at room temperature. Margarine is frequently supplemented with vitamins, such as A and D, to replicate the nutritional value of butter.

Key Takeaways

The margarine & shortening market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major margarine & shortening industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

Global customers have become more health concerned and ecologically aware, and there is a rising demand for plant-based alternatives to conventional animal-based products. Compared to butter and lard, margarine and shortening, which are commonly generated from vegetable oils such as soybean, palm, and sunflower, are cholesterol-free and have less saturated fat. This appeal is consistent with the dietary preferences of vegans, vegetarians, and flexitarians who wish to minimize their use of animal-derived goods for health, ethical, and environmental reasons. Furthermore, the growing frequency of lactose intolerance and dairy allergy is driving customers to dairy-free alternatives such as margarine. As a result, producers are inventing and extending their ranges of products to include plant-based margarine and shortening that not only meet health and nutritional requirements but also provide flavor and texture, fueling margarine & shortening market growth.

The volatility of raw material prices, particularly vegetable oils such as palm oil, soybean oil, and sunflower oil, is impeding the expansion of the margarine and shortening business. These oils are critical components in the making of margarine and shortening, and prices fluctuate significantly owing to several circumstances. Droughts and other severe weather?reduce agricultural yields, resulting in supply shortages and higher prices. Furthermore, geopolitical concerns and trade regulations disrupt the commodity supply chain, adding to price volatility.

The introduction of margarine and shortening formulations with enhanced nutritional profiles represents a huge growth potential in the margarine and shortening market forecast period. As consumer understanding of health and wellness grows, there is a greater desire for food products that provide not just convenience and flavor but also nutritional value. Manufacturers are reacting to this trend by developing and reformulating their goods to increase their health appeal. This involves lowering trans-fat?and saturated fat levels, which have been linked to negative health consequences, as well as adding helpful elements including omega-3 fatty acids, plant sterols, and vitamins. For instance, food items fortified with vitamins A and D may be appealing to health-conscious consumers looking to increase their nutrient consumption. These improvements appeal to the dietary requirements of vegans and vegetarians and to a larger audience looking for healthier alternatives to conventional fats.

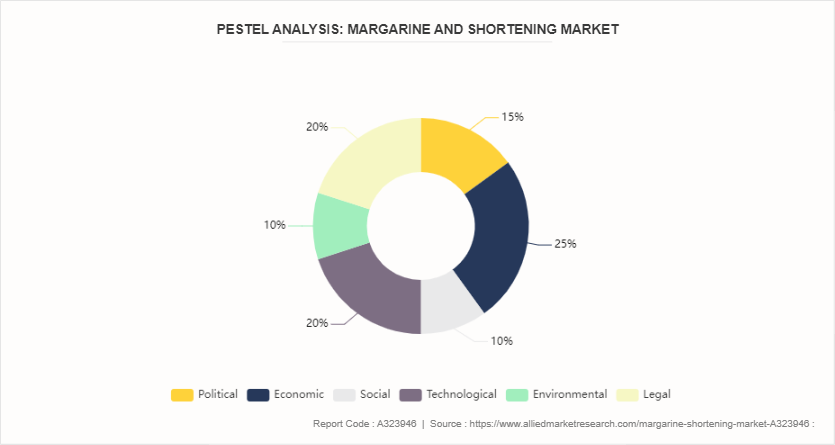

PESTLE Analysis of Global Margarine & Shortening Market

Political

Governments throughout the world are enacting stronger rules on trans fats, forcing producers to modify products to fulfill legal standards. Trade rules, such as tariffs and import or export restrictions, have an impact on the distribution network and pricing of important raw commodities like palm and soybean oil. Political stability in key producing regions is also important, as political turmoil interrupts production and delivery, resulting in shortages of supplies and price fluctuations.

Economic

Global economic conditions, consumer purchasing power, and raw material price volatility all influence the margarine and shortening business. Economic downturns lower consumer spending, impacting sales of margarine and shortening, products are frequently viewed as discretionary purchases. In contrast, economic expansion in emerging nations can increase demand since disposable incomes rise. Price volatility in vegetable oils is driven by factors such as crop yields, weather conditions, and geopolitical events, which have a direct impact on production costs and pricing tactics.

Social

Plant-based diets are becoming more popular, driven by health, environmental, and ethical factors, resulting in growing demand for plant-based margarine and shortening. As customers become more aware of the health risks associated with trans fats and saturated fats, they seek healthier alternatives, driving producers to come up with and offer nutritionally upgraded goods.

Technological

Technological developments in food manufacturing and new product development are key drivers of the margarine and shortening industry. Food science innovations allow for the production of goods with enhanced nutritional profiles, such as decreased trans fats and additional omega-3 fatty acids. Advanced processing methods improve the texture, flavor, and duration of storage of margarine and shortening, satisfying customer demands for quality and convenience.

Environmental

The production of important components such as palm oil has serious environmental consequences, including deforestation, biodiversity loss, and greenhouse gas emissions. Growing consumer and regulatory demand for environmentally friendly and sustainable products is prompting firms to implement sustainable sourcing strategies, such as utilizing certified palm oil that is environmentally friendly and lowering carbon footprints. Climate change and extreme weather events have an influence on agricultural yields and raw material availability, disrupting supply chains and causing price volatility.

Legal

Food safety rules, labeling specifications, and intellectual property laws are among the legal considerations that influence the margarine and shortening sector. Governments impose strict rules to safeguard the safety and quality of food items, requiring businesses to meet criteria for ingredients, processing, and packaging. Labeling requirements require straightforward and precise disclosure of nutrition information and ingredients, which influences customer decisions and brand trust.

Market Segmentation

The margarine & shortening market is segmented into product type, source, form, end user, application, distribution channel, and region. On the basis of product type, the market is divided into margarine and shortening. By source, the market is bifurcated into vegetables and animals. On the basis of form, the market is classified into solid and liquid. As per end user, the market is segregated into residential, food service, and industrial. On the basis of application, the market is categorized into bakery, confectionery, snacks & savory, industrial, and others. By distribution channel, the market is fragmented into direct, supermarkets/hypermarkets, departmental stores, online, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In North America and Europe, the industry is being pushed by a dramatic move towards health-conscious goods, with increasing consumer demand for trans-fat-free and plant-based alternatives. Innovations in product formulation to improve nutritional profiles are critical growth drivers.

Demand in Asia-Pacific is increasing due to expanding urbanization, rising disposable incomes, and the increasing acceptance of Western food patterns. Furthermore, the increasing bread and confectionery sectors in this area provide a substantial contribution to market growth.

Economic development and rising consumer awareness of health and wellness are driving market growth in LAMEA. The growing popularity of plant-based diets, as well as the desire for low-cost, healthy cooking fats, are major developments shaping market dynamics in these countries.

Industry Trends:

In February 2023, FGV Holdings Berhad made a deliberate decision to expand its market position in the developing Middle East and North Africa area. The firm accomplished this by presenting its most recent contribution to the FMCG?products market, ADELA Margarine. This new product was formally launched during Gulfood 2023, the world's premier culinary expo, held at the iconic Dubai World Trade Centre.

In February 2023, Unilever company?announced its launch of an innovative range of margarine water products. The products are intended to be a healthier alternative to traditional margarine since they are lower in both calories and fat.

In 2021, Cargill invested $15 million in a high-pressure hydrogenation factory in Kurkumbh, Maharashtra, to produce better fats, which are a health and nutritional additive for dairy animals.

Competitive Landscape

The major players operating in the market competing for margarine & shortening market share include Upfield BV, Conagra Brands Inc., Richardson International Limited, Associated British Foods PLC, Vandemoortele, Fediol, Wilmar International Ltd, Cargill Incorporated, J.M. Smucker Company, Premium Vegetable Oils Sdn Bhd, and Fuji Oil Co., Ltd.

Other players in market contributing to the margarine & shortening market size includes Bunge Limited., Puratos NV, NMGK Group, BRF SA, Associated British Foods plc, Ventura Foods, Namchow Chemical Industrial Co., Ltd, and others.

Recent Key Strategies and Developments

In February 2023, Unilever, a major player in the food and beverage industry, announced the introduction of a new range of margarine water products to offer a healthier alternative to traditional margarine, featuring lower fat and calorie content.

In April 2022, Vandemoortele launched Gold Cup margarine range and products that contains 100% vegetable oils and fats that offer functionality and convenience to support the sustainable production of palm oil through RSPO certification.

In November 2021, The Wilmar International Company announced the opening of a new facility for processing and packaging margarine and fat products to strengthen its manufacturing capacity globally.

In September 2021, Fuji Oil Group and ITOCHU Group expanded their vegetable oil business sales channels to cater to new customers to increase foothold and strengthen their presence in the North American market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the margarine & shortening market analysis from 2024 to 2033 to identify the prevailing margarine & shortening market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the margarine & shortening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global margarine & shortening market trends, key players, market segments, application areas, and market growth strategies.

Margarine & Shortening Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 36.5 Billion |

| Growth Rate | CAGR of 3.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 230 |

| By Product Type |

|

| By Source |

|

| By Form |

|

| By End User |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Premium Vegetable Oils Sdn Bhd, Wilmar International Ltd, J.M. Smucker Company, Upfield BV, Fuji Oil Co., Ltd, Vandemoortele, Richardson International Limited, Fediol, Associated British Foods PLC, Cargill Incorporated, Conagra Brands Inc. |

The global margarine and shortening market was valued at $26.8 billion in 2023, and is projected to reach $36.5 billion by 2033, growing at a CAGR of 3.1% from 2024 to 2033.

The margarine and shortening market registered a CAGR of 3.1% from 2024 to 2033.

The forecast period in the margarine and shortening market report is from 2024 to 2033.

The top companies that hold the market share in the margarine and shortening market include Upfield BV, Conagra Brands Inc., Richardson International Limited, Associated British Foods PLC, and others.

The margarine and shortening market report has 6 segments. The segments are product type, source, form, end user, application, and distribution channel.

Loading Table Of Content...