Marine Battery Market Statistics 2021-2030:

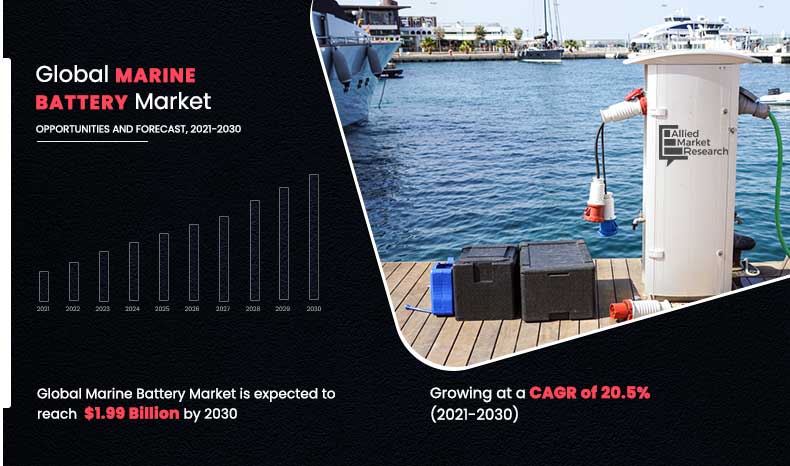

The global marine battery market was valued at $0.37 billion in 2021, and is projected to reach $1.99 billion in 2030, registering a CAGR of 20.5%.

The marine battery acts as a primary or auxiliary power source for the vessels and utilizes chemical energy to provide power for the various applications such as start–stop, lighting, a windlass, depth finders, and fish locators. Marine batteries have robust construction and equipped with heavier plates. These batteries are designed specifically for use on a ships or vessels to sustain the vibration and pounding that can occur onboard any boat.

Factors such as increase in demand for marine freight transportation vessels, advantage of lithium-ion battery over lead-acid batteries, and Increase in water sports & leisure activities are expected to drive the growth of the marine battery market. However, limited range and capacity of fully electric ships and maintenance and protection of batteries restrain the market growth. On the contrary, increase in automation in marine transportation and rise in adoption of hybrid and fully electric vessels are projected to offer lucrative growth opportunities for the market players.

The market is segmented into battery type, ship type, function, nominal capacity, sales channel, battery density, and region. By battery type, the market is divided into lithium, lead acid and others. On the basis of ship type, it is classified into commercial, and defense. By function, the market is divided into starting, deep cycle, and dual purpose. On the basis of nominal capacity, it is classified into less than 150 Ah and more than 150 Ah. By sales channel, the market is divided into OEM, and aftermarket. On the basis of battery density, it is classified into <100 WH/KG and More than 100 WH/KG. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players operating in the global marine battery market include Akasol AG, EnerSys, Toshiba Corporation, Siemens, Leclanché SA , Saft , Echandia AB, EverExceed Industrial Co, Lifeline Batteries Inc., and Spear Power Systems.

Increase in demand for marine freight transportation vessels

Marine transportation is one most prominent modes of transportation especially for freight transportation, owing to its cost-effectiveness. In recent years, seaborne trade has witnessed significant growth. For instance, according the United Nations Conference on Trade and Development (UNCTAD), in 2020, international seaborne trade volume reached 10.7 billion tons. Moreover, maritime shipping will continue to cover the majority of the movement of goods over long distances in the coming years. According to ITF transport outlook by The Organisation for Economic Co-operation and Development (OECD), 70% total freight will be transported by using maritime transport by 2030. Increase in marine freight transportation is attributed to rise in traffic congestion in trade lanes in Indian and Pacific Ocean.

By Battery Type

Lithium is projected as the most lucrative segments

Moreover, surge in demand for maritime freight transportation has propelled the demand for maritime vessels. According to UNCTAD, the fleet of commercial shipping fleet of 100 gross tons and above ships reached to around 99,800. Marine vessels are equipped with one or multiple marine batteries for several applications such as lighting, engine start–stop, and auxiliary power source. Such increase in demand for freight vessels equipped with advanced marine batteries is expected to propel the demand for marine batteries.

By Ship Type

Defense is projected as the most lucrative segments

Advantage of lithium-ion battery over lead-acid batteries

Currently, lead-acid batteries are most widely used in marine vessels for various applications such as engine start–stop and lighting due to its cost-effective nature. Furthermore, these batteries are widely available in a variety of off-the-shelf pack sizes with little concern for supply. However, these batteries have shorter service life and require regular maintenance to keep them running properly. Moreover, lead-acid batteries can lead to problems such as electrolyte leakage and creation of hazardous gases during cycling.

By Function

Dual Purpose is projected as the most lucrative segments

In recent times, the use of lithium-ion batteries for marine application has increased significantly, as it provides highest electrochemical potential, i.e., it can generate higher battery voltage than the other batteries. Lithium-ion batteries have extremely low resistance, allowing for much faster charging with minimal losses. Moreover, these batteries are much lighter, hold a charge better, and can withstand more charge/discharge cycles than lithium-ion batteries. Owing to these advantages of lithium ion over lead acid batteries, lithium-ion batteries are getting widely adopted in marine ships, which is expected to fuel the growth of the market.

By Nominal Capacity

More than 150 Ah is projected as the most lucrative segments

Maintenance and protection of batteries

Requirement of frequent maintenance of batteries to function properly and protection from being overcharged hampers the growth of the marine battery market. A widely used type of marine batteries are lead-acid batteries due to their low cost. These batteries have a limited service life and require regular maintenance to keep them running properly. Major safety issues associated with the battery of an vessels are electrical risk (short-cut), fire & explosion, risks due to chemical reactions, release of toxic liquids & fumes, thermal danger due to high temperatures, and mechanical risk owing to heavy weight of battery components. The negligence or error during the manufacturing of a battery can later create severe problems for ships it is installed in.

By Sales Channel

OEM is projected as the most lucrative segments

In addition, electrolyte contained inside the batteries such as lead-acid batteries is sulfuric acid. Batteries can lead to problems such as electrolyte leakage, emission of hazardous gases during cycling, and the problem of permanent sulfation. Moreover, sulfation in lead-acid batteries creates problems such as an increase in normal charging time, abnormally high temperatures inside a battery, and the need to recharge the battery more often. Furthermore, charging a battery over its maximum level leads to temporary or permanent damage to the battery. Overcharging the battery can explode or lose the ability to charge again, which creates a need for protection from being overcharged. Thus, all these factors collectively are expected to hamper the growth of the market.

By Battery Density

More than 100 WH/KG is projected as the most lucrative segments

Rise in adoption of hybrid and fully electric vessels

Shipbuilding companies and operators are moving toward emission-free transportation to keep up with the International Maritime Organization 2020 (IMO 2020) mandate, which enforces maximum sulfur content of 0.5% in marine fuels. Owing to this, the marine industry has seen inclination toward installation of hybrid and electric propulsion in existing and newbuild ships. The countries across the globe are using electrified passenger boats and ferries. Moreover, governments are backing the electrification in marine vessels. For instance, E-ferry Ellen a fully electric ferry was developed under European Union backed E-ferry project, which costs around 24 million. Ellen can carry 200 passengers and 30 vehicles. The ferry has two 750kW propulsion motors, and is equipped with 4.3 MWh lithium NMC battery. Moreover, Ferguson Marine, a shipbuilder in the UK, built the Catriona, a diesel-electric hybrid ferry worth $14 million for CalMac to use on its Clyde and Hebridean routes. In addition to this, companies are developing fully electric cargo ships for instance Yara International commissioned a fully electric cargo ship named Yara Birkeland in 2020. Such developments in the field electric and hybrid marine vessels is expected fuel the growth for marine batteries in near future.

By Region

Asia-Pacific would exhibit the highest CAGR of 22.1% during 2021-2030.

COVID-19 Impact Analysis

The COVID-19 impact on the marine batteries market is unpredictable, and is expected to remain in force for a few years.

The COVID-19 outbreak forced governments across the globe to implemented stringent lockdown and ban import–export of essential raw materials items for most of 2020 & few months in 2021. This led to sudden fall in the availability of important raw materials for marine batteries.

As a result of interrupted supply chains and production schedules caused by the COVID-19 pandemic, boat and engine manufacturers faced enormous losses in the first and second quarters of 2020.

Moreover, nationwide lockdown forced parts manufacturing facilities to partially or completely shut their operations.

Key Benefits For Stakeholders

This study presents analytical depiction of the global marine battery market analysis along with the current trends and future estimations to depict imminent investment pockets.

The overall marine battery market opportunity is determined by understanding profitable trends to gain a stronger foothold.

The report presents information related to key drivers, restraints, and opportunities of the global marine battery market with a detailed impact analysis.

The current marine battery market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Marine Battery Market Report Highlights

| Aspects | Details |

| By Battery Type |

|

| By Ship Type |

|

| By Function |

|

| By Nominal Capacity |

|

| By Sales Channel |

|

| By Battery Density |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The marine battery market is expected to witness significant growth globally due to rise in deployment of advanced communication and monitoring technologies across the world. The market growth is supplemented by numerous developments carried out by top marine battery manufacturing players such as Akasol AG, Enersys, Toshiba, Siemens, Leclanché SA, Echandia, and Spear Power Systems, which has led to the growth of the market. Moreover, innovative battery solutions and product development followed by increased demand for high-performance, long-lasting batteries supplement the growth of the marine battery market.

For instance, in January 2018, Akasol AG launched an innovative propulsion system E-motion on display at the Boot Dusseldorf show. Moreover, in January 2018 Akasol AG delivered eight battery systems to Sanlorenzo for 32M hybrid yacht. Similarly, in October 2021, EnerSys launched new ODYSSEY® PRO batteries. These batteries have been designed with advanced carbon additives for more reserve capacity and longer cycle life. They protect against high-impact shock & mechanical vibrations and provide trustworthy performance as well as long-lasting power for various applications such as marine, heavy-duty, and recreational vehicles. Such product launches supplement the growth of the market.

To gain a fair share of the market, major players adopted different strategies, for instance, product development, partnership, acquisition, collaboration, and business expansion. Among these, the partnership is a leading strategy used by prominent players such as Akasol AG, Enersys, Echandia, and, Spear Power Systems. For instance, Spear Power System entered into a partnership with SeaBubbles to provide Trident marine battery systems for the 100% electric, hybrid hydrogen, and batteries for ship manufacturer.

Among the analyzed regions, Europe dominated the market in terms of revenue in 2021, followed by North America, Asia-Pacific, and LAMEA. Asia-Pacific is expected to witness a lucrative growth rate during the forecast period, owing to rise in maritime trade and surge in demand from shipbuilding industry in the countries such as China, India, and Japan, along with rise in investments by private players and government in marine industry in the region.

The global marine battery market was valued at $0.37 billion in 2021, and is projected to reach $1.99 billion in 2030.

By Battery type, the Lithium segment held the fastest growing segment in marine battery market

The report sample for global marine battery market report can be obtained on demand from the website

Increase in demand for marine freight transportation vessels, Advantage of lithium-ion battery over lead-acid batteries, Increase in water sports and leisure activities are key driving factors of marine battery market

The marine battery industry is expected to grow at a CAGR of 3.8% during the forecast period

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated

Increase in automation in marine transportation and Rise in adoption of hybrid and fully electric vessels is expected create significant opportunity for marine battery market

Asia Pacific is the most lucritive segment in marine battery market

Increasing adoption of lithium-ion batteries for electric and hybrid vessels is major trend in marrine battery industry

Akasol AG, EnerSys, Toshiba Corporation, Siemens, Leclanché SA , Saft , Echandia AB , EverExceed Industrial Co, Lifeline Batteries Inc and Spear Power Systems among others are operating in marine batteries market

Loading Table Of Content...