Marine Cargo Insurance Market Research, 2032

The global marine cargo insurance market size was valued at $19.6 billion in 2022, and is projected to reach $29.9 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032.Marine cargo insurance refers to a type of insurance that provides coverage for goods and merchandise transported via various modes of transportation, primarily by sea. It is designed to protect the cargo owners or shippers against the potential risks and financial losses associated with the transportation of goods.

Marine cargo insurance typically covers the loss, damage, or theft of goods during transit, including risks such as sinking, fire, collision, piracy, and natural disasters. The policy can be tailored to the specific needs of the cargo owner or shipper, considering the type of cargo, the mode of transportation, the route, and other relevant factors. The insurance coverage may extend from the point of origin, such as the warehouse or manufacturer's location, to the final destination. It can also provide coverage during intermediate stops or transshipment points. The coverage can be provided on a per-voyage basis or through an annual policy that covers multiple shipments.

There is an increase in the volume of goods being transported across borders owing to the rising international trade. More goods in transit mean a greater exposure to potential risks such as theft, damage, or loss during transportation. Marine cargo insurance provides protection against these risks, ensuring that businesses are financially safeguarded.

Moreover, international trade involves various risks and uncertainties, including natural disasters, accidents, piracy, political instability, and regulatory changes. These risks can significantly impact the transportation and delivery of goods. Marine cargo insurance acts as a risk management tool, mitigating the financial impact of unforeseen events and providing peace of mind to exporters, importers, and logistics providers.

Many international trade contracts, such as letter of credit or sales agreement, require the parties involved to obtain marine cargo insurance. Insurance coverage provides assurance to the involved parties that the goods will be protected during transit, ensuring compliance with contractual obligations.

Furthermore, marine cargo insurance provides financial protection to businesses in the event of loss or damage to goods during transit. This coverage enables companies to mitigate potential financial losses and continue their operations smoothly. It also facilitates access to trade finance, as lenders often require cargo insurance as security for financing arrangements. As international trade expands, the marine cargo insurance market grows in response to the increasing demand for comprehensive coverage that safeguards goods during transit and mitigates potential financial losses.

The marine cargo insurance market is highly affected by external factors such as weather conditions, political instability, trade disputes, and global economic fluctuations. These uncertainties can lead to increased risks and losses for insurers, making it challenging to accurately assess and price insurance premiums. Moreover, political instability in various regions can have significant consequences for the marine cargo insurance market. Conflicts, civil unrest, or changes in government policies can disrupt trade routes, increase the risk of cargo theft or damage, and create uncertainties in insurance coverage. Insurers may struggle to assess the potential risks and losses associated with such situations.

Furthermore, trade disputes, such as tariffs, embargoes, or trade wars, can impact international trade flows and affect the marine cargo insurance market. Changes in trade patterns or restrictions can lead to shifts in cargo volumes, altered routes, or delays, which in turn can increase risks for insurers. The evolving nature of trade disputes makes it challenging to anticipate and assess their impact accurately.

Technological advancements can help the marine cargo insurance industry to enhance its operations and offer innovative solutions. Blockchain technology can revolutionize the way documentation is handled in the marine cargo insurance market. By utilizing distributed ledger technology, insurers can create a secure and transparent system for managing policies, claims, and other relevant documents. This can help reduce administrative costs, minimize errors, and improve efficiency. Moreover, blockchain's immutability and transparency can bring significant improvements to the claims process. Smart contracts can be utilized to automate claims settlement, ensuring faster and more accurate payments. In addition, the decentralized nature of blockchain can facilitate trust among various stakeholders, reducing disputes and improving customer satisfaction.

The Internet of Things (IoT) devices, such as sensors and tracking systems, can provide real-time data on cargo conditions, including temperature, humidity, and location. Integrating this data with insurance systems allows insurers to monitor cargo during transit, identify potential risks, and proactively take preventive measures. This can minimize losses and improve customer satisfaction. By embracing technological advancements, the marine cargo insurance industry can unlock these opportunities, leading to increased operational efficiency, cost savings, better risk management, and ultimately, improved customer satisfaction. These major factors are projected to offer growth opportunities for market players during the marine cargo insurance market forecast period.

The key players profiled in this report include Munich Re Group, Allianze, MARSH LLC., Tiba, Liberty Mutual Insurance Group, Samsung Fine & Marine Insurance Corp., Marine Insurance Co Ltd, Lioyd's, Chubb, and Atrium. Investment and agreement are common strategies followed by major market players. For instance, in March 20202, A.P. Moeller-Maersk (Maersk), the largest container shipping line in the world by market share, released a new door-to-door insurance solution in partnership with Zurich Insurance Plc.

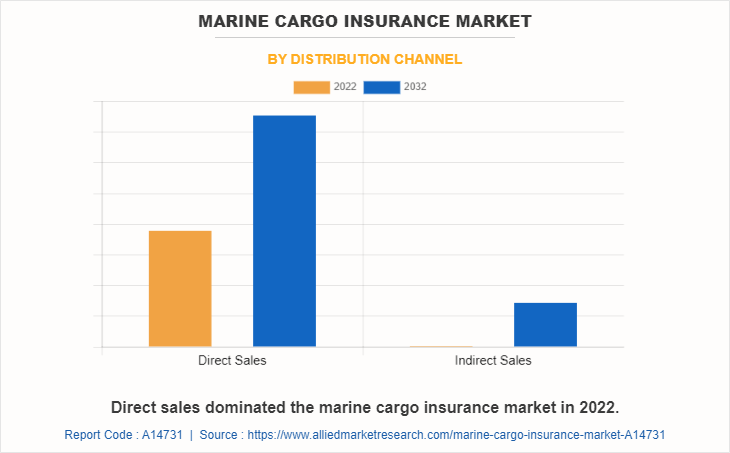

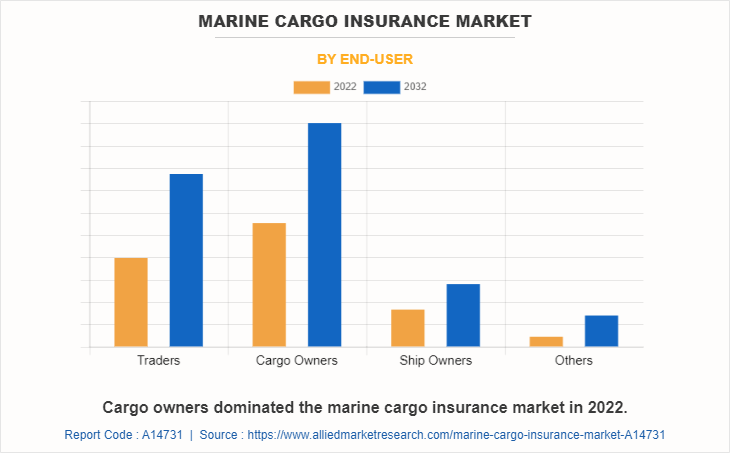

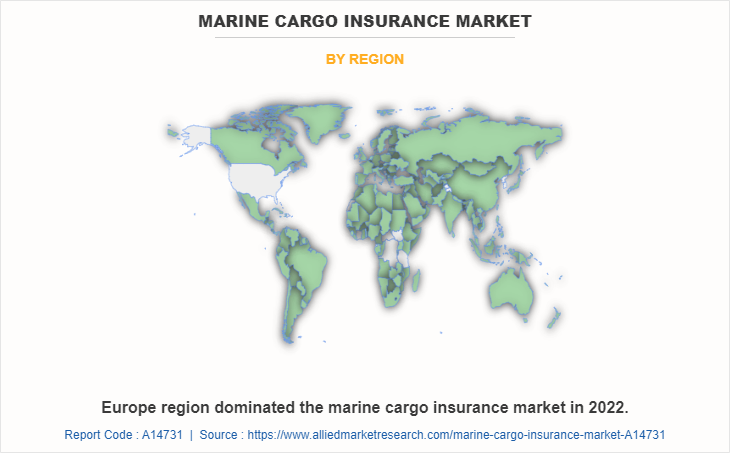

The marine cargo insurance market is segmented on the basis of distribution channel, end user, and region. By distribution channel, the market is divided into direct sales and indirect sales. By end user, the market is classified into traders, cargo owners, ship owners, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The marine cargo insurance market is segmented into Distribution Channel and End-user.

By distribution channel, the direct sales channels allow businesses to customize their insurance coverage based on their specific cargo requirements. This flexibility attracts businesses looking for tailored insurance solutions and drives the demand for Marine Cargo Insurance through direct sales. Moreover, advancements in technology have made it easier for businesses to directly purchase insurance online or through digital platforms. This convenience and accessibility contribute to the growth of the direct sales sub-segment in the marine cargo insurance market.

Furthermore, marine cargo shipments are exposed to various risks such as theft, damage, natural disasters, and accidents during transportation. Direct sales of marine cargo insurance enable businesses to mitigate these risks by providing financial protection in case of loss or damage to cargo. The importance of risk mitigation growing the demand for insurance coverage through direct sales. The Marine Cargo Insurance market is highly competitive, with several insurance providers offering direct sales options. This competition drives innovation, pricing competitiveness, and improved customer service, all of which contribute to the growth of the direct sales sub-segment..

By end user, the cargo owners sub-segment dominated the global marine cargo insurance market share in 2022. Cargo owners face various risks during transportation, including natural disasters, accidents, theft, and piracy. Marine cargo insurance provides a crucial risk mitigation mechanism for cargo owners, ensuring financial protection against potential losses or damages incurred during transit. The need for risk management drives cargo owners to secure appropriate marine cargo insurance coverage. Many countries require cargo owners to have marine cargo insurance coverage as a regulatory compliance measure. Compliance with these regulations ensures that cargo owners are financially responsible for any losses or damages that occur during the transportation of goods.

This regulatory factor drives the demand for marine cargo insurance among cargo owners. The value of goods being transported by cargo owners has been steadily increasing due to factors such as inflation, globalization, and technological advancements. With higher-value goods at stake, cargo owners are more inclined to obtain marine cargo insurance to protect their valuable assets during transit. Insurance providers have been offering more tailored and flexible marine cargo insurance coverage options to cater to the specific needs of cargo owners. These options include coverage for specific cargo types, storage, warehousing, and supply chain interruptions. The availability of customized coverage options attracts cargo owners who seek comprehensive protection for their goods.

By region, Europe dominated the global market in 2022. Europe is a major hub for international trade, with numerous ports and shipping routes connecting it to various regions around the world. The growth of global trade and increasing globalization have led to a higher demand for marine cargo insurance to protect shipments against potential risks and losses during transportation. The economic growth and industrial development in Europe have resulted in increased production and trade activities. As industries expand their operations and engage in international trade, the need for marine cargo insurance becomes crucial to protect against potential losses during transit.

The region has well-established regulations and legal frameworks related to marine insurance. Compliance with these regulations and the requirement for marine cargo insurance coverage for certain types of goods contribute to the overall demand in the market. Europe's trade relationships are expanding beyond traditional markets, with a focus on emerging economies and new trading routes. As trade patterns evolve, the need for marine cargo insurance grows to address the associated risks of operating in unfamiliar territories.

Impact of COVID-19 on the Global Marine Cargo Insurance Industry

- The COVID-19 pandemic has had a significant impact on the marine cargo insurance market. The pandemic led to disruptions in global supply chains, including delays in shipping, port closures, and reduced trade volumes. These disruptions impacted the demand for marine cargo insurance as businesses adjusted their shipping and procurement strategies, resulting in changes in insurance needs.

- With shifts in consumer demand and changes in global trade patterns, certain industries experienced fluctuations in cargo types and volumes. For example, there might be an increase in demand for medical supplies and decrease in demand for non-essential goods. Such changes influenced the underwriting and pricing of marine cargo insurance policies.

- The pandemic highlighted the vulnerability of global supply chains to unexpected disruptions. This awareness led businesses to reassess their risk management strategies and consider additional or enhanced coverage for their cargo. Insurers responded by offering new products or updating existing policies to address emerging risks.

- Cargo insurance policies typically cover various risks such as damage, loss, theft, and certain liabilities. Depending on the policy terms, coverage for claims related to the pandemic might vary. The extent of coverage will depend on the specific terms and conditions of each policy.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global marine cargo insurance market trends along with the Marine Cargo Insurance Market Outlook.

- The report elucidates the marine cargo insurance market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the marine cargo insurance market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the marine cargo insurance market growth.

Marine Cargo Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 29.9 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Distribution Channel |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Samsung Fire & Marine Insurance Corp., Lloyd's, MARSH LLC., TIBA, Chubb, Allianz, Marine Insurance Co Ltd, Munich Re Group, Atrium, Liberty Mutual Insurance Group |

The rising demand for international trade plays a significant role in driving the marine cargo insurance market. As global trade continues to expand, the movement of goods by sea increases, leading to a greater demand for marine cargo insurance to protect against risks such as loss, damage, or theft during transit, which is estimated to generate excellent opportunities in the marine cargo insurance market.

The major growth strategies adopted by the marine cargo insurance market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global marine cargo insurance market in the future.

Munich Re Group, Allianze, MARSH LLC., Tiba, Liberty Mutual Insurance Group, Samsung Fine & Marine Insurance Corp., Marine Insurance Co Ltd, Lioyd's, Chubb, and Atrium are the major players in the marine cargo insurance market.

The indirect sales sub-segment of the distribution channel acquired the maximum share of the global marine cargo insurance market in 2022.

Cargo owners and traders are the major customers in the global marine cargo insurance market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global marine cargo insurance market from 2022 to 2032 to determine the prevailing opportunities.

The market for inherent risks associated with maritime transportation, including vessel accidents, piracy, natural disasters, and political instability, drive the need for marine cargo insurance. Importers, exporters, and logistics companies seek insurance coverage to mitigate the financial impact of potential losses and ensure the smooth flow of goods which is estimated to drive the adoption of marine cargo insurance.

The rise of emerging markets as key players in global trade has contributed to the growth of the marine cargo insurance market. As developing countries experience economic growth and participate more actively in international trade, there is an increase in demand for insurance coverage to protect the value of goods in transit. This trend is anticipated to influence the marine cargo insurance market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...