Marine Dynamic Positioning System Market Overview

The global marine dynamic positioning system market was valued at USD 5.6 billion in 2020, and is projected to reach USD 17.6 billion by 2030, growing at a CAGR of 12.54% from 2021 to 2030.

Increase in seaborne trade across the globe, rise in number of dynamic position ships, such as survey & research vessels, advancements in offshore drilling technology, and greater deployment of offshore patrol vessels propel the growth of global marine dynamic positioning system market. However, complexity associated with the system and high maintenance costs are factors that restrain the growth of the market. Furthermore, technological advancements, increase in development of autonomous ships, and introduction of laser-based dynamic positioning systems are factors expected to offer growth opportunities during the forecast period.

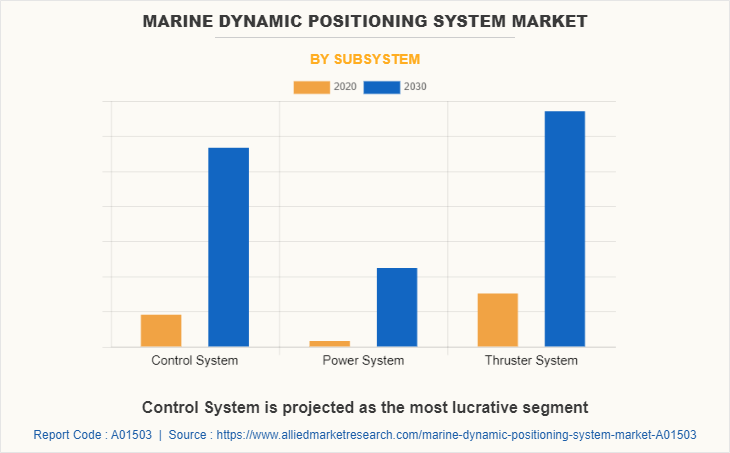

Dynamic positioning system is a computer operated system, installed in ships to control the position of vessel in water body. The main components of a dynamic positioning system include thruster system, control system, and power system. The positioning system comprises of a GPS, which monitors the position of vessel. As vessel moves off the intended position, the DP computer starts to calculate the required thrust to apply to maintain the position of vessel. Moreover, a dynamic positioning system keeps the vessel at a fix position and replaces the need of utilizing anchors in the vessel.

Segment Overview

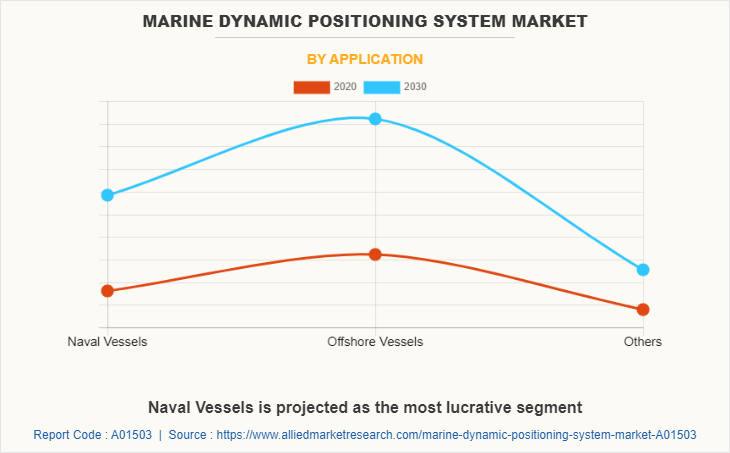

The marine dynamic positioning system market is segmented on the basis of subsystem, equipment class, application, sales channel, and region. On the basis of subsystem, it is classified into control system, power system, and thruster system. On the basis of equipment class, the market is categorized into class 1, class 2, and class 3. By application, it is fragmented into naval vessels, offshore vessels, and others. On the basis of sales channel, the market is classified into original equipment manufacturer and retrofit. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Players

Some leading companies profiled in the marine dynamic positioning system market report include ABB Ltd., AB Volvo, General Electric Company, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Marine Technologies, LLC, Navis Engineering Oy, Praxis Automation Technology B.V., Reygar Ltd., and Wartsila Corporation.

Top Impacting Factors

Increase in Global Seaborne Trade

Sea-based trade is considered as a preferable mode of transportation for goods between countries. About 90% of global trade is carried by sea. However, the COVID-19 pandemic affected the sea trade activities in 2020, but as the vaccine rolled out in 2021, the trade activities started to rise up and many countries opened their shores for sea trade. In addition, e-commerce activities also increased during the pandemic period, contributing to the growth of sea trade activities between countries. The rise in the seaborne trade results in increase in demand for large capacity carrying ships or container ships equipped with latest technologies, which is turn is expected to create demand for dynamic positioning system. Henceforth, increase in seaborne trade across the globe is a factor that is expected to drive the growth of the marine dynamic positioning system industry.

Increase in Number of Dynamic Position Ships such as Survey & Research Vessels

Presently, climate change is a global challenge that is being faced by countries across the globe. Scientists are utilizing research vessels to study the effects of climate change. For instance, a project, “Multidisciplinary drifting observatory for the study of arctic climate (MOSAiC)” was initiated in 2019, under which scientists study the arctic system and how it responds to climate change. Moreover, a research vessel equipped with dynamic positioning system can keep track of wind & waves and adjust its path accordingly without sacrificing its main objective.

Advancements in Offshore Drilling Technology

Offshore oil & gas production has led to development of advanced vessels equipped with latest technologies, such as dynamic positioning system. Moreover, during deepwater drilling, drilling vessels are held in place by two methods, such as anchoring or dynamic positioning system. At greater depths, dynamic positioning system equipped in drilling ships aids to maintain the position of the vessel without using anchors, making the drilling operation successful. Advancements in offshore drilling technology is anticipated to contribute to the growth of the marine dynamic positioning system industry during the forecast period.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the marine dynamic positioning system market analysis from 2020 to 2030 to identify the prevailing marine dynamic positioning system market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the marine dynamic positioning system market segmentation assists to determine the prevailing market opportunities.

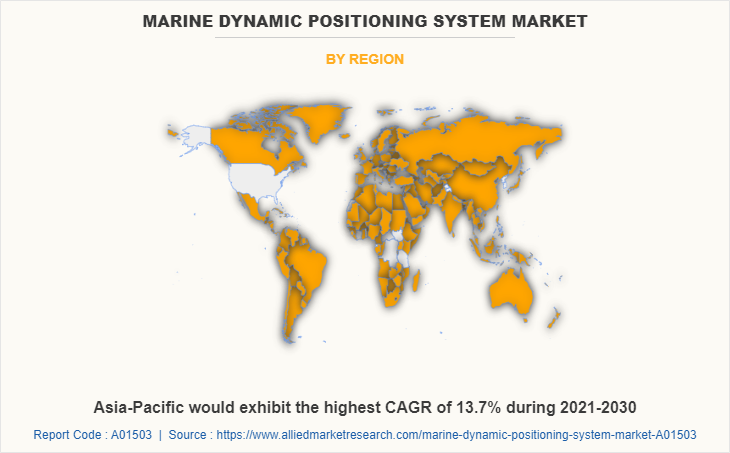

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global marine dynamic positioning system market trends, key players, market segments, application areas, and market growth strategies.

Marine Dynamic Positioning System Market Report Highlights

| Aspects | Details |

| By Subsystem |

|

| By Equipment Class |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Reygar Ltd, Praxis Automation Technology B.V., ABB Ltd, L3Harris Technologies, Inc., Kongsberg Gruppen ASA, Navis Engineering Oy, General Electric Company, AB Volvo, Wärtsilä Corporation, Marine Technologies, LLC |

| | Guidance Marine, JRC, Master Boat Builders Inc., RH Marine, Thrustmaster of Texas, Inc |

Analyst Review

Growth of the marine dynamic positioning system market is propelled by factors, such as development of advanced dynamic positioning system, including laser-based DP system and development of autonomous vessel. There has been increase in focus on automation of vessels to reduce emissions. For instance, in 2021, Svitzer, in a partnership with Kongsberg Maritime developed RECOTUG, which is fully remote-controlled tugboat. Rise in demand for marine dynamic positioning system from emerging economies, such as Asia-Pacific coupled with increase in seaborne trade in Asia-Pacific is expected to supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different regions.

Several developments have been carried out by key players operating in the marine dynamic positioning system market. In December 2021, Wartsila introduced a new OPTI-DP engagement tool that is built using computational fluid dynamics (CFD) modelling, to enable accurate and speedy configuration of thrusters and other propulsion systems, to deliver optimal dynamic positioning solution. Moreover, Navis Engineering, in an agreement with Emerson developed a DP-controller as add-on to Marex 3D joystick control system to bring intelligent automatic control to any boat in July 2020.

The global marine dynamic positioning system market is expected to reach $17.6 billion in 2030 from $5.6 billion in 2020.

Some major manufacturers of marine dynamic positioning system include ABB Ltd., AB Volvo, General Electric Company, Kongsberg Gruppen, L3Harris Technologies, Inc., Marine Technologies, LLC, Navis Engineering, Praxis Automation Technology B.V., Reygar Ltd., and Wartsila Corporation.

The sample/company profiles for global marine dynamic positioning system market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

They key segments covered in the report on marine dynamic positioning system include subsystem, equipment class, application, and sales channel.

The different types of marine dynamic positioning system include DP 1, DP 2, and DP 3.

The company profiles of the top market players of marine dynamic positioning system industry can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the marine dynamic positioning system industry.

The opportunities in marine dynamic positioning system industry include increase in development of autonomous ships, introduction of laser-based dynamic positioning systems, and technological advancements.

In December 2021, Wartsila introduced a new OPTI-DP Engagement tool that is built using computational fluid dynamics (CFD) modelling, to enable accurate & speedy configuration of thrusters & other propulsion systems, to deliver optimal dynamic positioning solution. In February 2020, Kongsberg Maritime received a contract from West Sea Viana Shipyard to equip four new cruise vessels with auxiliary engines, motion control systems, propulsion systems, power electric systems, and dynamic positioning systems. In June 2019, Praxis Automation Technology received a contract from Rawabi Vallianz Offshore Services to deliver a complete solution of its Dynamic positioning system onboard their fleet of Offshore supply vessels operating out of Saudi Arabia.

The upcoming trends of marine dynamic positioning system include introduction of laser-based dynamic positioning systems, and greater use in development of autonomous ships.

Dynamic positioning system is a computer operated system, installed in ships to control the position of vessel in water body. The main components of a dynamic positioning system comprise of positioning system, DP computer, and thrusters. The positioning system comprises of a GPS, which monitors the position of vessel.

Loading Table Of Content...