Global marine propulsion engine market is expected to reach $12 billion by 2022, growing at a CAGR of 4.1% from 2016 to 2022. Marine propulsion engines is a machine that burn fuel to create thrust, which helps ships to move across water. The marine propulsion engine market is expected to witness robust growth during the forecast period owing to various ongoing government investments in shipbuilding industry and inland waterways. Ships are integrated with one or more than one propulsion engines, depending on their size (gross tonnage). Moreover, in the early stage of marine propulsion, steam turbines were used; however, due to advancement in technology, diesel or alternative fuel engine and gas turbine have greater penetration.

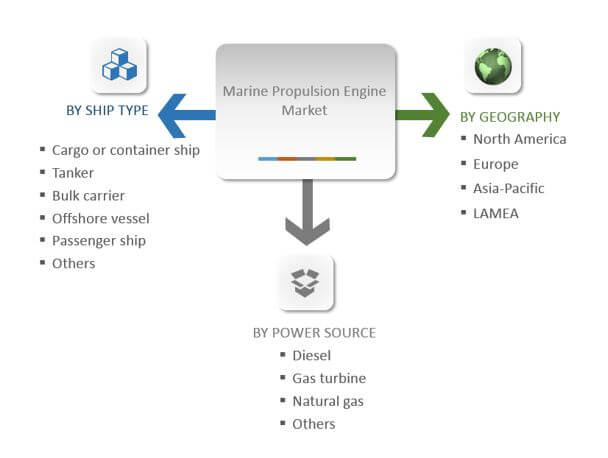

Market Segmentation

Marine propulsion engines are specifically engineered to withstand the harsh conditions encountered at sea, including high levels of vibration, corrosive environments, and prolonged operation under load. They are designed to be durable, reliable, and capable of delivering high power outputs over extended periods. Moreover, the marine propulsion engine market is highly competitive and consists of several global & regional players. Prominent companies in the industry employ various strategies to improve engine efficiency, reduce emissions, and comply with stringent environmental regulations, thereby further boosting the demand for the marine propulsion engine. For instance, in January 2023, Garden Reach Shipbuilders and Engineers (GRSE) partnered with Rolls Royce Solutions of Germany for manufacture of high-quality marine diesel engines. These engines generate a power output of 746-4300 kilowatts (KW) and are known to be reliable, compact, and simple to maintain.

Rise in international seaborne trade is a primary driver that fuels the growth of the marine engine propulsion market. Further, need for larger vessels, opening of new trade routes, retrofitting requirements, and emphasis on sustainability collectively contribute to the growth of the market. Engine manufacturers and suppliers must continue to innovate & develop efficient & environmentally friendly propulsion solutions to meet the evolving demand from the global trade industry.

The market segmentation is based on power source, ship types, and geography. The power source segment is divided into diesel, gas turbine, natural gas, and others (steam turbine, renewable energy, hybrid, and fuel cell). By ship types, the market is categorized into cargo & container, tanker, bulk carrier, offshore vessel, passenger ship, and others (tugs & service ships). Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

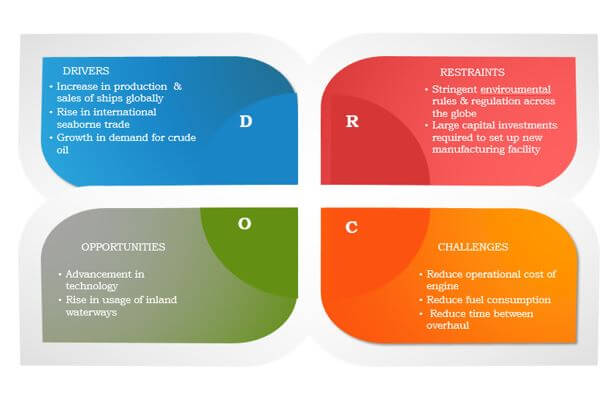

Market Dynamics

Increase in production & sales of ships globally and rise in international seaborne trade drive the market growth. In addition, increase in demand for resources such as crude oil, coal, steel, and iron from developing countries fuels the market growth. However, stringent environmental rules & regulations and large capital investment required to set up new manufacturing facilities hamper the market growth. Irrespective of these challenges, rise in usage of inland waterways and advancement in technology, such as new alternative fuel propulsion engine, are expected to provide various opportunities for new products and boost the market growth.

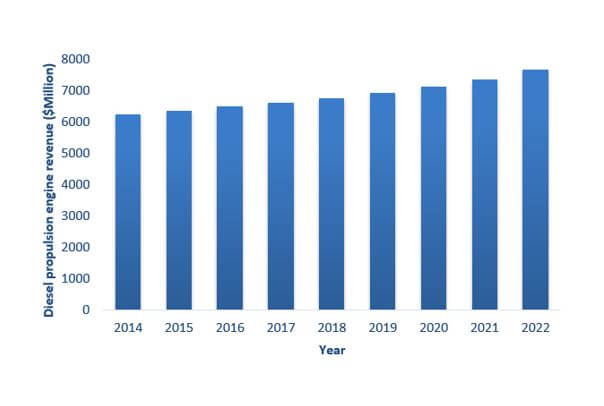

Diesel Propulsion Engine Leads the Marine Propulsion Engine Market

Diesel propulsion system is the most common marine propulsion system used in all types of vessel along with small and recreational boats. Moreover, diesel marine propulsion engine led the overall market, accounting for 70% in 2015. This is attributed to its benefits such as high reliability, economical nature, low maintenance cost, and easy availability of diesel globally.

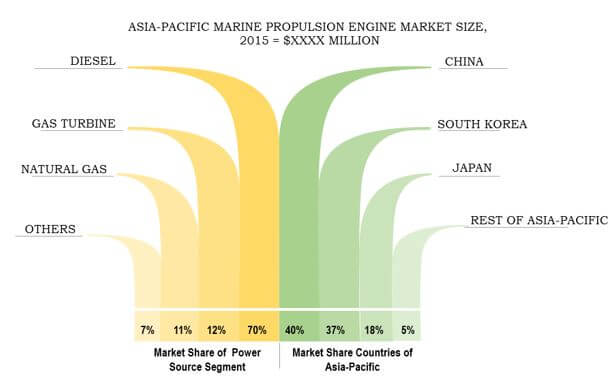

Asia-Pacific: Most Lucrative Market

Asia-Pacific is the most lucrative marine propulsion engine industry, owing to increase in shipbuilding industries in China & South Korea and growth in number of joint ventures with international brands. Moreover, rise in seaborne trade of crude oil mostly from Middle East countries to Asia-Pacific is another factor that drives the Asia-Pacific marine propulsion engine market.

MARINE PROPULSION ENGINE MARKET KEY BENEFITS

The report includes an extensive analysis of the factors that drive as well as restrain the global marine propulsion engine market.

The market projections from 2014 to 2022 are included along with the affecting factors.

The report also provides quantitative as well as qualitative trends to assist the stakeholders understand the situations that prevail in the market.

An in-depth analysis of key segments demonstrates stakeholders with different types of ships and different power sources.

Competitive intelligence highlights the business practices followed by leading market players across various geographies.

Marine Propulsion Engine Market Report Highlights

| Aspects | Details |

| By Power Source |

|

| By Ship Type |

|

| By Geography |

|

| Key Market Players | Rolls-Royce Plc, Mitsubishi Heavy Industries, Ltd., Scania, Hyundai Heavy Industries Co., Ltd, Wrtsil, Daihatsu Diesel Mfg. Co., Ltd., Caterpillar, Cummins Inc., Man Se (Man Diesel & Turbo), Yanmar Co., Ltd. |

Analyst Review

Marine propulsion engine is machine that burns fuel to create thrust, which helps ships to move across water. As of now, ship propulsion is not just about successful & smooth movement of the ship across the water. It also involves using the best mode of propulsion system to ensure a better safety standard for the marine ecosystem along with cost efficiency.

Rise in number of ships; increase in international seaborne trade; and increase in demand for resources such as crude oil, steel, iron, and coal drive the growth of the marine propulsion engine market. Furthermore, rise in usage of inland waterways and technological advancements such as fuel cell, hybrid & nuclear reactor engine boost the demand for marine propulsion engine.

As of now, there are latest RT-flex and ME engines which are camshaft less electronically controlled engines. These are used as intelligent engines by electronic control and feedback. Intelligent engine will monitor its own condition according to the feedback & pre- set setting and it will adjust the engine parameters itself.

The diesel propulsion engine segment constituted the largest market share owing to its benefits such as highly reliable engine, economical nature, low maintenance cost, and easy availability of diesel globally. The adoption rate of natural gas-powered marine propulsion engine is high as compared to others, owing to stringent marine engine emission rules and regulations. Moreover, the bulk carrier segment is expected to witness a robust growth due to increase in demand of resources such as ore, coal, grains and other similar products in loose form.

Asia-Pacific is projected to hold the largest market share, followed by Europe and North America. This is attributed to increase in shipbuilding industry of China and South Korea. Leading players such as Caterpillar, Cummins Inc., Rolls-Royce Plc, and Wärtsilä are expected to explore newer techniques and applications to cater to the growing demands of customers. Collaborations and acquisitions are projected to enable them to enhance their product portfolios and increase their geographical presence.

Loading Table Of Content...