Maritime Freight Transport Market Research, 2033

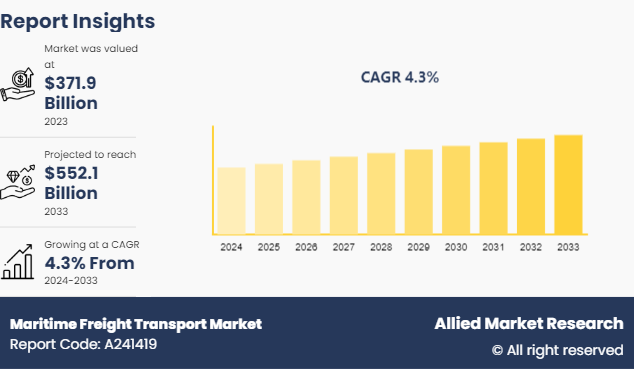

The global maritime freight transport market size was valued at $371.9 billion in 2023, and is projected to reach $552.1 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033.

Market Introduction and Definition

Maritime freight transport involves the movement of goods and cargo via sea routes, utilizing ships and other vessels. It is a critical component of global trade, enabling the efficient and cost-effective transportation of large volumes of commodities, raw materials, and finished products across international waters. This mode of transport is particularly suited for bulky, heavy, or non-perishable items, making it essential for industries such as oil, mining, and manufacturing. Key elements of maritime freight transport industry include ports, shipping lanes, containerization, and logistical support services, all of which contribute to the seamless flow of global commerce.

Maritime freight transport is integral to the global economy, facilitating international trade and supply chain operations. It involves complex logistics, including loading and unloading at ports, customs clearance, and adherence to international maritime regulations. Innovations like containerization and advancements in ship technology continue to enhance its efficiency and sustainability.

Key Takeaways

The maritime freight transport market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major maritime freight transport industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In September 2023, Hapag-Lloyd, a major German shipping company, and CMA CGM, a leading French container transportation and shipping company, signed a memorandum of understanding (MoU) to collaborate on various operational matters. The partnership aims to streamline port operations by coordinating schedules and consolidating operations where possible. This can lead to better utilization of port facilities, reduced congestion, and faster turnaround times for vessels. Optimized port operations contribute to lower operational costs and enhanced service levels.

In June 2023, Japanese shipping company Ocean Network Express (ONE) and Israeli shipping company ZIM have agreed to cooperate on container sharing and slot exchange agreements. The partnership enhances the global network coverage for both ONE and ZIM. By combining their routes and services, they can offer customers access to a wider range of destinations and more direct connections. This expanded network improves service reliability and reduces transit times for shipments.

Key Market Dynamics

The global trade expansion is a significant driver of the maritime freight transport market size. As global trade grows, the volume of goods being exchanged internationally rises. Maritime freight transport, being the most cost-effective method for shipping large quantities of goods over long distances, becomes increasingly essential to handle this surge in volume. Furthermore, the advancement in ship technology, and growth of E-commerce have driven the demand for the maritime freight transport market share.

However, environmental regulation is hampering the growth of the maritime freight transport market trends. Compliance with stringent environmental regulations often requires significant investments in cleaner technologies and fuels. Shipping companies may need to retrofit existing vessels with emission-reducing technologies, use low-sulfur fuels, or invest in new, more environmentally friendly ships. These added costs can reduce profit margins and increase shipping rates, potentially deterring customers. Moreover, geopolitical tension and port congestion are major factors that hamper the growth of the maritime freight transport market forecast.

On the contrary, digital transformation presents a significant and lucrative opportunity for the maritime freight transport market growth. Implementing advanced technologies like blockchain, IoT, and AI can optimize logistics, improve supply chain transparency, and enhance overall efficiency in maritime freight transport.

Supply Chain Dynamics for the Maritime Freight Transport Market

The maritime freight transport market is a complex and dynamic component of global supply chains, playing a crucial role in international trade. It involves a network of shipping companies, port operators, freight forwarders, and logistics providers that work together to move goods across the world's oceans. The dynamics of this market are influenced by various factors, including global economic conditions, trade policies, fuel prices, technological advancements, and environmental regulations. Demand for maritime freight services is driven by global trade volumes, which fluctuate based on economic growth rates and trade agreements. On the supply side, the capacity of the shipping fleet, the availability of port infrastructure, and the efficiency of logistics operations are key determinants.

In addition, the market is affected by geopolitical events, which can disrupt supply chains and lead to changes in shipping routes and practices. Technological innovations, such as automation and digitalization, are enhancing the efficiency and transparency of maritime operations. Environmental concerns are also reshaping the industry, with stricter emissions regulations pushing for greener shipping solutions. Overall, the maritime freight transport market is a vital and evolving sector that underpins global commerce by facilitating the efficient movement of goods across the globe.

Market Segmentation

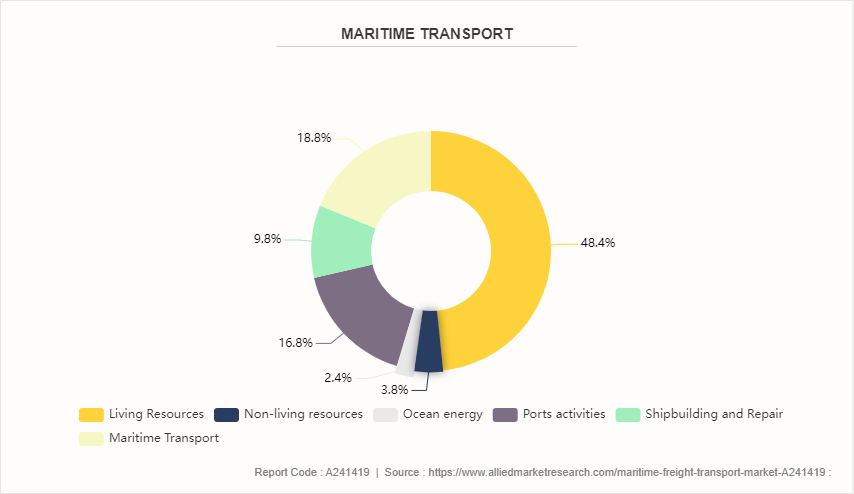

The maritime freight transport market is segmented into cargo type, vessel type, industry type, and region. On the basis of cargo type, the market is segmented into dry bulk (coal, iron ore, grains) , liquid bulk (oil, liquefied natural gas) , containerized goods, and general cargo (machinery, vehicles) . On the basis of vessel type, the market is divided into container ships, bulk carriers, tankers (crude oil, product, chemical) , Ro-Ro (Roll-on/Roll-off) vessels, LNG/LPG carriers, offshore support vessels, and cruise ships. As per industry type, the market is divided into food and beverage, manufacturing, oil and ores, electrical and electronics. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America attained the highest market share in the maritime freight transport market as the region's robust economic activity and significant trade volumes drive a high demand for maritime shipping services. The U.S. and Canada, in particular, are major importers and exporters of goods, necessitating extensive maritime transport networks to support their trade activities. Furthermore, North America's well-developed port infrastructure plays a crucial role. Major ports such as the Port of Los Angeles, Port of Long Beach, Port of New York and New Jersey, and the Port of Vancouver are among the busiest in the world, handling vast quantities of containerized and bulk cargo efficiently. These ports are equipped with advanced technology and logistics capabilities that enhance their handling capacity and operational efficiency.

Rapid economic development in countries such as China, India, and Southeast Asian nations has significantly increased the volume of exports and imports. These countries have become major players in global manufacturing and trade, driving demand for maritime shipping services to transport goods to international markets. Furthermore, the Asia-Pacific region is a global manufacturing powerhouse, particularly China, which is often referred to as the "world's factory." The high volume of manufactured goods produced in this region necessitates extensive use of maritime freight transport to distribute products worldwide.

Many Asia-Pacific countries have invested heavily in expanding and modernizing their port infrastructure. Ports such as Shanghai, Singapore, Hong Kong, and Busan are among the busiest and most efficient in the world, capable of handling large volumes of cargo with advanced logistics and technology.

In November 2023, Maersk, a Danish shipping giant, partnered with IBM to develop and implement a new digital platform for managing maritime logistics. This partnership aims to enhance efficiency and transparency throughout the global supply chain by leveraging blockchain technology, which underpins the platform.

In June 2023, the world's largest container shipping company, Maersk, has announced that it will invest $1 billion in sustainable shipping solutions. This includes the development of new ships that run on alternative fuels, such as methanol and ammonia.

Competitive Landscape

The report analyzes the profiles of key players operating in the maritime freight transport market such as AP Moller (Maersk) , China Ocean Shipping (Group) Company (COSCO) , CMA-CGM, COSCO Shipping, Evergreen Line, Hapag-Lloyd, HMM Co., Maersk, Mediterranean Shipping Company S.A. (MSC) , and ONE - Ocean Network Express. These players have adopted various strategies to increase their market penetration and strengthen their position in the maritime freight transport market.

Industry Trends

In May 2024, the container shipping "Megamax" class has achieved a new milestone, according to Alphaliner, a leading maritime analytics and consulting firm. The "Megamax" class refers to a category of ultra-large container ships (ULCS) capable of carrying over 20, 000 twenty-foot equivalent units (TEUs) , which are the standard measure for container capacity. These ships represent the pinnacle of current maritime engineering and logistical capabilities, designed to maximize efficiency in global trade.

In May 2024, SITA, the global leader in air transport technology, launched SmartSea in partnership with Columbia Shipmanagement (CSM) , a leading ship manager and maritime service provider. SmartSea aims to revolutionize the maritime sector by providing access to advanced technology that has previously transformed the air transport industry. CSM, as the first client of SmartSea, will significantly enhance its operations using this state-of-the-art technology.

In May 2024, CLdN, a prominent provider of integrated door-to-door logistics solutions, joined the Maritime Battery Forum community. CLdN owns 30 ships and operates over 200 weekly sailings, offering shortsea connections across the European continent, the United Kingdom, Ireland, Iberia, and Scandinavia. The company also owns and operates five ports in Belgium, the Netherlands, and the UK. With a Europe-wide reach through its extensive network of ships, terminals, and equipment, CLdN employs 3, 000 people and generates an annual turnover of approximately EUR 1 billion.

In March 2024, the spike in China-to-Mexico container shipping suggests that importers are looking to bypass U.S. tariffs and trade barriers by routing goods through Mexico. This strategy, known as "tariff engineering, " allows companies to take advantage of trade agreements like the USMCA (United States-Mexico-Canada Agreement) , which facilitates easier and cheaper access to the U.S. market. By importing goods into Mexico first, businesses can potentially reduce costs and avoid higher tariffs imposed directly on goods shipped from China to the U.S. This shift underscores the adaptability of global supply chains in response to changing trade policies and economic pressures.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the maritime freight transport market segments, current trends, estimations, and dynamics of the maritime freight transport market analysis from 2022 to 2032 to identify the prevailing maritime Freight Transport Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the maritime freight transport market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global maritime freight transport market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global maritime freight transport market trends, key players, market segments, application areas, and market growth strategies.

Maritime Freight Transport Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 552.1 Billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 455 |

| By Cargo Type |

|

| By Vessel Type |

|

| By Industry Type |

|

| By Region |

|

| Key Market Players | Hapag-Lloyd AG, China COSCO Shipping Corporation Limited, ONE - Ocean Network Express, Mediterranean Shipping Company S.A. (MSC), ZIM Integrated Shipping Services Ltd., CMA-CGM, HMM Co., AP Moller (Maersk), evergreen line, Hanjin Shipping Co., Ltd. |

Upcoming trends in the global Maritime Freight Transport Market include the adoption of digitalization and automation technologies, increased use of eco-friendly and energy-efficient vessels, growth in e-commerce driving demand for faster shipping solutions, expansion of blockchain for enhanced transparency and security, and the development of smart ports to improve efficiency and reduce congestion. Additionally, there is a rising focus on sustainability and regulatory compliance to reduce carbo

The leading application of the maritime freight transport market is container shipping, which involves the transportation of goods in standardized containers. This method is widely used due to its efficiency, flexibility, and ability to handle a diverse range of cargo types, making it the backbone of global trade.

North America is the largest regional market for maritime freight transport

$371.90 Billion is the estimated industry size of maritime freight transport

AP Moller (Maersk), CMA-CGM, COSCO Shipping, Evergreen Line, Hapag-Lloyd, HMM Co., Hanjin Shipping Co., Ltd., Mediterranean Shipping Company S.A. (MSC), ONE - Ocean Network Express, and ZIM Integrated Shipping Services Ltd are the top companies to hold the market share in maritime freight transport

Loading Table Of Content...