Mass Spectrometry Market Overview

The global mass spectrometry market size was valued at $6.9 billion in 2022, and is projected to reach $14.6 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. Advancement in mass spectrometry technology, increase in pharmaceutical and biotechnology research, increase in use of advanced mass spectrometry instruments over traditions mass spectrometers are a majorly driving mass spectrometry market.

Market Dynamics & Insights

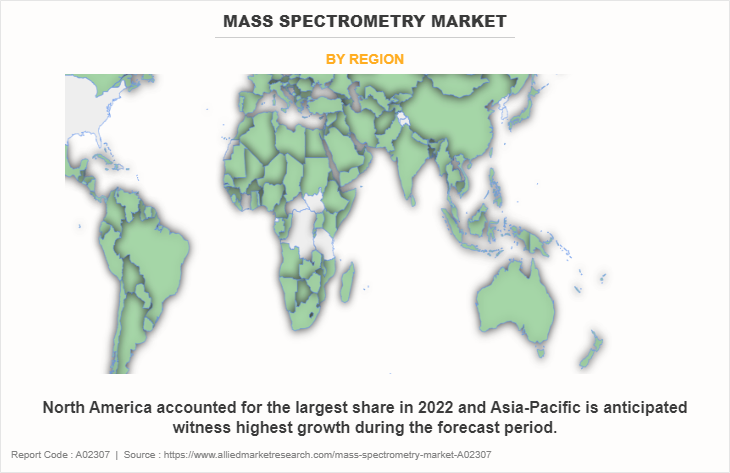

The Mass spectrometry industry in North America held a significant share of over 40% in 2022.

The Mass spectrometry industry in China is expected to grow significantly at a CAGR of 9.5% from 2023 to 2032.

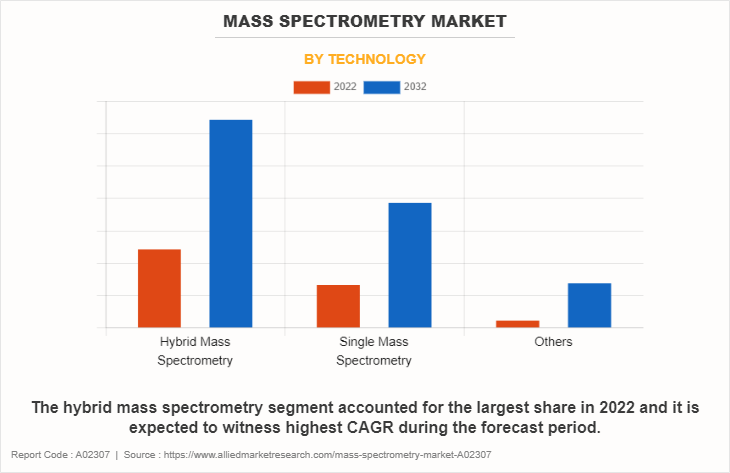

By technology, the Hybrid Mass Spectrometry is one of the dominating segment in the market and accounted for the revenue share of over 49.2% in 2022.

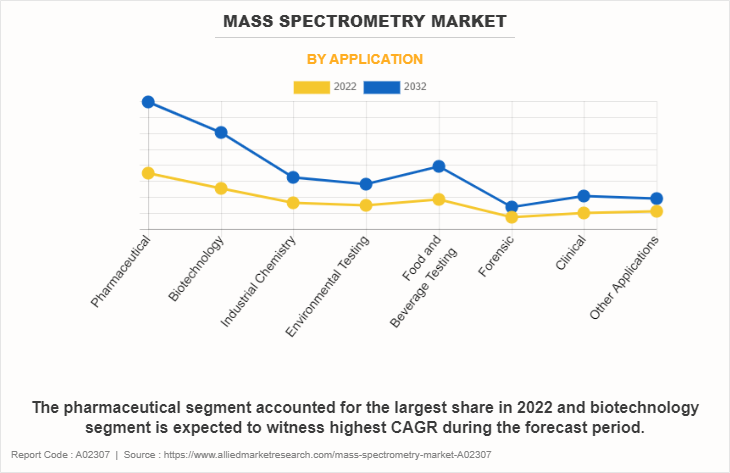

By application, the Pharmaceutical segment is the dominant segment in the market in 2022.

Market Size & Future Outlook

2022 Market Size: $6.9 Billion

2032 Projected Market Size: $14.5 Billion

CAGR (2023-2032): 7.7%

North America: Largest market in 2022

Asia Pacific: Fastest growing market

The mass spectrometry market trends include advancement in mass spectrometry technology, increase in pharmaceutical and biotechnology research, and surge in government and private funding. Technological advancement in mass spectrometry techniques is a major driver for the mass spectrometry market. Such advanced techniques allow MS analysis of all elements in complex sample and facilitate high resolution of components. Thus, adoption of technologically advanced mass spectrometers drives the market growth. Furthermore, increase in the funding for mass spectrometry research also drives the market growth. For instance, in August 2022, LSU Chemistry professor and principal investigator, Kermit Murray received $1 million to purchase new mass spectrometers to strengthen the research infrastructure. In addition, Stanford University encourages new mass spectrometry research projects by granting funds up to $10,000.

Key Takeaways

- By technology hybrid mass spectrometry segment dominated the global market in 2022.

- By application pharmaceutical segment dominated the global market in 2022.

- Biotechnology segment is anticipated to be the fastest growing segment during the forecast period.

- North America region dominated the market in terms of revenue in 2022.

- Asia-Pacific is expected to register highest CAGR during the forecast period.

Mass spectrometry (MS) is an analytical technique used to determine and identify quantity of a compound within a sample, and traces of components at very low concentrations. It allows scientists and researchers to comprehensively catalogue sophisticated samples in a single analysis. In this process, initially the sample is ionized by loss of an electron. The ions are then categorized and divided on the basis of their charge and mass, which are measured by use of a computer. It provides increased sensitivity over other analytical systems, owing to reduced background intrusion and superior specificity from characteristic fragmentation patterns to detect unknown compounds. In addition, it can identify the existence of suspected compounds and data regarding molecular weight of the compound in the mixture and provide data about isotopic abundance of elements and chemical data determined for a short term. Mass spectrometry is used in various industries such as pharmaceuticals, biotechnology, environmental analysis, forensic, and others.

Market Dynamics

The growth of mass spectrometry industry is driven by increase in use of advanced mass spectrometry instruments over traditions mass spectrometers and surge in adoption of mass spectrometers in various industries. Traditional MS techniques that are employed in shotgun and targeted proteomics procedures are anticipated to be replaced by recently emerging mass spectrometry techniques, namely Triple Quadrupole (Tandem), Quadrupole TOF (Q-TOF), and FT-MS. Further, increase in the technologically advanced new product launches also drives the market growth. For instance, in June 2020, Shimadzu Corporation, a biotechnology research company launched its LCMS-8060NX liquid chromatograph mass spectrometer in Japan. The newly launched LCMS-8060NX is a highly advanced mass spectrometry system that allows for precise and accurate qualitative and quantitative analysis.

Further, in September 2021, Thermo Fisher Scientific Inc., a biotechnology research company launched the world's first net zero mass spectrometer (MS), which has wide applications in food and beverage, environmental science, and forensic science. Thus, surge in new product launches is expected to boost the market growth during the forecast period. In addition, expansion of mass spectrometry applications in various industries such as forensics, clinical diagnostics, and environmental analysis also supports the market growth. The growth of the mass spectrometry market is expected to be driven by increase in food safety concerns. The regulatory authorities across the globe are implementing stringent regulations for food testing due to increase in cases of food contamination. To check the safety of the products mass spectrometry testing is mandatory which further supports the market growth.

However, high cost of mass spectrometry, limited access in low-income countries, and dearth of skilled analysts restrain the growth of the mass spectrometry market size. High costs of mass spectrometry may create barriers that restrict their adoption in smaller facilities. Thus, limited access to costly mass spectrometry hampers the market growth. Furthermore, lack of proper infrastructure, including stable power supply, trained personnel, and maintenance support, can restrict the widespread adoption and usage of mass spectrometers in such settings.

On the other hand, development of new portable mass spectrometers is expected to create lucrative opportunities for the market growth during the forecast period. A new trend of miniaturization of mass spectrometry devices is rapidly growing in the recent years, as modern technologies have evolved to provide portable analytical devices. This shift toward conventional devices has paved way for the development of technologically advanced miniaturized mass spectrometry devices for on-site analysis. Thus, development of miniaturized mass spectrometers are expected to create lucrative opportunities for the growth of the mass spectrometry market during the forecast period.

The ongoing global economic recession influences several industries, including medical technology, biotechnology and pharmaceuticals, which has an impact on the mass spectrometry market. During a recession, the medical technology industry is moderately impacted due to increase in cost for healthcare providers, supplies, and instruments. Furthermore, decrease in consumer spending on devices and high cost of mass spectrometry instruments further restrains the market growth. Despite these challenges, the mass spectrometry market continues to experience moderate revenue growth owing to, technological advancement in the mass spectrometry and need for the mass spectrometry in various industries such as pharmaceutical, chemical industries, and others. Thus, the mass spectrometry industry is moderately impacted by the recession.

Segments Overview

The mass spectrometry market is segmented on the basis of technology, application, and region. On the basis of technology, the market is classified into hybrid mass spectrometry, single mass spectrometry, and others. The hybrid mass spectrometry segment is further divided into triple quadrupole, quadrupole TOF, and FT-MS. The single mass spectrometry is further divided into ION trap, quadrupole, and time of flight. On the basis of application, the market is segmented into pharmaceutical, biotechnology, industrial chemistry, environmental testing, food and beverage testing, forensic, clinical, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

By Technology

The mass spectrometry market is segmented into hybrid mass spectrometry, single mass spectrometry, and others. The hybrid mass spectrometry accounted for the largest mass spectrometry market share in 2022, and is expected to remain dominant during the forecast period as it offers high resolution and mass accuracy, provides multiple modes of operation, and analyzes complex samples with high specificity. Furthermore, technological advancement in the hybrid mass spectrometry and increase in demand from the biopharmaceutical and biotechnology industry further boost the segment growth.

By Application

The mass spectrometry market is segregated into pharmaceutical, biotechnology, industrial chemistry, environmental testing, food and beverage testing, forensic, clinical, and others. The pharmaceutical segment accounted for the largest mass spectrometry market share in 2022, and is anticipated to continue this trend during the forecast period, owing to rise in R&D activities and surge in proteomics research. However, biotechnology segment is expected to register highest CAGR during the mass spectrometry market forecast period, owing to increase in use of mass spectrometers for proteomics and other studies.

By Region

The mass spectrometry market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the mass spectrometry market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., and PerkinElmer, Inc. and the presence of well-developed industrial sectors in the region drives the growth of the market. In addition, adoption of technologically advanced as well as portable mass spectrometers further boosts the market growth in this region.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The mass spectrometry market growth in this region is attributable to the increase in demand for mass spectrometry in this region. In addition, growing adoption of mass spectrometry further propels the market growth. Asia-Pacific offers profitable mass spectrometry market opportunity for the key players operating in the market, thereby registering the fastest growth rate during the forecast period, owing to the rise in disposable income, as well as increase in healthcare expenditure.

Competition Analysis

Competitive analysis and profiles of the major players in the mass spectrometry, such as Thermo Fisher Scientific Inc., Agilent Technologies, Danaher Corporation, Waters Corporation, Bruker Corporation, Perkinelmer, Inc., Shimadzu Corporation, Kore Technologies, Ltd., Hiden Analytical, and Leco Corporation. Other key players in the market include, Analytik Jena AG, JEOL Ltd., and others. Major players have adopted product launch, collaboration, product development/upgrade, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the mass spectrometry market.

Recent Product Launches in the Mass Spectrometry Market

In June 2023, Thermo Fisher Scientific Inc., a biotechnology research company launched its Thermo Scientific Orbitrap Astral mass spectrometer to identify new clinical biomarkers and develop new interventions for cardiovascular disease to cancer.

In November 2021, Thermo Fisher Scientific Inc. a global leader in science introduced its new-generation mass spectrometry instruments and will showcase new additions to its industry-leading offering during the 69th American Society for Mass Spectrometry (ASMS) Conference.

In August 2023, Shimadzu Corporation launched its ICPMS-2040 Series and ICPMS-2050 Series inductively coupled plasma mass spectrometers (ICP-MS) for the analysis of inorganic elements.

Recent Collaboration in the Mass Spectrometry Market

In June 2022, Thermo Fisher Scientific Inc., a global leader in biotechnology industry announced the co-marketing agreement with TransMIT GmbH Center for Mass Spectrometric Developments to promote the use of mass spectrometry imaging (MSI), for application in pharmaceuticals and clinical labs.

Recent Expansion in the Mass Spectrometry Market

In January 2021, Shimadzu Corporation opened Shimadzu-CGH Clinomics Centre in partnership with Changi General Hospital (CGH).

Recent Acquisition in the Mass Spectrometry Market

In February 2022, Waters Corporation acquired the technology assets and intellectual property rights of Megadalton Solutions Inc., a developer of Charge Detection Mass Spectrometry (CDMS) technology and services.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mass spectrometry market analysis from 2022 to 2032 to identify the prevailing mass spectrometry market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mass spectrometry market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mass spectrometry market trends, key players, market segments, application areas, and market growth strategies.

Mass Spectrometry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.6 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Shimadzu Corporation, Hiden Analytical Ltd., Thermo Fisher Scientific Inc. , Waters Corporation, Kore Technologies, Ltd., Leco Corporation, Danaher Corporation, Agilent Technologies, Inc., Bruker Corporation, PerkinElmer, Inc. |

Analyst Review

According to the insights of CXOs, growth of the global mass spectrometry is attributed to factors such as rise in new product launches, technological advancements, and surge in collaboration between market key players to expand their businesses and application industries in the different regions. For instance, in June 2022, Thermo Fisher Scientific Inc., a global leader in biotechnology industry has announced the co-marketing agreement with TransMIT GmbH Center for Mass Spectrometric Developments to promote the use of mass spectrometry imaging (MSI), for application in pharmaceuticals and clinical labs.

Furthermore, in October 2023, Waters Corporation, a biotechnology research company has collaborated with University of San Agustin to establish the first mass spectrometry imaging center in Philippines. The imaging center will help researchers to accelerate drug discoveries and develop therapeutics for the treatment of cancer and infectious diseases.

Furthermore, North America witnessed the highest growth in 2022, in terms of revenue, owing to surge in adoption of advanced mass spectrometry technologies. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period, owing to development of healthcare settings, surge in prevalence of chronic diseases, and development of new treatments.

The major factor that fuels the growth of the mass spectrometry market are technological advancement in the mass spectrometry, surge in R&D activities in pharmaceutical and biotechnology industry and development of portable mass spectrometers.

Hybrid Mass Spectrometry is the most influencing segment in mass spectrometry market which is attributed to technological advancement in the hybrid mass spectrometry and surge in adoption of hybrid mass spectrometry in various industries.

Top companies such as, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Bruker Corporation, Waters Corporation, and Shimadzu Corporation held a high market position. These key players held a high market position owing to the strong geographical foothold in different regions.

The total market value of mass spectrometry market is $6,930.55 million in 2022.

Mass spectrometry is an analytical technique used to identify and quantify the chemical composition of a sample by measuring the mass-to-charge ratio of its molecules.

The market value of mass spectrometry market in 2032 is $14,634.56 million.

The forecast period for mass spectrometry market is 2023 to 2032.

The base year is 2022 in mass spectrometry market.

The mass spectrometry is used for the qualitative and quantitative analysis of components.

Loading Table Of Content...

Loading Research Methodology...