Mattress Market Research, 2033

Market Introduction and Definition

The global mattress market was valued at $37.3 billion in 2023, and is projected to reach $66.5 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033. A mattress is a large, rectangular pad designed to support the reclining body, typically used on a bed frame or as a standalone sleeping surface. It plays an important role in providing comfort and support, promoting restful sleep and overall well-being. The mattress market includes a variety of types, such as innerspring, memory foam, latex, and hybrid models, each offering distinct features such as pressure relief, temperature regulation, and durability. The market has expanded significantly owing to rise in consumer awareness about the importance of sleep, advancements in mattress technologies, and increase in demand for customized sleeping solutions. Factors such as material innovation, eco-friendly options, and online retailing have further influenced mattress market size dynamics, making mattresses a key component of the global sleep industry.

Key Takeaways

The mattress market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major mattress industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Increasing awareness of sleep health has significantly surged demand in the mattress market. Consumers increasingly recognize the vital role of quality sleep in overall well-being, supported by public health campaigns and educational initiatives. For instance, the Centers for Disease Control and Prevention (CDC) reports that insufficient sleep is linked to chronic health issues like diabetes and heart disease, underscoring the importance of good sleep hygiene. This awareness has led to a higher demand for mattresses that offer better support, comfort, and durability. Innovations in mattress design, such as memory foam and adjustable beds, cater to diverse sleep needs, further boosting mattress market demand as consumers invest in products that enhance sleep quality and health.

However, the market saturation in developed countries has become a restraint for the mattress market, as high household penetration rates limit new sales opportunities. In regions like North America and Western Europe, a significant percentage of households already own high-quality mattresses, reducing the frequency of replacement purchases. The U.S. Census Bureau data indicates that the median household income is stable, leading to increased consumer spending on durable goods like mattresses. However, this also means that the replacement cycle extends as consumers hold onto their mattresses longer. As a result, the market faces challenges in achieving mattress market growth, focusing instead on premium product segments or innovations to stimulate demand.

Moreover, smart mattresses with sleep-tracking features are creating significant opportunities in the mattress market by catering to the growing interest in health and wellness. These mattresses offer integrated technologies such as sensors and apps that monitor sleep patterns, heart rate, and breathing. The National Institutes of Health (NIH) supports initiatives that enhance understanding of sleep and its impact on health, highlighting the relevance of such innovations. Consumers are increasingly adopting these advanced mattresses to gain insights into their sleep quality and improve their overall health. The integration of IoT and smart home systems also boosts the appeal, making smart mattresses a promising growth area in an otherwise mature market.

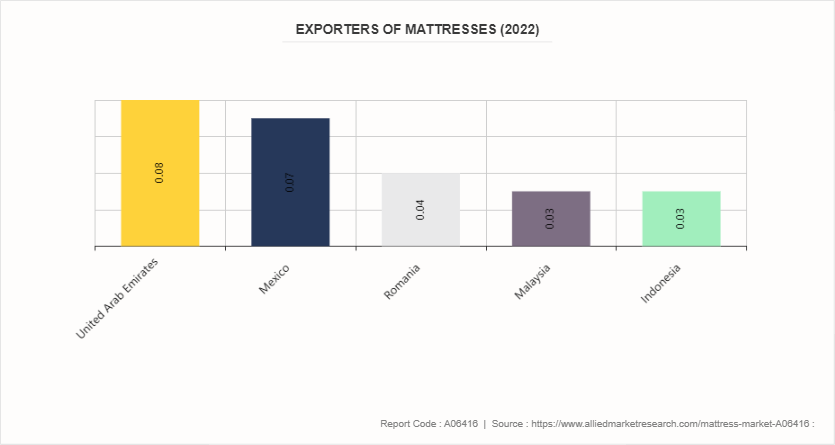

Between 2021 and 2022, the exports of Mattresses grew the fastest in United Arab Emirates ($0.08 billion) , Mexico ($0.07 billion) , Romania ($0.04 billion) , Malaysia ($0.03 billion) , and Indonesia ($0.03 billion) .

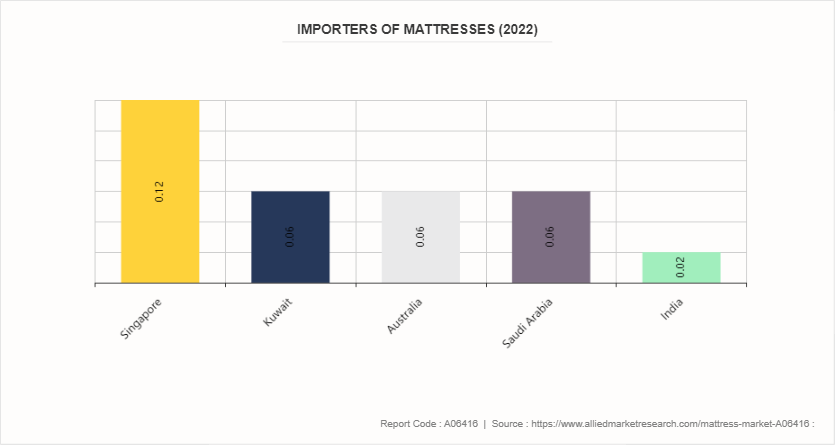

Between 2021 and 2022, the fastest growing importers of Mattresses were Singapore ($0.12 billion) , Kuwait ($0.06 billion) , Australia ($0.06 billion) , Saudi Arabia ($0.06 billion) , and India ($0.02 billion) .

Value Chain of the Mattress Market

Raw Material Sourcing: Raw material sourcing involves procuring essential components such as polyurethane foam, memory foam, latex, steel coils, textiles, and adhesives. These materials form the core of various mattress types, providing structure, comfort, and durability. Sourcing quality materials is crucial for ensuring the end product meets consumer expectations and industry standards.

Component Manufacturing: Component manufacturing includes shaping foam layers, forming spring units, and producing fabrics. Foam is cut and shaped to different densities, while springs and coils are assembled for innerspring mattresses. Fabrics are prepared and quilted to create mattress covers, adding comfort and aesthetic appeal to the final product.

Assembly and Production: In this stage, mattresses are assembled by layering and bonding different materials, such as foam, coils, and covers. Quality control measures are implemented to ensure durability and safety. Finally, mattresses are packaged, often compressed and rolled, to facilitate transportation and delivery, maintaining product integrity.

Distribution and Logistics: Distribution and logistics encompass storing finished mattresses in warehouses and managing their transportation to retailers or directly to consumers. This stage involves logistical planning to ensure timely delivery and proper handling of products, often including coordination with shipping carriers and delivery services.

Retail and Sales: Mattresses are sold through various channels, including physical stores and online platforms. In-store experiences allow consumers to test mattresses, while e-commerce offers convenience and a wider selection. Direct-to-consumer models often include additional services such as home delivery and setup, enhancing the overall customer experience.

After-Sales Service and Support: Customer service and after-sales support include handling warranties, returns, and exchanges to ensure customer satisfaction. Feedback is collected to inform future product improvements. Providing responsive support helps maintain brand loyalty and addresses any issues related to product performance or customer expectations.

Market Segmentation

The mattress market is segmented into type, mode of availability, size, industrial vertical, and region. On the basis of type, the market is divided into innerspring, latex, memory foam, and others. As per mode of availability, the market is bifurcated into online and offline. On the basis of size, the market is divided into single size mattress, double size mattress, queen size mattress, and king size mattress. As per industrial vertical, the market is classified into hospitality, healthcare, personal care, educational institute, others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America holds the largest mattress market share owing to several key factors. The region's high standard of living and disposable income enables consumers to invest in premium and technologically advanced mattresses, driving market demand. A strong culture of health and wellness awareness encourages spending on quality sleep products, further fueling growth. The well-established retail infrastructure, including both brick-and-mortar stores and a robust e-commerce presence, facilitates easy access to a wide range of mattress options. For instance, more than 35.9 million mattresses are shipped each year by the mattress industry. This includes international shipments and online purchase shipments (Statistic Brain) . In addition, North America's mature market is characterized by a high replacement rate, as consumers frequently upgrade to newer, more comfortable mattresses. Technological innovations and a focus on personalized sleep solutions also contribute to the market's expansion, as companies continuously introduce products catering to diverse consumer needs. These factors collectively position North America as a leading market in the global mattress industry.

Industry Trends

In the U.S. bedding industry, there are currently 600 companies currently engaged in the design, manufacture, and sale of mattresses. They are responsible for the direct employment of about 20, 500 people.

Twin-size mattresses are the most popular size sold in the U.S., accounting for 31% of the market share for the industry. 29% of households purchase a Queen-size mattress.

Most of the mattresses that are purchased today occur through a specialty sleep retailer. 43% of all new mattresses are purchased from this type of business. Furniture retailers are responsible for another 38% of total industry sales.

Globally, the Asia-Pacific region represents the fastest growing market for the mattress industry. A forecast CAGR of 8.1% through 2022 is the foundation of potential revenues that could top $39.4 billion in that timeframe.

Competitive Landscape

The major players operating in the mattress market include Sleepwell, Tempur Sealy International Inc., MM Foam, Relyon Limited, Simmons Bedding Company LLC, Duroflex, Rubco, Kurl-on, Serta Inc., and Kingsdown Inc.

Recent Key Strategies and Developments

In November 2023, Simmons Bedding Company LLC, a U.S.-based company, opened its new state-of-the-art manufacturing plant in Wisconsin for mattress and other bedding products production.

In May 2023, Tempur Sealy International Inc., a U.S.-based brand, announced the acquisition of Mattress Firm, a U.S.-based omnichannel retailer.

In May 2022, Simmons Bedding Company LLC, a U.S.-based company, launched their latest Beautyrest Black collection for mattresses. The collection features luxurious designs for mattresses that are made using luxury materials such as cashmere for enhanced airflow and breathability.

In March 2023, Setra Simmons partnered with VFI Group to produce luxurious bedding in India.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mattress market analysis from 2024 to 2033 to identify the prevailing mattress market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the mattress market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global mattress market trends, key players, market segments, application areas, and market growth strategies.

Mattress Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 66.5 Billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 170 |

| By Type |

|

| By Mode Of Availability |

|

| By Size |

|

| By Industrial Vertical |

|

| By Region |

|

| Key Market Players | Tempur Sealy International Inc., Sleepwell, MM Foam, Kingsdown Inc, Duroflex, Serta Inc., Kurl-on, Rubco, Simmons Bedding Company LLC, Relyon Limited |

The global mattress market is set to experience significant growth driven by several key trends. Notably, there is an increasing consumer preference for smart mattresses equipped with IoT technology, allowing users to monitor sleep patterns and enhance comfort through personalized adjustments. Additionally, sustainability is becoming a major focus, with rising demand for eco-friendly and organic mattress options as consumers prioritize environmentally conscious products.

The leading application of the mattress market is in the household segment, which dominated the market. The household segment is expected to continue its dominance as rising population, urbanization, and increasing disposable incomes drive the demand for mattresses in residential settings

North America is the largest regional market for Mattress.

The global mattress market was valued at $37.3 billion in 2023, and is projected to reach $66.5 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Sleepwell, Tempur Sealy International Inc., MM Foam are the top companies to hold the market share in Mattress.

Loading Table Of Content...