MDF And Chipboard Market Research, 2032

The Global MDF and Chipboard Market size was valued at $58.6 billion in 2020, and is projected to reach $134.5 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Medium density fiberboard, commonly known as MDF, is an engineered wood product crafted by binding wood fibers, often obtained from softwood or hardwood residuals, with synthetic resins and adhesives under high temperatures and pressure. Chipboard, referred to as particleboard, is an engineered wood composite created through the amalgamation of wood particles, chips, or flakes with a binding adhesive under heat and pressure. Moreover, both MDF and chipboard offer economical alternatives to solid wood, addressing the demand for sustainable material utilization.

Market Dynamics

The need for residential and non-residential structures has expanded significantly as a result of the rise in global population and urbanization. This has increased demand for MDF and chipboard, which is principally used for flooring, doors, and windows, as well as for the interior design of homes and other constructions. In addition, the demand for furniture has significantly increased, partly as a result of the increase in the number of homes and other residential and non-residential structures.

The expansion of the MDF And chipboard market growth is being fueled by the rise in demand for furniture because a substantial portion of furniture is constructed using MDF panels. In addition, MDF and chipboard are utilized in the production of a wide range of other goods, including speaker boxes, temporary wooden structures, and shipping boxes. Furthermore, the escalating trend of residential construction, driven by factors such as urbanization and population growth, has elevated the need for reliable and versatile construction materials. MDF and chipboard market opportunity have emerged as essential in this landscape due to their multifaceted applications. These engineered wood products are increasingly favored for interior elements, flooring, and structural components within residential structures. Their qualities of stability, uniformity, and cost-effectiveness resonate with the efficiency sought in modern construction.

Furthermore, manufacturers of MDF have responded with strategic expansions as the residential construction sector proliferates. For instance, in July 2022, Greenpanel Industries Limited, which is a leading manufacturer of wood-based products expanded its business by establishing a new MDF plant with an operational capacity of 231,000 CBM annually at an existing manufacturing facility in Chittoor, Andhra Pradesh, India. The extra capacity is expected to result in a 35% increase in the annual MDF manufacturing capacity of the company. The amplified demand for MDF has prompted these manufacturers to augment their production capacities, optimizing their ability to meet the escalating requisites of the construction industry. Such expansions encompass not only increased output but also innovations in product design, finishes, and sustainability aspects to align with evolving consumer preferences and environmental considerations.

Moreover, MDF and chipboard are manufactured using wood fibers, which can be sourced from various recycled materials such as sawdust, wood chips, and wood shavings that are by-products of other wood processing operations. MDF and chipboard production minimize the environmental impact that might result from discarding or incinerating such materials by repurposing these waste materials. In addition, processing recycled wood fibers typically requires less energy compared to processing virgin timber, as the material is already broken down and treated to some extent. This energy efficiency further contributes to the environmental benefits of MDF and chipboard market overview production.

The MDF and chipboard industry has witnessed various obstructions in its regular operations due to COVID-19 pandemic and inflation. lockdowns and travel restrictions imposed to curb the spread of the virus led to supply chain disruptions. Manufacturers faced difficulties in sourcing raw materials that are needed for producing MDF and chipboard. Delays in shipments and logistical bottlenecks affected the timely delivery of the MDF and chipboard, contributing to project delays and reduced operational efficiency. However, the COVID-19 has subsided, and the major manufacturers in 2023 have performed well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war, and a few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing MDF & chipboard panels. In addition to this, the cost of raw wood has also increased substantially, and many countries; especially, the countries in Europe, Latin America, and developing economies in Asia-Pacific have experienced severe negative impacts in the production of wood-based products. However, India and China have performed relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

Segmental Overview

The MDF and chipboard market is segmented on the basis of product type, application, end-user, and region. On the basis of product type, the market is categorized into MDF, chipboard, and edgeband. On the basis of application, the market is segmented into cabinet, flooring, furniture, molding, door, and millwork, packaging system, and others. On the basis of end-user, it is categorized into residential, commercial, and institutional. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, the UK, Croatia, Russia, Serbia, Spain, Poland, Denmark, Netherlands, Belgium, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Pakistan, Indonesia, Thailand, and rest of Asia-Pacific), Latin America (Brazil, Argentina, Chile, Colombia, and rest of Latin America), Middle East (UAE, Saudi Arabia, Turkey, and rest of the Middle East), and Africa (Algeria, Egypt, Morocco, South Africa, and rest of Africa).

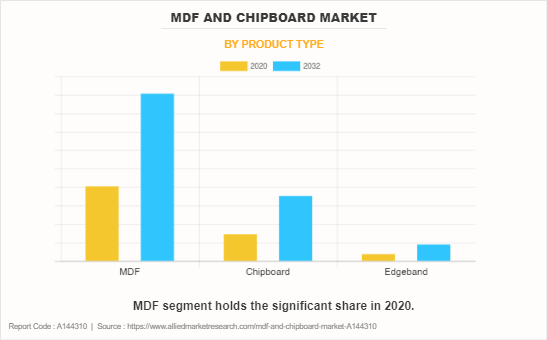

By Product Type:

The MDF and chipboard market is categorized into MDF, chipboard, and edgeband. In 2022, the MDF segment dominated the MDF and chipboard market share, in terms of revenue. However, the chipboard segment is expected to grow with a higher CAGR during the forecast period. Moreover, medium density fiberboard (MDF) offers notable advantages, including its smooth and consistent surface that readily accepts various finishes. It boasts high dimensional stability, resisting warping or swelling, ensuring lasting quality. In addition, its affordability relative to solid wood makes it an attractive choice for cost-effective yet visually appealing projects.

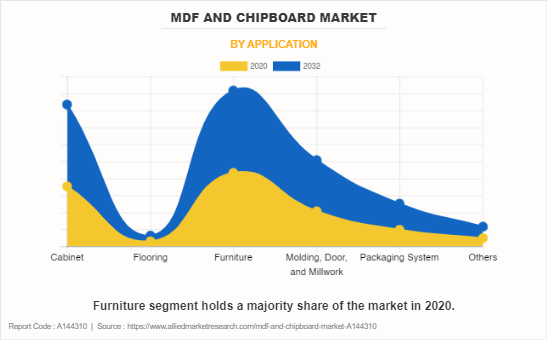

By Application:

The MDF and chipboard market is divided into cabinet, flooring, furniture, molding, door, and millwork, packaging system, and others. In 2022, furniture dominated the MDF and chipboard market forecast, in terms of revenue, and packaging system is expected to witness growth at a higher CAGR during the forecast period. Furthermore, utilizing MDF and chipboard for flooring supports sustainable practices by utilizing recycled wood fibers and waste materials, reducing the demand for virgin timber. Both materials can be easily cut, shaped, and finished, allowing for customizable designs and patterns in flooring installations.

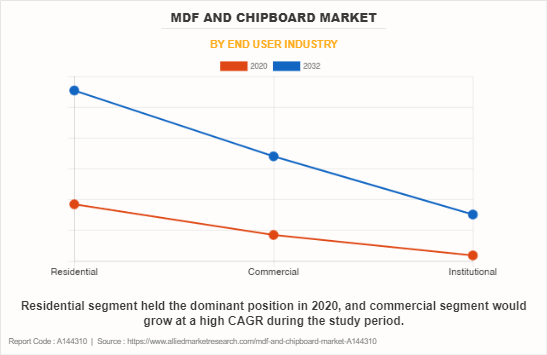

By End User:

The MDF and chipboard are divided into residential, commercial, and institutional. The residential segment accounted for a higher market share in 2022 and the commercial segment is anticipated to register a higher growth rate throughout the forecast period. MDF and chipboard are collectively used in residential settings for a variety of applications. They are utilized in crafting cabinets, shelves, and furniture pieces, providing cost-effective solutions while offering customizable designs. Both materials find roles in interior design, creating decorative elements such as moldings, panels, and accent walls.

By Region:

Asia-Pacific accounted for the highest market share in 2022. However, Arica is expected to grow with a higher CAGR throughout the projected period. The Asia-Pacific region has experienced rapid urbanization, with a growth in population moving to urban areas. This surge in urban living drives demand for affordable housing, infrastructure, and furniture, all of which heavily rely on MDF and chipboard for their cost-effectiveness and versatile applications.

Competition Analysis

Competitive analysis and profiles of the major players in the MDF and chipboard market are provided in the report. Major companies in the report includes AGT Agac Sanayi ve Ticaret A.S., Arauco and Constitution Pulp Inc., Arkopa Ahsap Panel San. A.S., ARPA INDUSTRIALE S.p.A. (FENIX), Boyut Plastik, Century Plyboards (India) Ltd, CLEAF S.P.A., Dare Panel Group Co., Ltd., Egger Holzwerkstoffe GmbH, Gizir Wood Products, Greenpanel Industries Limited, GRUPO ALVIC FR MOBILIARIO, S.L., Isik Ahsap, KAP Ltd., KAREBANT A.S., KASTAMONU ENTEGRE A.S, Korosten MDF manufacture, Kronospan Limited, M. KAINDL GmbH, Meva Ahap, Mobelkant, Portakal Ahap retim Paz.Ltd.ti, Saviola Holding srl, Swiss Krono, West Fraser Timber Co. Ltd., and Yildiz Entegre.

For instance, in April 2023, Kronospan Limited, which is a leading manufacturer of wood-based products, expanded its innovative, 460-acre Oriented Strand Board (OSB) manufacturing facility in Oxford, Alabama. A new water treatment facility, an extension of its current medium density fiberboard (MDF) press, and an increase in the production capacity of its current particle board plant are all included in this recent expansion.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mdf and chipboard market analysis from 2020 to 2032 to identify the prevailing mdf and chipboard market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mdf and chipboard market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mdf and chipboard market trends, key players, market segments, application areas, and market growth strategies.

Mdf And Chipboard Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 134.5 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 660 |

| By Application |

|

| By End User Industry |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | KAREBANT A.S., Saviola Holding srl, KAP Ltd., Portakal Pvc Kenar Bantlar, Meva Ahsap, Arauco and Constitution Pulp Inc., Greenpanel Industries Limited, Mobelkant, Isik Ahsap, Yildiz Entegre, Korosten MDF manufacture, M. KAINDL GmbH, Gizir Wood Products, Boyut Plastik, Kronospan Limited, Swiss Krono, Egger Holzwerkstoffe GmbH, Dare Panel Group Co., Ltd., ARPA INDUSTRIALE S.p.A. (FENIX), Arkopa Ahsap Panel San. A.S., KASTAMONU ENTEGRE A.?., Century Plyboards (India) Ltd, GRUPO ALVIC FR MOBILIARIO, S.L., CLEAF S.P.A., West Fraser Timber Co. Ltd., AGT Agac Sanayi ve Ticaret A.S. |

Analyst Review

The MDF and chipboard market has witnessed significant growth in the past few years, owing to a surge in construction and renovation activities of residential, commercial, and institutional buildings, along with the surge in the furniture industry. MDF and chipboard are made up of wood particulates, which are mixed with resin and wax, and compressed at high pressure and temperature. It has a homogenous and very dense structure, leading to high strength, durability, and resistance to bending and cracking due to this. Moreover, MDF and chipboard can be made water and fire-resistant/retardant; thereby, making it widely usable in many applications including water and fire.

Furthermore, MDF and chipboard are made with recycled wood which reduces its carbon footprint, and significantly reduces its price. In addition, the rise in demand for luxurious interiors of homes, especially in high-income countries such as the U.S., France, the UK, and Germany fuels the demand for MDF. In addition, increased building construction activities in countries, such as China and India have increased the demand for chipboard from residential and non-residential sectors. MDF and chipboard are extensively used in making temporary construction, such as exhibition booths, movie shooting sets, and others, aiding in increased demand for chipboard and MDF. In addition, rise in demand for furniture across the globe is anticipated to drive significant growth in the MDF and chipboard market. Moreover, rise in trend of home renovation activities in high- and mid-income countries is expected to provide lucrative opportunities for the growth of the MDF and chipboard market.

The MDF and Chipboard Market size was valued at $72,344.4 million in 2022.

Based on the product type, the MDF holds the maximum market share of the MDF and Chipboard Market in 2022.

The MDF and Chipboard Market is projected to reach $1,34,543.6 million by 2032.

The growth of the furniture industry and the rise in building construction are the key trends in the MDF and Chipboard Market.

Business expansions and acquisitions are key growth strategies of the MDF and Chipboard industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The fluctuating prices of raw materials is the effecting factor for MDF and Chipboard Market.

The latest version of MDF and Chipboard Market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...