Meat Packaging Market Research, 2034

The global plastic based meat packaging market was valued at $9.9 billion in 2024, and is projected to reach $14.4 billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

Introduction

Plastic based meat packaging refers to the specialized processes and materials used to encase, preserve, protect, and present meat products from the point of production to consumption. It is a critical aspect of the meat supply chain, ensuring that the product remains fresh, safe, and appealing while complying with regulatory requirements. Packaging for meat is uniquely complex due to the perishable nature of the product, its susceptibility to contamination, and the potential risks associated with improper handling or spoilage. As a result, meat packaging involves the use of advanced technologies and materials that extend shelf life, prevent microbial contamination, and maintain the product’s organoleptic qualities (such as color, texture, and flavor).

Packaging for meat is broadly categorized into two types: primary packaging, which comes in direct contact with the meat (such as plastic films, trays, or vacuum packs), and secondary packaging, which includes cartons or boxes used for transportation and display. The materials used often include polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and other composites engineered to be durable, flexible, and resistant to gas or moisture penetration. Packaging techniques such as vacuum sealing, modified atmosphere packaging (MAP), and active packaging are widely used depending on the type of meat, storage requirements, and distribution method. The meat packaging plays a crucial role in ensuring the hygienic handling and safe distribution of both raw and processed meats, including popular varieties such as beef, pork, poultry, lamb, and seafood. Given the highly perishable nature of meat, processors rely on advanced packaging technologies to maintain product quality from the production line to the point of sale.

Key Takeaways

- The plastic based meat packaging market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global plastic based meat packaging markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the plastc based meat packaging market are Amcor plc, Mondi, Berry Global Inc., Sealed Air Corporation, Winpak Ltd, Coveris, Bolloré Group, Sealpac International bv, Smurfit Kappa, and ULMA GROUP. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Increase in demand for meat consumption is expected to drive the growth of plastic based meat packaging market during the forecast period. Global meat demand continues to grow, driven by rise in incomes, urbanization, and shift in dietary habits, especially in developing regions where meat consumption signifies improved living standards. As meat is highly perishable, advanced packaging solutions such as vacuum packaging, modified atmosphere packaging (MAP), and skin packaging are gaining traction for preserving freshness, extending shelf life, and maintaining quality. E[1]commerce growth has further boosted demand for hygienic, leak-proof, and temperature-controlled meat packaging. While meat consumption is plateauing in high-income countries due to health and environmental concerns, poultry remains dominant, expected to comprise 41% of global meat protein intake by 2032. In response to growing demand, Amcor opened a $100M flexible packaging plant in China in 2022, featuring automated production and advanced manufacturing capabilities.

However, strict government regulations is expected to hamper the growth of plastic based meat packaging market. The meat packaging industry operates under a highly regulated environment due to the critical importance of food safety, consumer health, and environmental concerns. Governments across the globe have established stringent guidelines that manufacturers must comply with in areas such as hygiene practices, labeling accuracy, and the use of approved packaging materials. While these regulations are essential for protecting public health and maintaining trust in the food system, they present significant challenges for meat processors and packaging companies. In India, the packaging of meat and meat products is governed by strict regulations to ensure consumer safety and maintain product quality. The Government of India in Meat Food Products Order, 1973 (MFPO), is a key legislation that outlines the requirements for the preparation, packaging, and labeling of meat products. This order mandates that all operations related to meat food products must be conducted under strict hygienic conditions. In addition, the Prevention of Food Adulteration Act, 1954 in India, and its rules, further emphasize the importance of proper packaging to prevent contamination and adulteration.

Segments Overview

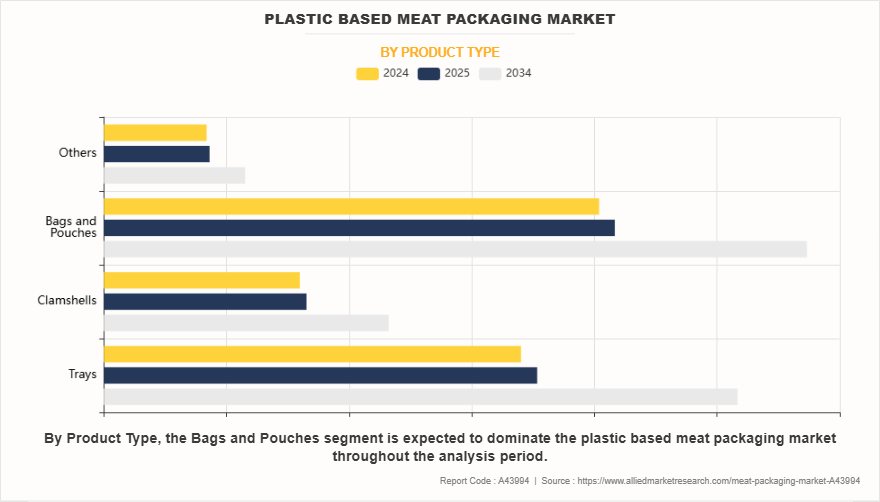

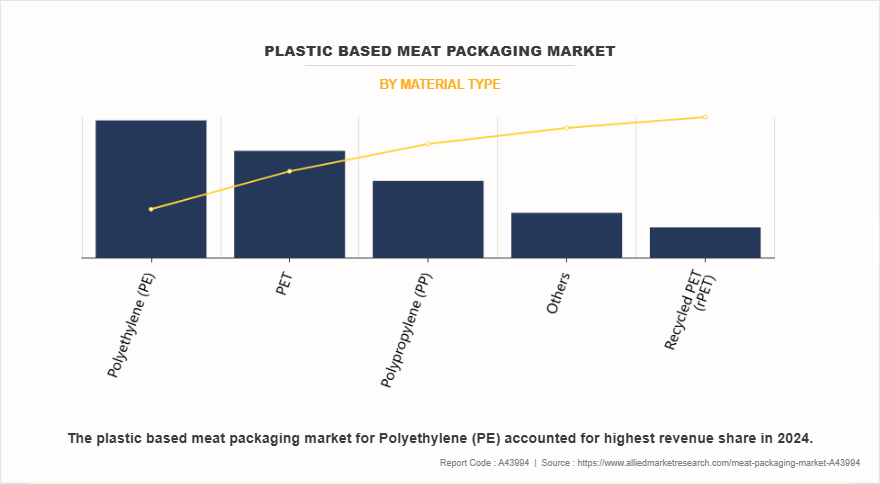

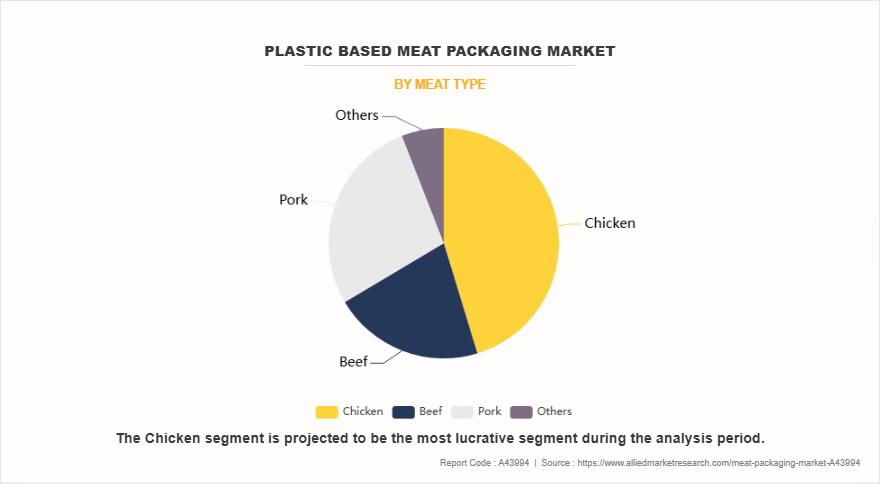

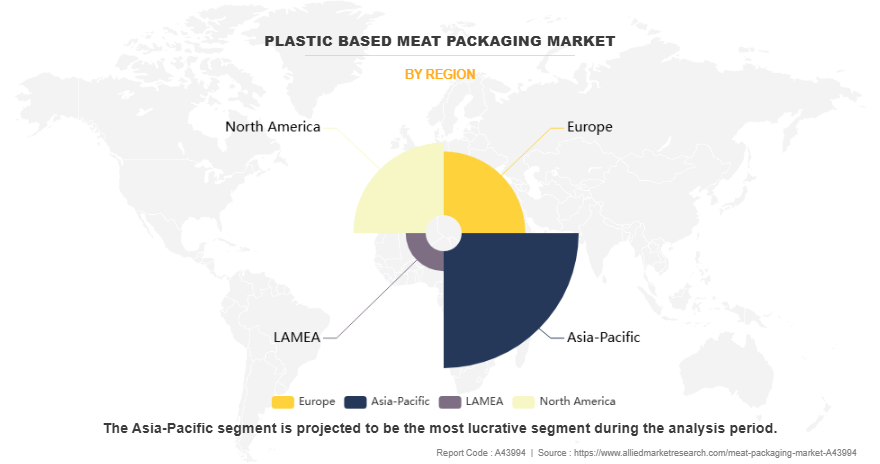

The plastic based meat packaging market is segmented into product type, material type, meat type, and region. On the basis of product type, the market is divided into trays, clamshells, bags & pouches, and others. On the basis of material type, the meat packaging market is categorized into polyethylene (PE), PET, recycled PET (rPET), polypropylene (PP), and others. On the basis of meat type, the meat packaging market is classified into pork, chicken, beef, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product type, the bags and pouches segment dominated the market, accounting for more than one fourth of the market share in 2024. Bags and pouches are typically made from multilayer films that provide barrier protection against moisture, oxygen, and contaminants, helping preserve the freshness, texture, and flavor of the meat. Vacuum-sealed pouches are especially common, as they remove air from the packaging, reducing the risk of microbial growth and oxidation. In addition to vacuum packaging, modified atmosphere packaging (MAP) in pouches is also gaining traction. MAP pouches replace the air inside with a gas mixture that slows bacterial growth, enabling longer shelf life and maintaining meat quality. In April 2025, retailers such as Asda transitioned their fresh beef and lamb mince products to vacuum-sealed packaging, aiming to reduce plastic use by 60% and cut carbon emissions. This change, implemented in late March 2025, is expected to double the shelf life of these products, reduce food waste, and help customers save money.

On the basis of material type, the polyethylene (PE) segment dominated the market in 2024. Polyethylene (PE) is one of the most widely used materials in the meat packaging industry due to its versatility, cost-effectiveness, and protective properties. Moreover, there are several types of polyethylene, primarily low-density polyethylene (LDPE) and high-density polyethylene (HDPE), that are used based on the packaging requirements of different meat products. PE films are particularly valued for their moisture barrier qualities, which help prevent dehydration and maintain the freshness of meat. In addition, PE's flexibility and strength make it suitable for various forms of packaging, including vacuum-sealed bags, stretch films, and shrink wraps, all commonly used in the preservation and transportation of both fresh and processed meats.

On the basis of meat type, the chicken segment dominated the market in 2024. Meat packaging plays a crucial role in the chicken industry, ensuring product safety, shelf life, and consumer convenience. The packaging of chicken meat must maintain the freshness of the product while preventing contamination from external sources. Retail chicken packaging comes in various formats depending on the type of product. Whole chickens are often packed in vacuum-sealed or shrink-wrapped plastic film to ensure minimal exposure to air. In contrast, chicken parts such as breasts, thighs, and wings are typically placed in foam trays wrapped with clear plastic film, allowing visibility and consumer appeal.

By region, Asia-Pacific dominated the meat packaging market in 2024. The Asia-Pacific region witnessed a significant increase in the use of meat packaging, driven by rapid urbanization, rise in disposable incomes, and a surge in preference for convenience foods. In China, the world’s largest meat consumer, meat packaging has evolved significantly due to heightened concerns about food safety, particularly after health crises such as African swine fever and COVID-19. The country has witnessed increased investment in vacuum packaging, modified atmosphere packaging (MAP), and skin packaging to extend shelf life and ensure product integrity. Similarly, in Japan and South Korea, where consumers are highly quality-conscious, advanced packaging technologies are adopted to preserve freshness, enhance visual appeal, and maintain hygiene standards.

Competitive Analysis

The major prominent players operating in the plastic based meat packaging market include Amcor plc, Mondi, Berry Global Inc., Sealed Air Corporation, Winpak Ltd, Coveris, Bolloré Group, Sealpac International bv, Smurfit Kappa, and ULMA GROUP.

- In August 2023, Amcor launched AmFiber Packpyrus, a paper-based packaging solution for meat products. This packaging contains at least 85% paper fibers from FSC certified sources and offers a 56% reduction in carbon footprint compared to traditional plastic trays.

- In August 2023, Amcor acquired Phoenix Flexibles, a flexible packaging company based in Gujarat, India, to expand its market presence. In November 2024, Amcor agreed to acquire Berry Global for $8.43 billion in stock, aiming to enhance its product portfolio and global footprint.

- In February 2024, Berry Global merged its Health, Hygiene, and Specialties division with Glatfelter Corporation to create a $3.6 billion specialty materials company, focusing on expanding their capabilities in sustainable packaging solutions.

- In September 2021, Indian meat brands introduced sustainable packaging solutions. For instance, Nandu's launched eco-friendly packaging made from non-plastic virgin food-grade material that is fully recyclable, aligning with the increasing consumer demand for environmentally responsible packaging.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the meat packaging market analysis from 2024 to 2034 to identify the prevailing plastic based meat packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic based meat packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic based meat packaging market trends, key players, market segments, application areas, and market growth strategies.

Plastic Based Meat Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 14.4 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 437 |

| By Material Type |

|

| By Product Type |

|

| By Meat Type |

|

| By Region |

|

| Key Market Players | COVERIS, Amcor PLC, Sealed Air Corporation, Sealpac International bv, Berry Global Inc., Bollore Group, Winpak Ltd., ULMA GROUP, Smurfit Kappa Group, Mondi |

Analyst Review

According to the opinions of various CXOs of leading companies, advancements in packaging technology is expected to drive the growth of meat packaging market. The meat packaging industry has witnessed major innovations enhancing shelf life, safety, and convenience. Key technologies include Modified Atmosphere Packaging (MAP), Vacuum Skin Packaging (VSP), and smart packaging. MAP extends freshness by altering internal gas composition, reducing oxygen and increasing nitrogen or carbon dioxide without preservatives. In June 2023, ProAmpac launched a sustainable MAP (Modified Atmosphere Packaging) fiber-based meat packaging for sandwich wedge in North America. Designed for premium meats, this packaging utilizes VSP (Vacuum Skin Packaging) technology, which tightly seals the product with a specialized film. This film removes oxygen, improving product presentation while maintaining freshness and extending shelf life. In April 2024, Coveris expanded its VSP capabilities at its Winsford site, investing in advanced co-extrusion technology to improve shelf life and protection. These innovations underscore the industry's focus on freshness, sustainability, and consumer appeal.

However, short shelf life of meat packaging is expected to hamper the growth of meat packaging market. The meat packaging industry faces significant challenges due to the short shelf life of fresh and minimally processed meats such as ground beef, poultry, and seafood. These products are highly perishable due to their high moisture content, nutrient richness, and exposure to air, which promote bacterial growth from Pseudomonas species. Ground and processed meats are particularly vulnerable to spoilage due to increase in surface area exposes them more to environmental factors. To extend shelf life, preservation methods like vacuum packaging and modified atmosphere packaging (MAP) are used. These techniques either remove oxygen or introduce gases like carbon dioxide to inhibit microbial growth. Oxidation also plays a key role in meat quality as it affects color, turning the bright red of oxymyoglobin into brown as metmyoglobin forms. High-oxygen MAP helps maintain the red color but speeds up oxidation, whereas low-oxygen MAP slows oxidation but may give the meat a less desirable purplish tint.

The key players operating in the plastic based meat packaging market include Amcor plc, Mondi, Berry Global Inc., Sealed Air Corporation, Winpak Ltd, Coveris, Bolloré Group, Sealpac International bv, Smurfit Kappa, and ULMA GROUP.

The global plastic based meat packaging market was valued at $9.9 billion in 2024, and is projected to reach $14.4 billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

Asia-Pacific is the largest regional market for plastic based meat packaging.

Trays are the leading product type of plastic based meat packaging market.

Smart packaging solutions are the upcoming trends of plastic based meat packaging market globally.

Loading Table Of Content...

Loading Research Methodology...