Meat Processing Equipment Market Research, 2034

Market Introduction and Definition

The global meat processing equipment market size was valued at $6.3 billion in 2023, and is projected to reach $13.6 billion by 2034, growing at a CAGR of 7.4% from 2024 to 2034. Meat processing equipment includes machines and tools that prepare and manufacture meat products. Operators use these machines for various stages, such as slaughtering, cutting, grinding, mixing, and packaging. Key equipment consists of slicers, grinders, mixers, meat saws, and packaging devices. Advanced systems often incorporate automated technologies to boost efficiency and ensure hygiene. Manufacturers design such equipment to maintain product consistency and adhere to industry standards. Workers transform raw meat into consumable products such as sausages, patties, and cured meats using meat processing equipment. Moreover, meat processing equipment can handle different meat types, including beef, pork, poultry, and fish. Meat processing equipment plays a crucial role in large-scale meat production, supporting global food supply chains. Such meat processing machinery is vital in commercial settings, as it helps meet the growing demand for processed meat products.

Key Takeaways

The meat processing equipment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in demand for processed and convenience foods has driven the growth of meat processing equipment market. Consumers increasingly seek ready-to-eat and easy-to-prepare meal options, which has led food manufacturers to expand their product lines with processed meat items such as pre-cooked meats, deli products, and packaged snacks. Advanced meat processing equipment is required to ensure efficiency and maintain high quality and consistency, which has significantly boosted the demand for meat processing equipment market. Manufacturers have started to invest in new technologies and equipment to meet the growing demand and enhance overall production efficiency. Moreover, innovations in processing techniques, including automation and improved safety measures, support the meat processing equipment industry to evolve with consumer preferences, further contributing to the growth of the meat processing equipment market share.

However, high initial investment costs for meat processing equipment create a significant restraint on market demand. The substantial financial outlay required for purchasing and installing advanced processing machinery can be prohibitive for many small to mid-sized food processing companies. These high costs include expenses for equipment, installation, and necessary facility upgrades, which can strain the budgets of smaller enterprises. Consequently, businesses may delay or avoid investing in new equipment, limiting their ability to expand production capabilities and adopt the latest technologies. Such a financial barrier also affects the entry of fresh players into the market, as significant capital is needed to compete effectively. In addition, the ongoing maintenance and operational costs associated with sophisticated equipment further increases financial pressures on the manufacturers. As a result, the market for meat processing equipment is expected to experience slower growth owing to these high initial investment costs.

Moreover, the development of sustainable and eco-friendly processing solutions creates significant opportunities in the meat processing equipment market. As environmental concerns increase globally, food manufacturers are increasingly focused on reducing their carbon footprint and enhancing sustainability. Equipment designed to minimize waste, energy consumption, and emissions addresses these needs effectively, thus driving the meat processing market growth. Advanced technologies, including energy-efficient systems and waste-recycling processes, support global sustainability goals and attract companies striving to improve their environmental impact. Equipment manufacturers that prioritize eco-friendly innovations are anticipated to capture market share by catering to the rise in demand for sustainable solutions. Moreover, evolving regulatory requirements and consumer preferences for environmentally responsible products have driven the adoption of these technologies. Furthermore, embracing green practices helps equipment manufacturers meet environmental challenges while positioning themselves competitively in a market focused on sustainability, thereby encouraging growth and creating new opportunities.

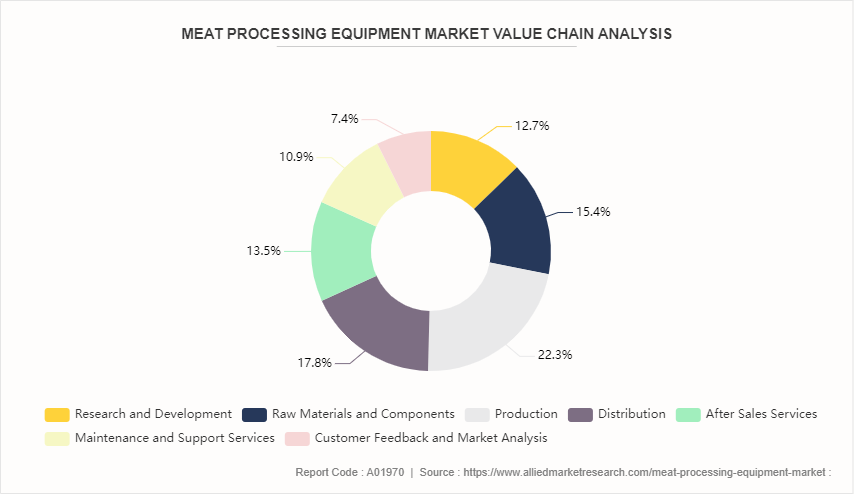

Value Chain of Global Meat Processing Equipment Market

The value chain of the meat processing equipment market begins with research and development, where manufacturers design and innovate recent technologies. Raw materials and components are sourced from suppliers, including metals, electronic parts, and specialized materials. Production follows, involving the assembly and testing of equipment. Distribution involves logistics and transportation to various end-users, including meat processors, food manufacturers, and distributors. After sales, installation and commissioning ensure the equipment operates correctly in the production environment. Maintenance and support services provide ongoing assistance and repairs. Finally, customer feedback and market analysis guide further improvements and innovations, which drives continuous development in the meat processing equipment market.

Market Segmentation

The global meat processing equipment market is segmented based on type, meat type, application, and region. Based on type, the market is classified into cutting equipment, blending equipment, tenderizing equipment, filling equipment, dicing equipment, grinding equipment, smoking equipment, massaging equipment, and others. Based on meat type, it is categorized into processed beef, processed pork, processed mutton, processed poultry, and others. The market is categorized based on application into fresh processed meat, raw cooked meat, precooked meat, raw fermented sausages, cured meat, dried meat, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Several major factors have driven the growth of the meat processing equipment market in the U.S. Increase in consumer demand for convenience foods and processed meat products has prompted investments in advanced processing technologies. Technological innovations, such as automation and smart equipment, have improved production efficiency and product quality. Regulatory standards for food safety and hygiene have pushed manufacturers to adopt advanced equipment that ensures compliance. Additionally, the expansion of foodservice and retail sectors has fueled the need for scalable and flexible meat processing solutions. Moreover, the focus on sustainability and environmental impact has also led to the development of energy-efficient and eco-friendly equipment. These factors collectively contribute to the robust growth of the meat processing equipment market growth in the U.S.

The Asia-Pacific market for meat processing equipment presents several future opportunities. Rapid urbanization and rise in incomes have led to increase in meat consumption, driving demand for advanced processing technologies. Growth in the food service and retail sectors necessitates scalable and efficient processing solutions. Emerging markets in the region offer untapped potential for meat processing equipment manufacturers. Innovations in automation and smart technologies can cater to evolving industry needs, such as improved food safety and production efficiency. Moreover, expansion into countries with growing meat industries and adapting equipment to local market requirements further enhance opportunities in the Asia-Pacific market.

Industry Trends:

The growth in demand for food safety and hygiene measures has significantly increased the demand for meat processing equipment. Increased consumer awareness and stricter regulations necessitate advanced equipment that ensures high standards of cleanliness and reduces contamination risks. Equipment manufacturers have responded by developing technologies with enhanced sanitation features, such as antimicrobial coatings and easy-to-clean designs. In addition, automation and advanced monitoring systems help maintain consistent hygiene standards and improve overall food safety. As food safety regulations become more stringent, meat processors invest in state-of-the-art equipment to comply with these requirements and meet consumer expectations. The emphasis on safety and hygiene drives the demand for sophisticated meat processing machine & equipment fueling market growth.

The rise in data analytics and artificial intelligence (AI) has boosted demand for meat processing equipment by enhancing operational efficiency and product quality. AI-driven systems enable real-time monitoring, predictive maintenance, and optimization of processing workflows, leading to more efficient use of resources and reduced downtime. Data analytics provides insights into production trends, quality control, and consumer preferences, which allows for more informed decision-making and tailored processing solutions. These advancements drive the demand for advanced equipment that integrates AI and data analytics capabilities. Consequently, the meat processing equipment industry sees a trend toward incorporating smart technologies to improve performance, enhance safety, and meet evolving market needs, thus fueling market growth during the meat processing equipment market forecast.

Competitive Landscape

The major players operating in the meat processing equipment market include Welbilt, Inc., GEA Group AG, The Middleby Corporation, Heat and Control, Inc., Marel, Key Technology, Inc., JBT Corporation, Illinois Tool Works Inc. (ITW) , Bettcher Industries, Inc., and Equipamientos Cárnicos S.L. (Mainca) .

Other players in the meat processing equipment market include Tetra Pak, SPX FLOW, Schenck Process, Buhler Industries, Nordson Corporation, Siemens AG, Krones AG, Alfa Laval, Paul Mueller Company, and Omron Corporation.

Recent Key Strategies and Developments

In July 2024, Ross Industries launched the AMS 400 Membrane Skinner, targeting craft and medium-sized meat processors to enhance efficiency and product quality.

In March 2024, Ross Industries unveiled the RVS 120 Vertical Chute Slicer, designed to enhance slicing precision in meat processing.

In July 2022, JBT Corporation acquired Alco-food-machines GmbH & Co. KG (Alco) to expand the product offering in meat processing equipment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the meat processing equipment market analysis from 2024 to 2034 to identify the prevailing meat processing equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the meat processing equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global meat processing equipment market trends, key players, market segments, application areas, and market growth strategies.

Meat Processing Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 13.6 Billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2024 - 2034 |

| Report Pages | 290 |

| By Type |

|

| By Meat Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Heat and Control, Inc., Bettcher Industries, Inc., Equipamientos Cárnicos S.L., Illinois Tool Works Inc. (ITW), JBT Corporation, Welbilt, Inc., The Middleby Corporation, KEY TECHNOLOGY, INC., Marel, GEA Group AG |

Analyst Review

Meat processing equipment are the tools used in the food processing industry, which are designed according to the specific end-user requirements. The global meat processing equipment market is witnessing considerable growth due to changing consumer preference toward ready-to-eat food products. In addition, increase in demand for processed meat is anticipated to boost the demand for meat processing equipment in the near future. On the contrary, high cost of raw materials is expected to hamper the market growth.

In 2017, North America dominated the global market and is expected to maintain its dominance throughout the forecast period. Asia-Pacific is expected to witness high adoption of meat processing equipment due to increase in demand for processed food in this region, owing to rise in small-scale meat processing firms.

Emerging trends include automation, advanced data analytics, eco-friendly technologies, smart sensors, and enhanced food safety measures.

The leading application of meat processing equipment is in the production of processed meat products, including sausages, deli meats, and ready-to-eat meals.

Based on region, North America held the highest market share in terms of revenue in 2023.

The global meat processing equipment market was valued at $6.3 billion in 2023.

The major players operating in the meat processing equipment market include Welbilt, Inc., GEA Group AG, The Middleby Corporation, Heat and Control, Inc., Marel, Key Technology, Inc., JBT Corporation, Illinois Tool Works Inc. (ITW), Bettcher Industries, Inc., and Equipamientos Cárnicos S.L. (Mainca).

Loading Table Of Content...

Loading Research Methodology...