Medical Bionics Market Overview:

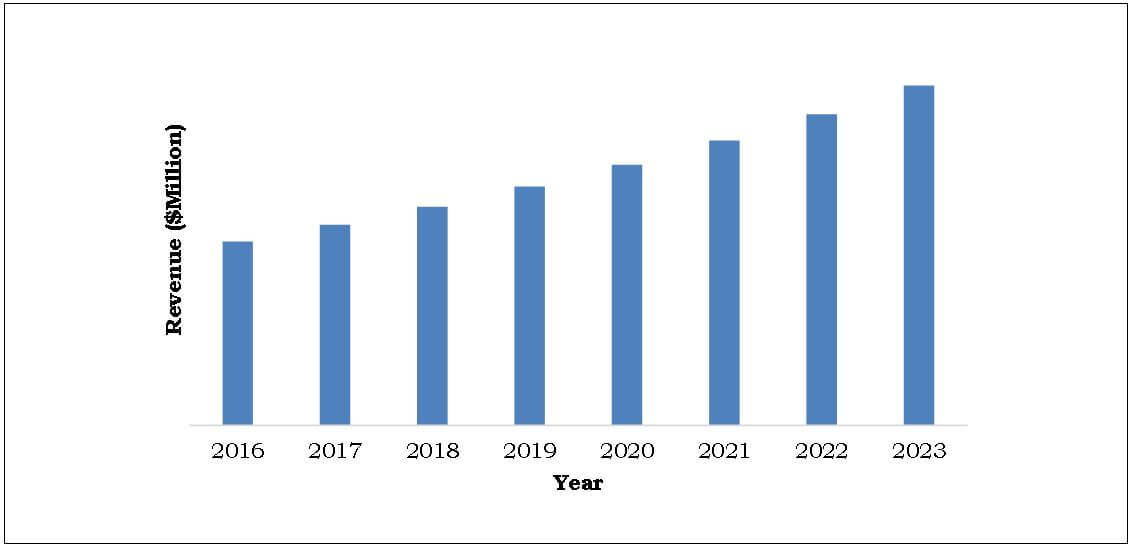

Global Medical Bionics Market was valued at $15,348 million in 2016, and is expected to garner $29,160 million by 2023, registering a CAGR of 9.6% during the forecast period. Bionics also known as biomedical implants are artificial addition to the body. These artificial implants mimic the function of the lost or non-functional body part such as limb or eye. Rise in geriatric population, increase in government focus on funding R&D initiatives, and upsurge in number of patients suffering from chronic diseases are expected to drive the market growth. Moreover, technological advancements, such as the cochlear implants, with speech recognition features that help to differentiate speech in noisy and reverberant situation fuel the demand for medical bionics. However, high cost of the devices and treatment and stringent approval process for these devices are expected to impede the market growth.

Rise in Incidence of Chronic Disease

As per the estimates of the annual report (2014) published by the American Heart Association in Heart Ware International, Inc., approximately 5.5 million individuals are affected by heart failure in the U.S. Moreover, approximately 670,000 new cases of heart failure are diagnosed each year in the U.S. Similarly, in Canada there is a rise in the prevalence of chronic diseases due to unhealthy lifestyle and aging population. In 2007, 1.3 million Canadians were reported to be diagnosed with heart diseases, around 1.6 million were reported to be living with the effects of stroke (Source: Public Health Agency of Canada).

Growth in Asia-Pacific Region

This region offers lucrative opportunities in this market owing to presence of large pool of patients suffering from chronic disorders such as cardiac disorders, neural disorders and hearing and vision loss. In 2011, the Australian Institute of Health & Welfare estimated that at least 300,000 Australians have suffered from chronic heart failure and 30,000 new cases are identified every year. Hence, high incidence of cardiac disorders makes it an attractive market for cardiac bionics. In addition, high prevalence of eye-related diseases in Japan makes it an attractive market for eye bionics in the country.

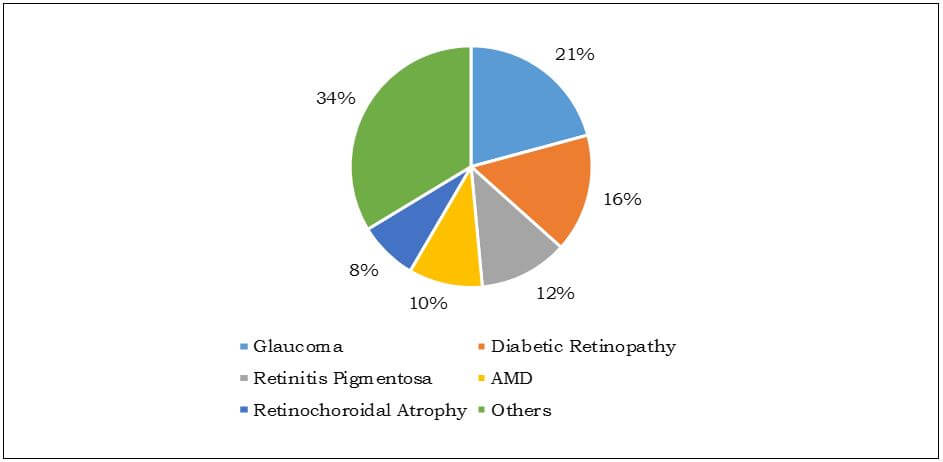

Leading Causes of Blindness in Japan, 2013

Technological Advancements Witnessed in the Market

The field of medical bionics have witnessed several technological advancements in the recent years. The cochlear implants available in the present scenario have speech recognition in difficult listening situations, which help to differentiate speech in noisy and reverberant situation, understand sound from television or telephone, and identify a sound from distance. In addition, hearing aids feature acoustic scene classifiers, which help hearing aids to classify and identify any sound based on background noise, speech in quiet or in noise, music, wind, and number of other parameters.

South Africa: Medical Bionics Market, ($Million) 2016-2023

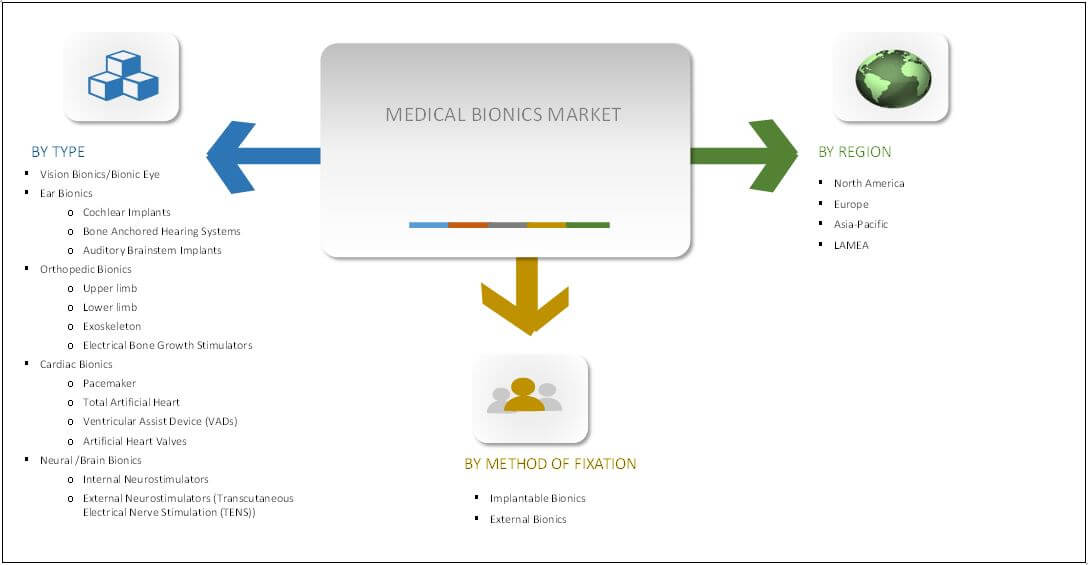

Segmentation

The key companies operating in the medical bionics market are Abbott, Boston Scientific Corporation, Cochlear Ltd., LivaNova PLC, Medtronic plc, Orthofix Holdings, Inc., ssur Corporate, Retina Implant AG, Sonova, SECOND SIGHT, SynCardia Systems, LLC, and William Demant Holding A/S

Key Benefits

- The study provides an in-depth analysis of the global medical bionics market, with current trends and future estimations, to elucidate the imminent investment pockets.

- Quantitative analysis from 2016 to 2023 is expected to enable the stakeholders to capitalize on prevailing market opportunities.

- Comprehensive analysis of all geographical regions is provided to determine the prevailing opportunities.

- Extensive analysis is conducted by closely following key product positioning and monitoring the top contenders within the market framework.

Medical Bionics Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By METHOD OF FIXATION |

|

| By Region |

|

| Key Market Players | OSSUR, BOSTON SCIENTIFIC CORPORATION, COCHLEAR LTD., LIVANOVA PLC, ORTHOFIX HOLDINGS, INC., SECOND SIGHT MEDICAL PRODUCTS, INC., SONOVA, ABOTT LABORATORIES, WILLIAM DEMANT HOLDING A/S, SYNCARDIA SYSTEMS, LLC, RETINA IMPLANT AG, MEDTRONIC PLC |

Analyst Review

Globally, chronic disease such as cardiac disorders, hearing loss, vision loss, and neural disorders, constitute a major proportion of health and economic burden as these increase the risk of organ failure. Hence, the development of bionics is a vital need so that these can imitate and perform the function of lost natural organ.

Upsurge in the incidence of chronic disease such as hearing and vision loss, which leads to the increased risk of organ failure, has led to high adoption of medical bionic. In addition, technological advancements such as use of cochlear implants and increase in government focus on funding R&D initiatives also led to market growth.

Rise in prevalence of chronic diseases coupled with the rapidly aging population worldwide is set to increase the demand for medical bionics. For instance, with increase in age, hearing loss, cardiac disorders become common among older adults. For instance, in 2013, the American Heart Association stated that 70.2% of men and 70.9% of women in the age group of 60–79 years suffered from cardiovascular disorders in the U.S.

Geographically, Asia-Pacific offers lucrative growth opportunity for the market due to increase in healthcare expenditure, rapid aging population, and rise in incidence of chronic disease. Thus, emerging economies (China and India) possess high potential for this market.

Loading Table Of Content...