Medical Ceramics Market Research, 2030

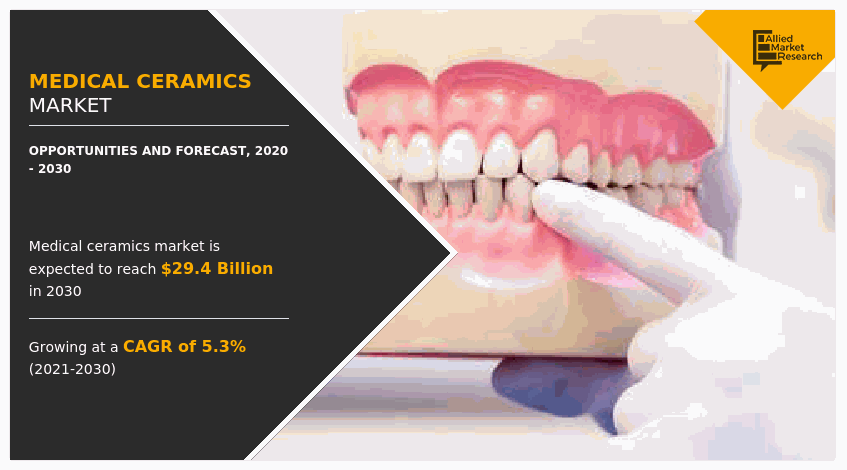

The global medical ceramics market size was valued at $17.5 billion in 2020, and is projected to reach $29.4 billion by 2030, growing at a CAGR of 5.3% from 2021 to 2030.

Medical ceramic requires pre-market approval and is classified under class I (includes surgical instruments), class II (includes medical instruments), class III (includes implants), and class IV (includes pacemakers) devices. A wide variety of medical ceramics have been approved in the U.S. (FDA approval), Europe (CE mark approval), and a few regions of Asia (MHLW approval). The stringency of these procedures delays the launch of highly beneficial devices and increases the expenses manufacturers incur to meet the regulatory policies proposed by the FDA and CE.

Increase in demand for medical ceramics in the healthcare industry gives rise to growth opportunities for manufacturers. Government initiatives further provide a platform for participants to capitalize on the opportunities. Governments, especially in developed countries, have increased funding for R&D initiatives for the development of novel technologies. Demand for medical ceramics is directly dependent upon the sales of medical implants and devices. Sharp rise in global population and increase in and geriatric population drive the sales of medical devices and implants. Acceptance of medical implants has increased worldwide among patients and doctors. For instance, many patients worldwide choose joint reconstruction surgeries to improve their quality of life.

Medical ceramics are prone to volatile prices and supply disorders. Medical ceramics prices are also volatile due to the varying mining outputs and trade sentiments. Medical ceramic buyers have to wait for long lead times or secure large inventories, which further increases buyer costs and hampers the market growth.

The global medical ceramics market is segmented on the basis of type, application, and region.

Medical Ceramics Market By Type

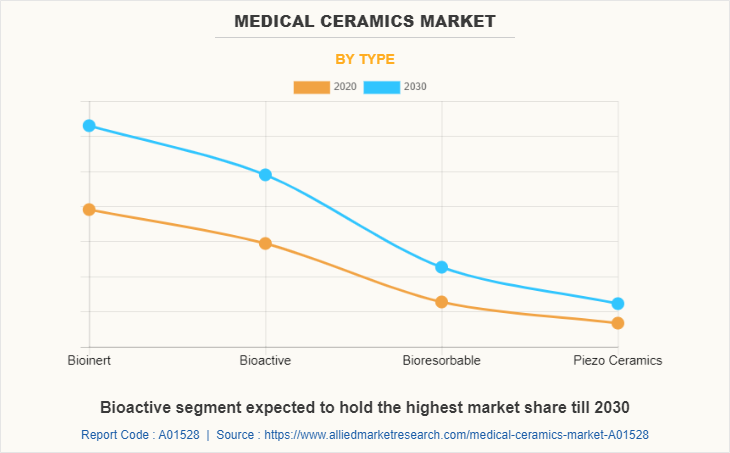

Medical ceramics are classified into bio-inert, bio-active, bio-resorbable, and piezo-ceramics. Bio-inert ceramics form bulk of the medical ceramics market and include aluminum oxide, zirconia, and carbon. Key bio-active ceramics, such as hydroxyapatite (HAP), glass & bio-glass, and zirconia alumina composite, are used as formative materials.

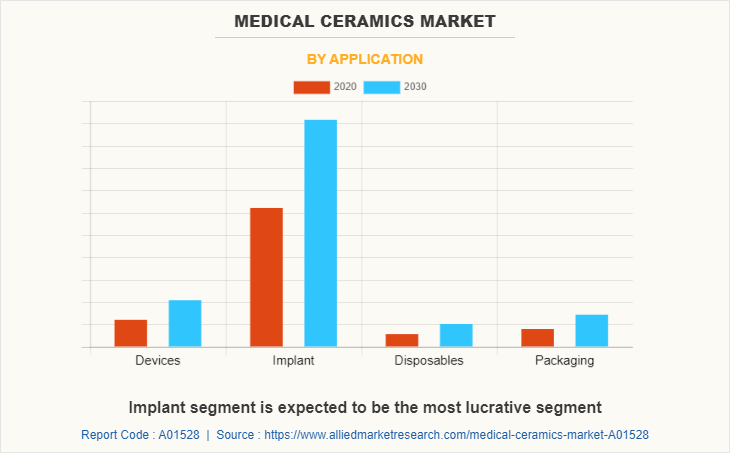

Medical Ceramics Market By Application

The market is classified into medical implants, devices, disposables (gloves, vials, and tools), and packaging. The global medical ceramics market is analyzed based on four regions, which include North America, Europe, Asia-Pacific, and LAMEA. Due to high prevalence of dental decay, increase in injuries, and rapid adoption of medical ceramics in the medical device market, North America is expected to account for the largest market share. Asia-Pacific is estimated to be the fastest growing regional medical ceramics market due to a large number of adults residing in the region suffering from dental avulsion, tooth decay, and gum disease, resulting in loss of teeth.

The key players operating in the global medical ceramics market are CoorsTek Inc., Zimmer Holdings Inc., Straumann, Stryker, Kyocera Corporation, H.C. Starck GmbH, 3M ESPE, Nobel Biocare Services AG, Morgan Advanced Materials, and DePuy Synthes. Other prominent players in the value chain include Advanced Ceramics Research Inc., Advanced Monolythic Ceramics Inc., Advanced Industrial Ceramics, APC International Ltd., AVX Corporation, CeramTec GmbH, and Advanced Cerametrics Inc. are competing for the share of the market through product launches, joint ventures, partnerships, and expanding the production capabilities to meet the future demand for the medical ceramics market in the forecast period.

North America occupies the largest part of the medical ceramics market and consists of countries such as the U.S., Canada, and Mexico. This region accounts for the largest market share due to the high prevalence of dental decay, increasing injuries, and the rapid adoption of medical ceramics in the medical devices market. The high demand for dental services and adequate availability of dental professionals in the region are expected to fuel the growth of the regional market. High usage rates of implantable medical devices and diagnostic imaging equipment, coupled with the presence of a relatively larger number of medical device manufacturers in this region, are some of the factors accounting for its large market share.

The bioinert segment dominated the global medical ceramics market in 2020. Bioinert ceramics exhibit high fracture toughness, low thermal conductivity, excellent resistance to wear & corrosion, and extremely high bending & tensile strength. Bioinert ceramics are widely used in the orthopedic and dental industries. The global bioinert ceramics segment” is further categorized into zirconia, alumina, and other bioinert ceramics. The zirconia segment accounted for the largest share of the global bioinert ceramics market, and is expected to grow at the highest rate during the forecast period. This can be attributed to the advantages of zirconia over other ceramic materials, rise in demand for aesthetically attractive dental restorations, launch of new & advanced products, and surge in research activities to develop novel products.

The implants segment dominates the global medical ceramics market, owing to rise in aging population and increase in prevalence of chronic diseases. Aged people are more susceptible to chronic diseases such as cardiovascular diseases, orthopedic disorders, endovascular diseases, and dental disorders, thus making them the major users of medical implants. For instance, with rise in aging population, dental health issues are expected to grow. Increase in awareness about the different types of medical implants among healthcare professionals boosts the medical ceramics marketgrowth. In addition, initiatives from medical health insurance companies to support critical health issues are facilitating the growth of the market, globally. Moreover, rise in government support to provide medical insurance coverage to downtrodden people in society for their better health is fueling the demand for implants.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical ceramics market analysis from 2020 to 2030 to identify the prevailing medical ceramics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical ceramics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical ceramics market trends, key players, market segments, application areas, and market growth strategies.

Medical Ceramics Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | CoorsTek Inc, DePuy Synthes, Stryker, Nobel Biocare Services AG, 3M ESPE, Kyocera Corporation, Zimmer Biomet, Straumann, H.C. Starck GmbH, Morgan Advanced Materials |

Analyst Review

Medical ceramic is a material that is utilized for a variety of human contact and non-contact applications in the medical industry. It is primarily used in the manufacturing of medical implants, devices, disposables (gloves, vials, and tools), and packaging. Medical ceramics are biocompatible in nature and either remain inert or are easily processed by the human body.

Increase in acceptance of medical ceramics and the development of low-cost materials are driving the demand for medical ceramics in the healthcare industry. Medical ceramics are widely used in the manufacture of medical devices, implants, disposables, and packaging. Much effort has been made throughout the industry to commercialize new medical ceramics to meet the specifications of high-end applications. Demand for ceramics in the healthcare market increased significantly as the demand for medical implants increased significantly, but the demand for implants increased primarily due to the increased incidence of chronic diseases.

Demand for medical ceramics is showing significant growth in all regions due to the rapid acceptance of ceramics from product design to final product manufacturing. The demand for medical ceramics is directly related to the sale of medical implants and devices. Rapid increase in global and elderly population are important drivers for the rise in sales of medical devices and implants. Acceptance of medical implants is increasing worldwide among patients and physicians. Many patients around the world choose to reconstruct their joints to improve their quality of life.

Growth in Sales of Medical Implants and Devices and rise in Number of FDA Approvals for Performing Clinical Trials to Benefit the Market are the key factors boosting the Medical Ceramics market growth

The market value of Medical Ceramics in 2030 is expected to be US$ 29.35 Billion

CoorsTek Inc., Zimmer Holdings Inc., Straumann, Stryker, Kyocera Corporation, H.C. Starck GmbH, 3M ESPE, Nobel Biocare Services AG, Morgan Advanced Materials, and DePuy Synthes.

Healthcare industry is projected to increase the demand for Medical Ceramics Market

The global medical ceramics market is segmented on the basis of type, application, and region. Based on type, medical ceramics are classified into bio-inert, bio-active, bio-resorbable, and piezo-ceramics. By application, the market is classified into medical implants, devices, disposables, and packaging. The global medical ceramics market is analyzed based on four regions, which include North America, Europe, Asia-Pacific, and LAMEA.

Funding and grants create market opportunities worldwide is the Main Driver of Medical Ceramics Market

Healthcare and packaging end-use industry are expected to drive the adoption of Medical Ceramics?

This pandemic outbreak had a certain impact on the development of the medical ceramic market, due to unavailability of labor, and international transportation lockdown has an impact on the raw material distribution and production of various products. Increase in the demand for pharmaceuticals during the outbreak of coronavirus has created an opportunity for manufacturers to expand the market.

Loading Table Of Content...