Medical Drones Market Research, 2032

The global medical drones market size was valued at $217.3 million in 2022, and is projected to reach $701.2 million by 2032, growing at a CAGR of 12.4% from 2023 to 2032. Medical drones, also known as healthcare drones or medical delivery drones, are unmanned aerial vehicles (UAVs) specifically designed to provide swift and efficient transport of medical supplies and equipment. These drones have emerged as a promising technology in the healthcare sector, offering numerous benefits in terms of speed, accessibility, and cost-effectiveness.

Market dynamics

The uses of medical drones are diverse and expanding, presenting both the medical drones market opportunity and increase in medical drones market share. One key application is the delivery of essential medical supplies to remote or inaccessible areas. In many parts of the world, particularly in remote or underserved regions, access to healthcare facilities and critical medical supplies is a significant challenge. With their vertical takeoff and landing capabilities, drones can bypass obstacles and reach remote locations that are otherwise inaccessible. This is particularly crucial in emergency situations, where time is of the essence and delays in receiving medical supplies can have life-threatening consequences. Medical drones can ensure the timely delivery of critical items such as medications, vaccines, blood products, and diagnostic samples, bridging the gap between patients and essential care. Additionally, medical drones can be utilized in disaster response scenarios to deliver medical aid and support emergency operations.

For instance, on March 28, 2023 Israel tested drone delivery for blood and other essential medical supplies. An autonomous drone carrying 3.8 kilograms (8.4 lbs) of blood took off from the Rambam Medical Centre in Haifa as part of the test flights. Near Israel's northern border with Lebanon, in Nahariya, on the grounds of Galilee Medical Centre, it touched down 13 minutes later. After the 25.2-kilometer (15.7-mile) flight, the blood units underwent a comprehensive inspection and were confirmed to be in perfect condition and suitable for use.

Furthermore, the cost and time efficiency is key factor driving the medical drones market growth. The medical drones market forecast predicts that the medical drones have potential to revolutionize the healthcare industry by providing swift and efficient delivery of essential medical supplies, thus overcoming the limitations of traditional transportation methods. Cost efficiency plays a pivotal role in the adoption of medical drones. In many regions, especially rural or remote areas, the lack of proper infrastructure makes it challenging to deliver medical supplies promptly. Traditional transportation methods such as road transportation or manned aircraft can be costly and time-consuming. Medical drones, on the other hand, offer a cost-effective alternative. They require less infrastructure and do not involve extensive manpower, resulting in reduced operational costs. These drones can access hard-to-reach areas and deliver medical essentials such as vaccines, medications, or blood samples quickly and efficiently. By minimizing transportation costs, medical facilities and organizations can allocate their resources more effectively, ensuring that the much-needed medical supplies reach patients in a timely manner. During emergencies or critical situations, every minute counts, and delays in medical supply delivery can have severe consequences.

Medical drones offer unparalleled speed, bypassing traffic congestion and delivering supplies directly to their destinations. With advanced navigational systems, these drones can quickly identify the shortest and safest routes, optimizing delivery time. For instance, in emergency situations like natural disasters or accidents, medical drones can swiftly transport life-saving equipment, medications, or blood units to the affected areas, providing timely assistance and potentially saving lives. Furthermore, medical drones equipped with real-time monitoring systems can transmit vital medical data and images from the field to healthcare professionals, enabling remote diagnosis and consultation, thereby saving valuable time.

Public health initiatives also play a significant role in driving the growth medical drones market size. Governments and healthcare organizations worldwide are increasingly recognizing the potential of drones to address healthcare challenges. Drones can be used to deliver vaccines, medications, and diagnostic tools to underserved areas, particularly in developing countries with limited healthcare infrastructure. By extending medical services to remote communities and improving accessibility, medical drones contribute to public health initiatives aimed at reducing health disparities and improving overall population health. For instance, The Medicine from the Sky programme in India was commissioned at the India Economic Summit in 2019. The programme was aimed at using drone technology to extend urban-grade healthcare to the remotest areas.

Additionally, the ability of medical drones to provide rapid and timely deliveries is a critical factor driving growth of medical drones market share. In emergency situations, such as cardiac arrests or severe injuries, every minute counts. Drones equipped with medical supplies can reach the scene faster than traditional methods, allowing immediate treatment to be administered before an ambulance or healthcare professional arrives. This rapid response can significantly increase the chances of survival and improve patient outcomes. By enabling swift and timely medical deliveries, drones are revolutionizing the way healthcare services are provided, particularly in time-sensitive situations

However, limited payload capacity is a significant restraint for the medical drone market. While drones have shown immense potential in revolutionizing the healthcare industry by enabling the transportation of medical supplies, samples, and even organs in remote or inaccessible areas, their payload capacity poses a considerable challenge. Drones typically have weight restrictions due to their size, power limitations, and aerodynamic constraints. This limitation restricts the amount of medical cargo that can be carried, which in turn affects the scale and scope of their applications.

Moreover, technological advancement has paved the way for exciting opportunities in various industries, and the medical drones market is no exception. With the rapid evolution of drone technology, these unmanned aerial vehicles are increasingly being utilized to revolutionize healthcare delivery, making it a potential growth opportunity with tremendous possibilities. Furthermore, advancements in artificial intelligence (AI) and machine learning play a significant role in the potential growth of medical drones. These technologies enable drones to analyze vast amounts of data, such as medical images or vital signs, on-site or during transportation. AI-powered drones can quickly process information, identify anomalies, and provide preliminary diagnostic insights to healthcare professionals, enhancing their decision-making process. Additionally, machine learning algorithms can continuously learn from collected data, improving the accuracy of future diagnoses and medical interventions. Such autonomous capabilities reduce the burden on healthcare workers and allow them to focus on critical tasks, thereby increasing overall efficiency and productivity. In addition, technological advancements have led to improvements in drone flight capabilities, including increased range, longer battery life, and enhanced maneuverability. These advancements contribute to the expansion of medical drones' operational scope, enabling them to cover larger areas and reach more patients. The integration of cutting-edge sensors and obstacle avoidance systems further enhances flight safety and reliability, reducing the risk of accidents or damage to medical cargo.

Segmental Overview

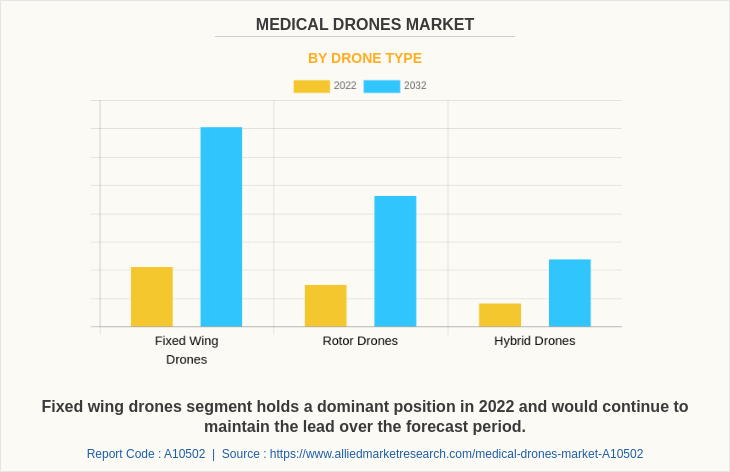

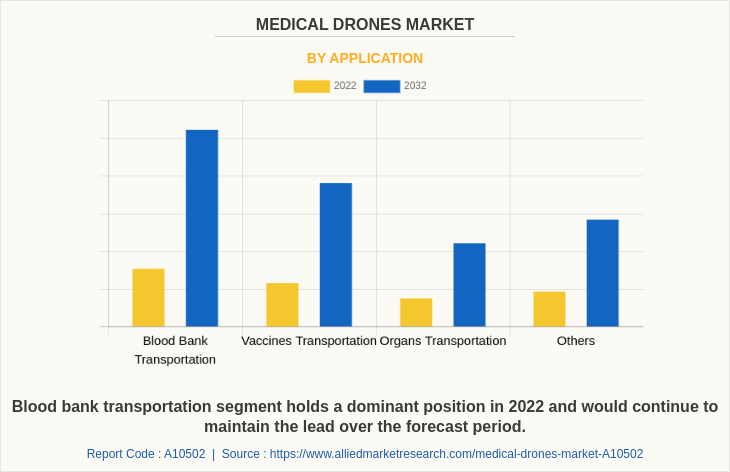

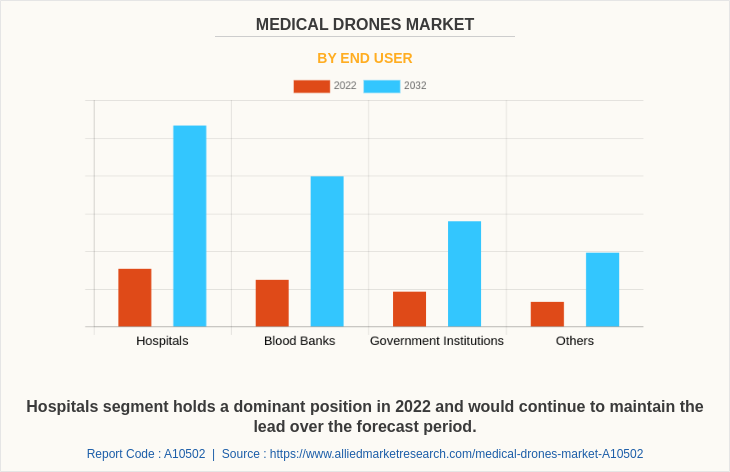

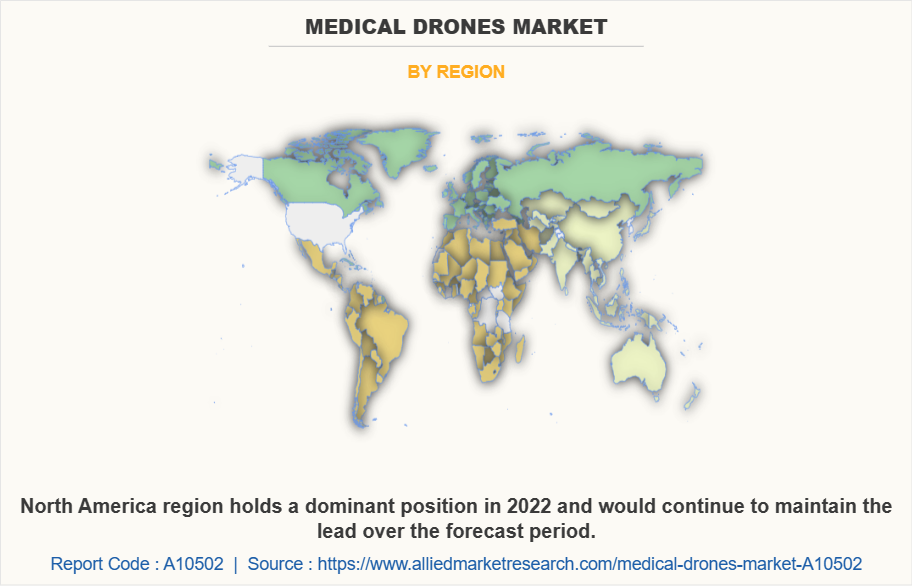

The medical drones market is segmented on the basis of drone type, applications, end users and region. By drone type the medical drones market is classified into fixed wing, rotor drones, and hybrid drones. By applications the medical drones market is categorized into blood bank transportation, vaccines transportation, organs transportation and others. On the basis of end users the medical drones market is categorized into hospitals, blood banks, government institutions, others. Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

By drone type:

The medical drones market is classified into fixed wing, rotor drones, and hybrid drones.The fixed wing segment accounted for the largest share in 2022 and is expected to remain dominant during the forecast period, owing to its larger flight range and high payload capacity.

By application:

The market is segmented into fixed wing, rotor drones, and hybrid drones. The blood bank transportation segment accounted for the largest share in 2022 and is also expected to remain dominant during the forecast period, owing to high adoption of drones for transportation of blood bank transportation in remote areas and the areas where transportation facility is not well developed.

By end users:

Medical drones market is segregated into blood bank transportation, vaccines transportation, organs transportation and others. Hospitals occupied the highest share in 2022 owing to use of drones for blood transport, organ transport and various other essentials in hospital.

By region:

Medical drones market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America generated maximum revenue in 2022 owing to the strong presence of key players, presence of robust healthcare infrastructure, and availability of approved medical drones with higher adoption of medical drones for the delivery of medical kits, blood, and organ transplantation. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period owing to increase in population, surge in healthcare expenditure, and rise in investments for development of medical drones.

Competition Analysis

Competitive analysis and profiles of the major players in the medical drones market, such as Volocopter GmbH, EHang Holdings Ltd., Matternet, SZ DJI Technology Co., Ltd., Zipline International Inc., Volansi, Inc., Yuneec Holding Ltd, Vayu Dones, Embenation, TU Delft. are provided in this report. Major player have adopted partnership, collaborations, acquisitions, product approval and product launch as key developmental strategies to improve the product portfolio of the medical drone market.

Recent partnership in medical drones industry

In October 2022, EHang Holdings Ltd announced that it has signed a memorandum of understanding regarding the potential partnership with Hong Kong Aircraft Engineering Company Limited , a subsidiary of Swire Group. The two parties plan to cooperate in multiple areas such as manufacturing and assembly, continued airworthiness, digital platforms, aircraft maintenance, and talent training. The focus is to co-develop systems and solutions that cater to the needs of continued airworthiness and after-sales maintenance services in preparation for the commercial operation of EH216-S, EHang's passenger-grade autonomous aerial vehicle.

In July 2022, Avy enters long term partnershiped with Fundashon Mariadal. The vision of this project is to connect the ABC islands with an autonomous drone network for the different use cases at hand. It will first be implemented on Bonaire to determine a viable business case, test the technology in local conditions and explore the most suitable routes for such a network.

Recent product approval in medical drones industry

In November 2022, Matternet, the developer of the world's leading drone delivery system, today announced that it has beengranted a Production Certificate by the Federal Aviation Administration (FAA) for its Matternet M2 drone.

Recent product launch in medical drones industry

In March 2023, Zipline today unveiled its new platform Platform 2 (P2) that provides quiet, fast and precise autonomous delivery directly to homes in cities and suburbs. The company's next generation home delivery platform is practically silent (designed to sound like wind rustling leaves), and is expected to deliver up to 7 times as fast as traditional automobile delivery, completing 10-mile deliveries in about 10 minutes.

Recent collaboration in medical drones industry

In April 2022, Avy collaborated with the Dutch Police on a pilot project investigating how long-range drones can be used for different types of emergencies. In the pilot-project potential drone-applications were tested, drone flights took place on a confined non-public airfield, and an ethical framework for this concept of drone-usage by the police was developed.

Recent acquisition in medical drones industry

In October 2022, Sierra Nevada Corporation announced it has acquired the portfolio of assets and intellectual property related to the Voly-50 and Voly-T series of unmanned aerial vehicles (UAVs) produced previously by Volansi. The move reaffirms SNC's commitment to delivering a next-generation, multi-role, long-haul, vertical takeoff and landing (VTOL) platform to customers across the DOD and establishing SNC as a leading solution provider in the UAV space.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical drones market analysis from 2022 to 2032 to identify the prevailing medical drones market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical drones market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical drones market trends, key players, market segments, application areas, and market growth strategies.

Medical Drones Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 701.2 million |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 336 |

| By Drone Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | SZ DJI Technology Co., Ltd., Zipline international inc., Matternet, EHang Holdings Ltd., Sierra Nevada Corporation, Volocopter GmbH., Vayu Drones, Embenation, Avy Technologies, Inc., Yuneec Holding Ltd |

Analyst Review

This section provides various opinions of top-level CXOs in the medical drones market. According to the insights of CXOs, increase in demand for medical drones and rise in investments for technological advancement are expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives supporting the adoption of medical drones to transport medical supplies to remote areas has piqued the interest of several companies to develop medical drones.

The CXOs further added that the medical drones market has experienced substantial growth due to advancements in drone technology, such as improved flight capabilities, longer battery life, and enhanced payload capacity, which have made it possible to transport medical supplies, samples, and even organs quickly and efficiently. This has been particularly beneficial in remote areas, disaster-stricken regions, and areas with inadequate infrastructure, where timely access to medical resources is crucial. Furthermore, medical drones can significantly reduce delivery times, enabling healthcare providers to offer prompt emergency medical assistance, deliver critical medications, and conduct diagnostic tests remotely. This not only improves patient outcomes but also reduces healthcare costs and burdens on traditional transportation systems.

In addition, the integration of drones with advanced technologies such as artificial intelligence (AI) and machine learning (ML) opens up new possibilities in the medical field. AI-powered drones can assist in real-time monitoring of patients, identifying potential health risks, and even provide telemedicine services in remote areas. These technological advancements have the potential to revolutionize healthcare delivery, particularly in underserved regions.

Medical drones are an unmanned aerial vehicle specifically designed for the transportation of medical supplies, equipment, and organs.

The forecast period for market drones market is 2023 to 2032.

The factors that restrain the growth of the market is limited payload capacity and battery life.

Top companies such as Volvocopter GmbH, Sierra Nevada and Ehang Holdings held a high market position in 2021.

The base year is 2022 in market drones market.

Fixed wing drones segment dominated the global market in 2022, and expected to continue this trend throughout the forecast period. The dominance of this segment can be attributed to larger flight ranges and higher payload capacity of fixed winged drones.

The total market value of the market drones market is $217.34 million in 2022.

Cost and time efficiency, emergency and disaster response and improved access to healthcare

Loading Table Of Content...

Loading Research Methodology...