Medical Exoskeleton Market Research, 2031

The global medical exoskeleton market size was valued at $232.5 million in 2021, and is projected to reach $3,044.7 million by 2031, growing at a CAGR of 29.4% from 2022 to 2031. Medical exoskeleton is a wearable electromechanical device that has been developed as external framework that is worn in the body to help patient recover from an injury and to enhance the biological capabilities such as orthotic devices for gait rehabilitation or locomotion assistance. Therefore, this frame offers limbs extra movement, strength, and endurance. Medical exoskeletons are used to power disabled, injured, or vulnerable people suffering from a variety of medical conditions such as spinal cord injury (SCI), neuropathy, major trauma such as stroke, and cerebral palsy. These medical exoskeletons are typically used in monitored settings such as hospitals and rehab centers under the supervision of medical professionals.

Market Dynamics

Growth of the global medical exoskeleton market size is majorly driven by increase in the prevalence of neurological disorders, orthopedic diseases and brain and spinal cord injuries. In addition, rise in the number of product launch and product approvals for medical exoskeletons. Neurological disorders such as Parkinson’s disease and multiple sclerosis are anticipated to drive the demand for medical exoskeleton devices. As these diseases affect the mobility of individual, thus, people suffering from neurological diseases may require medical exoskeletons. Therefore, rise in prevalence of Parkinson’s diseases and multiple sclerosis is attributed to drive the growth of the market. Parkinson’s disease is a brain disorder that causes unintended or uncontrollable movements, such as shaking, stiffness, and difficulty with balance and coordination. Symptoms usually begin gradually and worsen over time. As the disease progresses, people may have difficulty walking and talking. They may also have mental and behavioral changes, sleep problems, depression, memory difficulties, and fatigue. Thus, rise in prevalence of Parkinson’s disease drives the market growth. For instance, according to Parkinson’s Foundation, it was reported that, approximately 1 million people in the U.S. are living with Parkinson's disease (PD). This number is expected to rise to 1.2 million by 2030. Parkinson's is the second-most common neurodegenerative disease after Alzheimer's disease. As per the same source, nearly 90,000 people in the U.S. are diagnosed with PD each year.

Multiple sclerosis is a chronic disease that affects the central nervous system, including the brain, spinal cord, and optic nerves. Symptoms of multiple sclerosis change in gait, fatigue, loss of balance or coordination, muscle spasms, muscle weakness, tingling or numbness, and especially in the legs or arms. Thus, rise in prevalence of multiple sclerosis drives the demand for medical exoskeleton devices and boost the market growth.

Increase in the prevalence of spinal cord injuries and brain injuries drives the demand for medical exoskeleton devices. A spinal cord injury damage to any part of the spinal cord or nerves at the end of the spinal canal often causes permanent changes in strength, sensation, and other body functions below the site of the injury. A complete injury causes total paralysis (loss of function) below the level of the injury. It affects both sides of the body. A complete injury may cause paralysis of all four limbs (quadriplegia) or the lower half of the body (paraplegia). Therefore, patients who suffer from spinal cord injury require medical exoskeleton devices for physical support. Thus, rise in prevalence of spinal cord injuries anticipated to drive the growth of market.

In addition, rise in the prevalence of brain injuries drives the demand for medical exoskeleton devices. Traumatic brain injury (TBI) happens when a sudden, external, physical assault damages the brain. It is one of the most common causes of disability movement can become very slow and balance can be affected. Thus, rise in the prevalence of traumatic brain injury drives the demand for medical exoskeleton devices for physical support and fuels the market growth. For instance, according to Centers for Disease Control and Prevention (CDC), it was reported that, approximately 223,135 TBI-related hospitalizations in 2019 and 64,362 TBI-related deaths in 2020.

On the other hand, during the testing of the product, manufacturers' abilities and knowledge in technical designing may be important. Exoskeletons used for healthcare applications need to be scrutinized because a medical device's breakdown can have potentially fatal effects. The exoskeleton industry sorely needs many standards that are specifically relevant to it. The Food and Drug Administration (FDA) accepts ISO standards that apply to pertinent businesses, and only goods that have received regulatory approvals are allowed to be marketed on the open market. The use of powered lower limb exoskeletons has advanced significantly, yet users still have trouble navigating sloped or slippery surfaces. The prototypes cannot yet cope with twisting motions, so users making turns while carrying objects could tire out easily, resulting in adverse events, which can include skin and tissue damages and bone fractures. Thus, regulatory bodies have established a very tight approval process for such devices so that a wearer’s safety is not compromised due to the high-power output of actuators used in them. Thus, this factor is anticipated to restrain the growth of market.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global medical exoskeleton market. The COVID-19 pandemic has stressed healthcare systems globally. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for the patient diagnosed with COVID-19. Decrease in the number of road traffic accidents and fall injuries during COVID-19 pandemic due to lockdown is anticipated to decrease the demand for medical exoskeleton devices and have negative impact on market growth. Moreover, decrease in the revenue of market players who manufactures medical exoskeleton devices due to COVID-19 pandemic restraints the market growth. For instance, according to annual report of Ekso Bionics Holdings, Inc., a company that develops and manufactures powered exoskeleton bionic devices, in 2020, there is decrease in annual revenue of company by 36% due to COVID-19 impact. In addition, surgeons are more vulnerable for contracting and transmitting the coronavirus. Subsequently, this led to cancellation of many surgical procedures across the globe. Thus, these factors are anticipated to hinder the growth of the market during the pandemic.

Segmental Overview

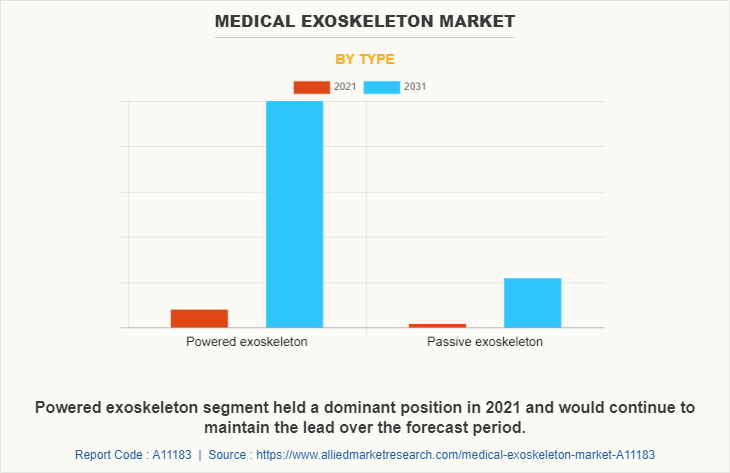

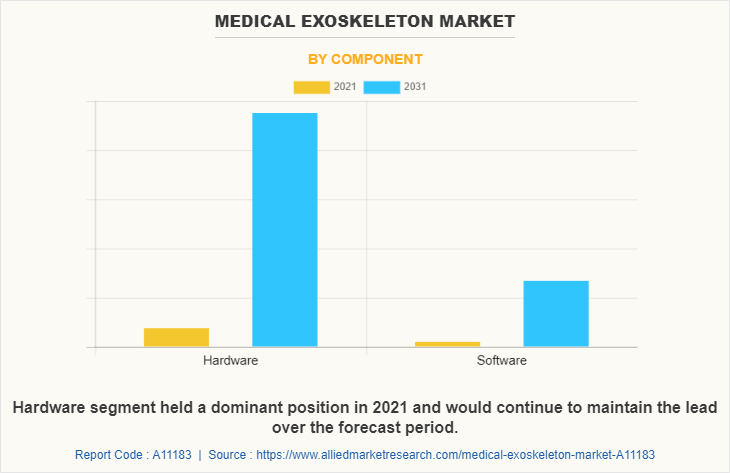

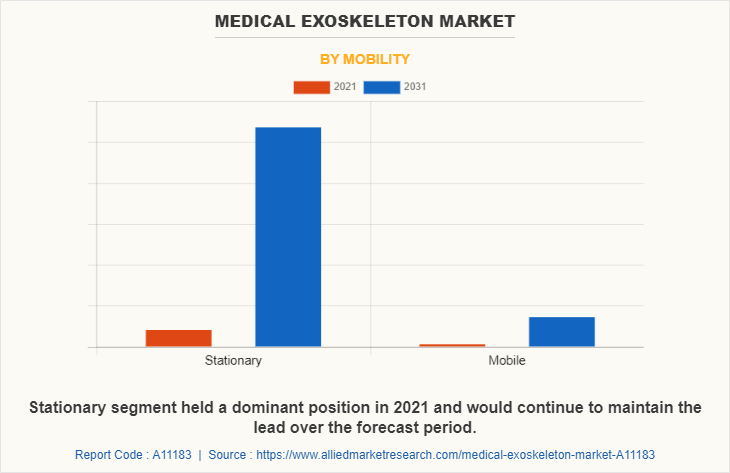

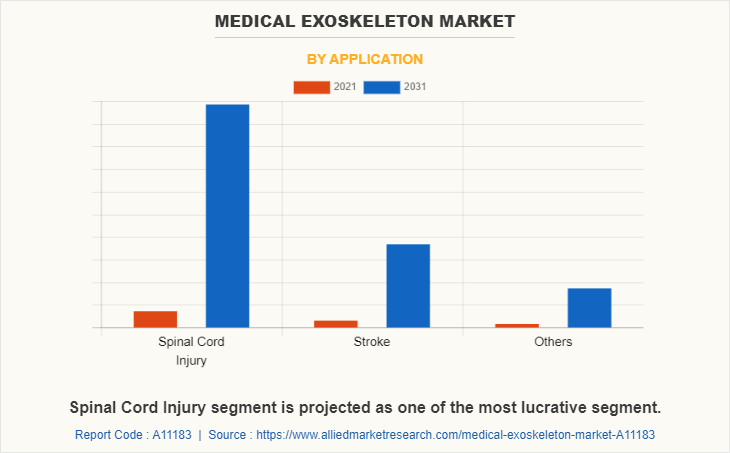

The medical exoskeleton market share is segmented into Type, Mobility, Component and Application. Based on type the market is divided into powered exoskeleton and passive exoskeleton. Based on component the market is divided into hardware and software. Based on mobility the market is segmented into stationary and mobile. Based in application the market is divided into spinal cord injury, stroke, and others. Others include multiple sclerosis, osteoarthritis, Parkinson’s disease and acquired brain injuries. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the market is segmented into powered exoskeleton and passive exoskeleton. The powered exoskeletons segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in number of product launch and product approvals for powered medical exoskeleton devices.

Based on component, the market is classified into hardware and software. The software segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to technological advancement in healthcare sector and rise in awareness among people regarding software component in exoskeletons.

Based on mobility, the market is divided into stationary and mobile. The mobile segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in the number of market players who manufactures mobile medical exoskeleton devices.

Based on application, the market is divided into spinal cord injury, stroke, and others. The spinal cord injuries segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in the prevalence of road traffic accidents and fall injuries and technological advancement in the healthcare sector.

North America medical exoskeleton market is expected to grow during the forecast period owing to rise in the number of populations suffering from neurological disorders such as Parkinson’s disease, multiple sclerosis, orthopedic diseases, and spinal cord injuries. For instance, according to National Multiple Sclerosis Society, it was reported that, in September 2020, approximately 2.8 million people worldwide are suffering from multiple sclerosis (MS). As per the same source, it was reported that, nearly 1 million of them are living in the U.S. in 2020.

Increase in the number of product launch and product approvals for medical exoskeleton and rise in the number of adoption of strategies such as collaboration, acquisition, and partnership by market players drives the market growth. For instance, in December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control (“HMC”) Business Unit from Parker Hannifin Corporation (“Parker”), a global leader in motion and control technologies. The acquisition includes the Indego lower limb exoskeleton line of products as well as the planned development of robotic assisted orthotic and prosthetic devices.

Moreover, rise in expenditure by government to develop healthcare infrastructure and increase in awareness among people regarding vision impairment fuels the market growth. For instance, according to the Centers for Medicare & Medicaid Services, the U.S. health care spending grew by 9.7% from 2019 to 2020, reaching $4.1 trillion ($12,530 per person).

Asia-pacific medical exoskeleton market is expected to witness growth during the forecast period owing to, economic development and low operating costs. The major driving factors for the market growth in this region include surge in prevalence of neurological and orthopedic diseases and rising geriatric population. Moreover, rise in prevalence of acquired brain injuries and spinal injuries are attributed to fuel the demand for medical exoskeleton devices and drives the medical exoskeleton market forecast period.

Moreover, the increase in geriatric population of Asia-Pacific is one of the propelling factors that drive growth of the market. According to the 2020 census, there are approximately 264 million (18.70%) people in China in the application of 60 and over. Moreover, medical exoskeleton industry in this region focus on expanding their business, which is expected to significantly enhance revenue generation, owing to availability of untapped areas and low cost of services. In addition, rise in the awareness among people regarding medical exoskeleton devices and boost the medical exoskeleton market growth.

COMPETITION ANALYSIS

Some of the major companies that operate in the medical exoskeleton market include CYBERDYNE INC., Ekso Bionics, Ergosanté, B-Temia, ExoAtlet, ReWalk Robotics., Ottobock SE & Co. KGaA (suit X), DIH medical Hocoma., Human Motion Technologies LLC., and Wearable Robotics srl.

Some examples of product approval in the market

In March 2021, CYBERDYNE Inc., Japanese robotics and technology company, received medical device approval from Thai Food and Medical Products Approval Authority (Thai FDA) for HAL Single Joint Type. The product is for patients with reduced mobility in the upper and lower limbs due to muscle weakness or paralysis.

Some examples of acquisition in the market

In December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control (“HMC”) Business Unit from Parker Hannifin Corporation (“Parker”), a global leader in motion and control technologies. The acquisition includes the Indego lower limb exoskeleton line of products as well as the planned development of robotic assisted orthotic and prosthetic devices.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical exoskeleton market analysis from 2021 to 2031 to identify the prevailing medical exoskeleton market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical exoskeleton market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical exoskeleton market trends, key players, market segments, application areas, and market growth strategies.

Medical Exoskeleton Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3 billion |

| Growth Rate | CAGR of 29.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 264 |

| By Type |

|

| By Mobility |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ergosante, Rewalk Robotics, Human Motion Technologies LLC, B-Temia, ExoAtlet, DIH Medical, Ekso Bionics, CYBERDYNE INC., Ottobock SE & Co. KGaA (suit X), Wearable Robotics srl |

| Other Players | Suit X. |

Analyst Review

Medical exoskeletons are mechanical devices attached to human bodies for either power augmentation or motion assistance.

Increase in number of product launch and product approvals for medical exoskeleton and rise in the number of adoption of strategies such as collaboration, acquisition, and partnership by market players drive the market growth. For instance, in December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control (“HMC”) Business Unit from Parker Hannifin Corporation (“Parker”), a global leader in motion and control technologies. The acquisition includes the Indego lower limb exoskeleton line of products as well as the planned development of robotic assisted orthotic and prosthetic devices.

In addition, in June 2020, Ekso Bionics Holdings, Inc., an industry leader in exoskeleton technology for medical and industrial use, announced it has received 501(k) clearance from the U.S. Food and Drug Administration (FDA) to market its EksoNRTM robotic exoskeleton for use with patients with acquired brain injury (ABI). EksoNR is the first exoskeleton device to receive FDA clearance for rehabilitation use with ABI, significantly expanding the device’s indication to a broader group of patients.

The top companies that hold the market share in Global medical exoskeleton market are CYBERDYNE INC., Ekso Bionics, Ergosanté, B-Temia, ExoAtlet, ReWalk Robotics., Ottobock SE & Co. KGaA (suit X), DIH medical Hocoma., Human Motion Technologies LLC., and Wearable Robotics srl.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to surge in prevalence of neurological and orthopedic diseases and rising geriatric population.

The key trends in the global medical exoskeleton market are by increase in the prevalence of neurological disorders, orthopedic diseases and brain and spinal cord injuries, and rise in the number of product launch and product approvals for medical exoskeletons.

The base year for the report is 2021.

Yes, Global medical exoskeleton companies are profiled in the report

The total market value of Global medical exoskeleton market is $232.5 million in 2021 .

The forecast period in the report is from 2022 to 2032

The market value of Global medical exoskeleton market in 2022 was $300.2 million

Loading Table Of Content...