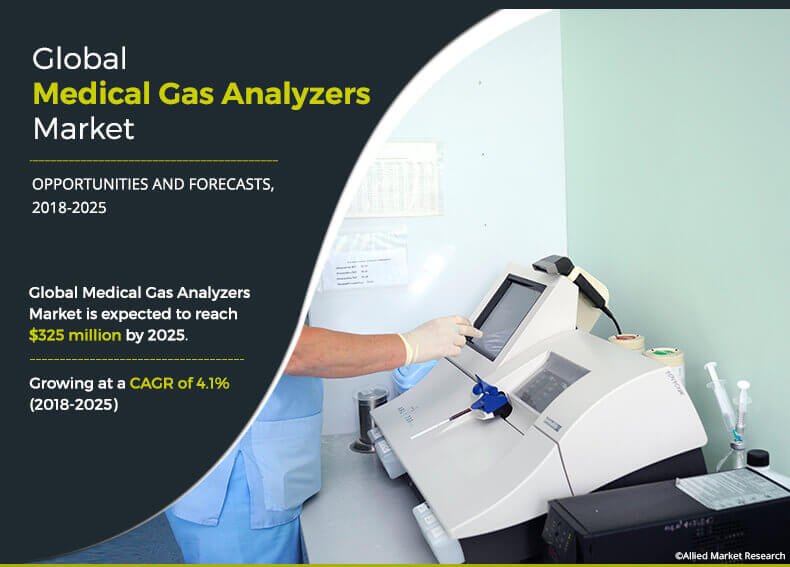

Medical Gas Analyzers Market Overview:

The global medical gas analyzers market generated $235 million in 2017, and is projected to reach $325 million by 2025, growing at a CAGR of 4.1% from 2018 to 2025. Medical gas analyzers are used for the detection, measurement, and analysis of medical gases in hospitals and healthcare industries. Rise in number of medical gas therapy across geographies with increase in number of surgeries and emergencies & ICU patients drive the growth the market. Furthermore, surge in prevalence of chronic diseases and technological advancements in medical gas analyzers are expected to boost the market growth during the forecast period. However, poor awareness about medical gas analyzers in some underdeveloped countries impedes the medical gas analyzers market growth.

Medical Gas Analyzers Market Segmentation

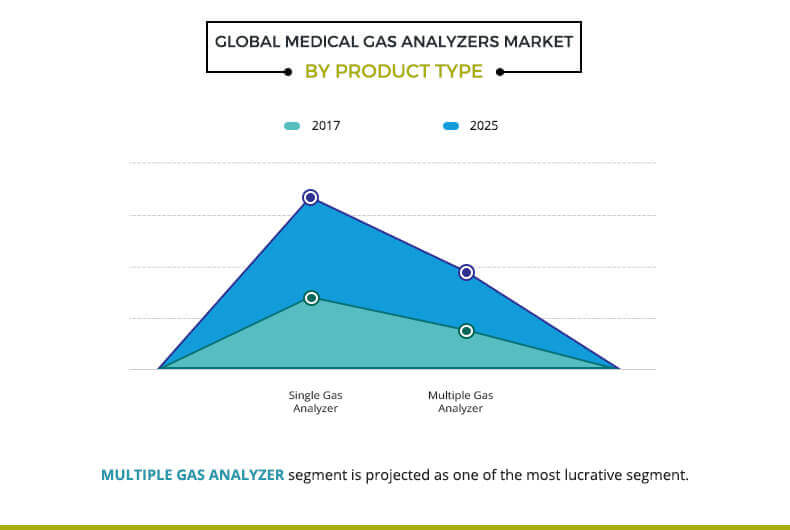

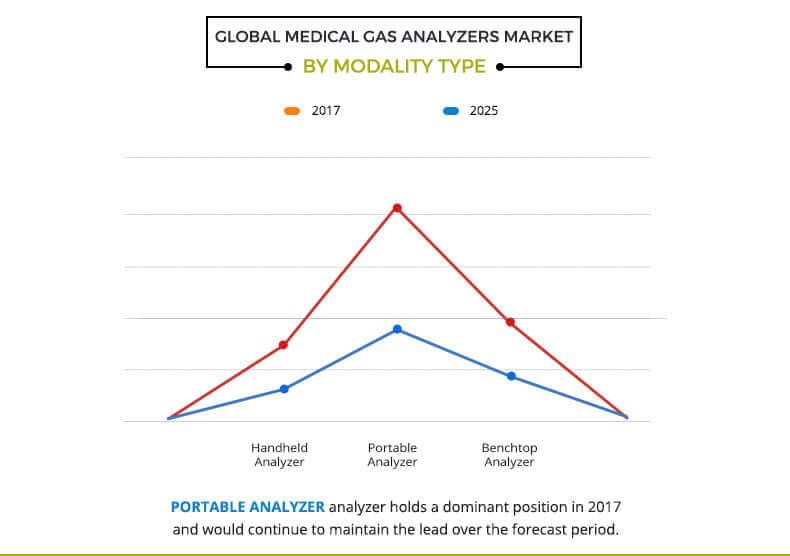

The global medical gas analyzers market is segmented based on product, modality type, end user, and region. On the basis of product, the market is classified into single gas analyzer and multiple gas analyzer. By modality type, it is categorized into handheld analyzer, portable analyzer, and benchtop analyzer. According to end user, it is divided into hospitals, ambulatory surgery centers, pharmaceutical industry, and others. Region wise, it is studied across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Segment Review

Based on product, the global medical gas analyzers market is dominated by single gas analyzer segment, owing to its advantages such as cost-effectiveness, accuracy, and reliability. Furthermore, increase in use of oxygen therapy supplements the growth of this segment. However, the demand for multiple gas analyzers is expected to increase during the forecast period, making it the highest revenue contributor, due to technological advancements.

Depending on modality type, the global medical gas analyzers market is fragmented into handheld, portable, and benchtop analyzer. At present, the portable analyzer segment is the major revenue contributor, and is estimated to show dominance during the forecast period. This is attributed to the fact that these analyzers offer ease of handling, portability, cost-effectivity, and test convenience. However, the handheld analyzer segment is expected to exhibit rapid growth during the forecast period, due to surge in demand for easy-to-use and technologically advanced gas analyzers.

Snapshot of Asia-Pacific Medical Gas Analyzers Market

Asia-Pacific presents lucrative opportunities for the key players operating in the medical gas analyzers industry, owing to the presence of large population base, rise in awareness about advanced medical gas analyzers, development in healthcare infrastructure, and surge in number of medical gas therapy. However, poor healthcare awareness in some Asian countries and few acts & regulations for medical gas systems are expected to restrain the growth of the Asia-Pacific market.

The key players profiled in this report include Dragerwerk AG & Co. KGaA, Graco Inc. (Geotechnical Instruments (UK) LTD.), Maxtec LLC, MEECO Inc., Novair Medical, Roscid Technologies, Sable Systems International, Systech Illinois, Tenex Capital Management (Ohio Medical), and WITT-Gasetechnik GmbH & Co KG.

Key Benefits

- The study provides an in-depth analysis of the medical gas analyzers market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers a quantitative analysis from 2017 to 2025, which is expected to enable the stakeholders to capitalize on the prevailing market opportunities.

- A comprehensive analysis of all the geographical regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the global market.

Medical Gas Analyzers Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Modality Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Roscid Technologies, NOVAIR S.A.S, Maxtec., Graco Inc. (Geotechnical Instruments (UK) LTD), Systech Illinois, MEECO Inc, Tenex Capital Management (Ohio Medical), Draegerwerk AG & Co. KGaA, WITT-Gasetechnik GmbH & Co KG, Sable Systems International |

Analyst Review

Medical gas analyzers are used to determine the concentration and purity of medical or pharmaceutical gases, which are used in different medical facilities such as hospitals, surgery centers, or pharmaceutical companies. The adoption of medical gas analyzers is expected to increase during forecast period, due to surge in the number of surgical procedures and rise in demand for medical gas analyzers among the developing countries.

Technological advancements in medical gas analyzers, increase in number of surgeries, rise in number of ICU & emergency room admissions, upsurge in in number of oxygen therapy are projected to supplement the growth of the medical gas analyzers market during the forecast period. In addition, implementation of stringent regulations for medical gas systems, rise in use of medical gas among the pharmaceutical & biotech companies support the market growth. However, lack of awareness about medical gas analyzers and poor demand from the undeveloped countries hinder the market growth.

North America is expected to remain dominant during the forecast period, due to stringent regulations for medical gas system and presence of developed hospitals & healthcare facilities. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to the key players in the near future, due to developments in healthcare infrastructure and rise in demand for advanced medical facilities.

Loading Table Of Content...