Medical Gases And Equipment Market Research, 2032

The global medical gases and equipment market size was valued at $14.3 billion in 2022 and is projected to reach $28.9 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032. Medical gases and equipment are tools and supplies used in healthcare facilities for various medical purposes. Medical gases are used for therapeutic, diagnostic, or anesthesia purposes, such as oxygen, nitrous oxide, helium, carbon dioxide, and others. Medical gases are supplied to the patients through various delivery systems, including gas cylinders, central pipeline systems, and liquid oxygen systems. Medical gas equipment refers to the devices and systems used to administer and monitor medical gases, such as oxygen, nitrous oxide, and others. Some common types of medical gas equipment include cylinder, regulator, outlet, valve, alarm system, and others.

Market Dynamics

The medical gases and equipment market share witnessed growth owing to a rise in prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), emphysema, and asthma that further increased the demand for medical gases and equipment. For instance, according to National Center for Environmental Health 2023, in U.S., 25,257,138 number of people were suffering from asthma in 2020. Out of the 25,257,138 asthma patients, 4,226,659 number of person were below the age of 18 years, and 21,030,479 number of person above the age of 18 years.

In addition, oxygen therapy is used in the treatment of cardiovascular diseases such as heart failure and angina. Supplemental oxygen can help increase the oxygen supply to the heart and reduce the workload on the heart, improving symptoms and preventing complications. Thus, rise in prevalence of cardiovascular diseases such as heart failure and angina, further increases the demand of medical gases and equipment and drives the growth of medical gases and equipment market share. For instance, according to world health organization (WHO) June 2021, an estimated 17.9 million people died from cardiovascular diseases and, representing 32% of all global deaths.

Moreover, oxygen therapy is the standard treatment for carbon monoxide poisoning, as it helps to displace the carbon monoxide from the blood and restore the oxygen supply to the body. Thus, the rise in incidence rate of carbon monoxide poisoning drives the growth of the medical gases and equipment industry. For instance, according to centers for disease control and prevention (CDC), 2023, every year, at least 420 people die in the U.S. from accidental CO poisoning. According to same source, more than 100,000 people in the U.S. visit the emergency department each year due to accidental CO poisoning. Hence, such factors drive the growth of medical gases and equipment market size.

Furthermore, rise in technological advancement in medical gases & equipment and increase in geriatric population suffering from heart disease & respiratory diseases, such as COPD and dyspnea, are anticipated to drive the growth of the medical gases and equipment industry during the forecast period. For instance, according to article “Aging and Respiratory Diseases” published in December 2020, dyspnea is highly prevalent in the elderly, and is reported by approximately 30% of individuals greater than 65 years of age suffering from dyspnea. Thus, the global geriatric population is expected to grow significantly in the coming years, which will drive the growth of the medical gases market during the forecast period.

Segmental Overview

The medical gases and equipment market is segmented into product type, application, end user, and region. On the basis of product type, the market is classified into medical gases, and medical gas equipment. The medical gases segment is further bifurcated into pure medical gases and medical gas mixtures. The medical gas equipment segmented is further bifurcated into compressors, cylinders, hose assemblies and valves, masks, vacuum systems, regulator, and others (manifolds, outlets, flowmeter, alarm system). Depending on application, the market is classified into therapeutics, diagnostics and others (pharmaceutical manufacturing, and research). By end user, it is segregated into hospitals, ambulatory surgical centers, diagnostic and research laboratories, and others (pharmaceutical and biotechnology companies, home healthcare, academic and research institutions). Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

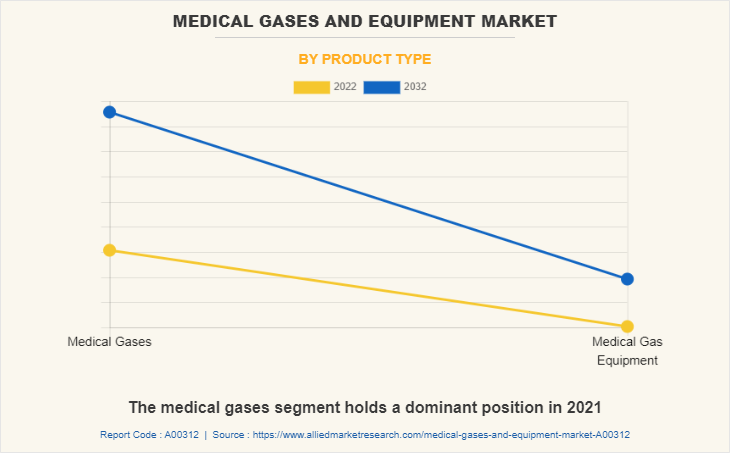

By Product Type

The medical gases and equipment market is segmented into medical gases, and medical gas equipment. The medical gases segment generated maximum revenue in 2022, owing to high demand of medical gases and the higher adoption of medical gases due to COVID-19. The same segment is expected to witness the highest CAGR during the forecast period, owing to an increase in prevalence of respiratory diseases that required medical oxygen and increase in use of medical gases for diagnostic purpose.

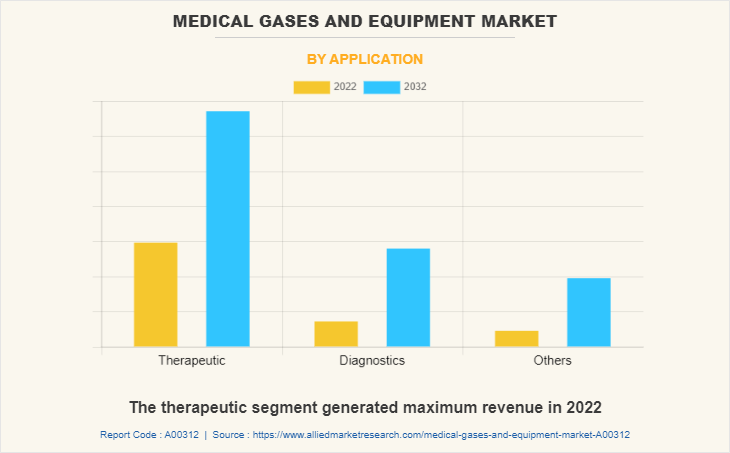

By Application

The medical gases and equipment market is segregated into therapeutic, diagnostics and others. The therapeutic segment dominated the market in 2022, owing to higher adoption of medical gases and equipment for treatment of diseases and surge in incidence of heart disease, which required oxygen gas. The diagnostics segment is expected to witness the highest CAGR during the forecast period, owing to an increase in endoscopy procedure that uses medical gases and equipment and rise in demand of medical gases for diagnostic purpose, such as increase in use of lung diffusion mixture for pulmonary function testing.

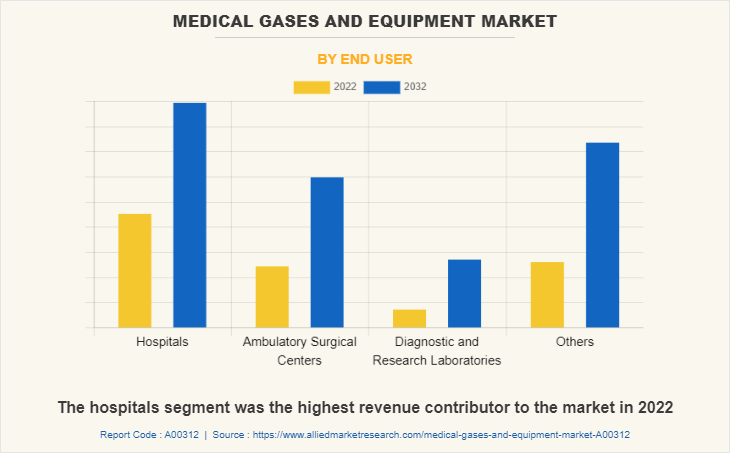

By End User

The medical gases and equipment market is segregated into hospitals, ambulatory surgical centers, diagnostic and research laboratories, and others. The hospital segment led the market in 2022, owing to high use of medical gases and equipment in hospital, high number of surgery performed in hospital, and the high number of patient admission in hospital who require oxygen gas. However, the other segment is expected to witness the highest CAGR during the forecast period, owing to increase in use of medical gases in home healthcare, and rise in geriatric population in home healthcare who required care and medical gas.

By Region

The medical gases and equipment market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the medical gases and equipment market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Air Products and Chemicals, Inc., Matheson Tri-Gas, Inc., and ESAB (GCE Holding AB), and the rise in the number of heart diseases that require medical oxygen, in the region drive the growth of the medical gases market.

Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels drives the growth of the market. Hence, such factors propel market growth. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the medical gases and equipment market throughout the forecast period. The presence of well-established healthcare infrastructure, high purchasing power, rise in the adoption rate of medical gases and equipment products, and a significant rise in capital income in developed countries are expected to drive market growth.

Asia-Pacific is expected to grow at the highest rate during the medical gases and equipment market forecast period. The medical gases and equipment market growth in this region is attributable to rise in the number of respiratory diseases such as chronic obstructive pulmonary disease (COPD), emphysema, pneumonia and asthma in this region, as well as increase in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020 and India is the second most populated country having 1,366,417.75 population in 2020.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the medical gases and equipment market, such as Advin Health Care, Air Liquide (Air Liquide Medical Systems), Air Products and Chemicals Inc, Atlas Copco AB, DCC plc (Flogas), ESAB (GCE Holding AB), Linde Plc, Matheson Tri-Gas Inc., Messer Holding GmbH, and Rotarex S.A (Rotarex) are provided in the report. There are some important players in the market such as ESAB (GCE Holding AB), Air Liquide, Atlas Copco AB, and Linde plc which have adopted acquisition as key developmental strategies to improve the product portfolio of the medical gases and equipment market.

Recent Acquisition in the Medical Gases And Equipment Market

- In October 2022, ESAB Corporation, one of the global leader in fabrication and gas control technology, announced that it acquired Ohio Medical, LLC (“Ohio Medical”), one of the global leader in oxygen regulators and central gas systems, from a private investor group for a cash purchase price of $127 million.

- In July 2020, Air Liquide announced the acquisition of Sasol's 16 Air Separation Units (ASU) located in Secunda, South Africa. Air Liquide is expected to operate the biggest oxygen production site in the world with a plan to reduce its CO2 emissions by 30% to 40% within the next ten years.

- In March 2023, Atlas Copco AB announced the acquisition of the operating assets of FS Medical Technology Business. FS Medical Technology sells, verifies, and tests piped medical and laboratory gas equipment and systems.

- In January 2023, Atlas Copco AB announced that it acquired MedCore Services Inc. MedCore Services Inc services piped medical gas equipment, including medical air systems, vacuum systems, and pipeline equipment. Customers are public healthcare and private clinics in Canada.

Recent Product Launch in the Medical Gases And Equipment Market

- Rotarex announced the launch of the new generation of Alpinox pressure regulators for medical gases. With innovative, robust, and ergonomic design, the new generation combines the best of performances into a lightweight solution

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical gases and equipment market analysis from 2022 to 2032 to identify the prevailing medical gases and equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical gases and equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical gases and equipment market trends, key players, market segments, application areas, and market growth strategies.

Medical Gases and Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28.9 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 416 |

| By Product Type |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | DCC Plc, Air Liquide, Atlas Copco AB, Matheson Tri-Gas, Inc., Linde plc, Air Products and Chemicals, Inc., Advin Health Care, Messer Holding GmbH, ESAB, Rotarex |

Analyst Review

The medical gases and equipment market has witnessed notable growth owing to rise in prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), emphysema, and asthma, which further increases the demand for medical gases and equipment.

According to the perspectives of CXOs, the global medical gases and equipment market is expected to witness a steady growth in the future. This is majorly attributed to rise in the number of heart diseases such as angina and heart failure that require medical gases to increase the oxygen supply to the heart and reduce the workload on the heart. In addition, an increase in technological advancement in medical gas equipment and rise in geriatric population suffering from heart & respiratory disease have led to an increase in demand for medical gases and equipment that boost the growth of the market. Furthermore, carbon dioxide is used to inflate the abdominal cavity and colon for laparoscopy and colonoscopy. Thus, rise in number of laparoscopy, endoscopy, and arthroscopy procedures drives the growth of medical gases and equipment market.

North America is expected to witness the highest growth, in terms of revenue owing to increase in cases of cardiac diseases, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in use of medical gases & equipment, rise in respiratory diseases, unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

The medical gases and equipment market was valued at $14,256.30 million in 2022 and is estimated to reach $28,920.50 million by 2032, exhibiting a CAGR of 7.6% from 2023 to 2032.

The increase in number of patients suffering from chronic obstructive pulmonary disease (COPD), asthma, and other respiratory diseases are the upcoming trends of Medical Gases and Equipment Market in the world.

The forecast period for Medical Gases and Equipment Market is 2023 to 2032.

The therapeutic is the leading application of Medical Gases and Equipment Market.

North America is the largest regional market for Medical Gases and Equipment.

The stringent regulations regarding manufacturing and sales of medical gases and equipment is impacting the Medical Gases and Equipment Market growth.

The Linde Plc, Matheson Tri-Gas Inc., Air Products and Chemicals Inc, Atlas Copco AB, and Air Liquide (Air Liquide Medical Systems) are the top companies to hold the market share in Medical Gases and Equipment.

Yes, competitive analysis is included in Medical Gases and Equipment Market report.

Loading Table Of Content...

Loading Research Methodology...